TIDMBME

RNS Number : 6025P

B&M European Value Retail S.A.

11 June 2020

11 June 2020

B&M European Value Retail S.A.

Preliminary Results Announcement

Solid growth and robust trading despite the challenges from

Covid-19

B&M European Value Retail S.A. ("the Group"), the UK's

leading variety goods value retailer, today announces its

Preliminary Results for the 52 weeks to 28 March 2020.

HIGHLIGHTS

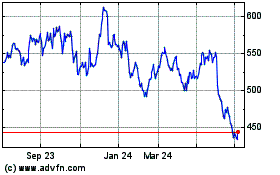

-- Group revenues(1) increased by 16.5% to GBP3,813.4m (FY19:

GBP3,272.6)

-- UK B&M(3) store fascia revenue(1) growth of 12.6%,

including Like-for-Like revenue(4) growth of 3.3% for the year,

including 6.6% in the fourth quarter

-- Group profit before tax increased by 3.2% to GBP252.0m for

the 52 week period (FY19: GBP244.3m), diluted earnings per share

19.5p (FY19:19.5p)

-- UK B&M store fascia(3) Adjusted EBITDA(1&5) growth of

8.7% to GBP319.8m (FY19: GBP294.1m)

-- Progress made in France with 19 Babou stores out of a total

estate of 101 stores, now trading as "B&M" but the controlled

testing of the performance of the converted stores was subsequently

interrupted by the 8 week Covid-19 closure period from 15 March to

11 May 2020

-- Cash generated from operations of GBP532.6m for the 52 week

period (2019: GBP423.0m), year-end net debt(6) of GBP347.5m before

the payment of the GBP150.1m special dividend in April 2020

following the sale and leaseback of the Bedford Distribution

Centre, and with net debt(6) to EBITDA of 1.02 x (FY19: 1.91x)

-- Recommended final dividend(7) increased to 5.4p per share

(FY19: 4.9p) to be paid on 28 September 2020, bringing full year

ordinary dividend to 8.1p per share being an increase of 6.6%

-- 36 net new B&M UK fascia stores opened in the period (51

gross) and a further 30 net new store openings planned for FY21.

The rate of new openings for FY21 is impacted by disruption from

Covid-19,but our overall long term target of at least 950 B&M

stores in the UK remains unchanged

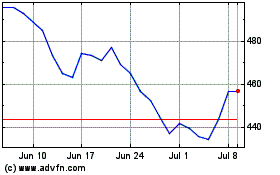

-- The trading since the year-end has been strong

-- Since the year end, the UK business delivered GBP1 million in

cash donations to Foodbanks and gave GBP2.9 million of discounts to

NHS workers. Store and distribution colleagues received 110% of

normal pay to reflect their increased responsibilities and

workload

Simon Arora, Chief Executive, said,

"In this last financial year our core B&M UK business

delivered solid growth, as did our Heron Foods convenience store

business. However, so much about our lives has changed so

profoundly and so fast as a result of Covid-19 that a financial

year which ended only a short time ago already seems a world away.

It is an understatement to say that the progress made during the

year has been overtaken by recent events. The challenges posed by

the virus have been beyond anything we have experienced before;

they have tested every aspect of the way we do business in recent

weeks and I'm pleased to say that B&M is coming through the

crisis well because of the strength of the B&M proposition and

the way our team has responded to those challenges. For that, I

express my gratitude to all of my colleagues across the

business.

Looking ahead, there are of course many uncertainties for the

economy, consumers and not least for the retail industry. We will

all be living with the consequences of the virus and the public

health responses to it for a long time to come. I am however

confident though that B&M with its modern network of mostly

out-of-town stores, well-invested infrastructure and value-led

variety offer is well positioned to support the communities in

which we trade for whatever lies ahead. The health and safety of

our colleagues and customers will remain a priority."

Financial Results

FY 2020 FY 2019 Change

Total Group Revenues

B&M 3,140.1 2,789.4 12.6%

Heron 389.9 354.1 10.1%

Babou 283.4 129.1 119.4%

Total 3,813.4 3,272.6 16.5%

---------- ---------- ----------

Number of Stores

Group 1,050 997 5.3%

B&M 656 620 5.8%

Heron Foods 293 281 4.3%

Babou 101 96 5.2%

---------- ---------- ----------

Adjusted EBITDA(5) 342.3 319.6 7.1%

B&M 319.8 294.1 8.7%

Heron Foods 25.5 19.9 28.2%

Babou (3.0) 5.6 -153.8%

---------- ---------- ----------

Adjusted EBITDA %(5) 9.0% 9.8% -79 bps

---------- ---------- ----------

Profit Before Tax 252.0 244.3 3.2%

---------- ---------- ----------

EPS 19.5 19.5 0.0%

---------- ---------- ----------

Adjusted Profit Before Tax(5) 260.0 252.4 3.0%

---------- ---------- ----------

Adjusted Diluted EPS(5) 20.3 20.2 0.5%

---------- ---------- ----------

Ordinary Dividends(7) 8.1p 7.6p 6.6%

---------- ---------- ----------

(1) The figures presented in this announcement are for the 52

week period ended 28 March 2020 for the continuing operations of

the Group following the sale of Jawoll prior to the year-end date.

The figures for the previous year 52 week period ended 30 March

2019 exclude Jawoll to provide a comparable basis with those for

the continuing operations at as 28 March 2020.

(2) Constant currency comparison involves restating the prior

year Euro revenues using the same exchange rate as that used to

translate the current year Euro revenues.

(3) References in this announcement to the B&M business,

includes the B&M fascia stores in the UK except for the

'B&M Express' fascia stores. References in this announcement to

the Heron Foods business, includes both the Heron Foods fascia and

B&M Express fascia convenience stores in the UK.

(4) Like-for-like revenues relate to the B&M estate only and

include each store's revenue for that part of the current period

that falls at least 14 months after it opened; compared with its

revenue for the corresponding part of the previous period. This 14

month approach has been used as it excludes the two month halo

period which new stores experience following opening.

(5) The Directors consider adjusted figures to be more

reflective of the underlying business performance of the Group and

believe that this measure provides additional useful information

for investors on the Group's performance. Further details can be

found in note 3 . Adjusting items are the effects of derivatives,

one off refinancing fees, foreign exchange on the translation of

intercompany balances and the effects of revaluing or unwinding

balances related to the acquisition of subsidiaries. Significant

project costs or gains or losses arising from unusual circumstances

or transactions may also be included if incurred, such as this year

with the gain on the sale and leaseback of the Bedford warehouse

and the direct loss incurred at Babou due to the closure of their

stores during the pandemic. The Babou stores closed under the

French Covid-19 restrictions from 15 March 2020 until 11 May 2020.

Babou incurred an EBITDA loss of GBP2.946m in the part of the

period when they were closed to 28 March 2020. A stock provision of

GBP6.369m has also been made relating to losses we are likely to

incur to discount seasonal stock not sold during the closed period

to sell it through in the rest of the Spring and Summer season.

They have both been included as adjusting items as they arose as a

result of the Covid-19 restrictions.

(6) Net Debt comprises interest bearing loans and borrowings,

overdrafts, cash/cash equivalents and finance leases excluding

capitalised fees. See notes 21, 23 and 24 for more details.

(7) Dividends are stated as gross amounts before deduction of

Luxembourg withholding tax which is currently 15%.

(8) Net capital expenditure includes the purchase of property,

plant and equipment, intangible assets and proceeds of sale of any

of those items.

