TIDMBPC

RNS Number : 9823V

Bahamas Petroleum Company PLC

13 August 2020

13 August 2020

Bahamas Petroleum Company plc

("BPC" or the "Company")

Operational and Corporate Update

Bahamas Petroleum Company plc ("BPC"), the Caribbean and

Atlantic margin focused oil and gas company, with exploration,

appraisal, development and production assets across the region, is

pleased to provide the following update in relation to a range of

operational and corporate matters.

Corporate Presentation

BPC has today released an updated corporate presentation, which

is available on the Company's website at www.bpcplc.com as well as

via the following link:

http://www.rns-pdf.londonstockexchange.com/rns/9823V_1-2020-8-12.pdf

The presentation provides consolidated introductory information

on BPC's expanded portfolio of assets, following the recent

completion of the merger with Columbus Energy Resources plc,

including the Company's intended work programme, as well as a clear

statement of the Company's goals and targets in the coming 18

months in terms of exploration activities, resource and reserve

maturation, production growth and potential cash generation

(depending on oil price assumptions). Shareholders are encouraged

to read this presentation in detail. Specifically contained within

this presentation, BPC has provided the following key statements,

goals and targets which the Company has commenced working

towards:

Vision and Strategy: The Company has sought to articulate a

clear statement of its vision and strategy, as follows:

-- Vision: To be a n Exploration and Production (E&P)

business generating reliable, growing production and thus free

cashflows capable of supporting core exploration activities, which

in combination creates significant value for all shareholders.

-- Strategy: A portfolio approach to asset ownership across the

full life cycle of the hydrocarbons business that appropriately

balances risk and reward, ensures access to capital on competitive

terms, and effectively leverages core expertise and experience

within the Company.

In seeking to deliver on our vision and enacting our strategy,

the Company will focus on:

Exploration: core to the Company's ongoing strategy is

maintaining access to large, meaningful exploration opportunities

and appraisal activities across the portfolio. This is encapsulated

in the Company plans for the imminent drilling of the Perseverance

#1 well in The Bahamas and maturing of a prospect inventory in

Uruguay. The Perseverance #1 well is targeting P(50) recoverable

prospective resources of 0.77 billion barrels of oil, with an

upside of 1.44 billion barrels, solely from the northern structural

closure portion of the B structure. In total the B structure

extends between 70 and 80 kms, has a mapped areal closure over 400

km(2) and has an aggregate most likely recoverable resource

potential in excess of 2 billion barrels. The Company's contract

for a drilling rig with Stena Drilling provides a window for

drilling activities to commence between 15 December 2020 and 1

February 2021. In addition, the Company expects over the coming 12

months to further mature its prospect inventory and exploration

plans in the highly prospective South West Peninsular (SWP) of

Trinidad, which will include a full assessment of the potential

from deeper reservoir horizons.

Production: currently, the Company's producing assets in

Trinidad and Tobago have average production of between 400 to 450

barrels of oil per day ("bopd"). The Company is targeting achieving

a stable production level of approximately 500 bopd per day (net)

by end 2020, building to 2,500 bopd (net) by the end of 2021, both

of which targets the Company considers can be achieved through a

combination of maintaining and then increasing production through

(i) increased data integrity, (ii) automation, (iii) overall

increased field activity - returning to the levels last seen in

2018, (iv) selective new wells, (v) enhanced oil recovery (EOR)

programmes, and (vi) other growth initiatives including production

from appraisal of the existing Saffron discovery and extended well

tests ("EWT") in Suriname. In the longer term, the Company

considers that the assets in Trinidad and Tobago and Suriname

provide a bridge to future production from the Company's project in

The Bahamas (assuming a successful exploration outcome). In the

success case, the Company believes that 15,000 bopd (net) would be

an appropriate aggregate production target by the end of 2025.

Reserves and Resources : currently, there is no consistent

estimation of reserves and resources across the Company's expanded

portfolio. For this reason, BPC has initiated a programme of work

to commission an independent third-party Competent Person's Report

(CPR) for the Company's various assets and licences in The Bahamas,

Trinidad and Tobago, Suriname, and Uruguay - a further announcement

will be made on the completion and issue of said report. Based on

information currently available, BPC believes that at the

conclusion of this exercise the Company will be able to report a

current portfolio-wide 2P reserve of 1 mmbbl (net). Thereafter,

ongoing maturation of resource and reserves across the portfolio is

a core busines objective, and based on information currently

available, the Company is targeting a 2P reserve as at end of 2021

of 10 mmbbl (net), and longer-term of 50 mmbbl (net) at end of 2025

(which could be considerably greater depending on the level of

success assumed in The Bahamas).

