TIDMBPC

RNS Number : 8295R

Bahamas Petroleum Company PLC

31 October 2019

31 October 2019

Bahamas Petroleum Company plc

("Bahamas Petroleum" or the "Company")

Cancellation of Existing Options & Grant of Options

At the Annual General Meeting ("AGM") of Bahamas Petroleum

Company plc, held on 17(th) September 2019, shareholders of the

Company approved:

1. The cancellation of all existing options;

2. The initial grant of 150,000,000 New Options to the

Directors, staff and consultants of the Company (out of a total

approved pool of 200,000,000 New Options); and

3. The grant of 25,000,000 options pursuant to the Convertible

Note Subscription Agreement entered into on 9 October 2019 with

Bizzell Capital Partners Pty Ltd and MH Carnegie & Co Pty

Ltd.

The Company has thus, effective 31 October 2019, proceeded to

enact each of these items in accordance with the approvals provided

by the Company's shareholders. Full details of each of these items,

including the terms of conditions of each, were set out in the

Company's Notice of Annual General Meeting (the "Notice"), dated 21

August 2019, and are summarised for the ready information of

shareholders in the Appendix to this announcement.

For further information, please contact:

Bahamas Petroleum Company plc Tel: +44 (0) 1624

Simon Potter, Chief Executive Officer 647 882

Strand Hanson Limited - Nomad Tel: +44 (0) 20

Rory Murphy / James Spinney 7409 3494

Shore Capital Stockbrokers Limited Tel: +44 (0) 207

Jerry Keen / Toby Gibbs 408 4090

CAMARCO Tel: +44 (0) 20

Billy Clegg / James Crothers 3757 4983

www.bpcplc.com

Regulatory Statements

The information communicated in this announcement contains

inside information for the purposes of Article 7 of the Market

Abuse Regulation (EU) No. 596/2014.

APPENDIX: DETAILS

1. Cancellation of Existing Options

By agreement with relevant option holders, the Company has,

effective 31 October 2019, cancelled all 68.85 million existing

options over ordinary shares in the Company, as approved by

shareholders at the AGM.

2. Grant of New Options to the Directors, staff and consultants of the Company

Effective 31 October 2019, New Options have been issued to the

Directors, staff and consultants of the Company in three tranches,

summarised as follows:

(i) Series A: 50,000,000 New Options, fully vested, immediately

exercisable, exercise price of 2.22p per New Option (consistent

with the exercise price of existing Options being cancelled);

(ii) Series B: 50,000,000 New Options, that will vest and become

exercisable at such point in time as the Board, having consulted

with the relevant advisers to the Company, determines that the cost

of an initial exploration well is fully funded on an unconditional

basis, exercise price of 2.4p per New Option;

(iii) Series C: 50,000,000 New Options, that will vest and

become exercisable at such point in time as the initial exploration

well commences, exercise price of 2.8p per New Option.

All New Options, if not exercised, will expire five years after

the date of issue. The New Options are not quoted or traded on AIM;

on exercise, the Company will make application for the new ordinary

shares arising to be admitted for trading on AIM.

The New Options have been allocated as follows:

OPTIONHOLDER SERIES A SERIES B SERIES C

William Schrader 1,500,000 750,000 750,000

---------------------- ---------------------- ----------------------

James Smith 750,000 375,000 375,000

---------------------- ---------------------- ----------------------

Eddie Shallcross* 750,000 375,000 375,000

---------------------- ---------------------- ----------------------

Ross McDonald 750,000 375,000 375,000

---------------------- ---------------------- ----------------------

Adrian Collins 750,000 375,000 375,000

---------------------- ---------------------- ----------------------

Simon Potter 20,000,000 15,000,000 25,000,000

---------------------- ---------------------- ----------------------

Other executives, employees

and consultants, in

aggregate 25,500,000 32,750,000 22,750,000

---------------------- ---------------------- ----------------------

Total: 50,000,000 50,000,000 50,000,000

---------------------- ---------------------- ----------------------

*Options granted to the estate of Edward Shallcross following

his passing away on 14 October 2019

3. Grant of options pursuant to the Convertible Note Subscription Agreement

Pursuant to the Convertible Note Subscription Agreement entered

into on 9 October 2019 with Bizzell Capital Partners Pty Ltd and MH

Carnegie & Co Pty Ltd, 25,000,000 options have been granted to

these parties with an exercise price of 2 pence per share

immediately exercisable for a period of 4 years. Of the total

options granted, 6,250,000 options have been granted to Bizzell

Capital Partners Pty Ltd and 18,750,000 options have been granted

to MH Carnegie & Co Pty Ltd.

END

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCMBBBTMBIJBRL

(END) Dow Jones Newswires

October 31, 2019 07:51 ET (11:51 GMT)

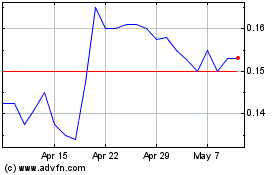

Challenger Energy (LSE:CEG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Challenger Energy (LSE:CEG)

Historical Stock Chart

From Apr 2023 to Apr 2024