TIDMBPC

RNS Number : 2243P

Bahamas Petroleum Company PLC

16 February 2021

16 February 2021

Bahamas Petroleum Company plc

("BPC" or the "Company")

Corporate and Strategic Update

BPC, the Caribbean and Atlantic margin focused oil and gas

company, with production, appraisal, development and onshore and

offshore exploration assets across the region, provides the

following update on a range of strategic and corporate matters.

Highlights

-- The drilling of Perseverance #1 fulfilled its core technical

objectives and a post-well review is underway. In parallel, BPC is

considering the most appropriate way forward for monetisation of

its assets in The Bahamas, in particular, the renewal of an active

farm-out process

-- Near term operational activity is now focussing on the

Company's 2021 work programme in Trinidad and Tobago and Suriname,

targeting exit production of c.2,500 bopd, and prospect maturation

in Uruguay

o Saffron appraisal well due to begin in Q1 2021 which, subject

to results, would see BPC seek approvals for field development with

up to seven production wells to follow through 2021

o Suriname appraisal well and Extended Well Test in the Weg Naar

Zee Block due to also begin in Q1 2021

-- The Company's funding strategy is to focus on consolidating

and strengthening the balance sheet, in support of directing

maximum effort toward planned value-adding drilling activities in

Trinidad and Tobago and Suriname during 2021

-- Consistent with this funding strategy, the conditional

convertible note facility has been restructured and extended along

with a further GBP2 million drawn, a final reconciliation of the

initial GBP7.5m tranche of the December 2020 Funding Agreement has

occurred requiring no net cash payment by the Company, and the

Company has issued 135 million new ordinary shares in lieu of cash

settlement of a number of current financial obligations

Simon Potter, CEO of BPC said:

"The Stena ICEMAX has just left the drilling location and is off

hire. However, the pace of operations has not ceased - the

post-well review has begun, as the Company charts its way forward

in The Bahamas with a renewal of the farm-out process.

Notwithstanding it is only a week since the completion of the

Perseverance #1 well, BPC has already moved to consolidate and

strengthen its balance sheet, so as to ensure all value-add options

to grow productions and cash generation in Trinidad and Tobago and

Suriname are maintained. Over the coming weeks the Company will

fully close out the Perseverance #1 operation and set the final

timetable for operations elsewhere across the portfolio."

Operating Strategy

The Perseverance #1 well result has confirmed the presence of a

working hydrocarbon system, validating the Company's structural

play concept. In addition to obtaining an invaluable new

sub-surface dataset which, in BPC's view, reduces the exploration

play risk for any future exploration activities in this frontier

province, the well verified the structural model the presence of

competent seals, high porosity reservoir and hydrocarbon charge.

The combination of these play elements points to significant

hydrocarbon potential remaining in a number of independent,

untested play systems and structures seismically identified from 2D

and 3D within BPC's extensive acreage extending over its four (4)

southern exploration licences covering approximately 12,000km(2)

(4,700 square miles - 3 million acres).

Post drilling sub-surface evaluation work has immediately

commenced on a comprehensive post-well review, which includes

cuttings analysis and geologic age dating, petrophysical analysis,

gas chromatography and recalibration of the exploration play

concepts. These learnings will be utilised to revise the

stratigraphic and structural models as well as the extent of

vertical closures and a revised play-type analysis. This extensive

assessment will allow the Company to fully integrate the new

Perseverance well data into an updated interpretation of the

previously mapped prospect and lead inventory accessible within the

licences, and more accurately inform and direct the focus of the

Company's forward strategy within its Bahamian exploration acreage

portfolio.

As previously advised, the Company has continued to assess

options for a farm-out or similar transaction as part of its

overall risk mitigation and funding strategy, and maintained an

active dialogue with a number of interested parties, including a

number of oil and gas majors and supermajors, right up to the point

of spudding the Perseverance #1 well. Since announcing the well

results, the Company has received a number of unsolicited

approaches from industry counterparties. Gneiss Energy has been

formally engaged to assist in managing a formal process to solicit

broader industry interest in a farm-in alongside this early,

positive interest.

The plugging and abandonment of the Perseverance #1 well has

been carried out both safely and responsibly and the rig has moved

off location and hire. The Company's remaining tasks to wrap-up

well activities are to complete final well reports, statutory

documentation and other formal records.

Trinidad and Tobago and Suriname

With Perseverance #1 completed, key near-term operational

planning is on upcoming drilling and operational activities in

Trinidad and Tobago and Suriname, with a view to building reserves

and resources, and rapidly increasing production and cashflow

across the portfolio. The Company is seeking to exit 2021 with net

production of 2,500 bopd.

T&T 2021 programme:

-- Drilling of the Saffron #2 appraisal well, targeted to

commence in Q1 2021, which, subject to results, would rapidly see

BPC seek approvals for a Saffron field development, and with up to

seven production wells to follow through 2021. Work is currently

underway in terms of site preparation, final permitting, and

finalising rig procurement.