Analyst & Investors Webcast and Conference Call

An Analyst & Investors only webcast and conference call in

relation to the final results will be held on Thursday 11 June 2020

at 08:30 am (UK):

The conference call can be accessed live via a dial-in facility

on:

UK & International: +44 (0) 800 408 7373

US: +1 800 939 0944

Room number: 596070

Participant Pin: 2969

A simultaneous audio webcast of the presentation slides will be

on the B&M corporate website at www.bandmretail.com

Enquiries:

B&M European Value Retail S.A.

For further information please contact +44 (0) 151 728 5400

Simon Arora, Chief Executive

Paul McDonald, Chief Financial Officer

Steve Webb, Investor Relations Director

Investor.relations@bandmretail.com

Media

For media please contact +44 (0) 207 379 5151

Maitland

Daniel Yea

bmstores-maitland@maitland.co.uk

This announcement contains statements which are or may be deemed

to be 'forward-looking statements'. Forward-looking statements

involve risks and uncertainties because they relate to events and

depend on events or circumstances that may or may not occur in the

future. All forward-looking statements in this announcement reflect

the Company's present view with respect to future events as at the

date of this announcement. Forward-looking statements are not

guarantees of future performance and actual results in future

periods may and often do differ materially from those expressed in

forward-looking statements. Except where required by law or the

Listing Rules of the UK Listing Authority, the Company undertakes

no obligation to release publicly the results of any revisions to

any forward-looking statements in this announcement that may occur

due to any change in its expectations or to reflect any events or

circumstances arising after the date of this announcement.

Notes to editors

B&M European Value Retail S.A. is a variety retailer with

656 stores in the UK operating under the "B&M" brand, 293

stores under the "Heron Foods" and "B&M Express" brands, and

101 stores in France operating under the "Babou" and B&M brand

as at 28 March 2020. It was admitted to the FTSE 250 index in June

2015.

The B&M Group was founded in 1978 and listed on the London

Stock Exchange in June 2014. For more information please visit

www.bmstores.co.uk

Chief Executive's Review

Covid-19

So much has changed and is changing in many aspects of

everyone's lives as we come to terms with the impact of Covid-19.

It seems strange to be reviewing a period that ended only in March

2020 but which already seems a long time ago. The impacts of the

virus on individuals, communities, our industry and the wider

economy are today still unknown but clearly very significant and

potentially long lasting.

The progress of the business in this last year has inevitably

been overtaken by events. While business moves on quickly, the

challenges posed by this new threat have been of a whole new order

and scale. Much of our focus and effort was switched in the recent

period leading up to the year-end to the immediate operational

challenges of how we deal with the new realities of serving our

customers safely, protecting and supporting our colleagues and on

managing our supply chain both in the UK and in China.

I am very proud of the way the whole B&M team has risen to

those challenges. Normally in my annual updates, I express my

thanks to our colleagues at the end with gratitude for another year

in which their hard work was again decisive in our continued

success. The team once again delivered in FY20, but this year is

different because of the experience of recent weeks. Thanking my

team and all our colleagues for everything they have done on behalf

of customers and shareholders is my most important task this year.

Covid-19 is different from anything any of us has encountered

before, and as a retailer of essential goods, during the crisis

keeping our shelves continually re-stocked and serving customers

efficiently and safely during periods of high demand were

critically important. The whole team deserves our thanks and praise

for their efforts.

The crisis and how we have reacted to it also speaks to the

strength and resilience of the B&M model. At its heart is the

fact we are a variety goods retailer, backed by a fully invested

infrastructure and robust supply chain. The unique breadth of our

product range delivers balance and resilience to overall financial

performance from year to year and allows us to absorb downturns in

any one specific product category. The business also has been able

to respond quickly to the changing needs of our customers,

particularly during the restrictions imposed by the pandemic crisis

in our store and supply chain operations. Our 656 B&M UK stores

are conveniently located, easy to shop safely and they have

demonstrated they are now destinations in their own right. They are

increasingly in high quality locations and are not dependent on

shopping malls or anchor department stores to generate footfall.

When the strain of meeting high and fluctuating demand,

particularly for everyday essentials was at its most intense,

B&M was well-positioned and able to react quickly. At our

warehouses we re-deployed labour and re-prioritised the picking of

products experiencing the highest demand at stores to keep them

replenished and serving customers daily with what they needed.

Our business quickly implemented social distancing measures

across its stores and distribution centres. We deployed masks,

disposable gloves, hand sanitiser and social distancing marshalling

across the network. Our store, warehouse and transport colleagues

faced increased workloads and responsibilities with the

implementation of social distancing, whilst the business was

experiencing high levels of absence due to sickness or

self-isolating. To recognise this additional burden, we increased

the pay of store and distribution colleagues by 10% over the peak

of the crisis.

To play our part in the collective national effort to respond to

the pandemic, we quickly implemented two successful initiatives. We

made a total GBP1 million cash donation at speed to Foodbanks

across the UK using our store network. We granted priority access

to NHS workers for the first hour of each trading day and we have

provided GBP2.9 million in discounts to NHS workers in a 2 month

period.

We should also not forget that as a discounter, our appeal is

strengthened when large sections of the population are worried

about their personal finances or are having to live within

constrained household budgets.

This is important, not just because we were able to do our bit

in the crisis, but because I believe it demonstrates the

flexibility of our model to adapt very quickly to meet the evolving

needs of customers. The lasting effects of Covid-19 on our industry

may result in the further acceleration of the already profound

structural changes affecting retailing. Positioning the business to

address two of the most powerful strategic trends in retail, being

discount and convenience shopping, will, in my view, continue to

deliver plenty of growth opportunity for B&M into the long

term.

Financial Performance

The core B&M UK business had a good year, tempered in part

by the weak performance of our Christmas and Toy categories during

the third quarter which was also impacted by disappointing footfall

affecting most UK retailers at the time of election and Brexit

uncertainty. We have taken steps to learn from the year's Christmas

trading period as we plan our space allocation and sales budgets

for the 2020 Golden Quarter. Our final quarter saw a strong return

in trading performance with pleasing like-for-like ("LFL") sales of

6.6%, attributable to a surge in grocery sales in late March.

The performance of new stores exceeded our expectations and

demonstrated our continued ability to deliver profitable organic

growth. A robust gross margin, combined with diligent control of

costs, resulted in a good overall outcome in terms of profit growth

and cash generation.

Heron Foods continued to perform well throughout the year and

also benefitted from the exceptionally high demand in March. Its

emphasis on local convenience retailing and value for money put it

in good stead to serve shoppers' needs throughout the coronavirus

crisis.

Until the disruption caused by Covid-19, our repositioning of

Babou and the development of B&M in France was making good

progress. A large proportion of Babou's product range had moved to

the Group's supply chain in China. The business had successfully

reduced its reliance on Clothing while increasing its ambient

grocery and FMCG ranges to drive frequency of visit and average

transaction values. In the final quarter of FY20, we rebranded 13

stores from Babou to B&M and were encouraged by initial

customer reaction. We ended the financial year with 19 stores in

France trading as B&M out of the store estate of 101 stores.

However, the lockdown imposed on the business from 15 March 2020,

which was lifted on 11 May 2020, has delayed our ability to

continue the development of the B&M proposition.

Our Babou stores are focused on short term trading priorities

and the delivery of social distancing measures for the remainder of

the Summer 2020. It would not be sensible for us to disrupt 2020

Golden Quarter trading with store remodelling and rebranding to

B&M. We expect to resume the rebranding of Babou to the B&M

brand in France in early 2021, subject to the controlled testing of

the performance of the pilot group of 19 stores converted to

B&M format stores so far.

Recent and Current Trading

Our priority since the year-end in our UK businesses has been

the safety of our colleagues and customers. The teams have worked

quickly and tirelessly to deliver social distancing guidelines at

our stores, which were permitted to stay open due to the majority

of our sales falling within the Government's essential categories

of Food, Drink, Personal & Household Care, Petcare as well as

DIY and Hardware.

