TIDMBP.

RNS Number : 4718X

BP PLC

30 April 2019

FOR IMMEDIATE RELEASE

London 30 April 2019

BP p.l.c. Group results

First quarter 2019

==========================

For a printer friendly copy of this announcement, please click

on the link below to open a PDF version

http://www.rns-pdf.londonstockexchange.com/rns/4718X_1-2019-4-29.pdf

Highlights Resilient earnings and cash flow, continued strategic progress

-- Earnings and cash flow

- Underlying replacement cost profit for the first quarter of

2019 was $2.4 billion, compared to $2.6 billion a year earlier. The

result reflected the weaker price and margin environment at the

start of the quarter, partially offset by strong supply and trading

results.

- Operating cash flow, excluding Gulf of Mexico oil spill

payments, for the quarter was $5.9 billion, including a

$1.0-billion working capital build (after adjusting for inventory

holding gains). Gulf of Mexico oil spill payments in the quarter

were $0.6 billion.

- Dividend of 10.25 cents a share announced for the quarter,

2.5% higher than a year earlier.

-- New projects and marketing growth

- Reported oil and gas production for the quarter averaged 3.8

million barrels a day of oil equivalent. Upstream production, which

excludes Rosneft, was 2% higher than a year earlier. BP-operated

Upstream plant reliability was 96.2%.

- Integration of US onshore assets acquired from BHP continues,

with BP taking operational control in March.

- Three Upstream major projects - in Trinidad, Egypt and the

Gulf of Mexico - have started production in 2019 and BP has taken

final investment decisions for three more Upstream major

projects.

- Downstream continued growth in fuels marketing reflected

increased numbers of convenience partnership sites and expansion in

new markets.

-- Advancing low carbon

- Strong progress is being made towards BP's published targets

for operational greenhouse gas (GHG) emissions, with reduced

operational GHG emissions in 2018, good delivery of sustainable GHG

emissions reductions, and methane intensity remaining on

target.

- A $100-million fund to support new emissions-reducing projects

in the Upstream was announced, as well as an agreement with

Environmental Defense Fund to advance technologies and practices to

reduce oil and gas industry methane emissions.

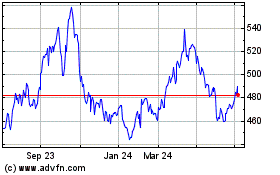

See chart on PDF

Bob Dudley - Group chief executive:

BP's performance this quarter demonstrates the strength of our strategy.

With solid Upstream and Downstream delivery and strong trading results,

we produced resilient earnings and cash flow through a volatile period

that began with weak market conditions and included significant turnarounds.

Moving through the year, we will keep our focus on disciplined growth,

with efficient project execution and safe and reliable operations.

Financial summary First Fourth First

quarter quarter quarter

$ million 2019 2018 2018

======= ======= =========

Profit for the period attributable to BP shareholders 2,934 766 2,469

Inventory holding (gains) losses, net of tax (839) 1,951 (80)

RC profit 2,095 2,717 2,389

Net (favourable) adverse impact of non-operating items

and fair value accounting effects, net of tax 263 760 197

======

Underlying RC profit 2,358 3,477 2,586

========================================================= ====== ======= ======

RC profit (loss) per ordinary share (cents) 10.38 13.58 11.99

RC profit (loss) per ADS (dollars) 0.62 0.81 0.72

Underlying RC profit per ordinary share (cents) 11.69 17.38 12.98

Underlying RC profit per ADS (dollars) 0.70 1.04 0.78

========================================================= ====== ======= ======

RC profit (loss), underlying RC profit, operating cash flow

excluding Gulf of Mexico oil spill payments and working capital are

non-GAAP measures. These measures and Upstream plant reliability,

major projects, inventory holding gains and losses, non-operating

items and fair value accounting effects are defined in the Glossary

on page 31.

The commentary above and following should be read in conjunction with

the cautionary statement on page 35.

----------------------------------------------------------------------

Top of page 2

Effects on key financial metrics of the adoption of IFRS 16

'Leases'

A new IFRS standard on leases came into effect on 1 January

2019. The impact on key financial metrics for the first quarter is

shown below.

Balance sheet and $0.1 billion would have been reported

As a result of the adoption of IFRS as capital expenditure without the

16, $9.6 billion of right-of-use assets adoption of IFRS 16. Impact

and $10.3 billion of lease liabilities of

have been included in the group balance IFRS

sheet as at 31 March 2019. The majority $ billion 16

of these were previously reported =============================

as operating leases and so were not Balance sheet at 31 March

previously recognized on the balance 2019

sheet. The total lease liability also Fixed assets 9.6

includes leases that were previously Lease liabilities 10.3

classified as finance leases under ============================== ==========

IAS 17, which totalled $0.7 billion Income statement for the

at 31 December 2018. Lease liabilities first quarter 2019

are now presented separately on the Operating lease expenses(a) 0.6 -

group balance sheet, do not form part Depreciation, depletion +

of finance debt and are not included and amortization 0.5

in net debt and gearing in the financial Interest charge 0.1 +

framework. Replacement cost profit* Negligible

============================== ==========

Income statement Cash flow for the first

The increase in depreciation from quarter 2019

recognizing right-of-use assets and Operating cash flow 0.5 +

interest on the lease liability is Capital expenditure 0.1 +

largely offset by the absence of operating Lease payments 0.6 -

lease expenses, resulting in no material Free cash flow* Nil

overall effect on group profit measures. ============================== ==========

Cash flow (a) Included in production and manufacturing

In prior years, operating lease payments expenses and distribution and administration

were presented as operating cash flows* expenses under IAS 17.

or capital expenditure*. Lease payments

are now split into payments of principal See pages 17-19, 22 and 24 for more

that are presented as financing cash information.

flows, and payments of interest that

are presented as operating cash flows.

There were $0.6 billion of lease payments

of principal included within financing

cash flows for the first quarter of

2019. BP estimates that $0.5 billion

of these would have been reported

as operating cash outflow

Top of page 3

Group headlines

Results Share buybacks

For the first quarter, underlying BP repurchased 6 million ordinary

replacement cost (RC) profit* was shares at a cost of $50 million, including

$2,358 million, compared with $2,586 fees and stamp duty, during the first

million in 2018. Underlying RC profit quarter of 2019. Our share buyback

is after adjusting RC profit* for programme is expected to be weighted

a net charge for non-operating items* to the second half of 2019 and to

of $252 million and net adverse fair fully offset the impact of scrip dilution

value accounting effects* of $11 million since the third quarter 2017 by the

(both on a post-tax basis). end of 2019.

RC profit was $2,095 million for the Operating cash flow*

first quarter, compared with $2,389 Excluding post-tax amounts related

million in 2018. to the Gulf of Mexico oil spill, operating

BP's profit for the first quarter cash flow* for the first quarter was

was $2,934 million, compared with $5.9 billion, including a $1.0-billion

$2,469 million for the same period working capital* build (after adjusting

in 2018. for inventory holding gains* and excluding

See further information on pages 4, Gulf of Mexico oil spill working capital

26 and 27. effects). For the same period in 2018

Depreciation, depletion and amortization we reported $5.4 billion (prior to

The charge for depreciation, depletion the implementation of IFRS 16).

and amortization was $4.5 billion Including amounts relating to the

in the quarter. In the same period Gulf of Mexico oil spill, operating

in 2018 it was $3.9 billion (prior cash flow for the first quarter was

to the adoption of IFRS 16). In 2019, $5.3 billion (after a $2.7-billion

we expect the full-year charge to working capital build). For the same

be around $2.5 billion higher than period in 2018 we reported $3.6 billion

2018 reflecting the depreciation of (prior to the implementation of IFRS

the right of use assets recognized 16).

under IFRS 16 (expected to be offset See page 29 for further information

in the income statement as operating on Gulf of Mexico oil spill cash flows

lease expenses will no longer appear and on working capital.

in the income statement). Capital expenditure*

Non-operating items Organic capital expenditure* for the

Non-operating items amounted to a first quarter was $3.6 billion. We

post-tax charge of $252 million for reported $3.5 billion for the same

the quarter. See further information period in 2018 (prior to the implementation

on page 26. of IFRS 16).

