TIDMBLU

RNS Number : 7304Q

Blue Star Capital plc

30 June 2022

30 June 2022

Blue Star Capital plc

("Blue Star" or "the Company")

Half-Yearly Results

Half-yearly Results for the Six Months Ended 31 March 2022

Blue Star Capital (AIM: BLU), the investing company with a focus

on esports, technology and its applications within media and

gaming, announces its half-yearly results for the six months ended

31 March 2022.

Financial Highlights:

-- Decrease in the mark-to-market value of the portfolio, as of

31 March 2022, of GBP937,941 (1H21: GBP19,684 decrease) resulting

in Net Assets of GBP11,718,709 (FY21: GBP12,715,515)

-- Net Cash, as of 31 March 2022, of GBP113,416 (FY21: GBP296,106)

For further information, please contact:

Blue Star Capital plc Via Vox Markets

Derek Lew

Cairn Financial Advisers LLP (Nominated Adviser) +44 (0) 20 7213 0880

Jo Turner / Liam Murray

Stanford Capital Partners Limited (Broker) +44 (0) 20 3650 3650

Patrick Claridge / John Howes / Bob Pountney

Vox Markets

Kat Perez bluestarcapaital@voxmarkets.co.uk

www. Vox M arkets.co.uk/listings/LON/BLU

About Blue Start Capital

Blue Star Capital plc ("the Company" or "Blue Star") provides

investors with exposure to a global portfolio of quoted and

unquoted companies that operate at the leading edge of high-growth

and disruptive technology sectors.

Our portfolio focuses on new technologies particularly in the

areas of esports, decentralised finance and blockchain. Our current

portfolio consists of 11 innovative, disruptive, global businesses

where eight have a focus on the rapidly growing esports and mobile

gaming markets, two working across the fields of decentralised

finance and payments and one in the area of Non-Fungible

Tokens.

Chairman's Statement

It was a productive period for our portfolio of investee

companies and below I provide the following portfolio company

highlights, inclusive of updates, for the six-month period ended 31

March 2022 and any subsequent developments.

Esports and Mobile Gaming

Esports

According to Newzoo, the games market analytics company, there

are now more than 2.7 billion gamers globally, with gaming

overtaking social media as the largest consumption of screen time

in most developed markets.

By 2023, Newzoo predicts the games market will be worth $200.8

billion per annum, with the number of players worldwide surpassing

the three-billion mark.

Guild Esports plc ("Guild")

Since September 2021, Guild has achieved several operational

milestones attracting strategic partnerships with major brands such

as Selfridges London, Samsung Electronics UK, Sony's PlayStation

and Bitstamp, the world's longest-running crypto exchange.

In October 2021, Guild successfully launched Apex Legends Team

to compete in the Apex Legends Global Series and achieved success

wining two new trophies. In November 2021, Guild won its fourth

major esports trophy after one of its Fortnight players won first

place in the Fortnite Champion Series Grande Royale and a fifth

trophy at a later Fortnite series during the year.

In June 2022, Guild opened a new HQ in Shoreditch, located at

the heart of the capital's booming technology hub. It will also be

the home for its global esports Guild Academy. The academy will

provide state-of-the-art training facilities for gamers and is

expected to deliver additional commercial opportunities for Guild

including content sponsorship and naming rights for the building

itself.

Guild has several potentially significant sponsorship deals with

tier 1 brands at advanced stages of negotiations and, whilst there

is no certainty when these prospects may get signed, the board of

Guild remains confident of its overall new business plans for

2022.

To date, the Company has invested approximately GBP706,000 in

Guild for 5.95% of Guild's total issued share capital. During the

period the Guild share price decreased from 5.1p per share to

1.95p, resulting in a fair value decrease of the holding of

approximately GBP915,000 to GBP646,076 as of 31 March 2022.

Dynasty Gaming and Media ("Dynasty")

Dynasty, the leading mass-market, white label B2B gaming and

media platform ecosystem, secured three additional multi-year

partnership agreements during the period.

These partnership agreements, with large-scale organisations,

include Malaysia's leading telecoms operator, New Zealand's largest

telco and a market-leading Indian company, include both fixed

licence fees up front and ongoing managed services revenue share

terms over the term of the license.

Long-term investors will recall Dynasty's initial business model

was a typical 'SaaS' structure based on collecting monthly licence

fees over a minimum 24-month contract. However, going forward, the

business has adopted a hybrid 'SaaS plus revenue share' model with

Dynasty delivering what it describes as a genuine managed service

solution.

Under the new commercial model, Dynasty anticipates that the

revenue share component will contribute more than 85% of its total

revenue within the next 12 months. The company remains in dialogue

with all parties regarding a potential listing of the company's

shares on the Australian Stock Exchange ("ASX"). However, there are

several interesting discussions ongoing that could potentially that

may lead a different outcome to an IPO on the ASX. We remain

reassured that the board of Dynasty will continue to act on the

best interests of all its shareholders.

To date, the Company has invested approximately GBP968,000 in

Dynasty based on Dynasty's valuation of US$50 million in the last

fundraising round. As of 31 March 2022, the Company's holding in

Dynasty is valued at approximately US$6.5 million (approximately

GBP4.8 million).

Mobile Gaming

East Sides Games ("ESG")

ESG has achieved several major milestones, including the global

launch of RuPaul's Drag Race Superstar mobile game, which occurred

on 25 October 2021, surpassing 1 million downloads and over 150,000

active average daily users, which is the highest daily active users

for any of its active games.

By November 2021, RuPaul's Drag Race Superstar had become the

number one ranking role playing or simulation game in the iOS App

Store across 44 countries and ranked in the top 10 in 67 countries.

In addition, the game reached the top 100 grossing games in 40

countries on iOS.