Our ability to react quickly and implement new ways of working

safely have underpinned our unusually strong trading performance in

the period since the year-end. This has been boosted by the very

favourable hot weather and the acceleration of demand in DIY, much

of which will be a pull-forward of trade from later in the season.

All our stores are currently trading and we do not have any

employees on furlough under the Government's scheme, other than

colleagues in receipt of the "shielding letter" for those extremely

vulnerable to the virus. We have not taken any loans under the UK

Government's lending schemes, nor are we currently paying VAT or

any other taxes on a delayed basis. However, the pandemic has

brought significant increases in cost of working both at a store

level and in distribution. Due to the general uncertainty over

future consumer behaviour and the duration of restrictions, it is

currently particularly difficult to predict what the remainder of

the year may be like.

We have seen very strong early LFL sales in the UK businesses

since the year-end of 22.7% to 23 May 2020. Excluding Gardening and

DIY categories, the LFL sales performance for that period was

10.3%. We have also incurred increased costs of trading (excluding

the benefit of the business rates holiday) from the social

distancing measures implemented in our stores and warehouses since

the onset of the Covid-19 crisis. Together with closure period

losses in Babou, these costs partially offset the additional

revenue from the recent surge in Gardening and DIY sales.

In France we had to temporarily close all of our 101 stores

under the French Government restrictions for a period of 8 weeks

from 15 March 2020. Since the stores re-opened on 11 May 2020 we

have seen an initial strong sales performance with LFL sales of

81.8% in the period to 23 May 2020, with the French consumer having

been able to access stores for the first time since the 8 week

closure period.

Strategic Development

Although maintaining a strong focus on dealing with the

challenges posed by Covid-19 has been vitally important, we have

not lost sight of the need to drive our strategy for growth

forward, both before and since the crisis. From a strategic

standpoint the execution of our UK expansion strategy has continued

to go well. Inevitably there are also consequences of the Covid-19

crisis and its aftermath for the implementation our UK strategy in

the near term. For example, the slowdown in the construction

sectors in the UK will result in some delay in our new store

opening programme. We have not taken a decision to deliberately

slow that programme but it will take some months for building and

shop-fitting contractors to catch up time lost during lockdown

periods. This applies not only to our own shop-fitting works but

also further upstream where works are required to be carried out by

the property owner prior to handover to us. In France the

transformation of the Babou business we acquired in 2018 to a model

similar to B&M and testing of a pilot group of 19 stores

converted to the B&M format is underway, although progress has

been delayed due to the disruption from Covid-19.

The completion of the sale of our Jawoll business in Germany

just before the financial year end, to a private equity led buyer

consortium, was the culmination of a the strategic review process

which began in late 2019. The comprehensive review we undertook

included an evaluation of the likely potential for the Group to

create value from the business in Germany going forward under our

ownership and weighing that against the continued disappointing

performance of the business driven by persistent recruitment,

trading and operational issues. The carrying value of the brand,

goodwill and of property, plant and equipment on under-performing

stores, had already been impaired by us at the half year-end of the

Group in September 2019. The Group also cancelled and wrote-off

EUR36.1m of loans and intra-group debt owed to it by the German

business as part of the terms of the sale. The review concluded

that the path to restoring profitability, the creation of a

business model capable of delivering acceptable financial returns

and the potential for long term growth was likely to entail further

substantial investment with an uncertain outcome. As a result, the

decision was taken to find a buyer for the business where it could

be repositioned back to a clearance outlet model under other

ownership. This was in the best interests of the Group and the

other stakeholders of the Jawoll business, notably its colleagues.

Clearly the experience in Germany was beset with difficulties, but

the lessons learned have informed our approach in France so that

the execution of our strategy avoids the issues we encountered in

Germany.

The B&M Group's strategy for driving sustainable growth in

revenues, earnings and free cash flow has the following four key

elements. Details of our progress in relation to those during the

year were as follows:

1. Delivering great value to our customers

B&M is all about delivering great value across a variety of

product categories, with the range of items within each product

line being limited to best sellers. The offer is focused on the

things customers buy regularly for their homes and families. There

is always something a household needs that can be bought quickly,

cheaply and conveniently at B&M, whether it is a light bulb, a

new kettle, a jar of coffee or a tube of toothpaste. Combined with

a constant stream of typically c.100 new lines each week, this is

why our customers (which averaged about4.8m a week) choose to keep

coming back to our stores so regularly. With 656 stores across the

UK B&M has become a routine part of customers' shopping habits

wherever we trade. In the week immediately prior to the Covid-19

lockdown crisis our stores served6.6m customers, with some of them

also likely being new to B&M. Our stores are generally in

locations with easy access by car or other independent means of

travel, as opposed to being dependant on city public transport

links with the social distancing risks associated with those

networks.

Our competitiveness and our profitability are driven by

relentless discipline around keeping costs low, buying large

volumes per product line directly from factories rather than

through intermediaries, and stocking only a limited assortment of

the best-selling items. Low costs help us deliver low prices but

B&M is not just about seeking cheap products. Our focus is on

selling quality products, including many leading brands at

discounted prices. Some people need a bargain but many people also

enjoy one, and that's why B&M's appeal continues to

broaden.

The majority of our product categories saw strong overall total

sales growth this year helped by the new store programme, resulting

in continued market share gains. On a comparable basis, it was a

similarly strong picture. Our Homewares categories saw excellent

year on year growth, in part rebounding from a weaker performance

in the prior year. Following a complete range review and reset in

the prior year all stores have been fully re-merchandised in

Homewares and we have been delighted with the improved design,

ranging, co-ordination and presentation of these ranges. This

includes areas across home textiles, bedding and home adornment.

The customer response to these changes has been excellent, and as a

result we have extended some of the themed styles to this year's

outdoor leisure and furniture ranges. Homewares remains an

opportunity area for the business and we will be allocating more

space to those products when the disruptive impact of Covid-19

subsides.

Seasonal goods are a significant element of B&M's appeal in

general merchandise. Around 20% of the space in a typical store is

fully re-merchandised through the seasons. These are also areas

where our pricing can be at its most disruptive. Garden and Outdoor

Leisure enjoyed a pleasing 2019 season, despite very demanding

comparables from the prior year's heatwaves. By contrast, the

Christmas selling season was disappointing, partly driven by the

weakness in the toy market but we believe also by the unhelpful

timing of the UK's General Election in early December and the

intense media coverage of potential Brexit impacts to the economy.

Although margins remained robust through the season, like-for-like

sales in the Autumn/Winter seasonal categories were lower than

expected.

Grocery categories achieved strong growth. For most of the year

their outperformance of the business as a whole was modest, but

sales accelerated during the final weeks of the year driven by

customer anxiety over the potential impact of Covid-19. Customers

buying tinned and packaged food, cleaning and laundry products,

soft drinks, paper goods and pet care products drove very strong

growth in the last few weeks of the year. Because of the long life

nature of what we sell, as well as our low prices and high levels

of buffer stock, B&M proved to be a very efficient way for many

customers, including those new to B&M, to stock-up and at

consistently great value prices.

2. Investing in new stores

We have a long growth runway in the UK, with the potential to

open at least 950 B&M facia stores across the country from our

current base of 656, both in heartland areas and in areas where we

have few or even no stores. This excludes Heron Foods, our discount

convenience business which, with its smaller existing geographic

footprint, strong returns profile and small store model, has the

potential itself to become multiple times larger than its present

293 store count. With B&M new store performance continuing to

be very strong and the flow of attractive profitable opportunities

looking healthy, the target of at least 950 B&M stores in the

UK is increasingly looking like a conservative estimate.