Effective tax rate Inorganic capital expenditure* for

The effective tax rate (ETR) on RC the first quarter was $2.0 billion,

profit or loss* for the first quarter including $1.7 billion relating to

was 42%, compared with 36% for the the BHP acquisition, compared with

same period in 2018. Adjusting for $0.4 billion for the same period in

non-operating items and fair value 2018.

accounting effects, the underlying Organic capital expenditure and inorganic

ETR* for the first quarter was 40%, capital expenditure are non-GAAP measures.

compared with 37% for the same period See page 25 for further information.

a year ago. The higher underlying Divestment and other proceeds

ETR for the first quarter reflects Divestment proceeds* were $0.6 billion

charges for adjustments in respect for the first quarter, compared with

of prior years. In the current environment $0.2 billion for the same period in

the underlying ETR in 2019 is expected 2018.

to be around 40%. ETR on RC profit Gearing*

or loss and underlying ETR are non-GAAP Net debt* at 31 March 2019 was $45.1

measures. billion, compared with $39.3 billion

Dividend a year ago. Gearing at 31 March 2019

BP today announced a quarterly dividend was 30.4%, compared with 30.0% at

of 10.25 cents per ordinary share the end of 2018 and 27.8% a year ago.

($0.615 per ADS), which is expected Net debt and gearing are non-GAAP

to be paid on 21 June 2019. The corresponding measures. See page 22 for more information.

amount in sterling will be announced

on 10 June 2019. See page 22 for further

information.

Brian Gilvary - Chief financial officer:

Our first quarter results reflect the effects of IFRS 16 for the first

time. While this impacts a number of lines across our financial statements,

our financial framework is unchanged. In particular, we have retained

a measure of gearing broadly consistent with the past, and continue to

target a range of 20-30%.

* For items marked with an asterisk throughout this document,

definitions are provided in the Glossary on page 31.

The commentary above contains forward-looking statements and should be

read in conjunction with the cautionary statement on page 35.

-----------------------------------------------------------------------

Top of page 4

Analysis of underlying RC profit* before interest and tax

First Fourth First

quarter quarter quarter

$ million 2019 2018 2018

======= ======= =========

Underlying RC profit before interest and tax

Upstream 2,928 3,886 3,157

Downstream 1,733 2,169 1,826

Rosneft 567 431 247

Other businesses and corporate (418) (344) (392)

Consolidation adjustment - UPII* (13) 142 (160)

Underlying RC profit before interest and tax 4,797 6,284 4,678

Finance costs and net finance expense relating to pensions

and other post-retirement benefits (754) (654) (464)

Taxation on an underlying RC basis (1,620) (2,148) (1,566)

Non-controlling interests (65) (5) (62)

====== ======

Underlying RC profit attributable to BP shareholders 2,358 3,477 2,586

============================================================= ====== ====== ======

Reconciliations of underlying RC profit or loss to the nearest

equivalent IFRS measure are provided on page 1 for the group and on

pages 6-11 for the segments.

Analysis of RC profit (loss)* before interest and tax and

reconciliation to profit for the period

First Fourth First

quarter quarter quarter

$ million 2019 2018 2018

RC profit before interest and tax

Upstream 2,884 4,168 3,174

Downstream 1,765 2,138 1,713

Rosneft 486 400 247

Other businesses and corporate (546) (1,110) (571)

Consolidation adjustment - UPII (13) 142 (160)

RC profit before interest and tax 4,576 5,738 4,403

Finance costs and net finance expense relating to pensions

and other post-retirement benefits (882) (776) (584)

Taxation on a RC basis (1,534) (2,240) (1,368)

Non-controlling interests (65) (5) (62)

RC profit attributable to BP shareholders 2,095 2,717 2,389

Inventory holding gains (losses)* 1,088 (2,574) 92

Taxation (charge) credit on inventory holding gains

and losses (249) 623 (12)

Profit for the period attributable to BP shareholders 2,934 766 2,469

============================================================= ====== ====== ======

Top of page 5

Strategic progress

Upstream At the end of the quarter BP announced

Upstream production, excluding Rosneft, the establishment of a new initiative

for the quarter was 2,656mboe/d, 2% under which up to $100-million will

higher than a year earlier due to be made available over the next three

acquisition of the BHP assets and years to support projects across the

growth of major projects*. Upstream Upstream to deliver new emissions

plant reliability* was 96.2%. Upstream reductions. BP has also entered into

unit production costs* were $7.39/boe. an agreement with Environmental Defense

Constellation in the Gulf of Mexico Fund to collaborate in development

was the first Upstream major project of technologies and practices to accelerate

to come onstream in 2019, followed reduction of methane emissions across

by the second stage of the West Nile the oil and gas industry.

Delta development, the Giza and Fayoum BP opened two dedicated electric vehicle

fields, in Egypt and the Angelin development charging stations in the quarter,

offshore Trinidad. These are the first the first in China, in partnership

of five Upstream major projects expected with 66i Fuel, and the second in the

to begin production in 2019. BP has UK.

now safely brought 22 new upstream Financial framework

major projects into production since Following the introduction of IFRS

2016, remaining on track to deliver 16, the positive impacts on Operating

900,000boe/d from new projects by cash flow* and Organic capital expenditure*

2021. are fully offset in the cash flow

Since the start of the year, BP has statement by a new line, Lease liability

taken final investment decisions on payments. Lease payments are now included

the Atlantis Phase 3 development in in the definition of free cash flow*

the Gulf of Mexico, Azeri Central as a use of cash, which means the

East in Azerbaijan and Seagull in net impact on this measure is zero

the UK North Sea. following the adoption of IFRS 16.

On 1 March, BPX Energy assumed full

control of the BHP acquired US field Operating cash flow excluding Gulf

operations. of Mexico oil spill payments* was

In March, BP confirmed a gas discovery, $5.9 billion for the first quarter

operated by Eni, in the Nour North of 2019. For the first quarter of

Sinai offshore prospect in the Egyptian 2018, we reported $5.4 billion (prior

Eastern Mediterranean. to the implementation of IFRS 16).

Downstream Organic capital expenditure for the

Increased year-on-year fuels marketing first quarter of 2019 was $3.6 billion.

earnings reflected higher premium BP expects 2019 organic capital expenditure

fuels volumes and the continued roll-out to be in the range of $15-17 billion.

of convenience partnership sites.

Expansion in new markets continued, Lease liability payments of principal

including new sites opening in Mexico, for the first quarter of 2019 were

Indonesia and China. $0.6 billion.

In the quarter BP opened its first

BP-branded retail site in Shandong Divestments and other proceeds were

Province, China. $0.6 billion for the quarter.

BP and Lotte agreed an expansion of

capacity at their joint venture acetyls Gulf of Mexico oil spill payments

petrochemicals site in South Korea, on a post-tax basis totalled $0.6

helping to meet growing regional demand. billion in the quarter. Payments for

BP also signed an agreement with Virent the full year are expected to be around

and Johnson Matthey to advance the $2 billion on a post-tax basis.

development of bio-paraxylene, a raw

material for the production of renewable Gearing* at the end of the quarter

polyester. was 30.4%. Assuming recent average

oil prices, and in line with expected

Advancing the energy transition growth in free cash flow supported

BP announced progress against its by divestment proceeds, we expect

near-term targets for operational gearing to move towards the middle

GHG emissions: 2018 operational emissions of our targeted range of 20-30% in

were 1.7 million tonnes CO(2) equivalent 2020. See page 22 for more information.