-- Completion of reprocessing of the entire 3D seismic grid over

the highly prospective South West Peninsula ("SWP"), the objective

being to high-grade Saffron lookalike prospects for drilling and

with a view to identifying up to two initial exploration well

targets for drilling by the end of 2021.

-- Depending on Covid-19 operational constraints, technical

outcomes, speed of permitting approvals, and rig and funding

availability, an even more accelerated 2021 work program could then

include further Saffron production wells, and a further exploration

well in the SWP.

Suriname 2021 programme:

-- Drilling of an appraisal well and conduct of Extended Well

Test (EWT) in the Weg Naar Zee Block in Suriname in Q1 2021, and

subject to results, rapidly moving into a wider field development,

with up to six production wells to follow through 2021.

-- Depending on Covid-19 operational constraints technical

outcomes, speed of permitting approvals, and rig and funding

availability, an accelerated 2021 work program could include up to

a further three Weg Naar Zee production wells in Suriname.

Capital Strategy

Following the conclusion of the Perseverance #1 drilling

programme, the Company is seeking to consolidate and further

strengthen its balance sheet, so as to direct maximum effort

towards planned value-adding drilling activities in Trinidad and

Tobago and Suriname throughout the course of 2021.

As part of this process, and further to the Company's

announcement on 8 February 2021:

-- BPC has reached agreement with the provider of its

conditional fixed conversion price convertible note facility (the

"Facility") to establish revised terms for the Facility and extend

this Facility to ensure it remains available through the course of

2021 drilling operations in Trinidad and Tobago and Suriname, as

follows:

o the conversion price of all notes issued under the Facility

("Notes") has been amended from 2.5p to 0.8p;

o the maturity date for all Notes will be a single maturity date

of 31 December 2023, regardless of the date of issue of the

relevant Notes;

o the coupon on the Notes remains 12 per cent., to accrue from

the date of receipt of any subscription funds by the Company;

o coupon will be payable periodically throughout the term of the

Notes, on each of 30 June 2021, 31 December 2021, 30 June 2022, 31

December 2022, 30 June 2023, and 31 December 2023 (each an

"Interest Payment Date");

o on any Interest Payment Date, BPC can elect (at its sole

discretion) to capitalise up to 50 per cent. of the coupon accrued

on the Notes at the relevant Interest Payment Date, with any amount

not capitalised to be paid in cash. Alternatively, BPC can elect to

pay 100 per cent. of the coupon accrued on the Notes at the

relevant Interest Payment Date in the form of BPC ordinary shares,

to be issued at a price equivalent to 90 per cent of the volume

weighted average price of BPC's shares in the 10 trading days prior

to the relevant Interest Payment Date. This variation reflects BPC

management's expectation that the Company, which is targeting

material growth in production and cashflow through the course of

2021 and beyond, will have the ability to cash settle coupon (all

or in part) throughout the term of the Notes, which will then allow

the Company to use available surplus cashflow from production for

this purpose, thereby reducing the overall potential dilutive

impact of the Notes;

o the provider has agreed to make an immediate additional GBP2

million subscription for Notes on an unconditional basis, thus

increasing to GBP5 million the total amount of Notes subscribed for

to-date, with settlement for the additional subscription (and

coupon accrual commencement) on 28 February 2021;

o the last date for subscription for further amounts of Notes,

up to the total undrawn Facility availability of GBP10 million, is

extended to 16 April 2021, and this date will be extended further

to 30 June 2021 if a minimum of GBP8.5 million of Notes in

aggregate have been subscribed for by 16 April 2021. The ability to

draw-down on these remaining funds remains subject to satisfaction

of certain conditions precedent, which the Company and the provider

are engaging on collaboratively;

o BPC retains the right, at is sole election, to scale back the

remaining availability of the Notes by up to GBP7.5 million and BPC

will now also have the additional ability at any time during the

term of the Notes, at its sole discretion, to issue a notice to

redeem the Notes early, by way of cash payment of the subscription

price, all accrued coupon to the time of redemption, an early

redemption premium of 5 per cent, and the issue of options to

acquire the equivalent of 30% of the number of shares the redeemed

Notes would otherwise have converted into, with such options to

have an exercise price of 0.8p per share and an expiry date of 31

December 2023 . If the Company does elect to redeem the Notes in

this way, the provider will first have a 10-day period in which it

may elect to convert the Notes the subject of an early redemption

notice; and

o the fee payable to the provider on subscriptions for Notes is

6 per cent.

All other terms and conditions of the Facility remain unchanged,

as previously advised.