We opened 51 new B&M fascia stores during the year, with 8

of those being replacement stores where larger and more profitable

store opportunities have become available to move our business

elsewhere in a town. There were a further 7 closures, largely the

consequence of older, early generation stores coming to the end of

leases and where the locations were not attractive enough to renew

or in fact a larger replacement store had been opened in prior

years. In the year there were therefore 36 net new B&M store

openings. The current year's opening programme is, or would have

been, equally strong had the unhelpful impact of Covid-19 on the

construction industry not intervened. Currently, we expect a

reduced programme to that in FY20, with 30 net new openings in FY21

and being more heavily weighted to the second half of the financial

year. The forward pipeline for FY22 is similarly impacted but it is

possible that the fallout across the retail industry from the

impact of the virus may provide further attractive opportunities

that we have not yet factored into our budgets.

Heron Foods had another strong year, benefitting from its

appealing positioning as a value convenience retailer. Profit

performance was particularly pleasing, helped by improvements to

labour scheduling and also distribution efficiencies. Like our

B&M main facia stores, Heron Foods performed strongly during

the final few weeks of the financial year, as customers altered

their shopping habits towards stocking-up. Heron Foods'

neighbourhood locations and predominantly frozen and packaged food

offer was, and is, very appropriate to its customers' needs. Heron

Foods opened at total of 18 new stores during the year, bringing

the total to 293. We are expecting to open about 15 new Heron Foods

stores in FY21, but that is subject to any impacts of disruption to

building fit-out works from Covid-19. As with the B&M UK fascia

the openings will be weighted to the second half of FY21.

In France, we opened 5 new stores, most of them having been

committed to prior to our ownership of the business. All of them

were opened under the B&M fascia and with layouts and

merchandising akin to our UK stores, albeit with a category

emphasis reflecting the differing needs of the Babou customer.

Babou operated a total of 101 Babou and B&M fascia stores at

the year end.

3. Developing our international business

Until the imposition of the lockdown period in France linked to

Covid-19, which kept the stores fully closed for 8 weeks, the

business was making good progress moving towards the B&M model

with the re-setting and re-formatting of a number of pilot stores

in the estate. Most of the category changes we envisaged, including

switching to products sourced from the B&M supply chain, were

also well advanced. We had made progress in reducing Babou's

exposure to the Clothing category and we had begun to introduce

more Food, Grocery and FMCG products. Babou's supply chain had

proven itself up to the task of managing large volumes of

containerised inbound product, having navigated the peak stock

intake last Autumn smoothly and successfully. We now have 19

B&M pilot re-formatted stores trading in France, most of them

converted in early 2020 from existing Babou stores, combined with

the 5 new stores openings. In the early weeks of trading prior to

the Covid-19 closure restrictions coming into force, the B&M

stores were trading encouragingly above their trading levels as

Babou, but it is as yet unclear how much of this improved

performance was not just the 'halo effect' of a new store

opening.

Inevitably, a lengthy period of store closure during the

lockdown period in France has been unhelpful and has set back our

plans for the business to some extent. Our priority since the

lifting of the lockdown has been to trade the stores and sell

through inventory. Before the further development of the B&M

fascia, we need a more settled period of time first to test the

results of the 19 stores converted as a pilot group so far.

4. Investing in our people and infrastructure

Our new c.1 million square feet Southern distribution centre at

Bedford was completed and fitted-out during the financial year. It

is our largest single distribution centre building. Commissioning

of the facility was successfully achieved before and during the

Covid-19 crisis and it is now supplying almost one-third of the

B&M store estate. Having the additional logistics capacity in

place during the Covid-19 surge in demand for particular categories

was particularly useful, but it is fair to say that the lockdown

restrictions are imposing higher costs and inefficiencies across

our network. We expect the new centre to provide sufficient

capacity for our expansion plans for the foreseeable future

including enough to meet our 950 UK store target.

At store level, we had planned by the time of this report going

to print to have rolled-out our digital technology Workforce

Management System. That was unfortunately delayed by the on-set of

Covid-19 in view of the priority rightly given to the

implementation of new safety measures rather than the roll-out of

training on a new system. We have successfully piloted it and the

technology is ready to go live across the estate as soon as it's

practical to do so.

During the financial year we recruited Allison Green as the

Group People Director. Allison is re-joining the business after

having been with B&M previously until 2016 and then having

worked in the hospitality sector. We are delighted that she has

re-joined the management team at B&M, having made a significant

contribution during her previous tenure with the business.

In France we welcomed Gilles de Frémicourt who we appointed

during the year as the Distribution Director to the Babou business,

with the distribution function having been fully integrated into

the Babou business in place of the separately managed distribution

workforce service arrangement that was in place prior to the

acquisition. We also appointed Anthony Giron as President of Babou

on 11 May 2020, in order to strengthen the senior management team

in line with our high ambitions for the business. Anthony has

previously launched and rolled out the Hema retail business in

France, and his experience is a good fit with the opportunities

ahead of us to grow B&M in France.

Corporate Social Responsibility

We are very proud as a Group to serve customers across the UK in

many different communities and localities through our B&M and

Heron Food stores. Our presence in communities gives customers

access locally to the everyday products they need and at bargain

prices. Our new store opening programmes extend the reach of our

value proposition to new communities and customers, create new

local jobs and help in our own way to revitalise areas where other

retailers have in many cases retrenched. We strive in all the areas

where we operate to be a good corporate citizen and to make a

difference, whether that's through the great prices we offer in

stores to our customers or through career opportunities and

development paths for our colleagues. Some of the points I would

like to highlight this year are:

-- the creation by the Group this year of over 2,200 new jobs in

the UK, mainly through our store expansion programmes;

-- the development and training of our own talent through our

Step-Up Programme promoting 125 colleagues to B&M Deputy and

Store Manager positions;

-- our recycling of high levels of supply chain waste, with

99.8% of the Group's trade packaging waste being recycled;

-- proudly supporting for the fourth year the "Mission

Christmas" charity appeal through sponsorship, with stores

participating as collection points for presents donated for

underprivileged or poorly children for the appeal;

-- in response to the Covid-19 virus and the impacts to some of

the most vulnerable in society, we donated GBP1,500 per B&M

store to local Foodbanks totalling GBP1m nationally; and

-- extending GBP2.9 million of discounts to all National Health

Service workers during the peak of the crisis.

Outlook

For many retailers the outlook in the Covid-19 world is more

about survival than it is about the shape of the year ahead and

beyond. B&M has significant advantages. The 'variety retailing'

model with its core strength in everyday essentials, a

well-invested infrastructure, strong value credentials, a modern

and convenient store network with continuing growth opportunities

in the UK and France, mean that the business is better positioned

and more resilient than most to deal with the new realities.

We welcome the UK Government's business rates holiday which we

see as essential to support the viability of the UK retail industry

and the incremental operating costs of serving customers in the

present circumstances. We hope this will be a precursor to the much

needed reform of the UK business rates system. The benefit of the

business rates holiday for B&M will fall in our financial year

ending March 2021 and is likely to be fully offset by Covid-19

related costs, dependent on the progression of the virus and, in

particular, the nature and duration of social distancing

requirements.

Our strong trading performance in the B&M UK stores in the

initial 8 weeks of the new financial year was boosted in particular

by our Gardening and DIY categories as announced on 29 May. Much of

that outperformance is likely to have been a pull-forward of sales

which would ordinarily be achieved later in the first half of the

financial year. LFL customer count was -28.9% whilst LFL Average

Transaction Value was +72.5% over the initial 8 weeks. Whilst

trading has continued to be strong in more recent weeks, the growth

rate is unlikely to be sustained as Gardening ranges have sold

through and stock in some other categories is now lower than normal

for this time of year.