(MteCO(2) e) lower than 2017; 2.5MteCO(2) Safety

e sustainable GHG emissions reductions BP has introduced a new safety operating

have been generated throughout BP's metric including tier 2 as well as

operations since the beginning of tier 1 process safety events, giving

2016; and methane intensity was maintained a wider view of process safety within

at 0.2% in 2018. BP's operations. The increase compared

to the first quarter 2018 was mainly

due to a higher number of tier 2 events.

Operating metrics First quarter Financial metrics First quarter

2019 2019

========================== ============================

(vs. First quarter (vs. First quarter

2018) 2018)

========================== =================== ============================ ===================

Tier 1 and tier 2 Underlying RC profit*

process safety events* 28 $2.4bn

========================== ============================

(+15) (-$0.2bn)

========================== =================== ============================ ===================

Reported recordable Operating cash flow

injury frequency* excluding Gulf of

Mexico oil spill payments

0.16 (post-tax)(c) $5.9bn

========================== ============================

(-22%) (+$0.6bn)

========================== =================== ============================ ===================

Group production 3,822mboe/d Organic capital expenditure $3.6bn

========================== ============================

(+2.4%) (+$0.1bn)

========================== =================== ============================ ===================

Upstream production Gulf of Mexico oil

(excludes Rosneft spill payments (post-tax)

segment) 2,656mboe/d $0.6bn

========================== ============================

(+2.0%) (-$1.1bn)

========================== =================== ============================ ===================

Upstream unit production Divestment proceeds*

costs(a) $7.39/boe $0.6bn

========================== ============================

(-3.9%) (+$0.4bn)

========================== =================== ============================ ===================

BP-operated Upstream

plant reliability 96.2% Gearing 30.4%

=========================== ============================

(+0.3) (+2.6)

=================== ============================ ===================

BP-operated refining Dividend per ordinary

availability*(b) 94.3% share(d) 10.25 cents

========================== ============================

(-0.5) (+2.5%)

=================== ============================ ===================

(a) Broadly flat with the same period in 2018 after excluding

the impacts of IFRS 16 on production costs.

(b) From the first quarter 2019 refining availability has

changed to BP-operated refining availability to more closely align

to the BP-operated upstream plant reliability measure.

(c) 1Q19 includes estimated $0.5 billion impact due to IFRS 16.

(d) Represents dividend announced in the quarter (vs. prior year quarter).

The commentary above contains forward-looking statements and should be

read in conjunction with the cautionary statement on page 35.

-----------------------------------------------------------------------

Top of page 6

Upstream

First Fourth First

quarter quarter quarter

$ million 2019 2018 2018

Profit before interest and tax 2,886 4,156 3,175

Inventory holding (gains) losses* (2) 12 (1)

======

RC profit before interest and tax 2,884 4,168 3,174

Net (favourable) adverse impact of non-operating items*

and fair value accounting effects* 44 (282) (17)

Underlying RC profit before interest and tax*(a) 2,928 3,886 3,157

========================================================== ====== ====== ======

(a) See page 7 for a reconciliation to segment RC profit before interest and tax by region.

Financial results

The replacement cost profit before interest and tax for the

first quarter was $2,884 million, compared with $3,174 million for

the same period in 2018. The first quarter included a net

non-operating charge of $4 million, compared with a net charge of

$104 million for the same period in 2018. Fair value accounting

effects in the first quarter had an adverse impact of $40 million,

compared with a favourable impact of $121 million in the same

period of 2018.

After adjusting for non-operating items and fair value

accounting effects, the underlying replacement cost profit before

interest and tax for the first quarter was $2,928 million, compared

with $3,157 million for the same period in 2018. The result for the

first quarter mainly reflected lower liquids realizations and the

impact of turnaround activities in the US Gulf of Mexico, partly

offset by strong gas marketing and trading.

Production

Production for the quarter was 2,656mboe/d, 2.0% higher than the

first quarter of 2018. Underlying production* for the quarter

decreased by 1.9%, mainly due to turnaround and maintenance

activities in the US Gulf of Mexico and severe weather impacts in

BPX Energy.

Key events

On 6 February, the Constellation development in the US Gulf of

Mexico, a tieback to the Constitution spar, commenced production

(Anadarko operator 33.33% and BP 66.67%).

On 11 February, BP confirmed it started gas production from the

second stage of Egypt's West Nile Delta development, in the Giza

and Fayoum fields (BP operator 82.75% and DEA Deutsche Erdoel AG

17.25%).

On 26 February, BP announced first gas from the Angelin project

in Trinidad.

On 1 March, BPX Energy assumed control of all Petrohawk Energy

Corporation operations from BHP.

On 13 March, BP and Environmental Defense Fund announced a

three-year strategic commitment to advance technologies and

practices to reduce methane emissions from the global oil and gas

supply chain.

On 14 March, BP confirmed a gas discovery in the Nour

exploration prospect located in the Nour North Sinai Concession,

located in the Eastern Egyptian Mediterranean (Eni operator 40%, BP

25%, Mubadala Petroleum 20% and Tharwa Petroleum 15%). The well is

currently under evaluation.

On 26 March, BP announced that it has established a fund of up

to $100-million to be made available over the next three years for

projects that will deliver new greenhouse gas (GHG) emissions

reductions in its Upstream oil and gas operations. The new Upstream

carbon fund will provide further support to BP's work in

sustainably reducing GHG emissions in its operations.

In March, a final investment decision was made on Seagull, a

development tieback to the Central UK North Sea (Neptune Energy

operator 35%, BP 50% and Japan Petroleum Exploration Co. LTD.

15%).

In April, a final investment decision was made on the Azeri

Central East (ACE) project, the next stage of the

Azeri-Chirag-Deepwater Gunashli (ACG) field.

Outlook

Looking ahead, we expect second-quarter 2019 reported production

to be broadly flat with the first quarter reflecting ramp up of

major projects* offset by ongoing seasonal turnaround and

maintenance activities in high margin regions.

The commentary above contains forward-looking statements and should be

read in conjunction with the cautionary statement on page 35.

-----------------------------------------------------------------------

Top of page 7

Upstream (continued)

First Fourth First

quarter quarter quarter

$ million 2019 2018 2018

Underlying RC profit before interest and tax

US 612 1,400 526

Non-US 2,316 2,486 2,631

2,928 3,886 3,157

====== ====== ======

Non-operating items

US (30) (267) (145)

Non-US 26 403 41

(4) 136 (104)

====== ====== ======

Fair value accounting effects

US (93) 127 (9)

Non-US 53 19 130

(40) 146 121

====== ====== ======

RC profit before interest and tax

US 489 1,260 372

Non-US 2,395 2,908 2,802

2,884 4,168 3,174

====== ====== ======

Exploration expense

US 25 84 309

Non-US 342 373 205

367 457 514

Of which: Exploration expenditure written off 284 351 426

================================================ ====== ====== ======

Production (net of royalties)(a)

Liquids* (mb/d)

US 455 495 448

Europe 159 154 139

Rest of World 685 673 731

1,299 1,321 1,319

====== ====== ======

Natural gas (mmcf/d)

US 2,310 2,255 1,790

Europe 145 215 217

Rest of World 5,417 5,104 5,456

7,872 7,574 7,463

====== ====== ======

Total hydrocarbons* (mboe/d)

US 853 884 757

Europe 184 191 177

Rest of World 1,619 1,553 1,672

2,656 2,627 2,605

====== ====== ======

Average realizations*(b)

Total liquids(c) ($/bbl) 56.47 61.80 61.40

Natural gas ($/mcf) 4.02 4.33 3.78

Total hydrocarbons ($/boe) 39.37 42.98 41.39

================================================ ====== ====== ======

(a) Includes BP's share of production of equity-accounted entities in the Upstream segment.

(b) Realizations are based on sales by consolidated subsidiaries

only - this excludes equity-accounted entities.

(c) Includes condensate, natural gas liquids and bitumen.

Because of rounding, some totals may not agree exactly with the

sum of their component parts.

