TIDMBPC

RNS Number : 9555S

Bahamas Petroleum Company PLC

15 March 2019

15 March 2019

Bahamas Petroleum Company plc ("BPC" or the "Company")

Placing to raise US$2.5 million

Bahamas Petroleum Company plc, the oil and gas exploration

company with a significant prospective resource in licences in The

Commonwealth of The Bahamas ("The Bahamas"), is pleased to announce

that it has raised US$2.54 million before expenses through a firm

placing of 120,000,000 new ordinary shares of 0.002p each

("Ordinary Shares") (the "Placing Shares") at a price of 1.6p each

(the "Placing").

Highlights of the Placing:

-- Placing to raise gross proceeds of US$2.54 million through

the issue of 120,000,000 Placing Shares at a price of 1.6p

each.

-- Proceeds of the Placing will be used to fund the Company as

it seeks to secure a farm-in partner to finance an initial

exploratory well on the Company's four southern licences in The

Bahamas (the "Licences").

-- BPC is confident of being able to attract a farm-in partner

now its licences have been extended to 31 December 2020.

-- Discussions are ongoing with a number of potential farm-in partners.

Placing Summary

The Placing will raise, in aggregate, $2.544 million before

expenses through the placing of, in aggregate, 120,000,000 new

Ordinary Shares at a price of 1.6p per share (the "Placing"). The

Placing Shares to be issued will rank pari passu in all respects

with the Company's existing Ordinary Shares and will represent

approximately 7.1per cent. of the Company's enlarged issued

ordinary share capital, following admission of the Placing Shares.

7.2 million unlisted warrants to subscribe for new Ordinary Shares

at the Placing Price per share for a period of 24 months from the

earlier of the business day following passing of the relevant

resolutions at the Company's next AGM or 1 January 2020, are to be

issued to Shore Capital as part compensation for services provided

under the Placing.

Application will be made for the 120,000,000 Placing Shares to

be admitted to trading on the AIM market of the London Stock

Exchange ("AIM") and it is expected that admission will take place

and trading in the Placing Shares will commence from 8:00am on 22

March 2019 ("Admission").

Total Voting Rights

Following the Admission, the Company's issued share capital will

consist of 1,692,719,096 Ordinary Shares, with each Ordinary Share

carrying the right to one vote. The Company does not hold any

Ordinary Shares in treasury. This figure of 1,692,719,096 Ordinary

Shares may therefore be used by shareholders in the Company, as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change in their

interest in, the share capital of the Company under the FCA's

Disclosure Guidance and Transparency Rules ("DTRs").

Working Capital

The directors consider that the proceeds of the placing,

together with the Company's existing financial resources will

provide sufficient working capital for its currently anticipated

requirements for at least the next 12 months. Refer to Note 1 below

for additional details in relation to working capital.

Simon Potter, Chief Executive Officer commented:

"Our focus at Bahamas Petroleum remains clear and unwavering: to

drill an initial exploration well on our highly prospective acreage

in The Bahamas.

Now more than ever, we believe that the ingredients for success

are present. We have a world-class drill-ready asset, with

multi-billion barrel potential as certified by third parties. We

have a robust technical case, as endorsed by the interest to-date

of potential partners. The Bahamian regulatory regime is fully

enacted, and we have a clear licence term through to the end of

2020, thus providing potential farm out partners with clarity as to

tenure, term, schedule and operating environment. Now, with today's

placing, we have secured the funds needed as we continue to seek a

farm-out agreement, and thereafter move forward to drilling of the

initial exploration well and realising the offshore potential in

The Bahamas.

I would like to thank existing and new shareholders for their

continued support and I look forward to updating them on further

progress in due course."

Ends

For further information, please contact:

Bahamas Petroleum Company plc Tel: +44 (0) 1624 647

Simon Potter, Chief Executive Officer 882

Strand Hanson Limited - Nomad Tel: +44 (0) 20 7409

Rory Murphy / James Spinney 3494

Shore Capital Stockbrokers Limited - Broker Tel: +44 (0) 207 408

Jerry Keen / Toby Gibbs 4090

CAMARCO Tel: +44 (0) 20 3757

Billy Clegg / James Crothers 4983

Note 1: Additional Details in relation to Working Capital

In relation to working capital, as announced on 22 February 2019

the Company has received formal notification from the Government of

The Bahamas (the "Government") that the term of the second

exploration period of the Licences is extended until 31 December

2020.

During this extension, the Company and the Government must, in

the coming months:

(i) establish a forward process and schedule for 2019 and 2020

for the consideration and finalisation of the Environmental

Authorisation previously submitted by the Company in April 2018, in

accordance with the relevant Act and Regulations, and

(ii) determine any additional licence fees that may be payable

by the Company up to the end of 2020, when reconciled against:

a. Licence fees amount previously paid in good faith by the

Company (approximately US$1.05 million) despite the inability to

undertake Licence activities,

b. Licence fee levels previously established with the Government

(being US$250,000 per Licence per annum) as may be modified in view

of changed industry circumstances since Licence fee levels were

initially proposed in 2013 under very different then prevailing

circumstances,

c. Periods in which Licence activities were unable to be

undertaken owing to various disruptions beyond the control or

discretion of the Company, and during which Licence fees were

correspondingly abated, and

d. Other amounts presently held on account by the Government in relation to various other matters (approximately US$620,000).

(Note: these items have previously been identified in the

relevant Company annual accounts in the periods 2012 - 2018).

In 2018 the Company submitted to the Government a proposed

reconciliation in respect of all of the above items, which

indicated a balance payment due to the Government of approximately

US$200,000 for Licence fees up to the end of 2020.

This amount, along with consideration of various sensitivities,

has been taken into account in determining the adequacy of working

capital for the next 12 months.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IOECKQDQBBKBDND

(END) Dow Jones Newswires

March 15, 2019 03:01 ET (07:01 GMT)

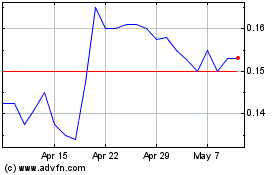

Challenger Energy (LSE:CEG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Challenger Energy (LSE:CEG)

Historical Stock Chart

From Apr 2023 to Apr 2024