The pandemic has delayed construction work on new stores and

consequently there has been a slowdown to our store opening

programme for this financial year. For FY21 we now expect to have

30 net new B&M UK store openings and the programme could be

reduced to a similar number in FY22 dependent on the progress of

the virus and social distancing requirements. Our overall long term

target of at least 950 B&M stores in the UK remains

unchanged.

There are greater than usual uncertainties during the remainder

of the year. The economic environment and its impact on customers

is difficult to predict. In addition to the impact of social

distancing on operating costs, should this continue during the

winter months, it is likely to reduce footfall due to the

reluctance of customers to queue outside during less pleasant

weather, and detract from our ability to serve customers in their

usual numbers during the peak trading season.

Against this uncertain backdrop B&M, as noted above, is in a

strong position to continue to grow profitably in the UK, and work

continues to develop and prove the proposition in France.

Simon Arora

Chief Executive Officer

11 June 2020

Financial Review

Accounting period

The FY20 accounting period represents the 52 weeks trading to 28

March 2020 and the comparative financial period represents the 52

week period for the B&M UK segment to 30 March 2019. This is

the first time that the Financial Statements have therefore been

prepared following the introduction of IFRS16. The comparative

figures in this report have been restated for IFRS16 as we have

adopted the fully retrospective approach. Additional details in

relation to this can be found in notes 17 and 18. We have continued

to report underlying figures where we believe they are relevant to

understanding the performance of the Group and these underlying

figures referred to are presented pre the impact of IFRS16.

As a result of the disposal of our German business, Jawoll, in

March 2020, the results of Jawoll are treated under IFRS5 as a

discontinued operation within the statement of consolidated income

and the comparative figures have also been restated to reflect

this.

Financial performance

Group

The Group revenue in FY20 was GBP3,813.4m (FY19: GBP3,272.6m),

this represents an increase of 16.5% and on a constant currency

basis, a 16.6% increase(2) .

The overall adjusted gross margin(5) was 33.8% (FY19: 34.1%).The

adjusted operating costs(5) of the Group, excluding depreciation

and amortisation, grew by 18.3% to GBP946.9m (including new store

pre-opening costs) and depreciation and amortisation expenses

(excluding adjusting items) grew by 28.2% to GBP57.7m, reflecting

the increased number of stores as a result of the new store opening

programme and the additional costs relating to the non-comparable

period of Babou following the acquisition in October 2018.

We report an adjusted EBITDA(5) to allow investors to understand

better the underlying performance of the business. The items that

we have adjusted are detailed in note 4, they totalled GBP(40.7)m

in FY20 (FY19: GBP(5.5)m).

Overall Group adjusted EBITDA(2) increased by 7.1% to

GBP342.3m.

B&M UK

In the UK, B&M revenues increased by 12.6% to GBP3,140.1m,

driven by an increase in like-for-like revenues of 3.3% and the new

store opening programme, including both the annualisation of

revenues from the 44 net new store openings in FY19 and the 36 net

new store openings in FY20, and an additional GBP16.3m from

wholesale revenue.

There were 51 gross new store openings in the year and 15

closures with 8 of the closures being relocations. We have

continued to see attractive returns on investment on the FY20 new

store openings and they delivered GBP157.9m of revenues in the

year. We have also continued to take advantage of relocation

opportunities. These are typically small first generation B&M

stores that are replaced by modern, larger stores that allow

customers access to the full product range, and these opportunities

continue to be earnings enhancing.

Revenues in the like-for-like store estate grew by 3.3%

(FY19:0.7%). The like-for-like performance was enhanced by a two

week period of exceptional demand in March 2020 as the UK consumer

purchased essential products ahead of the Coronavirus lockdown in

the UK. Excluding these two weeks, the like-for-like would have

been 1.7%. During the year we have seen a continuation of the

strong performance on grocery/FMCG ranges as consumers structurally

continue to seek out value and we have also seen an improved

performance on our homeware ranges following the changes that were

made to the ranges, against the backdrop of a disappointing

performance in FY19.

In the B&M UK business the margin reduced by 63 basis

points, this comprises 12 basis points as a result of the levels of

demand in March 2020 on the lower margin grocery and FMCG sales and

the increase in the wholesale revenues.

In the B&M UK business, operating costs, excluding

depreciation and adjusting costs, grew by 11.3% to GBP734.4m, while

costs as a percentage of revenues decreased by 27 basis points to

23.4%. Within the year the business has managed to largely absorb

the impact of the living wage through efficiency savings, although

there have been inflationary cost pressures on transport and

distribution costs, as well as the additional operating costs

arising from the opening of our new warehouse in Bedford.

In the B&M UK business, adjusted EBITDA(5) increased by 8.7%

to GBP319.8m (FY19: GBP294.1m) and the adjusted EBITDA(5) margin

decreased by 36bps to 10.2%.

Heron Foods

Revenues at our convenience food store business, Heron Foods

grew to GBP389.9m (FY19: GBP354.1m). The business has continued to

deliver a strong sales performance following the strong

like-for-like performance that was delivered in FY19. The business

also benefited from an exceptional level of demand in March 2020

ahead of the Coronavirus lockdown.

The business has continued to manage its cost base despite the

headwinds of inflationary cost increases on store wages and

operating costs as a percentage of revenues decreased by 82bps to

25.0% (FY19: 25.9%).The EBITDA(5) was GBP25.5m, which compares to

GBP19.9m for FY19 and the EBITDA margin improved by 93bps to

6.6%.

Babou

Babou's revenues grew to EUR324.2m, (FY19: EUR146.5m), an

increase of 121.3%, of which EUR162.2m related to the

non-comparable period of ownership. Within the year the business

opened 5 new stores. Trading in the business was impacted by the

lockdown in France with all stores closed from 11 March 2020, as a

result of the French government's response to the Coronavirus

outbreak.

The business had been progressing with its transformation and

moving the product offer to that of the B&M UK stores. However,

the store closures following the lockdown period in France resulted

in a negative EBITDA of GBP3.0m during the lockdown period and an

additional net realisable value provision of GBP6.4m has been made

on stock, mainly clothing that will require additional markdowns to

be sold, both of these items have been excluded from the adjusted

EBITDA.

The adjusted EBITDA was GBP(3.0)m and this compares to GBP5.6m

in FY19.

Jawoll

Following the disposal of the Group's entire 80% shareholding in

Jawoll to a private equity-led consortium in March 2020, the

results of Jawoll are shown with discontinued operations.

The Group received an initial consideration of EUR2.5m and there

is a further EUR10.0m to be received no later than December

2020.This element of the consideration is subject to the on-going

trading of Jawoll. This was in consideration for a EUR5.6m

intragroup trading account and a EUR43.0m loan provided by the

Group. The loss from discounted operations was GBP113.9m,

reflecting a loss on writing-off loan balances, trading losses in

the year and impairment of assets.

Financing

The net interest charge in the year was GBP81.7m (FY19:

GBP75.2m) representing an increase of 8.6%

The interest charge includes GBP57.2m for the finance costs

relating to the lease liabilities under the IFRS16 accounting

treatment following the introduction of the new standard lease

interest, (FY19: GBP52.0m). Bank, high yield bond and interest

receivable was GBP22.7m (FY19: GBP20.3m) and amortised fees of

GBP2.1m (FY19: GBP1.9m).

The increase in the cash interest charge largely reflected the

additional funding required for the build of the new warehouse at

Bedford prior to the sale and leaseback transaction which was

completed on 6 March 2020.

Profit before tax

The statutory profit before tax was GBP252.0m, which compares to

GBP244.3m in FY19. We also report an adjusted profit before tax to

allow investors to understand better the operating performance of

the business (see note 4). The adjusted profit before tax(5) was

GBP260.0m (FY19: GBP252.4m) which reflected a 3.0% increase.