Top of page 8

Downstream

First Fourth First

quarter quarter quarter

$ million 2019 2018 2018

Profit (loss) before interest and tax 2,811 (332) 1,782

Inventory holding (gains) losses* (1,046) 2,470 (69)

RC profit before interest and tax 1,765 2,138 1,713

Net (favourable) adverse impact of non-operating items*

and fair value accounting effects* (32) 31 113

Underlying RC profit before interest and tax*(a) 1,733 2,169 1,826

========================================================== ====== ====== ======

(a) See page 9 for a reconciliation to segment RC profit before

interest and tax by region and by business.

Financial results

The replacement cost profit before interest and tax for the

first quarter was $1,765 million, compared with $1,713 million for

the same period in 2018.

The first quarter includes a net non-operating charge of $4

million, compared with a charge of $53 million for the same period

in 2018. Fair value accounting effects had a favourable impact of

$36 million in the first quarter, compared with an adverse impact

of $60 million for the same period in 2018.

After adjusting for non-operating items and fair value

accounting effects, the underlying replacement cost profit before

interest and tax for the first quarter was $1,733 million, compared

with $1,826 million for the same period in 2018.

Replacement cost profit before interest and tax for the fuels,

lubricants and petrochemicals businesses is set out on page 9.

Fuels

The fuels business reported an underlying replacement cost

profit before interest and tax of $1,292 million for the first

quarter, compared with $1,398 million for the same period in 2018.

The year-on-year movement was driven by lower refining margins,

partially offset by a strong contribution from supply and trading

and higher fuels marketing earnings.

The refining result for the quarter reflects the impact of lower

industry refining margins and narrower North American heavy crude

oil discounts.

The fuels marketing result for the quarter primarily reflects

year-on-year retail earnings growth, benefiting from higher premium

volumes, the continued roll out of our convenience partnership

model and further expansion in new markets, most notably

Mexico.

In the quarter we opened our first BP-branded retail station in

Shandong Province, through our joint venture with Dongming. This

marks the start of our plan to add 1,000 new sites over the next

five years to our existing network in China of more than 740

sites.

Lubricants

The lubricants business reported an underlying replacement cost

profit before interest and tax of $272 million for the first

quarter, compared with $331 million for the same period in 2018.

The result for the quarter reflects continued adverse foreign

exchange rate movements and one-off impacts related to the

completion of a systems implementation.

Petrochemicals

The petrochemicals business reported an underlying replacement

cost profit before interest and tax of $169 million for the first

quarter, compared with $97 million for the same period in 2018. The

result for the quarter reflects increased margin optimization and a

lower level of turnaround activity.

In the quarter we agreed an expansion of capacity at our joint

venture petrochemicals facility in South Korea which will help us

to meet the region's growing acetyls demand. We also continued to

make progress in our commitment to a low carbon future, signing an

agreement with Virent and Johnson Matthey to further advance the

development of bio-paraxylene, a key raw material for the

production of renewable polyester.

Outlook

Looking to the second quarter of 2019, we expect higher industry

refining margins, a similar level of North American heavy crude oil

discounts and a significantly higher level of turnaround

activity.

The commentary above contains forward-looking statements and should be

read in conjunction with the cautionary statement on page 35.

-----------------------------------------------------------------------

Top of page 9

Downstream (continued)

First Fourth First

quarter quarter quarter

$ million 2019 2018 2018

======= ======= =========

Underlying RC profit before interest and tax - by region

US 531 995 589

Non-US 1,202 1,174 1,237

1,733 2,169 1,826

====== ====== ======

Non-operating items

US 1 (109) (17)

Non-US (5) (292) (36)

(4) (401) (53)

====== ====== ======

Fair value accounting effects(a)

US 61 184 (121)

Non-US (25) 186 61

36 370 (60)

====== ====== ======

RC profit before interest and tax

US 593 1,070 451

Non-US 1,172 1,068 1,262

1,765 2,138 1,713

====== ====== ======

Underlying RC profit before interest and tax - by business(b)(c)

Fuels 1,292 1,624 1,398

Lubricants 272 311 331

Petrochemicals 169 234 97

1,733 2,169 1,826

====== ====== ======

Non-operating items and fair value accounting effects(a)

Fuels 37 173 (110)

Lubricants (4) (198) (3)

Petrochemicals (1) (6) -

32 (31) (113)

====== ====== ======

RC profit before interest and tax(b)(c)

Fuels 1,329 1,797 1,288

Lubricants 268 113 328

Petrochemicals 168 228 97

======

1,765 2,138 1,713

====== ====== ======

BP average refining marker margin (RMM)* ($/bbl) 10.2 11.0 11.7

Refinery throughputs (mb/d)

US 735 691 715

Europe 767 735 797

Rest of World 237 240 249

1,739 1,666 1,761

BP-operated refining availability* (%) 94.3 95.6 94.8

=================================================================== ====== ====== ======

Marketing sales of refined products (mb/d)

US 1,077 1,138 1,096

Europe 993 1,053 1,045

Rest of World 520 526 481

2,590 2,717 2,622

Trading/supply sales of refined products 3,296 3,199 3,181

Total sales volumes of refined products 5,886 5,916 5,803

=================================================================== ====== ====== ======

Petrochemicals production (kte)

US 601 672 499

Europe 1,160 1,037 1,128

Rest of World 1,299 1,259 1,391

3,060 2,968 3,018

====== ====== ======

(a) For Downstream, fair value accounting effects arise solely

in the fuels business. See page 27 for further information.

(b) Segment-level overhead expenses are included in the fuels business result.

(c) Results from petrochemicals at our Gelsenkirchen and Mülheim

sites in Germany are reported in the fuels business.

Top of page 10

Rosneft

First Fourth First

quarter quarter quarter

$ million 2019(a) 2018 2018

======= ======= =========

Profit before interest and tax(b)(c) 526 308 269

Inventory holding (gains) losses* (40) 92 (22)

RC profit before interest and tax 486 400 247

Net charge (credit) for non-operating items* 81 31 -

Underlying RC profit before interest and tax* 567 431 247

================================================ ====== ======= ======

Financial results

Replacement cost (RC) profit before interest and tax for the

first quarter was $486 million, compared with $247 million for the

same period in 2018.

After adjusting for a non-operating item, the underlying RC

profit before interest and tax for the first quarter was $567

million. There were no non-operating items in the first quarter of

2018.

Compared with the same period in 2018, the result for the first

quarter primarily reflects favourable foreign exchange effects,

partially offset by the impact of lower oil prices.

On 16 April 2019, Rosneft announced that the board of directors

had recommended that the annual general meeting (AGM) adopts a

resolution to pay dividends of 11.33 roubles per ordinary share,

which would bring the total dividend for 2018 to 25.91 roubles per

ordinary share, which constitutes 50% of the company's IFRS net

profit. In addition to the dividend received in October 2018 in

relation to the results for the first half of 2018, BP expects to

receive later this year a dividend of 21.3 billion roubles, after

the deduction of withholding tax, subject to approval at the

AGM.

First Fourth First

quarter quarter quarter

2019(a) 2018 2018

========================================== ======= ======= =========

Production (net of royalties) (BP share)

Liquids* (mb/d) 937 946 902

Natural gas (mmcf/d) 1,327 1,312 1,307

Total hydrocarbons* (mboe/d) 1,166 1,173 1,127

=========================================== ======= ======= =======

(a) The operational and financial information of the Rosneft

segment for the first quarter is based on preliminary operational

and financial results of Rosneft for the three months ended 31

March 2019. Actual results may differ from these amounts.

(b) The Rosneft segment result includes equity-accounted

earnings arising from BP's 19.75% shareholding in Rosneft as

adjusted for the accounting required under IFRS relating to BP's

purchase of its interest in Rosneft and the amortization of the

deferred gain relating to the divestment of BP's interest in

TNK-BP. These adjustments increase the segment's reported profit

before interest and tax, as shown in the table above, compared with

the amounts reported in Rosneft's IFRS financial statements.