Cashflow: Consistent with the Company's vision and strategy

statements, generating stable and reliable cash flows is a core

business objective of the Company in the future. Presently, the

Company generates a base level of revenues from sale of production

in Trinidad and Tobago. As the Company moves forward with its plans

to grow production (and assuming stable or increasing oil prices),

the Company expects a corresponding increase in revenues and

cashflows. Assuming the Company is able to achieve its production

target of 2,500 bopd (net) by the end of 2021, the Company's

corresponding cashflow targets by the end of 2021 would be for $15

million revenue (on an annual run rate basis). On this basis, the

Company would be seeking to be in a position, by end of 2021, to be

generating sufficient cash flows to cover all overhead and

operating expenses, and potentially making a considerable

contribution to ongoing capital and exploration expenditures).

The management of BPC believe very strongly in providing clear,

measurable milestones, goals and targets for the benefit of

shareholders, as set out in this announcement and the Company's

presentation. The Company will seek to regularly update the market

on progress against these.

Appointment of Investec as joint broker

The Company is pleased to advise that it has appointed Investec

Bank Plc as joint broker. Investec Bank Plc is an international

banking and wealth management group. The firm's corporate and

investment banking division works with growth-oriented companies,

institutions and private equity funds, offering deep sector

experience in resources and oil & gas and providing its broking

clients with a comprehensive range of solutions spanning capital,

advice and treasury risk management.

BPC's existing broking arrangement with Shore Capital continues

unaffected, and the Company's financial advisory mandate with

Gneiss Energy has been extended for at least another nine months

with Strand Hanson continuing as Nominated Adviser. BPC considers

that the ability to assemble a roster of such high-quality advisers

is a testament to the strength of the Company's current position

and the strategic benefit afforded by the recently expanded asset

base, and provides the Company with access to the skills, expertise

and network necessary over the coming months as the Company moves

forward with its expanded programme of activities.

Executive and Board appointments

The Company confirms that Mr Leo Koot is shortly expected to

join the Board of BPC as a non-executive director, once customary

due diligence checks by BPC's Nominated Adviser are completed.

The Company is pleased to announce the appointment of Dr.

Parbodh Gogna to the role of Health, Safety, Environment &

Security (HSE&S) and Government Relations Director, commencing

from 26 August 2020. Dr. Gogna is currently the Chief Medical

Officer for the Australian Department of Home Affairs and Surgeon

General for the Australian Border Force. In this role, he has been

central to evaluating, developing and implementing procedures for

operating during the pandemic, as well as managing liaison across

all levels of Government. Prior to this role, Dr Gogna has had an

extensive leadership career in both private and national health

services roles, with over 30 years of active medical practice, as

well as serving as a captain in the Australian Special Air Service

Regiment. BPC considers securing the services of a person with Dr.

Gogna's experience and skill set to be especially important at this

time, given that the Company is now engaged in active production

operations in remote locations as well as ramping up for offshore

drilling activities, when effective Government interaction and HSE

planning and execution is more important than ever in the context

of Covid-19's global impact. Dr. Gogna will join the Company's

executive leadership group and will be based in Nassau.

Perseverance #1 operational readiness and force majeure

extension

BPC has received proposals for suitable well control insurance

policies for the upcoming Perseverance #1 well, and has instructed

its insurance broker, AON, to begin the process of placing and

binding that policy. The Company expects this process to complete

within the next eight weeks - a further announcement will be made

at that time.

Liaison between BPC's drilling team and Stena Drilling is

already underway, with the teams working to prepare bridging

documentation to manage the interface between the two companies'

management systems. This work will continue over the coming weeks

along with protocols to assure continuous operations and updating

of the logistics plan for uninterrupted essential supplies and

equipment to the drill ship.

The Company has received formal notification from the Government

of The Bahamas that on an interim basis, a 3.5 months force majeure

extension to the second exploration period of the Company's

southern licences in The Bahamas has been granted, such that the

current term of those licences will now extend to at least

mid-April 2021, and by which time BPC must have commenced well

activities.

Given that the relevant force majeure event is presently

continuing (namely, the impact of the Covid-19 pandemic, currently

ongoing in both The Bahamas and in relevant international

jurisdictions), BPC remains in constructive dialogue with The

Government as to the ultimate full extent of the force majeure

extension. However, the interim extension to mid-April 2021, as now

confirmed, is sufficient to provide certainty for the purposes of

the drilling of Perseverance #1, which is scheduled to commence in

the window of 15 December 2020 to 1 February 2021.

