Bahamas Petroleum Company PLC Court Sanction of Merger with CERP (2802V)

August 05 2020 - 12:10PM

UK Regulatory

TIDMBPC

RNS Number : 2802V

Bahamas Petroleum Company PLC

05 August 2020

05 August 2020

Bahamas Petroleum Company plc

("BPC" or the "Company")

Court Sanction of Merger with Columbus Energy Resources plc

Bahamas Petroleum Company plc ("BPC"), the Caribbean and

Atlantic margin focused oil and gas company, with exploration,

production, appraisal and development assets across the region, is

pleased to confirm that the merger with Columbus Energy Resources

Plc ("Columbus"), effected by means of a Court sanctioned scheme of

arrangement under Part 26 of the Companies Act 2006 (the "Scheme"),

has been sanctioned by the Court earlier today ("Court Sanction").

The Scheme will become effective upon the Court Order being

delivered to the Registrar of Companies, which is expected to take

place on or about 7 August 2020, consistent with the expected

timetable of events as set out in Columbus's Scheme Document.

Subject to the Scheme becoming effective, the new BPC ordinary

shares pursuant to the merger will be issued and allotted to

holders of Scheme Shares. A further announcement will be made when

the Scheme has become effective.

Conditions to the Scheme

Prior to the Court Sanction hearing, BPC notified Columbus that

it would not seek to invoke the Condition of the Scheme (as set out

in paragraph 5 of Part III of Columbus's Scheme Document) related

to the entry by Columbus into the Goudron EPSC with Heritage prior

to the date of the Court Sanction hearing. It is expected that the

Goudron EPSC will be entered into in the ordinary course of

business but until such time, BPC and Columbus's management have

agreed the delay in the issuance of 25,562,167 new BPC Shares due

to Columbus's management pursuant to their respective settlement

and termination arrangements as set out in Columbus's Scheme

Document.

The expected timetable of principal events for the

implementation of the Scheme remains as set out on page 13 of

Columbus's Scheme Document. If any of these dates and/or times

change, a further announcement will be made.

Defined terms used but not defined in this announcement have the

meaning given to them in Columbus's Scheme Document, a copy of

which, is available on the BPC website at www.bpcplc.com.

Simon Potter, Chief Executive Officer of Bahamas Petroleum

Company plc commented:

"Completion of the merger is a milestone for BPC as we move

forward with our vision to create a business with a range of assets

representative of each phase of our industry - a full-cycle

exploration and production business. I would like to thank our

existing shareholders for their support, and at the same time

welcome our new shareholders to this expanded company that, in our

view, will be much better equipped to thrive in the currently

prevailing industry conditions. The Board and the entire team at

BPC is committed to leveraging operations in our new assets in

Trinidad, Suriname and Uruguay, as well completing our Perseverance

#1 well in The Bahamas so that the newly combined assets deliver

exceptional shareholder value."

This announcement is inside information for the purposes of

Article 7 of Regulation 596/2014.

For further information, please contact:

Bahamas Petroleum Company plc Tel: +44 (0) 1624

Simon Potter, Chief Executive Officer 647 882

Strand Hanson Limited - Nomad Tel: +44 (0) 20 7409

Rory Murphy / James Spinney / Jack Botros 3494

Shore Capital Stockbrokers Limited Tel: +44 (0) 207 408

Jerry Keen / Toby Gibbs 4090

CAMARCO

Billy Clegg / James Crothers / Hugo Liddy

ENDS

Notes to editors

Bahamas Petroleum Company plc ("BPC"), is a Caribbean and

Atlantic margin focused oil and gas company, with exploration,

production, appraisal and development assets in licences located in

the waters of The Bahamas and Uruguay and onshore licenses in

Trinidad and Suriname. BPC is currently on-track for drilling an

initial exploration well in The Bahamas, Perseverance #1, in late

2020 / early 2021, with the well targeting recoverable P50

prospective oil resources of 0.77 billion barrels, with an upside

of 1.44 billion barrels. BPC's exploration licence in Uruguay is

highly prospective, with a potential resource of 1 billion barrels

of oil equivalent. In Trinidad, on completion of the merger, BPC

will have five producing fields, two appraisal / development

projects and a prospective exploration portfolio in the South West

Peninsula. In Suriname, BPC will have an onshore appraisal /

development project.

BPC is listed on the AIM of the London Stock Exchange.

www.bpcplc.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCFLFEETTIEIII

(END) Dow Jones Newswires

August 05, 2020 12:10 ET (16:10 GMT)

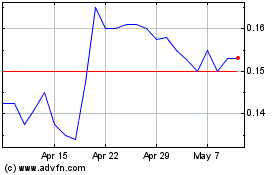

Challenger Energy (LSE:CEG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Challenger Energy (LSE:CEG)

Historical Stock Chart

From Apr 2023 to Apr 2024