(c) BP's adjusted share of Rosneft's earnings after Rosneft's own finance costs, taxation and non-controlling interests is included in the BP group income statement within profit before interest and taxation. For each year-to-date period it is calculated by translating the amounts reported in Russian roubles into US dollars using the average exchange rate for the year to date.

Top of page 11

Other businesses and corporate

First Fourth First

quarter quarter quarter

$ million 2019 2018 2018

======= ======= =========

Profit (loss) before interest and tax (546) (1,110) (571)

Inventory holding (gains) losses* - - -

RC profit (loss) before interest and tax (546) (1,110) (571)

Net charge (credit) for non-operating items* 128 766 179

====== ====== ======

Underlying RC profit (loss) before interest and tax* (418) (344) (392)

======================================================= ====== ====== ======

Underlying RC profit (loss) before interest and tax

US (155) (179) (147)

Non-US (263) (165) (245)

(418) (344) (392)

====== ====== ======

Non-operating items

US (128) (654) (148)

Non-US - (112) (31)

(128) (766) (179)

====== ====== ======

RC profit (loss) before interest and tax

US (283) (833) (295)

Non-US (263) (277) (276)

(546) (1,110) (571)

====== ====== ======

Other businesses and corporate comprises our alternative energy

business, shipping, treasury, corporate activities including

centralized functions, and any residual costs of the Gulf of Mexico

oil spill.

Financial results

The replacement cost loss before interest and tax for the first

quarter was $546 million, compared with $571 million for the same

period in 2018.

The results included a net non-operating charge of $128 million

for the first quarter, primarily relating to costs of the Gulf of

Mexico oil spill, compared with a charge of $179 million for the

same period in 2018.

After adjusting for non-operating items, the underlying

replacement cost loss before interest and tax for the first quarter

was $418 million, compared with $392 million for the same period in

2018.

Alternative Energy

The net ethanol-equivalent production (which includes ethanol

and sugar) for the first quarter was 14 million litres, compared

with 7.6 million litres for the same period in 2018.

Net wind generation capacity* was 1,001MW at 31 March 2019,

compared with 1,432MW at 31 March 2018. BP's net share of wind

generation for the first quarter was 773GWh, compared with 1,217GWh

for the same period in 2018. The lower production for the quarter

is due to divestments in the fourth quarter of 2018.

Lightsource BP announced that the Green Energy Equity Fund,

managed by its Indian joint venture, EverSource Capital, is

partnering with the National Investment and Infrastructure Fund and

CDC Group plc to invest a total of $330 million in Ayana Renewable

Power. Ayana was launched to develop utility scale solar and wind

generation projects in India.

Outlook

During 2019, Other businesses and corporate average quarterly

charges, excluding non-operating items, are expected to be around

$350 million although this will fluctuate quarter to quarter.

The commentary above contains forward-looking statements and should be

read in conjunction with the cautionary statement on page 35.

-----------------------------------------------------------------------

Top of page 12

Financial statements

Group income statement

First Fourth First

quarter quarter quarter

$ million 2019 2018 2018

======= ======= =========

Sales and other operating revenues (Note 3) 66,321 75,677 68,172

Earnings from joint ventures - after interest and tax 185 236 293

Earnings from associates - after interest and tax 649 425 414

Interest and other income 163 295 159

Gains on sale of businesses and fixed assets 89 252 105

=======

Total revenues and other income 67,407 76,885 69,143

Purchases 48,272 59,019 51,512

Production and manufacturing expenses 5,356 6,173 5,438

Production and similar taxes (Note 5) 424 186 368

Depreciation, depletion and amortization (Note 4) 4,461 3,987 3,931

Impairment and losses on sale of businesses and fixed

assets 96 244 91

Exploration expense 367 457 514

Distribution and administration expenses 2,767 3,655 2,794

=======

Profit (loss) before interest and taxation 5,664 3,164 4,495

Finance costs 867 742 553

Net finance expense relating to pensions and other

post-retirement benefits 15 34 31

Profit (loss) before taxation 4,782 2,388 3,911

Taxation 1,783 1,617 1,380

Profit (loss) for the period 2,999 771 2,531

=============================================================== ======= ======= =======

Attributable to

BP shareholders 2,934 766 2,469

Non-controlling interests 65 5 62

2,999 771 2,531

======= ======= =======

Earnings per share (Note 6)

Profit (loss) for the period attributable to BP shareholders

Per ordinary share (cents)

Basic 14.54 3.83 12.40

Diluted 14.47 3.80 12.33

Per ADS (dollars)

Basic 0.87 0.23 0.74

Diluted 0.87 0.23 0.74

=============================================================== ======= ======= =======

Top of page 13

Condensed group statement of comprehensive income

First Fourth First

quarter quarter quarter

$ million 2019 2018 2018

======= ======= =========

Profit (loss) for the period 2,999 771 2,531

Other comprehensive income

Items that may be reclassified subsequently to profit

or loss

Currency translation differences 989 (937) 531

Cash flow hedges and costs of hedging 19 (68) (82)

Share of items relating to equity-accounted entities,

net of tax (50) 200 155

Income tax relating to items that may be reclassified (34) 33 (90)

924 (772) 514

====== ====== ======

Items that will not be reclassified to profit or loss

Remeasurements of the net pension and other post-retirement

benefit liability or asset (853) (651) 865

Cash flow hedges that will subsequently be transferred

to the balance sheet 8 (8) 13

Income tax relating to items that will not be reclassified 273 223 (265)

(572) (436) 613

Other comprehensive income 352 (1,208) 1,127

====== ====== ======

Total comprehensive income 3,351 (437) 3,658

=============================================================== ====== ====== ======

Attributable to

BP shareholders 3,281 (444) 3,580

Non-controlling interests 70 7 78

3,351 (437) 3,658

====== ====== ======

Top of page 14

Condensed group statement of changes in equity

BP shareholders' Non-controlling Total

$ million equity interests equity

At 31 December 2018 99,444 2,104 101,548

Adjustment on adoption of IFRS 16, net

of tax(a) (329) (1) (330)

========================================= ============== ============= =======

At 1 January 2019 99,115 2,103 101,218

=========================================

Total comprehensive income 3,281 70 3,351

Dividends (1,435) (36) (1,471)

Cash flow hedges transferred to the

balance sheet, net of tax 5 - 5

Repurchase of ordinary share capital (50) - (50)

Share-based payments, net of tax 280 - 280

Share of equity-accounted entities'

changes in equity, net of tax 3 - 3

At 31 March 2019 101,199 2,137 103,336

========================================= ============== ============= =======

BP shareholders' Non-controlling Total

$ million equity interests equity

========================================

At 31 December 2017 98,491 1,913 100,404

Adjustment on adoption of IFRS 9, net

of tax(b) (180) - (180)

=========================================

At 1 January 2018 98,311 1,913 100,224

=========================================

Total comprehensive income 3,580 78 3,658

Dividends (1,828) (13) (1,841)

Cash flow hedges transferred to the

balance sheet, net of tax 1 - 1

Repurchase of ordinary share capital (120) - (120)

Share-based payments, net of tax 244 - 244

Transactions involving non-controlling

interests, net of tax (1) - (1)

At 31 March 2018 100,187 1,978 102,165

========================================= ============== ============= =======

(a) See Note 1 for further information.

(b) See Note 1 in BP Annual Report and Form 20-F 2018 for further information.