Taxation

The tax charge in the year was GBP57.2m (GBP49.2m in FY19) and

we expect the tax rate going forward to reflect the mix of the

impact of the tax rates in the countries in which we operate being

19% in the UK and 30% in France, with an effective rate of 19.5% in

FY21.

As a Group we are committed to paying the right tax in the

territories in which we operate. In the UK the total tax paid was

GBP275.6m. This is mostly those taxes which are ultimately borne by

the company amounting to GBP182.8m which includes corporation tax,

customs duties, business rates, employer's national insurance

contributions and stamp duty and land taxes. The balance of

GBP92.8m are taxes we collect from customers and employees on

behalf of the UK Exchequer which includes Value Added Tax, Pay As

You Earn and employee national insurance contributions.

Profit after tax and earnings per share

The profit after tax was GBP80.9m compared to GBP191.1m in FY19

and the fully diluted earnings per share was 9.0p (FY19:

19.5p).

On an adjusted profit after tax basis(5) , which we consider to

be a better measure of performance due to the reasons outlined

above, it was GBP203.0m which was a 0.2% increase over last year

(FY19: GBP202.7m) and the adjusted fully diluted earnings per

share(5) was 20.3p (FY19: 20.2p).

Investing activities

The Group incurred GBP124.6m on the purchase of property, plant,

equipment and intangible assets, including GBP32.0m on the build

and fit out of our new warehouse in Bedford with a further GBP42.5m

being incurred on the 74 gross new stores opening programme across

the Groups fascia's and an additional GBP50.1m on the Groups

infrastructure and ensuring that our existing store estate and

warehouses are appropriately invested and maintained. The Group

will continue to invest in its existing store estate and IT

infrastructure across the Group in the year to March 2021 and we

would expect the level of maintenance expenditure to be 0.8% of

revenues.

The deferred consideration that was outstanding relating to the

acquisition of Heron in August 2017 that was due was agreed with

the vendors and GBP12.0m was paid in the year.

There were GBP160.5m of proceeds received from the sale of

property, plant and equipment in the year, the majority of this

related to the proceeds from the sale and leaseback of our

warehouse in Bedford, GBP149.5m in March 2020 and there was a

further GBP6.6m relating to the sale of freehold properties. In

addition there were also receipts of GBP2.4m from the disposal of

our shareholding in Jawoll and GBP2.6m in dividends received from

associates.

Net debt and cash flow

As a Group we continue to be strongly cash generative and the

cash flow from operations increased by 25.9% to GBP532.6m (FY19:

GBP423.0m).

The cash generation reflects the continued growth in the Group's

EBITDA(5) , and the continuation of the attractive cash paybacks

from the new store opening programme. Within the year we have also

seen a working capital inflow as a result of both the accelerated

demand for essential products in March 2020 ahead of the lockdown

and also lower levels of imported stock following some delays to

the timing of merchandise being shipped from the Far East following

the Covid-19 outbreak in China. The working capital benefit is

likely to reverse in FY21 if normal trading conditions are

experienced.

The strong cash flows have enabled the Group to pay GBP76.0m of

dividends in the year and also to declare a dividend of GBP150.1m

that was paid to shareholders in April 2020.

The Group's net debt(6) in the year has reduced to GBP347.5m

(FY19: GBP610.9m) and the net debt(6) to adjusted EBITDA(5) has

reduced to 1.02 times (FY19: 1.91 times). Adjusting the net debt

for the GBP150.1m special dividend that was paid on 17 April 2020,

the underlying net debt would have increased to GBP497.6m and the

net debt to adjusted EBITDA would have been 1.45 times. This

remains comfortably within our 2.25 times leverage target.

B&M periodically explores opportunities to repay, prepay,

repurchase, refinance or extend its existing indebtedness prior to

the scheduled maturity of such indebtedness, and/or amend its terms

with the requisite consent of lenders as part of B&M's

continuing efforts to manage its capital structure. B&M and/or

its Group may also incur additional indebtedness to the extent

permitted by the covenants of existing indebtedness or with the

requisite consent of lenders, including in connection with the

Group's evaluation of strategic expansion and acquisition

opportunities.

The Board adopted a long-term capital allocation policy in 2016

to provide a framework to help investors understand how the Group

will continue to balance the funding requirements of a growth

business like B&M with the desire to return surplus capital to

shareholders. The Board will continue to evaluate opportunities to

invest and support the growth of the business along with the scope

for any incremental return of capital to shareholders in the

context of that framework.

Dividends

The Group has a dividend policy which targets a pay-out ratio of

between 30-40% of net income on a normalised tax basis. The Group

generally pays the interim and final dividends for each financial

year approximately in proportions of one-third and two-thirds

respectively of the total annual dividend.

The Group is strongly cash generative and its capital policy is

to allocate cash surpluses in the following order of priority:

1. the roll-out of new stores with a strong payback profile;

2. ordinary dividend cover to shareholders;

3. mergers & acquisition opportunities; and

4. returns of surplus cash to shareholders.

The above list is a summary of the main items, but it is not an

exhaustive list as other factors may arise from time to time which

require investment to support the long-term growth objectives of

the Group.

The parent company of the Group is an investment holding company

which does not carry on retail commercial trading operations. Its

distributable reserves are derived from intra-group dividends

originating from its subsidiaries. As the parent company is a

Luxembourg registered company the Board is permitted to have

recourse to the company's share premium account as a distributable

reserve. It remains the Group's policy though generally to have

recourse to distributable profits from within the Group, and

accordingly, ahead of interim dividends, and also ahead of the year

end in relation to final dividends, the Board reviews the levels of

dividend cover in the parent company to maintain sufficient levels

of distributable profits in the parent company for each of those

dividends. The Group's consolidated balance sheet position as at 28

March 2020 includes distributable profit reserves of GBP245m. The

vast majority of these reserves have been generated by and are on

the balance sheet of the principal trading subsidiary of the Group

in the UK, B&M Retail Limited. There are intermediate holding

companies in the Group structure between B&M Retail Limited and

the Group's ultimate parent company, but those intermediate holding

companies do not carry on retail trading business operations and

there are no dividend blocks of any material amounts in any year in

relation to expenses which those companies may incur.

The Group has continued to be strongly cash generative and is in

a very good position to fund and maintain its dividend policy

notwithstanding the current economic situation general. The

principal risks of the Group and in particular those relating to

Covid-19, supply chain, competition, economic environment,

commodity prices, infrastructure and international expansion are

relevant to the ability of the Group to maintain its dividend

policy in the future. The Group however maintains strategies to

mitigate those risks and the Board believes the Group has a robust

and resilient business model through the combination of having a

value-led product assortment which to a large extent comprises

essential goods and also competes across a very broad section of

the retail markets in our chosen locations.

During the year the Company paid an interim dividend of 2.7p per

share and also declared a special dividend of 15.0p per share

following the sale and leaseback of the Bedford Distribution Centre

which was paid in April 2020. Subject to approval of the dividend

by shareholders at the AGM on 18 September 2020, a final dividend

of 5.4p per share is to be paid on 28 September 2020 to

shareholders on the register of the Company at the close of

business on 21 August 2020. The ex-dividend date will be 20 August

2020.

