BP Posts Fifth Straight Quarterly Loss -- 2nd Update

October 27 2020 - 8:51AM

Dow Jones News

By Sarah McFarlane

LONDON -- BP PLC reported a fifth consecutive quarterly loss on

Tuesday, providing the first glimpse of how major oil companies

navigated the third quarter amid a prolonged slump in demand

triggered by the coronavirus pandemic.

The loss follows one of the worst second quarters ever for the

sector, in which BP halved its dividend and cut jobs. In the third

quarter, oil prices stabilized at around $40 a barrel after diving

earlier in the year. Still, prices remain around a third below

where they were in the same period a year earlier.

BP's earnings also suffered from lower refining margins and

weaker trading results. Trading had provided a bright spot in the

previous quarterly earnings for BP, Royal Dutch Shell PLC and Total

SE, but lower volatility in the quarter ended Sept. 30 reduced

trading opportunities.

Other major oil companies are expected to report another weak

quarter, with Shell and Exxon Mobil Corp. having already flagged

expected losses in their oil-and-gas production businesses in

recent weeks.

Shell is due to report its earnings on Thursday, followed by

Chevron Corp. and Exxon on Friday.

Refining and trading sometimes offer some relief to major oil

companies during times of lower energy prices but recently even

these areas haven't been as profitable. Refining margins have in

the past risen when oil prices have fallen, but Covid-19's

decimation of fuel demand meant this didn't happen.

"Oil prices went down but refineries couldn't get the product

away to the market, people weren't flying, people weren't driving,"

said Murray Auchincloss, BP's chief financial officer, in an

interview.

BP said that the outlook for trading and refining margins

remained challenging due to Covid-19, with record-high inventories

and a leveling off in demand for gasoline and jet fuel.

The company reported a replacement cost loss -- a metric similar

to the net income figure that U.S. oil companies report -- of $644

million for the three months ended Sept. 30, from a loss of $351

million in the year-earlier period.

It is the first set of earnings for the British company since it

gave details of a wide-ranging revamp to become less dependent on

oil, while increasing investments in renewables and other

low-carbon energy sources over the next decade, at an event last

month.

That shift hasn't eased investor worry. The company's shares are

trading near a 25-year low and have underperformed their peers in

recent months.

"While the results were better than expected, they are still

extremely weak and it is far too early to anticipate a change in

market evaluation of BP's likely future performance under its

radical new strategy," said Colin Smith, an analyst at Panmure

Gordon.

BP's gearing -- the ratio of net debt to the total of net debt

and equity -- was in line with the previous quarter at 37.7%

including leases in the three months to Sept. 30. It remained above

the company's target of 20% to 30%.

The company's net debt fell slightly to $40.4 billion, from

$40.9 billion at the end of June.

When BP halved its dividend in August, the company said that it

would return at least 60% of surplus cash as share buybacks once

debt is below $35 billion.

"I would expect we'll move into buyback territory somewhere

around 4Q 2021, 1Q 2022," said BP's Mr. Auchincloss, adding this

was based on a Brent oil price of $45 to $50 a barrel.

The company plans to sell $25 billion of its assets by 2025 and

has already achieved around half of the target, including recent

sales of its Alaska business and its chemicals unit.

Net debt is expected to fall in the fourth quarter as proceeds

from the sales are received.

BP's shares traded down 0.1% on Tuesday.

Write to Sarah McFarlane at sarah.mcfarlane@wsj.com

(END) Dow Jones Newswires

October 27, 2020 08:36 ET (12:36 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

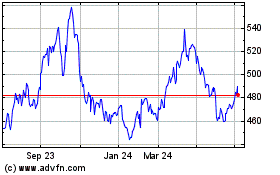

Bp (LSE:BP.)

Historical Stock Chart

From Mar 2024 to Apr 2024

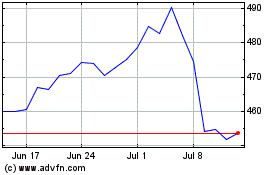

Bp (LSE:BP.)

Historical Stock Chart

From Apr 2023 to Apr 2024