Top of page 15

Group balance sheet

31 March 31 December

$ million 2019 2018(a)

Non-current assets

Property, plant and equipment 144,625 135,261

Goodwill 12,277 12,204

Intangible assets 16,505 17,284

Investments in joint ventures 8,701 8,647

Investments in associates 19,073 17,673

Other investments 1,269 1,341

Fixed assets 202,450 192,410

Loans 642 637

Trade and other receivables 2,111 1,834

Derivative financial instruments 5,265 5,145

Prepayments 814 1,179

Deferred tax assets 3,593 3,706

Defined benefit pension plan surpluses 5,709 5,955

220,584 210,866

======== ===========

Current assets

Loans 340 326

Inventories 21,426 17,988

Trade and other receivables 24,490 24,478

Derivative financial instruments 3,004 3,846

Prepayments 1,082 963

Current tax receivable 965 1,019

Other investments 134 222

Cash and cash equivalents 21,256 22,468

=========================================================

72,697 71,310

======== ===========

Total assets 293,281 282,176

========================================================= ======== ===========

Current liabilities

Trade and other payables 46,749 46,265

Derivative financial instruments 2,340 3,308

Accruals 3,924 4,626

Lease liabilities 2,099 44

Finance debt 11,480 9,329

Current tax payable 2,348 2,101

Provisions 2,332 2,564

71,272 68,237

======== ===========

Non-current liabilities

Other payables 13,898 13,830

Derivative financial instruments 5,294 5,625

Accruals 547 575

Lease liabilities 8,195 623

Finance debt 54,510 55,803

Deferred tax liabilities 9,770 9,812

Provisions 17,773 17,732

Defined benefit pension plan and other post-retirement

benefit plan deficits 8,686 8,391

118,673 112,391

======== ===========

Total liabilities 189,945 180,628

========================================================= ======== ===========

Net assets 103,336 101,548

========================================================= ======== ===========

Equity

BP shareholders' equity 101,199 99,444

Non-controlling interests 2,137 2,104

=========================================================

Total equity 103,336 101,548

========================================================= ======== ===========

(a) Finance debt on the comparative balance sheet has been

re-presented to align with the current period. See Note 1 for

further information.

Top of page 16

Condensed group cash flow statement

First Fourth First

quarter quarter quarter

$ million 2019 2018 2018

======= ======== =========

Operating activities

Profit (loss) before taxation 4,782 2,388 3,911

Adjustments to reconcile profit (loss) before taxation

to net cash provided by operating activities

Depreciation, depletion and amortization and exploration

expenditure written off 4,745 4,338 4,357

Impairment and (gain) loss on sale of businesses and

fixed assets 7 (8) (14)

Earnings from equity-accounted entities, less dividends

received (589) (30) (536)

Net charge for interest and other finance expense,

less net interest paid 88 222 80

Share-based payments 297 126 237

Net operating charge for pensions and other post-retirement

benefits, less contributions and benefit payments

for unfunded plans (77) (60) (202)

Net charge for provisions, less payments (116) 617 144

Movements in inventories and other current and non-current

assets and liabilities (2,695) 778 (3,398)

Income taxes paid (1,146) (1,542) (933)

Net cash provided by operating activities 5,296 6,829 3,646

============================================================== ====== ======= ======

Investing activities

Expenditure on property, plant and equipment, intangible

and other assets (3,695) (5,962) (3,586)

Acquisitions, net of cash acquired (1,795) (6,379) -

Investment in joint ventures - (290) (39)

Investment in associates (145) (265) (338)

Total cash capital expenditure (5,635) (12,896) (3,963)

Proceeds from disposal of fixed assets 235 660 85

Proceeds from disposal of businesses, net of cash disposed 365 1,758 82

Proceeds from loan repayments 55 619 9

Net cash used in investing activities (4,980) (9,859) (3,787)

============================================================== ====== ======= ======

Financing activities(a)

Net issue (repurchase) of shares (45) (16) (110)

Lease liability payments (617) (11) (10)

Proceeds from long-term financing 2,124 2,118 122

Repayments of long-term financing (2,640) (1,795) (1,147)

Net increase (decrease) in short-term debt 1,089 889 (349)

Net increase (decrease) in non-controlling interests - - (1)

Dividends paid - BP shareholders (1,435) (1,733) (1,829)

- non-controlling interests (36) (41) (13)

Net cash provided by (used in) financing activities (1,560) (589) (3,337)

============================================================== ====== ======= ======

Currency translation differences relating to cash and

cash equivalents 32 (105) 145

Increase (decrease) in cash and cash equivalents (1,212) (3,724) (3,333)

============================================================== ====== ======= ======

Cash and cash equivalents at beginning of period 22,468 26,192 25,575

Cash and cash equivalents at end of period 21,256 22,468 22,242

============================================================== ====== ======= ======

(a) Financing cash flows for the fourth and first quarters 2018

have been re-presented to align with the current period. See Note 1

for further information.

Top of page 17

Notes

Note 1. Basis of preparation

The interim financial information included in this report has

been prepared in accordance with IAS 34 'Interim Financial

Reporting'.

The results for the interim periods are unaudited and, in the

opinion of management, include all adjustments necessary for a fair

presentation of the results for each period. All such adjustments

are of a normal recurring nature. This report should be read in

conjunction with the consolidated financial statements and related

notes for the year ended 31 December 2018 included in BP Annual

Report and Form 20-F 2018.

BP prepares its consolidated financial statements included

within BP Annual Report and Form 20-F on the basis of International

Financial Reporting Standards (IFRS) as issued by the International

Accounting Standards Board (IASB), IFRS as adopted by the European

Union (EU) and in accordance with the provisions of the UK

Companies Act 2006 as applicable to companies reporting under IFRS.

IFRS as adopted by the EU differs in certain respects from IFRS as

issued by the IASB. The differences have no impact on the group's

consolidated financial statements for the periods presented.

The financial information presented herein has been prepared in

accordance with the accounting policies expected to be used in

preparing BP Annual Report and Form 20-F 2019, which are the same

as those used in preparing BP Annual Report and Form 20-F 2018 with

the exception of the adoption of IFRS 16 'Leases' from 1 January

2019.

New International Financial Reporting Standards adopted

BP adopted IFRS 16 'Leases', which replaced IAS 17 'Leases' and

IFRIC 4 'Determining whether an arrangement contains a lease', with

effect from 1 January 2019. Further information is included in BP

Annual Report and Form 20-F 2018 - Financial statements - Note 1

Significant accounting policies, judgements, estimates and

assumptions - Impact of new International Financial Reporting

Standards.

IFRS 16 provides a new model for lessee accounting in which the

majority of leases are accounted for by the recognition on the

balance sheet of a right-of-use asset and a lease liability.

Agreements that convey the right to control the use of an

identified asset for a period of time in exchange for consideration

are accounted for as leases. A lease liability is recognized at the

present value of future lease payments over the reasonably certain

lease term. Variable lease payments that do not depend on an index

or a rate are not included in the lease liability. The right-of-use

asset is recognized at a value equivalent to the initial

measurement of the lease liability adjusted for lease prepayments,

lease incentives, initial direct costs and any restoration

obligations. The subsequent amortization of the right-of-use asset

and the interest expense related to the lease liability are

recognized in the income statement over the lease term.

The group recognizes the full lease liability, rather than its

working interest share, for leases entered into on behalf of a

joint operation if the group has the primary responsibility for

making the lease payments. If the right-of-use asset is jointly

controlled by the group and the other joint operators, a receivable

is recognized for the share of the asset transferred to the other

joint operators.

BP elected to apply the modified retrospective transition

approach in which the cumulative effect of initial application is

recognized in opening retained earnings at the date of initial

application with no restatement of comparative periods' financial

information. Comparative information in the group balance sheet and

group cash flow statement has, however, been re-presented to align

with current year presentation, showing lease liabilities and lease

liability payments as separate line items. These were previously

included within the finance debt and repayments of long-term

financing line items respectively. Amounts presented in these line

items for the comparative periods relate to leases accounted for as

finance leases under IAS 17.

