TIDMBPC

RNS Number : 5390V

Bahamas Petroleum Company PLC

07 August 2020

07 August 2020

Bahamas Petroleum Company plc

("BPC" or the "Company")

Completion of Merger with Columbus Energy Resources plc and

Issue of New Shares

Bahamas Petroleum Company plc ("BPC"), the Caribbean and

Atlantic margin focused oil and gas company, with exploration,

production, appraisal and development assets across the region, is

pleased to confirm that, as of today, the merger with Columbus

Energy Resources Plc ("Columbus"), effected by means of a Court

sanctioned scheme of arrangement under Part 26 of the Companies Act

2006 (the "Scheme"), has completed.

Pursuant to the Scheme, a total of 757,261,511 new BPC ordinary

shares will be issued and allotted to holders of Scheme Shares,

5,160,305 new BPC ordinary shares will be issued to Columbus's

management pursuant to their respective settlement and termination

arrangements and 106,466,976 new BPC shares will be issued and

allotted to Trafalgar Capital Management (HK) Limited pursuant to

the Replacement Funding Agreement, the proceeds of which will be

used to settle the Lind Convertible Loan Agreement. Therefore, a

total of 868,888,792 new BPC ordinary shares (together, the "New

Shares") will be issued and allotted pursuant to the Scheme.

A further issue of approximately 21 million new BPC ordinary

shares and 17 million new BPC nil cost options, pursuant to the

Columbus Executive Salary Options and as set out in Columbus's

Scheme Document, and 31 million new BPC ordinary shares to BPC's

advisors in relation to the merger is expected to occur during the

week commencing 17 August 2020, with the exact number to be

finalised during the week commencing 10 August 2020. A further

announcement will be made when these shares and options are

issued.

As announced on 5 August 2020, until such time as the Goudron

EPSC is entered into, which is expected will occur in the ordinary

course of business, BPC and Columbus's management have agreed to

delay the issuance of a further 25,562,167 new BPC ordinary shares

due to Columbus's management pursuant to their respective

settlement and termination arrangements, as set out in Columbus's

Scheme Document. These new BPC ordinary shares will be issued once

the Goudron EPSC is entered into, and a further announcement will

be made when these shares are issued.

The New Shares will rank pari passu with the existing ordinary

shares of 0.002p each in the capital of BPC (the "Ordinary

Shares"). Application has been made to the London Stock Exchange

for admission of the New Shares to trading on AIM. Admission is

expected to occur on 10 August 2020 and CREST accounts will be

credited as soon as possible after 8.00 am on 10 August 2020. The

latest date for dispatch of share certificates in respect of the

New Shares is 21 August 2020.

Following the issue of the New Shares, the Company's total

issued share capital will comprise 3,352,664,877 Ordinary

Shares.

The Company does not hold any shares in treasury at the date of

this disclosure. The issued share capital figure can be used by

shareholders as the denominator for the calculations by which to

determine if they are required to notify their interest in, or a

change to their interest in, the Company under the FCA's Disclosure

and Transparency Rules.

Defined terms used but not defined in this announcement have the

meaning given to them in Columbus's Scheme Document, a copy of

which, is available on the BPC website at www.bpcplc.com .

Simon Potter, Chief Executive Officer of BPC, said:

"With the completion of the merger of BPC and Columbus, we today

become a single company, in pursuit of a single-minded vision: the

creation of a revenue generating, full-cycle, Atlantic margin

exploration and production (E&P) business.

To achieve this vision we have a clear strategy, where we will

apply a portfolio approach to asset ownership across the full life

cycle of the hydrocarbons business, in a manner that appropriately

balances risk and reward, ensures access to capital on competitive

terms, and effectively leverages our core expertise and experience.

Going forward, BPC is an exploration and production business,

intent on generating reliable, growing production cashflows capable

of supporting exploration activities, and which together will

create significant value for all stakeholders. The merger of the

two companies allows each to provide something different from

within that business cycle to the combined new company; each is

providing what the other hitherto has not or does not have.

Together the asset base is more robust, has broader interests and

is, as a consequence, more financeable and thus more valuable.

Many people have worked tirelessly from both companies and

advisor groups in order to bring this merger about - even more so

given the difficult and trying circumstances brought about by

Covid-19 restrictions. I would like to thank them all for their

efforts.

Now comes the hard work."

For further information, please contact:

Bahamas Petroleum Company plc Tel: +44 (0) 1624

Simon Potter, Chief Executive Officer 647 882

Gneiss Energy Limited - Financial Advisor T el: +44 (0) 20 3983

Jon Fitzpatrick / Paul Weidman 9263

Strand Hanson Limited - Nomad Tel: +44 (0) 20 7409

Rory Murphy / James Spinney / Jack Botros 3494

Shore Capital Stockbrokers Limited Tel: +44 (0) 207 408

Jerry Keen / Toby Gibbs 4090

CAMARCO Tel: +44 (0) 20 3757

Billy Clegg / James Crothers / Hugo Liddy 4983

ENDS

Notes to editors

Bahamas Petroleum Company plc ("BPC"), is a Caribbean and

Atlantic margin focused oil and gas company, with exploration,

production, appraisal and development assets in licences located in

the waters of The Bahamas and Uruguay and onshore licenses in

Trinidad and Suriname. BPC is currently on-track for drilling an

initial exploration well in The Bahamas, Perseverance #1, in late

2020 / early 2021, with the well targeting recoverable P50

prospective oil resources of 0.77 billion barrels, with an upside

of 1.44 billion barrels. BPC's exploration licence in Uruguay is

highly prospective, with a potential resource of 1 billion barrels

of oil equivalent. In Trinidad, BPC has five producing fields, two

appraisal / development projects and a prospective exploration

portfolio in the South West Peninsula. In Suriname, BPC has an

onshore appraisal / development project.

BPC is listed on the AIM of the London Stock Exchange.

www.bpcplc.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IOEBDGDISXGDGGR

(END) Dow Jones Newswires

August 07, 2020 08:38 ET (12:38 GMT)

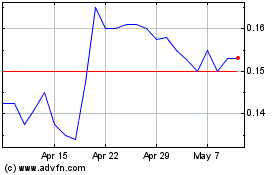

Challenger Energy (LSE:CEG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Challenger Energy (LSE:CEG)

Historical Stock Chart

From Apr 2023 to Apr 2024