BlackRock Greater Europe Investment Trust Plc - Portfolio Update

January 16 2020 - 9:26AM

PR Newswire (US)

BLACKROCK GREATER EUROPE

INVESTMENT TRUST plc (LEI - 5493003R8FJ6I76ZUW55)

All information is at 31 December

2019 and unaudited.

Performance at month end with net income reinvested

|

One

Month |

Three

Months |

One

Year |

Three

Years |

Launch

(20 Sep 04) |

| Net asset value

(undiluted) |

0.0% |

4.4% |

30.1% |

46.9% |

445.8% |

| Net asset value*

(diluted) |

-0.4% |

4.1% |

29.6% |

46.4% |

444.5% |

| Share price |

2.8% |

7.4% |

34.7% |

53.1% |

443.6% |

| FTSE World Europe ex

UK |

1.1% |

0.9% |

20.4% |

28.2% |

275.7% |

* Diluted for treasury shares and subscription shares.

Sources: BlackRock and Datastream

At month end

| Net asset value

(capital only): |

412.69p |

| Net asset value

(including income): |

412.76p |

| Net asset value

(capital only)1: |

411.35p |

| Net asset value

(including income)1: |

411.40p |

| Share price: |

407.00p |

| Discount to NAV

(including income): |

1.4% |

| Discount to NAV

(including income)1: |

1.4% |

| Net gearing: |

7.0% |

| Net

yield2: |

1.4% |

| Total assets

(including income): |

£348.0m |

| Ordinary shares in

issue3: |

84,323,101 |

| Ongoing

charges4: |

1.09% |

1 Diluted for treasury shares.

2 Based on a final dividend of 4.10p per share and an interim

dividend of 1.75p per share for the year ended 31 August 2019.

3 Excluding 26,005,837 shares held in treasury.

4 Calculated as a percentage of average net assets and using

expenses, excluding interest costs, after relief for taxation, for

the year ended 31 August 2019.

| Sector

Analysis |

Total

Assets

(%) |

|

Country

Analysis |

Total

Assets

(%) |

| Industrials |

21.8 |

|

Switzerland |

16.3 |

| Health Care |

18.9 |

|

Denmark |

16.1 |

| Technology |

17.9 |

|

France |

13.7 |

| Consumer Goods |

15.6 |

|

Germany |

13.7 |

| Financials |

9.6 |

|

Italy |

7.3 |

| Consumer Services |

8.7 |

|

Netherlands |

7.0 |

| Basic Materials |

3.2 |

|

Sweden |

5.3 |

|

Telecommunications |

3.2 |

|

Spain |

4.9 |

| Oil & Gas |

1.5 |

|

United Kingdom |

4.6 |

| Net Current

Liabilities |

-0.4 |

|

Israel |

2.5 |

|

----- |

|

Ireland |

1.8 |

|

100.0 |

|

Poland |

1.8 |

|

===== |

|

Belgium |

1.6 |

|

|

|

Finland |

1.4 |

|

|

|

Russia |

1.4 |

|

|

|

Greece |

1.0 |

|

|

|

Net Current

Liabilities |

-0.4 |

|

|

|

|

----- |

|

|

|

|

100.0 |

|

|

|

|

===== |

|

|

|

|

|

| Ten Largest Equity

Investments |

|

|

| Company |

Country |

%

of

Total Assets |

| SAP |

Germany |

6.3 |

| Sika |

Switzerland |

5.6 |

| Adidas |

Germany |

5.4 |

| Safran |

France |

5.4 |

| Novo Nordisk |

Denmark |

5.3 |

| Royal Unibrew |

Denmark |

5.2 |

| DSV |

Denmark |

4.6 |

| RELX |

United Kingdom |

4.6 |

| ASML |

Netherlands |

4.6 |

| Lonza Group |

Switzerland |

4.1 |

|

|

|

|

Commenting on the markets, Stefan Gries, representing the

Investment Manager noted: |

|

During the month, the Company’s NAV was flat and the share

price rose by 2.8%. For reference, the FTSE World Europe ex UK

Index returned 1.1% during the period.

European ex UK markets continued their rally through December,

ending the year up 20.4% (GBP). Through December, sector leadership

came from consumer services, financials and oil & gas sectors,

whilst telecommunications significantly lagged.