IFRS 16 introduces a revised definition of a lease. As permitted

by the standard, BP elected not to reassess the existing population

of leases under the new definition and will only apply the new

definition for the assessment of contracts entered into after the

transition date. On transition the standard permits, on a

lease-by-lease basis, the right-of-use asset to be measured either

at an amount equal to the lease liability (as adjusted for prepaid

or accrued lease payments), or on a historical basis as if the

standard had always applied. BP elected to use the historical asset

measurement for its more material leases and used the asset equals

liability approach for the remainder of the population. BP also

elected to adjust the carrying amounts of the right-of-use assets

as at 1 January 2019 for onerous lease provisions that had been

recognized on the group balance sheet as at 31 December 2018,

rather than performing impairment tests on transition.

Top of page 18

Note 1. Basis of preparation (continued)

The effect of the adoption of IFRS 16 on the group balance sheet

is set out below.

Adjustment

31 December 1 January on adoption

$ million 2018 2019 of IFRS 16

=========== ========= =============

Non-current assets

Property, plant and equipment 135,261 143,950 8,689

Trade and other receivables 1,834 2,159 325

Prepayments 1,179 849 (330)

Deferred tax assets 3,706 3,736 30

Current assets

Trade and other receivables 24,478 24,673 195

Prepayments 963 872 (91)

Current liabilities

Trade and other payables 46,265 46,209 (56)

Accruals 4,626 4,578 (48)

Lease liabilities 44 2,196 2,152

Finance debt 9,329 9,329 -

Provisions 2,564 2,547 (17)

Non-current liabilities

Other payables 13,830 14,013 183

Accruals 575 548 (27)

Lease liabilities 623 7,704 7,081

Finance debt 55,803 55,803 -

Deferred tax liabilities 9,812 9,767 (45)

Provisions 17,732 17,657 (75)

================================== =========== ========= ==========

Net assets 101,548 101,218 (330)

================================== =========== ========= ==========

Equity

BP shareholders' equity 99,444 99,115 (329)

Non-controlling interests 2,104 2,103 (1)

================================== =========== ========= ==========

101,548 101,218 (330)

=========== ========= ==========

The presentation and timing of recognition of charges in the

income statement has changed following the adoption of IFRS 16. The

operating lease expense previously reported under IAS 17, typically

on a straight-line basis, has been replaced by depreciation of the

right-of-use asset and interest on the lease liability. In the cash

flow statement payments are now presented as financing cash flows,

representing payments of principal, and as operating cash flows,

representing payments of interest. Variable lease payments that do

not depend on an index or rate are not included in the lease

liability and will continue to be presented as operating cash

flows. In prior years, operating lease payments were principally

presented within cash flows from operating activities.

The following table provides a reconciliation of the group's

operating lease commitments as at 31 December 2018 to the total

lease liability recognized on the group balance sheet in accordance

with IFRS 16 as at 1 January 2019.

$ million

=========

Operating lease commitments at 31 December 2018 11,979

Leases not yet commenced (1,372)

Leases below materiality threshold (86)

Short-term leases (91)

Effect of discounting (1,512)

Impact on leases in joint operations 836

Variable lease payments (58)

Redetermination of lease term (252)

Other (22)

Total additional lease liabilities recognized on adoption

of IFRS 16 9,422

============================================================ ======

Finance lease obligations at 31 December 2018 667

Adjustment for finance leases in joint operations (189)

============================================================ ======

Total lease liabilities at 1 January 2019 9,900

============================================================ ======

Top of page 19

Note 1. Basis of preparation (continued)

An explanation of each reconciling item shown in the table above

is provided in BP Annual Report and Form 20-F 2018 - Financial

statements - Note 1 Significant accounting policies, judgements,

estimates and assumptions - Impact of new International Financial

Reporting Standards.

The total adjustments to the group's lease liabilities at 1

January 2019 are reconciled as follows:

$ million

========

Total additional lease liabilities recognized on adoption

of IFRS 16 9,422

Less: adjustment for finance leases in joint operations (189)

Total adjustment to lease liabilities 9,233

============================================================ =====

Of which - current 2,152

* non-current 7,081

============================================================ =====

Note 2. Analysis of replacement cost profit (loss) before

interest and tax and reconciliation to profit (loss) before

taxation

First Fourth First

quarter quarter quarter

$ million 2019 2018 2018

======= ======= =========

Upstream 2,884 4,168 3,174

Downstream 1,765 2,138 1,713

Rosneft 486 400 247

Other businesses and corporate (546) (1,110) (571)

4,589 5,596 4,563

Consolidation adjustment - UPII* (13) 142 (160)

RC profit (loss) before interest and tax* 4,576 5,738 4,403

Inventory holding gains (losses)*

Upstream 2 (12) 1

Downstream 1,046 (2,470) 69

Rosneft (net of tax) 40 (92) 22

Profit (loss) before interest and tax 5,664 3,164 4,495

Finance costs 867 742 553

Net finance expense relating to pensions and other

post-retirement benefits 15 34 31

Profit (loss) before taxation 4,782 2,388 3,911

===================================================== ====== ====== ======

RC profit (loss) before interest and tax*

US 771 1,487 359

Non-US 3,805 4,251 4,044

4,576 5,738 4,403

====== ====== ======

Top of page 20

Note 3. Sales and other operating revenues

First Fourth First

quarter quarter quarter

$ million 2019 2018 2018

=========================================================== ======= ======= =========

By segment

Upstream 14,594 15,050 13,870

Downstream 58,416 67,733 61,406

Other businesses and corporate 356 536 343

73,366 83,319 75,619

======= ====== =======

Less: sales and other operating revenues between segments

Upstream 6,324 8,669 6,733

Downstream 586 (1,232) 482

Other businesses and corporate 135 205 232

7,045 7,642 7,447

======= ====== =======

Third party sales and other operating revenues

Upstream 8,270 6,381 7,137

Downstream 57,830 68,965 60,924

Other businesses and corporate 221 331 111

Total sales and other operating revenues 66,321 75,677 68,172

============================================================ ======= ====== =======

By geographical area

US 21,848 26,890 23,613

Non-US 49,618 53,540 51,240

============================================================ ======= ====== =======

71,466 80,430 74,853

Less: sales and other operating revenues between areas 5,145 4,753 6,681

66,321 75,677 68,172

======= ====== =======

Revenues from contracts with customers

Sales and other operating revenues include the following

in relation to revenues from contracts with customers:

Crude oil 14,282 15,448 14,917

Oil products 42,583 47,847 44,130

Natural gas, LNG and NGLs 5,793 5,862 5,159

Non-oil products and other revenues from contracts

with customers 3,501 3,618 3,495

66,159 72,775 67,701

======= ====== =======

Note 4. Depreciation, depletion and amortization

First Fourth First

quarter quarter quarter

$ million 2019 2018 2018

================================ ======= ======= =========

Upstream

US 1,113 1,137 1,088

Non-US 2,498 2,242 2,272

3,611 3,379 3,360

======= ======= =======

Downstream

US 323 240 219

Non-US 383 298 302

706 538 521

======= ======= =======

Other businesses and corporate

US 13 11 16

Non-US 131 59 34

================================= ======= ======= =======

144 70 50

Total group 4,461 3,987 3,931

================================= ======= ======= =======

Top of page 21

Note 5. Production and similar taxes

First Fourth First

quarter quarter quarter

$ million 2019 2018 2018

======= ======= =========

US 81 99 90

Non-US 343 87 278

424 186 368

======= ======= =======

Note 6. Earnings per share and shares in issue

Basic earnings per ordinary share (EpS) amounts are calculated

by dividing the profit (loss) for the period attributable to

ordinary shareholders by the weighted average number of ordinary

shares outstanding during the period. During the quarter the

company repurchased for cancellation 6 million ordinary shares for

a total cost of $50 million, as part of the share buyback programme

as announced on 31 October 2017. The number of shares in issue is

reduced when shares are repurchased.

The calculation of EpS is performed separately for each discrete

quarterly period, and for the year-to-date period. As a result, the

sum of the discrete quarterly EpS amounts in any particular

year-to-date period may not be equal to the EpS amount for the

year-to-date period.

