BlackRock Income Portfolio Update

October 21 2019 - 10:44AM

UK Regulatory

TIDMBRIG

BLACKROCK INCOME AND GROWTH INVESTMENT TRUST PLC (LEI:5493003YBY59H9EJLJ16)

All information is at 30 September 2019 and unaudited.

Performance at month end with net income reinvested

Since

One Three One Three Five 1 April

Month Months Year Years Years 2012

Sterling

Share price 3.1% 3.1% 5.3% 17.7% 38.7% 96.3%

Net asset value 3.2% 1.9% 1.5% 18.3% 42.8% 84.2%

FTSE All-Share Total Return 3.0% 1.3% 2.7% 21.7% 38.9% 78.7%

Source: BlackRock

BlackRock took over the investment management of the Company with effect from

1 April 2012.

At month end

Sterling:

Net asset value - capital only: 201.66p

Net asset value - cum income*: 205.98p

Share price: 200.00p

Total assets (including income): GBP51.4m

Discount to cum-income NAV: 2.9%

Gearing: 5.1%

Net yield**: 3.5%

Ordinary shares in issue***: 23,017,476

Gearing range (as a % of net assets) 0-20%

Ongoing charges****: 1.1%

* includes net revenue of 4.32 pence per share

** The Company's yield based on dividends announced in the last 12 months as at

the date of the release of this announcement is 3.5% and includes the 2018

final dividend of 4.40p per share declared on 20 December 2018 and paid to

shareholders on 19 March 2019 and the 2019 interim dividend of 2.60p per share

declared on 25 June 2019 and paid to shareholders on 27 August 2019.

*** excludes 9,916,456 shares held in treasury

**** Calculated as a percentage of average net assets and using expenses,

excluding performance fees and interest costs for the year ended

31 October 2018.

Sector Analysis Total assets (%)

Oil & Gas Producers 9.8

Pharmaceuticals & Biotechnology 9.2

Media 9.1

Life Insurance 8.1

Support Services 7.1

Banks 6.8

Financial Services 5.6

Household Goods & Home Construction 5.4

Food Producers 5.1

Travel & Leisure 4.3

Tobacco 3.7

Food & Drug Retailers 3.3

Gas, Water & Multiutilities 3.2

Mining 3.1

Health Care Equipment & Services 2.9

Industrial Engineering 2.6

Mobile Telecommunications 2.2

Nonlife Insurance 2.0

Electronic & Electrical Equipment 1.2

Construction & Materials 0.9

Chemicals 0.6

General Retailers 0.5

Beverages 0.3

Net current assets 3.0

------

Total 100.0

======

Ten Largest Equity Investments

Company Total assets (%)

Royal Dutch Shell 'B' 6.4

AstraZeneca 4.9

GlaxoSmithKline 4.3

RELX 4.2

British American Tobacco 3.7

BP Group 3.5

Tesco 3.3

National Grid 3.2

BHP 3.1

Prudential 3.1

Commenting on the markets, Adam Avigdori and David Goldman representing the

Investment Manager noted:

The UK equity market traded sideways over the quarter, disguising a period of

weakness in August and a marked style rotation, out of momentum and into value,

at the beginning of September. Concerns around geopolitical risk, global trade

uncertainty and weakening global economic data did though create headwinds,

with intraday share prices influenced by ongoing news flow surrounding trade

tensions. Market concern spiked in August, with investors turning to safe-haven

assets as global government yields plunged to historical lows and the US

Treasury curve inverted between the 2 and 10-year yields, resuming fears of

impending recession as it has previously been a lead-indicator. Market risk was

balanced by central banks shifting monetary policy to a more dovish stance. The

US Federal Reserve cut rates by 50 basis points in Q3, aiming to ease

inflationary pressures and offset rising geopolitical tensions. The European

Central Bank introduced a comprehensive easing package, cutting the deposit

facility rate by 10 basis points to -0.5% and restarting asset purchases at the

pace of 20bln EUR per month, with a commitment to run the programme until its

2% inflation target was met. Emerging markets detracted the most throughout the

third quarter. Chinese assets took the biggest hit as disruptions in global

trade have begun to be reflected in the economic data. In August, Chinese

industrial production slowed to +4.8% year-on-year, the weakest in 17 years and

well below market expectations. In the UK, in June, newly-elected UK Prime

Minister Boris Johnson pledged to leave the European Union on October 31st with

or without a deal. Ever since, the Brexit debate has become more heated, with

the risks of a disruptive 'no-deal' Brexit still looming large. This, plus the

contraction in domestic GDP in the second quarter, led to additional weakness

in Sterling.