The Company underperformed the reference index over the month with

stock selection weighing on returns. On a sector basis, the primary

relative losses came from the portfolio’s underweight position in

financials. We saw a recovery in European banks based on the hope

of regulatory changes easing future capital requirements and a

small move higher in short-term interest rates. This, however, did

not change our fundamentally negative view on the sector and we

continue to hold our underweight position.

The primary detractor from performance over the month was our

holding in Safran, which had posted strong returns throughout the

rest of 2019. Shares fell in response to Boeing announcing a

temporary suspension to production of its 737 Max programme. Safran

had based its expectations for 2020 on a run rate of around 42

plane deliveries a month for this plane, which will now have to be

reviewed. Whilst this leads to minor cuts in both earnings and

cashflow in the near term, we believe that those cash-flows are

merely delayed rather than lost and it does not alter our overall

positive view of the earnings potential of Safran’s new leap engine

programme.

Shares in Diasorin also fell in response to competitor Qiagen

pulling out of a potential deal as they believe keeping their

independence will create more value for shareholders over the long

run. Shares in Qiagen de-rated 20%, having risen a similar amount

in preceding months, moving the rest of the sector lower with

it.

The Company benefited from not owning any telecoms stocks. Avoiding

names like Orange, Deutsche Telekom and Telefonica was additive to

returns. The sector was dragged down by Orange’s capital markets

day early in the month which left investors disappointed. While

management shared limited information on the much-anticipated

towers spin-out, it decided to cut 2020 EBITDA guidance and

increased capex intentions.

Semiconductor stocks continued to perform strongly with ASML a top

contributor to returns. Within the same sector, shares in SAP gave

up some performance as US peer Oracle slightly missed expectations.

We believe that SAP is on a different path to peers as our latest

channel checks would suggest the S4/Hana product upgrade cycle

remains strong.

At the end of the period the Company had a higher allocation than

the reference index towards technology, industrials, consumer

services and health care. The Company had a neutral weighting

towards telecommunications and a lower allocation was held in

financials, consumer goods, utilities, basic materials and oil

& gas.

Outlook

Despite the challenging conditions which continue to plague

industrial end markets in Europe, there are reasons emerging to be

more hopeful. We have seen stabilisation in certain end markets

which should be further supported by policy, both monetary and, in

some select instances, fiscal. The strong fiscal position of the

region, aided by lower yields, has the potential to make a

meaningful difference and is complimented by a resilient consumer

boasting some of the highest savings ratios in the developed world.

Along with extreme consensus underweight positioning to the region,

pillars of an investment case for Europe are building, leading to

recommendation upgrades from sell-side commentators. We agree

fiscal policy and falling political uncertainty could both give a

boost to the region, but caution buying specific exposures based on

macro narratives alone. Europe continues to have areas of the

market which appear to be value traps with whole sectors suffering

from falling profitability and management teams with limited

ability to turn the tide. We believe selectivity in the region and

a focus on long-term winners underpinned by superior fundamentals

could be meaningful for the overall return achieved from the

region. We continue to hold a preference for well-positioned luxury

goods and aerospace companies and avoid cyclically and structurally

challenged areas such as autos and banks.

16 January 2020

ENDS |

| Latest

information is available by typing www.brgeplc.co.uk on the

internet, "BLRKINDEX" on Reuters, "BLRK" on Bloomberg or "8800" on

Topic 3 (ICV terminal). Neither the contents of the Manager’s

website nor the contents of any website accessible from hyperlinks

on the Manager’s website (or any other website) is incorporated

into, or forms part of, this announcement. |

Copyright y 16 PR Newswire

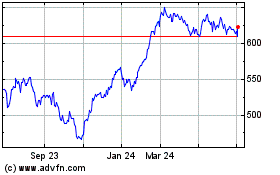

Blackrock Greater Europe... (LSE:BRGE)

Historical Stock Chart

From Mar 2024 to Apr 2024

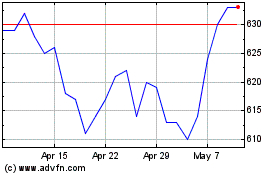

Blackrock Greater Europe... (LSE:BRGE)

Historical Stock Chart

From Apr 2023 to Apr 2024