For the diluted EpS calculation the weighted average number of

shares outstanding during the period is adjusted for the number of

shares that are potentially issuable in connection with employee

share-based payment plans using the treasury stock method.

First Fourth First

quarter quarter quarter

$ million 2019 2018 2018

========== ========== ============

Results for the period

Profit (loss) for the period attributable to BP

shareholders 2,934 766 2,469

Less: preference dividend - - -

Profit (loss) attributable to BP ordinary shareholders 2,934 766 2,469

========================================================= ========== ========== ==========

Number of shares (thousand)(a)

Basic weighted average number of shares outstanding 20,175,634 20,007,781 19,918,700

ADS equivalent 3,362,605 3,334,630 3,319,783

========================================================= ========== ========== ==========

Weighted average number of shares outstanding

used to calculate diluted earnings per share 20,281,773 20,133,087 20,030,656

ADS equivalent 3,380,295 3,355,514 3,338,442

========================================================= ========== ========== ==========

Shares in issue at period-end 20,330,597 20,101,658 19,943,591

ADS equivalent 3,388,432 3,350,276 3,323,931

========================================================= ========== ========== ==========

(a) Excludes treasury shares and includes certain shares that

will be issued in the future under employee share-based payment

plans.

Top of page 22

Note 7. Dividends

Dividends payable

BP today announced an interim dividend of 10.25 cents per

ordinary share which is expected to be paid on 21 June 2019 to

ordinary shareholders and American Depositary Share (ADS) holders

on the register on 10 May 2019. The corresponding amount in

sterling is due to be announced on 10 June 2019, calculated based

on the average of the market exchange rates for the four dealing

days commencing on 4 June 2019. Holders of ADSs are expected to

receive $0.615 per ADS (less applicable fees). A scrip dividend

alternative is available, allowing shareholders to elect to receive

their dividend in the form of new ordinary shares and ADS holders

in the form of new ADSs. Details of the first quarter dividend and

timetable are available at bp.com/dividends and details of the

scrip dividend programme are available at bp.com/scrip.

First Fourth First

quarter quarter quarter

2019 2018 2018

======= ======= =========

Dividends paid per ordinary share

cents 10.250 10.250 10.000

pence 7.738 8.025 7.169

Dividends paid per ADS (cents) 61.50 61.50 60.00

=======

Scrip dividends

Number of shares issued (millions) 90.1 47.5 23.4

Value of shares issued ($ million) 629 322 155

===================================== ======= ======= =======

Note 8. Net debt and net debt including leases

Net debt* First Fourth First

quarter quarter quarter

$ million 2019 2018 2018

========== ========== ============

Finance debt(a) 65,990 65,132 61,540

Fair value (asset) liability of hedges related to

finance debt(b) 350 813 46

66,340 65,945 61,586

Less: cash and cash equivalents 21,256 22,468 22,242

Net debt 45,084 43,477 39,344

==================================================== ========== ========== ==========

Equity 103,336 101,548 102,165

Gearing 30.4% 30.0% 27.8%

==================================================== ========== ========== ============

(a) The fair value of finance debt at 31 March 2019 was $67,003

million (31 December 2018 $65,259 million).

(b) Derivative financial instruments entered into for the

purpose of managing interest rate and foreign currency exchange

risk associated with net debt with a fair value liability position

of $609 million (fourth quarter 2018 liability of $827 million and

first quarter 2018 liability of $457 million) are not included in

the calculation of net debt shown above as hedge accounting is not

applied for these instruments.

As a result of the adoption of IFRS 16 'Leases', leases that

were previously classified as finance leases under IAS 17 are now

presented as 'Lease liabilities' on the group balance sheet and

therefore do not form part of finance debt. Comparative information

for finance debt (previously termed 'gross debt'), net debt and

gearing (previously termed 'net debt ratio') have been amended to

be on a consistent basis with amounts presented for 2019. The

relevant amounts for finance lease liabilities that have been

excluded from comparative information are $667 million and $649

million for the fourth and first quarters 2018. The previously

disclosed amounts for finance debt for the fourth and first

quarters 2018 were $65,799 million and $62,189 million

respectively. The previously disclosed amounts for net debt for the

fourth and first quarters 2018 were $44,144 million and $39,993

million respectively. The previously disclosed amounts for gearing

for the fourth and first quarters 2018 were 30.3% and 28.1%

respectively.

Net debt including leases* First Fourth First

quarter quarter quarter

$ million 2019 2018 2018

===================================================== ======= ======= =========

Net debt 45,084 43,477 39,344

Lease liabilities 10,294 667 649

Net partner (receivable) payable for leases entered

into on behalf of joint operations (303) - -

Net debt including leases 55,075 44,144 39,993

====================================================== ====== ======= =======

Top of page 23

Note 9. Inventory valuation

A provision of $124 million was held against hydrocarbon

inventories at 31 March 2019 ($604 million at 31 December 2018 and

$54 million at 31 March 2018) to write them down to their net

realizable value. The net movement credited to the income statement

during the first quarter 2019 was $480 million (fourth quarter 2018

was a charge of $562 million and first quarter 2018 was a credit of

$9 million).

Note 10. Statutory accounts

The financial information shown in this publication, which was

approved by the Board of Directors on 29 April 2019, is unaudited

and does not constitute statutory financial statements. Audited

financial information will be published in BP Annual Report and

Form 20-F 2019. BP Annual Report and Form 20-F 2018 has been filed

with the Registrar of Companies in England and Wales. The report of

the auditor on those accounts was unqualified, did not include a

reference to any matters to which the auditor drew attention by way

of emphasis without qualifying the report and did not contain a

statement under section 498(2) or section 498(3) of the UK

Companies Act 2006.

Top of page 24

Additional information

Effects on the financial statements of the adoption of IFRS 16

'Leases'

BP adopted IFRS 16 'Leases' with effect from 1 January 2019. The

principal effects of the adoption are described below. BP elected

to apply the modified retrospective transition approach in which

the cumulative effect of initial application is recognized in

opening retained earnings at the date of initial application with

no restatement of comparative periods' financial information. For

further information of the effects of adoption see Financial

statements - Note 1 and Note 8.

Balance sheet

As a result of the adoption of IFRS 16, $9.6 billion of

right-of-use assets and $10.3 billion of lease liabilities have

been included in the group balance sheet as at 31 March 2019. Lease

liabilities are now presented separately on the group balance sheet

and do not form part of finance debt. Comparative information for

finance debt in the group balance sheet has been re-presented to

align with current year presentation.

31 March 31 December

$ billion 2019 2018

====================================== ======== =============

Property, plant and equipment(a) (b) 9.6 0.5

Lease liabilities(a) 10.3 0.7

Finance debt 66.0 65.1

======================================= ======== ===========

(a) Comparative information represents finance leases accounted for under IAS 17.

(b) Net additions to right-of-use assets for the first quarter of 2019 were $0.9 billion.

Income statement

The presentation and timing of recognition of charges in the

income statement has changed following the adoption of IFRS 16. The

operating lease expense reported under the previous lease

accounting standard, IAS 17, typically on a straight-line basis,

has been replaced by depreciation of the right-of-use asset and

interest on the lease liability. Depreciation of right-of-use

assets for the first quarter of 2019 was $0.5 billion. Interest on

the group's lease liabilities for the first quarter of 2019 was

$0.1 billion. Operating lease expenses were previously principally

included within Production and manufacturing expenses and

Distribution and administration expenses in the income statement.

It is estimated that the resulting benefit to these line items is

offset, in total, by an equivalent amount in depreciation and

interest charges. Therefore, there has been no material overall

effect on group profit measures in the first quarter of 2019.

Cash flow statement

Lease payments are now presented as financing cash flows,

representing payments of principal, and as operating cash flows,

representing payments of interest. In prior years, operating lease

payments were presented as operating cash flows and capital

expenditure. Of the $0.6 billion of lease payments included within