Over the quarter, the Company returned 2.01%, outperforming the benchmark

index, the FTSE All Share, which returned 1.27% in the same period.

The largest contributor was London Stock Exchange Group, one of the fund's core

holdings, whose shares rose further this month as the market further

appreciated the synergies and growth potential of the Refinitiv deal. Shares in

pest control specialist Rentokil also contributed this month. After the

positive set of trading results late in July, we met with the company's

management team and would note that the pest control division continues to be

the key driver with strong structural drivers in a fragmented industry. Medtech

player Smith & Nephew also contributed as shares rose further after a strong

trading statement released at the end of July where they upgraded revenue

guidance further. Shares were rallying through August as the investment

community further appraised what this entails for the company.

The largest detractor to the fund was Prudential whose shares were weak, not

only due to further potential rate cuts from the Fed against the ongoing

US-China trade tensions, but also the social unrest in Hong Kong. Its shares

saw a sharp sell-off prior to reporting H1 2019 results. The results themselves

highlighted that they are embarking on a strategy of organic and inorganic

diversification for their US business into Fixed Annuities, noting the poorer

conditions in the Variable Annuities market as distribution shifts from broker

to advised. Elsewhere in the group, Asia continues to deliver with no change in

its structural growth story, despite the aforementioned concerns. Shares in

John Laing detracted following a weak H1 2019 update with sizeable write-downs

on their wind assets in Australia and Germany citing issues of transmission/

regulatory and lack of wind respectively. These write-downs were more than

offset by value enhancements and project completions elsewhere such that NAV

still increased. Bodycote also detracted from performance. As a global cyclical

it is sensitive to market concerns about global growth. We felt its results

were reassuring in light of news flow from sector peers and where its highest

margin areas delivered. In our view, this is a differentiated and

well-capitalised industrial, with a management team we rate highly.

Over the quarter we initiated a position in Aviva, WPP and Grafton Group. We

added to positions in Standard Chartered, Taylor Wimpey, Phoenix Group, Smith &

Nephew, St James's Place, National Grid and Fuller Smith and Turner. We sold

our position in Imperial Brands. We have also trimmed exposure to Lloyds, John

Laing, BP, Rentokil, Barclays, Elementis and MoneySupermarket.com.

We continue to see a period of sustained growth. Importantly, we expect nominal

growth to remain modest as we see structural pressures from demographics,

corporate underinvestment and new technology continuing to act as a drag on

inflation. The dovish tilt from central banks is clearly supportive for

markets, however from time to time we expect markets to worry about a shift to

a more hawkish stance. With heightened political uncertainty and investor

nervousness, we expect volatility to return to markets. This provides us, as

active managers of a concentrated portfolio, with a great opportunity to

identify high-quality cash generative businesses, with robust balance sheets,

that can weather various market cycles and help to deliver long term capital

and income growth for our clients.

We continue to like cash generative consumer staple companies, especially those

exposed to the emerging market consumer given the prevalent demographic trends

in certain markets. These companies often generate substantial cash flow which

allows them to invest in innovation, marketing and distribution to ensure the

longevity of their brands while also paying attractive and growing dividends to

shareholders. We have also sought exposure to infrastructure spend whilst at

the same time we are watching for signs of overheating in the US and monitoring

economic growth in China. We also note that inflationary pressures are

starting to build and therefore we seek those companies with sufficient pricing

power and efficiency potential to withstand rising costs. As the recent past

has demonstrated, it is crucial to be selective and to focus on those companies

that are strong operators, that provide a differentiated service or product and

that boast a strong balance sheet.

END

(END) Dow Jones Newswires

October 21, 2019 10:44 ET (14:44 GMT)

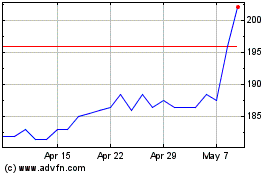

Blackrock Income And Gro... (LSE:BRIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

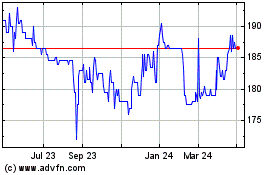

Blackrock Income And Gro... (LSE:BRIG)

Historical Stock Chart

From Apr 2023 to Apr 2024