TIDMBME

RNS Number : 6960F

B&M European Value Retail S.A.

11 March 2020

11 March 2020

B&M European Value Retail S.A.

Sale of German Business

B&M European Value Retail S.A. (the "Company" or the

"Group") announces that, following the strategic review in relation

to the Group's German business, which was announced in November

2019, it has exchanged contracts today for the sale of J.A.

Woll-Handels GmbH ("Jawoll").

The sale is for the Group's entire 80% shareholding (the

"Shares") in Jawoll to a purchasing consortium led by AC Curtis

Salta GmbH, a company funded by Adiuva Capital. The purchaser

consortium also includes Wiebke Stern, Sebastian Dorin, Alexander

Dorin, STIWEC GmbH and Jalogy Beteiligungs GmbH.

Completion of the transaction, which is conditional upon, among

other things, German competition authority clearance being granted,

is expected to occur within the next 28 days or by a long stop date

of 1 June 2020.

Subject to completion, the total consideration payable to the

Group for the transaction is EUR12,501,000 which is to be paid in

cash. EUR2,501,000 is payable on completion of the transaction and

EUR10,000,000 is payable on 31 December 2020 conditional on the

on-going trading of Jawoll. In addition, on completion the

purchaser's consortium will repay Jawoll's bank debt, which has a

facility limit of up to EUR16m, and had been guaranteed by the

Group.

The total consideration payable to the Group comprises:

(i) EUR2,500,000 as a part repayment of an intra-group trading

account balance of EUR5,600,000 owed by Jawoll to the Group with

the remaining balance having been waived;

(ii) EUR10,000,000 part repayment of loans made by the Group to

Jawoll of EUR42,980,000 (including interest) with the balance of

those loans having been waived; and

(iii) a nominal sum of EUR1,000 for the Shares.

Accordingly, the transaction will not have a material impact on

the Group's leverage.

Jawoll, together with its wholly owned subsidiary, Jawoll

Vertriebs GmbH ("Vertriebs"), is a general merchandise discount

retailer with 89 stores in the North-West of Germany. The

consolidated losses of those entities as reported for the financial

year ended 31 March 2019 was GBP15.4m and the value of their Gross

Assets as at 28 September 2019 (under IFRS16) was GBP192.6m.

The sale of Jawoll (together with its wholly owned subsidiary)

constitutes a Class 2 transaction for the purposes of the UK

Financial Conduct Authority's Listing Rules, and, as such does not

require B&M shareholders' approval.

One of the purchaser's consortium, STIWEC GmbH ("STIWEC"), is an

existing shareholder owning 13% of the shares of Jawoll. Another

member of the purchaser's consortium, Jalogy Beteiligungs GmbH

("Jalogy"), is an investment company owned by Ralf Hartwich. Mr

Hartwich is the Managing Director of Jawoll and Vertriebs and he is

also an existing shareholder owning 7% of the shares of Jawoll. The

transaction falls within the exemption in Listing Rule 11 Annex 1

Paragraph 9 of transactions to which the related party transaction

rules do not apply, as it relates to shares in an insignificant

subsidiary undertaking of B&M's Group.

The transaction does however constitute a related party

transaction under the Luxembourg Law of 24 May 2011 (as amended on

1 August 2019). For the purpose of that law the Company confirms as

follows. The related parties are STIWEC and Jalogy and the nature

of their relationships with Jawoll and Vertriebs is as set out

above in this Announcement. They have no other material

relationships with the Company or any other entities in the B&M

Group. The date of the transaction is the date of this

Announcement. The value and net financial impact to the B&M

Group of the transaction is as set out above in this Announcement.

The sale transaction with the purchaser consortium includes the

sale of 11% of the total issued shares in Jawoll to STIWEC and

8.45% of the total issued shares in Jawoll to Jalogy, for part of

the nominal consideration (as referred to above in this

Announcement) to be paid for the Shares. The transactions with

those parties forms part of the terms of the overall sale

transaction with the purchaser consortium, in respect of which the

total consideration for the sale transaction is set out above. That

consideration reflects the loss making position of Jawoll and its

subsidiary as described above.

This announcement contains inside information which is disclosed

in accordance with the Market Abuse Regulation.

Enquiries

B&M European Value Retail S.A.

For further information please contact +44 (0) 151 728 5400

Simon Arora, Chief Executive

Paul McDonald, Chief Financial Officer

Steve Webb, Investor Relations Director

Investor.relations@bandmretail.com

Media

For media please contact +44 (0) 207 379 5151

Maitland

Daniel Yea

bmstores-maitland@maitland.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

DISJBMBTMTTBMLM

(END) Dow Jones Newswires

March 11, 2020 03:00 ET (07:00 GMT)

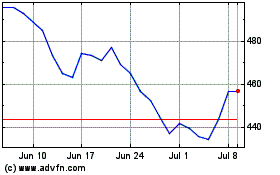

B&m European Value Retail (LSE:BME)

Historical Stock Chart

From Mar 2024 to Apr 2024

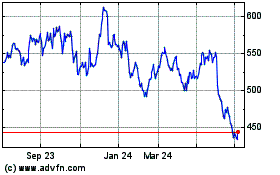

B&m European Value Retail (LSE:BME)

Historical Stock Chart

From Apr 2023 to Apr 2024