Paul McDonald

Chief Financial Officer

11 June 2020

Consolidated Statement of Comprehensive Income

Restated*

52 weeks ended 52 weeks ended

Period ended 28 March 2020 30 March 2019

Note GBP'000 GBP'000

Continuing operations

Revenue 3 3,813,387 3,272,632

Cost of sales (2,530,579) (2,152,403)

Gross profit 1,282,808 1,120,229

Gain on sale and leaseback of the Bedford

warehouse 17 16,932 -

Administrative expenses (966,928) (801,492)

Operating profit 5 332,812 318,737

Share of profits in associates 14 879 775

Profit on ordinary activities before

net finance costs and tax 3 333,691 319,512

Finance costs on lease liabilities 6 (57,206) (52,040)

Other finance costs 6 (24,809) (24,228)

Finance income 6 213 369

Gain on revaluation of financial instruments 6, 23 134 716

Profit on ordinary activities before

tax 252,023 244,329

Income tax expense 12 (57,246) (49,220)

Profit for the period from continuing

operations 3 194,777 195,109

-------------- ---------------

Attributable to owners of the parent 194,777 195,109

Discontinued operations

Loss from discontinued operations 7 (113,922) (3,975)

Profit for the period 80,855 191,134

-------------- ---------------

Attributable to non-controlling interests (9,172) (2,717)

Attributable to owners of the parent 90,027 193,851

Other comprehensive income for the period

Items which may be reclassified to profit

and loss:

Exchange differences on retranslation

of subsidiary and associate investments 1,661 (2,125)

Fair value movement as recorded in the

hedging reserve 8,679 19,996

Items which will not be reclassified

to profit and loss:

Actuarial gain on the defined benefit

pension scheme 9 - 5

Tax effect of other comprehensive income 12 (1,383) (3,481)

-------------- ---------------

Total comprehensive income for the period 89,812 205,529

-------------- ---------------

Attributable to non-controlling interests (9,753) (3,051)

Attributable to owners of the parent 99,565 208,580

Earnings per share from continuing operations

Basic earnings per share attributable

to ordinary equity holders (pence) 13 19.5 19.5

Diluted earnings per share attributable

to ordinary equity holders (pence) 13 19.5 19.5

Earnings per share from all operations

Basic earnings per share attributable

to ordinary equity holders (pence) 13 9.0 19.4

Diluted earnings per share attributable

to ordinary equity holders (pence) 13 9.0 19.4

-------------- ---------------

The accompanying accounting policies and notes form an integral

part of these consolidated financial statements.

* This statement has been restated in respect of the Group's

first time application of IFRS 16 (see notes 1, 2, 17 and 18), for

the reclassification of the Germany Jawoll segment as a

discontinued operation (see notes 1 and 7) and for the results of

the final purchase price allocation exercise for Babou (see notes 1

and 8).

Consolidated Statement of Financial Position

Restated* Restated*

28 March 30 March 1 April

As at Note 2020 2019 2018

Assets GBP'000 GBP'000 GBP'000

Non-current

Goodwill 15 921,911 954,757 929,718

Intangible assets 15 119,696 126,559 120,962

Property, plant and equipment 16 312,198 378,581 298,581

Right of use assets 17 1,086,618 1,036,873 872,686

Investments in associates 14 5,700 6,920 5,140

Other receivables 20 7,517 7,237 -

Deferred tax asset 12 22,988 23,751 17,923

----------- ----------- -----------

2,476,628 2,534,678 2,245,010

----------- ----------- -----------

Current assets

Cash at bank and in hand 21 428,205 86,202 90,816

Inventories 19 588,000 665,570 558,690

Trade and other receivables 20 60,588 52,400 16,438

Other financial assets 23 16,702 6,294 -

Income tax receivable - 3,781 -

1,093,495 814,247 665,944

----------- ----------- -----------

Total assets 3,570,123 3,348,925 2,910,954

----------- ----------- -----------

Equity

Share capital 26 (100,058) (100,056) (100,056)

Share premium (2,474,318) (2,474,249) (2,474,249)

Retained earnings (244,829) (393,375) (273,619)

Hedging reserve (9,280) (1,984) 14,532

Legal reserve (10,010) (10,010) (10,000)

Merger reserve 1,979,131 1,979,131 1,979,131

Foreign exchange reserve (8,035) (5,793) (7,583)

Put/call option reserve - 13,855 13,855

Non-controlling interest - (9,753) (12,804)

(867,399) (1,002,234) (870,793)

----------- ----------- -----------

Non-current liabilities

Interest bearing loans and

borrowings 24 (561,418) (562,941) (558,426)

Lease liabilities 17 (1,146,233) (1,056,759) (913,268)

Other financial liabilities 23 - - (19,209)

Other liabilities 22 (171) (578) (419)

Deferred tax liabilities 12 (29,008) (26,522) (24,281)

Provisions 25 (766) (184) (151)

----------- ----------- -----------

(1,737,596) (1,646,984) (1,515,754)

----------- ----------- -----------

Current liabilities

Interest bearing loans and

borrowings 24 (211,062) (124,272) (47,212)

Overdrafts 21 (928) (5,646) (6,112)

Trade and other payables 22 (419,999) (376,722) (320,058)

Lease liabilities 17 (149,011) (150,163) (108,754)

Other financial liabilities 23 (1,847) (13,731) (16,666)

Income tax payable (26,115) (23,197) (19,677)

Dividends payable 34 (150,087) - -

Provisions 25 (6,079) (5,976) (5,928)

----------- ----------- -----------

(965,128) (699,707) (524,407)

----------- ----------- -----------

Total liabilities (2,702,724) (2,346,691) (2,040,161)

----------- ----------- -----------

Total equity and liabilities (3,570,123) (3,348,925) (2,910,954)

----------- ----------- -----------

* These statements have been restated in respect of the Group's

first time application of IFRS 16 (see notes 1, 17 and 18) and for

the results of the final purchase price allocation exercise for

Babou (see note 8).

The accompanying accounting policies and notes form an integral

part of these consolidated financial statements. This consolidated

statement of financial position was approved by the Board of

Directors and authorised for issue on 10 June 2020 and signed on

their behalf by:

Simon Arora, Chief Executive Officer.

Consolidated Statement of Changes in Shareholders' Equity

Total

Foreign Put/call Non- Share-

Share Share Retained Hedging Legal Merger exch. option control. holders'

capital premium earnings Reserve reserve reserve reserve Reserve interest equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1

April 2018 100,056 2,474,249 327,073 (14,532) 10,000 (1,979,131) 7,833 (13,855) 13,692 925,385

Restatements

due to the

adoption of

IFRS 16 - - (53,454) - - - (250) - (888) (54,592)

Restated

balance as at

1 April 2018 100,056 2,474,249 273,619 (14,532) 10,000 (1,979,131) 7,583 (13,855) 12,804 870,793

Allocation to

legal reserve - - (10) - 10 - - - - -

Ordinary

dividends

declared - - (75,042) - - - - - - (75,042)

Effect of

share options - - 954 - - - - - - 954

------- --------- --------- -------- ------- ----------- ------- -------- -------- ---------

Total

transactions

with owners - - (74,088) - - - - - - (74,088)

Profit/(loss)

for the

period - - 193,851 - - - - - (2,717) 191,134

Other

comprehensive

income - - 3 16,516 - - (1,790) - (334) 14,395

------- --------- --------- -------- ------- ----------- ------- -------- -------- ---------

Total

comprehensive

income for

the period - - 193,854 16,516 - - (1,790) - (3,051) 205,529

Balance at 30

March 2019 100,056 2,474,249 393,375 1,984 10,010 (1,979,131) 5,793 (13,855) 9,753 1,002,234

------- --------- --------- -------- ------- ----------- ------- -------- -------- ---------

Ordinary

dividends

declared - - (76,042) - - - - - - (76,042)

Special

dividends

declared - - (150,087) - - - - - - (150,087)

Effect of

share options 2 69 1,411 - - - - - - 1,482

------- --------- --------- -------- ------- ----------- ------- -------- -------- ---------

Total

transactions

with owners 2 69 (224,718) - - - - - - (224,647)

Profit for the

period

relating to

continuing

operations - - 194,777 - - - - - - 194,777

Loss for the

period

relating to

discontinued

operations - - (104,750) - - - - - (9,172) (113,922)

Other

comprehensive

income - - - 7,296 - - 2,242 - (581) 8,957

------- --------- --------- -------- ------- ----------- ------- -------- -------- ---------

Total

comprehensive

income for the

period - - 90,027 7,296 - - 2,242 - (9,753) 89,812

Disposal of

Jawoll - - (13,855) - - - - 13,855 - -

Balance at 28

March 2020 100,058 2,474,318 244,829 9,280 10,010 (1,979,131) 8,035 - - 867,399

------- --------- --------- -------- ------- ----------- ------- -------- -------- ---------

The accompanying accounting policies and notes form an integral

part of these consolidated financial statements.