Commenting, Simon Potter, Chief Executive Officer of BPC,

said:

"We are making rapid progress on familiarising ourselves with

the potential of our recently expanded portfolio of assets. The

publication today of our latest corporate presentation provides an

initial view as to where we wish to take the portfolio, our targets

and goals, and what our shareholders can anticipate as we get to

grips with leveraging additional performance. We will expand these

metrics as our confidence on delivery grows, but our strategic

focus, as detailed in our new presentation, is simple and

unwavering: to deliver shareholder value through a combination of

high-impact exploration success and growing production cash flows.

Already discrete teams are focused on delivering immediate

objectives, though none more important than the dedicated drilling

team's total focus on the commencement of the Perseverance #1 well

in The Bahamas later this year.

At the same time, the benefits of BPC's portfolio strategy are

already being felt.

First, we welcome Investec as joint broker to the Company, and

the expanded investor reach they bring. A core rationale for

expanding our business was the view that a portfolio of assets

would be of greater interest to larger institutional investors, of

the type with which Investec frequently works. We look forward to

Investec's input over the coming months, including the depth and

quality of their research analysis to complement that already

provided by Shore Capital.

Second, we welcome Dr. Gogna to our team. As we expand

operations across a broader portfolio, and in particular as we

build-up to drilling of our Perseverance #1 well in The Bahamas, it

is extraordinarily reassuring to attract to the organisation

someone with his skills, network and depth of experience,

especially in regards to developing our operating protocols to

ensure continuous and Covid-19 free operations.

We are also pleased to have received confirmation from The

Government of The Bahamas of an interim force majeure extension to

our southern licences, sufficient to ensure drilling can be

completed consistent with the timelines contained in the rig

contract with Stena Drilling, and in full compliance with the term

and obligations of the licences. We are especially grateful to the

Office of the Attorney General in The Bahamas for their

collaborative approach to working with BPC, even whilst a state of

emergency remains in force in The Bahamas.

These are interesting and exciting times for BPC, and we look

forward to keeping shareholders fully appraised of our progress in

the coming months."

For further information, please contact:

Bahamas Petroleum Company plc Tel: +44 (0) 1624

Simon Potter, Chief Executive Officer 647 882

Strand Hanson Limited - Nomad Tel: +44 (0) 20 7409

Rory Murphy / James Spinney / Jack Botros 3494

Shore Capital Stockbrokers Limited - Tel: +44 (0) 207 408

J oint Broker 4090

Jerry Keen / Toby Gibbs

Investec Bank Plc - J oint Broker Tel: +4 4 (0) 207

Chris Sims / Rahul Sharma 597 5970

CAMARCO Tel: +44 (0) 020 3757

Billy Clegg / James Crothers / Hugo Liddy 4980

The information communicated in this announcement contains

inside information for the purposes of Article 7 of the Market

Abuse Regulation (EU) No. 596/2014.

In accordance with the AIM Note for Mining and Oil & Gas

Companies, Bahamas Petroleum Company discloses that Randolph

Hiscock, Bahamas Petroleum Company Technical Lead, is the qualified

person who has reviewed the technical information contained in this

document. He has a Masters in geology and is a member of the AAPG.

He has over 35 years' experience in the oil and gas industry.

Randolph Hiscock consents to the inclusion of the information in

the form and context in which it appears.

The internal reserve and resource estimates in this announcement

have been reported in accordance with the Petroleum Resource

Management System ("PRMS").

Technical terms used within this announcement are as defined in

accordance with the PRMS.

ENDS

Notes to editors

BPC is a Caribbean and Atlantic margin focused oil and gas

company, with a range of exploration, appraisal, development and

production assets and licences, located offshore in the waters of

The Bahamas and Uruguay, and onshore in Trinidad and Tobago, and

Suriname. BPC is currently on-track for drilling an initial

exploration well in The Bahamas, Perseverance #1, in late 2020 /

early 2021, with the well targeting recoverable P(50) prospective

oil resources of 0.77 billion barrels, with an upside of 1.44

billion barrels. In Trinidad and Tobago, BPC has five producing

fields, two appraisal / development projects and a prospective

exploration portfolio in the South West Peninsula. BPC's

exploration licence in Uruguay is highly prospective, with a

potential resource of 1 billion barrels of oil equivalent. In

Suriname, BPC has an onshore appraisal / development project.

BPC is listed on the AIM market of the London Stock Exchange.

www.bpcplc.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

UPDSFEESEESSEEA

(END) Dow Jones Newswires

August 13, 2020 02:00 ET (06:00 GMT)

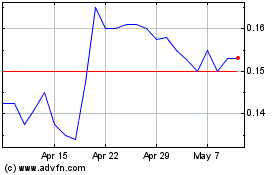

Challenger Energy (LSE:CEG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Challenger Energy (LSE:CEG)

Historical Stock Chart

From Apr 2023 to Apr 2024