-- In relation to the package of funding arrangements put in

place between the Company and 1798 Volantis Fund Ltd ("the

Investor") on 13 December 2020 ("the Funding Agreements"), the

Company confirms that:

o a full and final reconciliation payment of approximately

GBP370,000 in respect of the initial GBP7.5 million tranche has

been made by BPC to the Investor, representing approximately 5 per

cent. of the funds received by the Company under this initial

tranche. This payment has been entirely offset by an agreed rebate

of advisory and fundraising fees paid by the Company, such that the

net cash cost to the Company in respect of the full and final

reconciliation for this tranche of funding has been nil;

o t he GBP3.75 million Call Option under the Funding Agreement

has now fully lapsed; and

o th e GBP3.75 million Put Option under the Funding Agreement,

which was exercised by the Company on 12 January 2021, remains

subject to a similar final reconciliation process on 16 April 2021,

with the reconciliation amount (if any) able to be satisfied in

cash or shares (or any combination thereof) at both parties'

discretion, after which any obligations under the Put Option will

be fully satisfied and the Funding Agreements will terminate.

-- Lastly, the Company has settled a number of corporate

creditors through the issuance of, in aggregate, 135 million new

BPC shares ("New BPC Shares"). Application has been made for the

New BPC Shares to be admitted to trading on the AIM market of the

London Stock Exchange and it is expected that admission will take

place, and trading in New BPC Shares will commence, at 8:00am on 22

February 2021 ("Admission").

The Company currently has approximately $15 million of available

cash (inclusive of the funds to be made available on 28 February

2021 under the Facility).

The immediate anticipated cost of planned activities in Trinidad

and Tobago and Suriname in the balance of H1 2021 (in particular,

the drilling of Saffron 2 and the WNZ appraisal well) is

approximately $4 million. The timing of future operations in both

Trinidad and Tobago and Suriname remains dependent on the speed of

permitting approvals, and Covid-19 access constraints. The Company

will update the market with regards to the detailed work programme

and timing of operations in due course.

Close-out of remaining costs associated with the drilling of

Perseverance #1 (a number of which will not be finalised and become

payable for 30-60 days post-well completion) is also ongoing.

In addition to securing further draw-downs under the conditional

convertible note facility, the Company has access to a range of

other potential funding sources, including utilising cash flow

generated from production in Trinidad and Tobago and Suriname,

reserve-based lending facilities in respect of the Company's

petroleum reserves in Trinidad and Tobago (which are expected to

grow during 2021), and generating prospective payments and back

cost reimbursements through a farm-in to the licences in The

Bahamas.

Total Voting Rights

Following Admission, BPC's issued share capital will consist of

4,838,548,349 ordinary shares, with each ordinary share carrying

the right to one vote. The Company does not hold any ordinary

shares in treasury. This figure of 4,838,548,349 ordinary shares

may therefore be used by shareholders in the Company, as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change in their

interest in, the share capital of the Company under the FCA's

Disclosure Guidance and Transparency Rules.

The information communicated in this announcement contains

inside information for the purposes of Article 7 of the Market

Abuse Regulation (EU) No. 596/2014.

For further information, please contact:

Bahamas Petroleum Company plc Tel: +44 (0) 1624

Simon Potter, Chief Executive Officer 647 882

Strand Hanson Limited - Nomad Tel: +44 (0) 20 7409

Rory Murphy / James Spinney / Jack Botros 3494

Shore Capital Stockbrokers Limited - Tel: +44 (0) 207 408

J oint Broker 4090

Jerry Keen / Toby Gibbs

Investec Bank Plc - J oint Broker Tel: +4 4 (0) 207

Chris Sim / Rahul Sharma 597 5970

Gneiss Energy - Financial Adviser Tel: +44 (0) 20 3983

Jon Fitzpatrick / Paul Weidman / Doug 9263

Rycroft

CAMARCO Tel: +44 (0) 020 3757

Billy Clegg / James Crothers / Hugo Liddy 4980

Notes to Editors

BPC is a Caribbean and Atlantic margin focused oil and gas

company, with a range of exploration, appraisal, development and

production assets and licences, located offshore in the waters of

The Bahamas and Uruguay, and onshore in Trinidad and Tobago, and

Suriname. In Trinidad and Tobago, BPC has five (5) producing

fields, two (2) appraisal / development projects and a prospective

exploration portfolio in the South West Peninsula. In Suriname, BPC

has on onshore appraisal / development project. BPC's exploration

licence in each of Uruguay and The Bahamas are highly prospective,

and offer high-impact value exposure within the overall portfolio

value.

BPC is listed on the AIM market of the London Stock Exchange. www.bpcplc.com

ENDS

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDTFMFTMTJBMTB

(END) Dow Jones Newswires

February 16, 2021 02:00 ET (07:00 GMT)

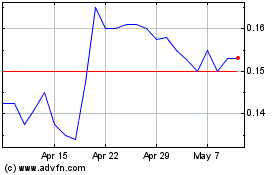

Challenger Energy (LSE:CEG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Challenger Energy (LSE:CEG)

Historical Stock Chart

From Apr 2023 to Apr 2024