Consolidated Statement of Cash Flows

Restated*

52 weeks 52 weeks

ended 28 ended

March 30 March

Period ended 2020 2019

Note GBP'000 GBP'000

Cash flows from operating activities

Cash generated from operations 27 532,645 422,996

Non cash write off from discontinued

operations 68,036 -

Income tax paid (57,924) (47,271)

---------- ----------

Net cash flows from operating activities 542,757 375,725

---------- ----------

Cash flows from investing activities

Purchase of property, plant and equipment 16 (123,270) (103,315)

Purchase of intangible assets 15 (1,361) (2,654)

Business acquisitions net of cash

acquired 8 - (75,879)

Deferred consideration in respect

of business acquisitions 23 (11,950) -

Business disposal net of cash disposed 7 2,964 -

Acquisition of shares in associates 14 - (1,200)

Proceeds from sale of property, plant

and equipment 160,518 563

Finance income received 214 369

Dividends received from associates 14 2,580 570

---------- ----------

Net cash flows from investing activities 29,695 (181,546)

---------- ----------

Cash flows from financing activities

Receipt of bank loans 24 - 81,086

Net receipt of Group revolving bank

loans 24 80,000 (5,000)

Net repayment of Heron facilities 24 (2,030) (2,297)

Net receipt/(repayment) of Babou facilities 24 1,587 (5,489)

Repayment of the principal in relation

to right of use assets (142,653) (109,972)

Payment of interest in relation to

right of use assets (63,790) (58,544)

Capitalised fees on refinancing (119) (935)

Finance costs paid (23,957) (21,476)

Receipt from exercise of employee

share options 11 60 -

Dividends paid to owners of the parent 34 (76,042) (75,042)

Net cash flows from financing activities (226,944) (197,669)

---------- ----------

Effects of exchange rate changes on

cash and cash equivalents 1,213 (658)

Net increase(decrease) in cash and

cash equivalents 346,721 (4,148)

Cash and cash equivalents at the beginning

of the period 80,556 84,704

---------- ----------

Cash and cash equivalents at the end

of the period 427,277 80,556

---------- ----------

Cash and cash equivalents comprise:

Cash at bank and in hand 21 428,205 86,202

Overdrafts (928) (5,646)

---------- ----------

427,277 80,556

---------- ----------

The accompanying accounting policies and notes form an integral

part of these consolidated financial statements.

* This statement has been restated in respect of the Group's

first time application of IFRS 16 (see notes 1, 17 and 18), and to

represent foreign exchange movement in line with the current year

presentation (see note 1).

Notes to the Consolidated Financial Statements

1 General information and basis of preparation

The consolidated financial statements have been prepared in

accordance with International Financial Reporting Standards as

adopted by the European Union.

The Group's trade is general retail, with continuing trading

taking place in the UK and France and discontinued operations in

Germany. The Group has been listed on the London Stock Exchange

since June 2014.

The consolidated financial statements have been prepared under

the historical cost convention as modified by the revaluation of

financial assets and financial liabilities at fair value through

profit or loss. The measurement basis and principal accounting

policies of the Group are set out below and have been applied

consistently throughout the consolidated financial statements.

The consolidated financial statements are presented in pounds

sterling and all values are rounded to the nearest thousand

(GBP'000), except when otherwise indicated.

The consolidated financial statements cover the 52 week period

from 31 March 2019 to 28 March 2020 which is a different period to

the parent company stand alone accounts (from 1 April 2019 to 31

March 2020). This exception is permitted under article 1712-12 of

the Luxembourg company law of 10 August 1915 as amended as the

Directors believe that;

-- the consolidated financial statements are more informative

when they cover the same period as used by the main operating

entity, B&M Retail Ltd; and

-- that it would be unduly onerous to rephase the year end in

this subsidiary to match that of the parent company.

The year end for B&M Retail Ltd, in any year, would not be

more than six days prior to the parent company year end.

B&M European Value Retail S.A. (the "Company") is the head

of the Group and there is no consolidation that takes place above

the level of this company.

The principal accounting policies of the Group are set out

below.

Restatement due to the Group's adoption of IFRS 16 'Leases'

The new leasing standard, IFRS 16, was adopted by the Group on

31 March 2019, the start of the current financial year. The Group

has adopted the fully retrospective approach and therefore has

applied the standard to all leases from the acquisition date of

each lease, with the consequence that the prior year financial

statements have been restated.

The impact on our financial statements is significant, see notes

17 and 18 for more details.

The Group has taken advantage of the practical expedient allowed

on transition to IFRS 16 to not re-assess which contracts contain

or are a lease and which are not. Therefore the Group has applied

the standard to those contracts previously identified as leases

only, as well as contracts entered into after 31 March 2019.

Our new accounting policies for Leases are as follows:

Leases

The Group applies the leasing standard, IFRS 16, to all

contracts identified as leases at their inception, unless they are

considered a short-term lease (with a term less than a year) or

where the asset is of a low underlying value (under GBP5k). Assets

which may fall into this categorisations include printers, vending

machines and security cameras, and the lease expense is within

administrative expenses.

The Group has lease contracts in relation to property,

equipment, fixtures & fittings and vehicles. A contract is

classified as a lease if it conveys the right to control the use of

an identified asset for a period of time in exchange for

consideration.

When a lease contract is recognised, the business assesses the

term for which we are reasonably certain to hold that lease, and

the minimum lease payments over that term are discounted to give

the initial lease liability. The initial right-of-use asset is then

recognised at the same value, adjusted for incentives or payments

made on the day that the lease was acquired. Any variable lease

costs are expensed to administrative costs when incurred.

The date that the lease is brought into the accounts is the date

from which the lease has been effectively agreed by both parties as

evidenced by the Group's ability to use that property.

The right-of-use asset is subsequently depreciated on a

straight-line basis over the term of that lease, or useful life

(whichever is shorter) with the charge being made to administrative

costs. The lease liability attracts interest which is charged to

finance costs, and is measured at amortised cost using the

effective interest method.

Right-of-use assets may be impaired if, for instance, a lease

becomes onerous. Impairment costs are charged to administrative

costs.

On a significant event, such as the lease reaching its expiry

date or the likely exercise of a previously unrecognised break

clause, the lease term is re-assessed by management as to how long

we can be reasonably certain to stay in that property, and a new

lease agreement or modification (if the change is made before the

expiry date) is recognised for the re-assessed term.

The discount rate used is individual to each lease. Where a

lease contract includes an implicit interest rate, that rate is

used. In the majority of leases this is not the case and the

discount rate is taken to be the incremental borrowing rate as

related to that specific asset. This is a calculation based upon

the external market rate of borrowing for the Group, as well as

several factors specific to the asset to be discounted.

The Group separates lease payments between lease and non-lease

components (such as service charges on property) at the point at

which the lease is recognised. Non-lease components are charged

through administrative expenses.

Sale and leaseback transactions

The Group recognises a sale and leaseback transaction when the