BP Swings to 4Q Profit But Misses Consensus Estimates -- Update

February 02 2021 - 3:34AM

Dow Jones News

--BP achieved a profit in the fourth quarter, helped by the

disposal of its petrochemicals business

--Net debt was reduced to $39 billion

--The oil major continues to expect to reach its $35 billion

debt target in late 2021 or early 2022

By Jaime Llinares Taboada

BP PLC said Tuesday that it swung to a profit in the fourth

quarter of 2020 and forecast that it will reach its deleveraging

target in the fourth quarter of 2021 or the first quarter of

2022.

The British oil major made a net profit of $1.36 billion in the

three months to Dec. 31, compared with a net loss of $450 million

in the third quarter. The company's financial performance benefited

from the $2.3 billion sale of its petrochemicals business.

Its underlying replacement cost profit increased to $115 million

from $86 million quarter-on-quarter, but was below the

company-compiled market consensus of $370 million, based on 26

brokers' estimates. The metric is similar to the net profit figure

that U.S. oil companies use but strips out one-off items.

The full-year result was a loss of $5.7 billion compared with a

$10 billion profit in 2019, driven by lower oil and gas prices,

significant exploration write-offs and refining margins and

depressed demand.

BP said operating cash flow for the quarter, excluding Gulf of

Mexico oil spill payments of $0.1 billion, was $2.4 billion.

Compared with the third quarter, this reflected the significant

impact of lower marketing volumes in downstream and a significantly

weaker contribution from gas marketing and trading.

At year end net debt was $39 billion, down $1.4 billion over the

quarter and $6.5 billion over the full year. Net debt is expected

to increase in the first half of 2021, driven by severance

payments, the annual Gulf of Mexico oil spill payment and payment

following completion of the offshore wind joint venture with

Equinor. It is expected to then fall in the second half with

growing operating cash flow and the receipt of divestment

proceeds.

BP said it continues to expect to reach its $35 billion net debt

target around fourth quarter 2021 and first quarter 2022. This

assumes oil prices in the range of $45-$50 a barrel and BP planning

assumptions for refining marker margin and gas prices. The company

said this summer it will return cash to shareholders through share

buybacks once net debt is reduced to $35 billion.

BP declared a quarterly dividend of 5.25 cents a share, bringing

the full-year payment to 31.50 cents, down from 41.00 cents in

2019.

The company said that oil prices have risen since the end of

October and demand is expected to recover in 2021. Moreover, BP

forecast U.S. gas prices will benefit from lower production and a

recovery in international liquefied natural gas demand driven by

Asia.

However, the group also projected that its Downstream division

will be hurt by the pandemic in the first quarter of 2021, as

restrictions weigh on product demand.

Write to Jaime Llinares Taboada at jaime.llinares@wsj.com;

@JaimeLlinaresT

(END) Dow Jones Newswires

February 02, 2021 03:19 ET (08:19 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

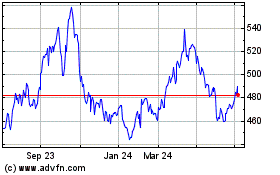

Bp (LSE:BP.)

Historical Stock Chart

From Mar 2024 to Apr 2024

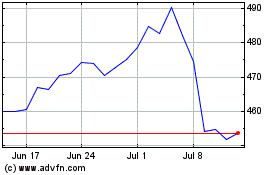

Bp (LSE:BP.)

Historical Stock Chart

From Apr 2023 to Apr 2024