In January 2022, ESG announced a multi-year partnership with BBC

Studios, the commercial subsidiary of the global British

Broadcasting Corporation ("BBC"), for the worldwide release of a

free-to-play mobile title based on the Doctor Who franchise.

In April 2020, Blue Star invested approximately GBP57,000 into

East Side Games Group Inc, formerly known as LEAF, at a price of

CAD$1.60 per consolidated share (following a 10:1 share

consolidation which occurred in July 2021), prior to listing the

shares on the TSX Venture Exchange. East Side Games Group Inc.,

shares traded at CAD$2.90 as of 31 March 2022, valuing Blue Star's

holding at approximately GBP110,399.

DeFi, Payments and NFT

SatoshiPay

In the period under review, SatoshiPay saw the positive momentum

with Pendulum raising $5.0 million, via the private sale of PEN

tokens, to fund further development. The new funding allows for

SatoshiPay to be contractually retained to continue to develop

Pendulum blockchain.

Pendulum is an open source blockchain built on the stable and

existing Substrate framework that aims to establish the missing

link between fiat and the DeFi ecosystems through a sophisticated

smart contract network.

In November 2021, SatoshiPay presented a demonstration of

Pendulum at the "Meridian 2021", a forum that gathers experts in

finance, policy, and technology.

With funding for Pendulum in place, SatoshiPay took the timely

decision in January 2022 to appoint Meinhard Benn as Chairman and

Alexander Wilke as CEO. After co-founding SatoshiPay in 2014 and

leading the company as CEO for seven years, Meinhard's new role

will focus on the long-term vision of SatoshiPay and strategic

networking, while Alex, who joined SatoshiPay as Chief Operations

Officer in 2016, will take over the CEO duties. In addition to

other internal promotions and strategic hires, we believe

SatoshiPay is now structured for rapid scale-up and well-placed to

deliver further Pendulum milestones.

Post period end, Pendulum received a grant from the Web3

Foundation for developing Spacewalk. Spacewalk is the first bridge

between the Stellar network and the Polkadot/Kusama ecosystems. It

is implemented as a Substrate pallet and allows any Substrate-based

blockchain to implement a direct Stellar bridge.

Pendulum will implement Spacewalk as a Substrate pallet, a

component that can be plugged into any Substrate based blockchain.

Stellar is not smart contract capable, therefore the Spacewalk

bridge design is based on XCLAIM. XCLAIM is a framework for

achieving decentralised, trustless and efficient cross-chain

transfers.

XCLAIM has been further improved by Interlay for the open-source

Bitcoin bridge "interBTC". Spacewalk is based on the interBTC

implementation with the term interBTC being used for both the

bridge and for Bitcoin that is available on a Substrate-based

chain.

The fast progress of Pendulum and the Polkadot ecosystem may

accelerate the mission at SatoshiPay to offer instant cross-border

payments on blockchain sooner than expected with further news

expected in the near future while Solar Wallet continues to be in

maintenance mode with a recent update patch released to the market.

This release includes a minor change for adding funds with Moonpay,

which was required from March 2022.

As of 31 March 2021, total equity funding to date for SatoshiPay

was EUR4.6m with Blue Star currently holding 27.9% of SatoshiPay's

issued share capital, worth GBP4.5m, based on the last external

fund raise in 2019.

It is the Board's view that the valuation of SatoshiPay may have

increased significantly since the last fund raise given the

operational progress of Pendulum. However, no revaluation work on

SatoshiPay has been undertaken since 2019.

Sthaler

Earlier in the year, Sthaler's biometric technology platform,

FinGo, partnered with the RBC Group, a pioneer in automated retail

design and manufacturing of vending machines.

In February 2022, FinGo entered into a strategic partnership

with the leading security access service provider, Croma Security

Solutions. The new alliance will strengthen each company's

world-leading solutions in the provision of non-invasive biometric

technology, expanding access to FinGo's Vein ID platform to Croma's

global customer base.

Post period end, FinGo unveiled the World's first vein iD

enabled vending machine where users can pay and prove their age

through a simple scan of their finger. The Company remains

confident the age verification service, "FinGoVend" is expected to

lead the way in 'unattended retail' for age-restricted products

such as alcoholic drinks, e-cigarettes and vapes.

Blue Star invested GBP50,000 in exchange for approximately 0.8%

Sthaler's issued share capital. As of 31 March 2022, the company's

holding in Stahler is currently valued at approximately GBP387,000,

based on Sthaler's last completed fundraise.

NFT Investments ("NFT")

NFT Investments raised GBP35m (Gross) and listed on the AQSE

Stock Exchange in London in April 2021. Since admission, the

Company made seven investments and one exit in early-stage growth

technology and media businesses engaged in NFTs and digital assets

totalling approximately GBP5.8m. NFT also established significant

positions in cryptocurrencies BNB, Bitcoin, Ether, XBD, FLOW and

DOT.

As at 31 December 2021, NFT had a Net Asset Value of GBP34.38m,

equivalent to 3.43p per share, comprising cash and cash equivalents

of GBP21.9m and net book value of investments, including

cryptocurrencies, of GBP12.5m.

The Company had previously made an investment of GBP50,000 in an

earlier funding round of NFT Investments and, as a result of

further investment, currently holds 9,000,000 ordinary shares

representing approximately 0.9 per cent of NFT's issued share

capital. The Company's holding in NFT was valued at GBP223,000 at

the period end.

Outlook

The Board believes that the Company's portfolio has continued to

achieve significant operational and financial milestones during the

period. Importantly, the Board maintains its confidence in the

strong underlying trends across the sectors within which it is

invested in and believes in the benefit of the portfolio approach

when investing in early-stage companies out ways the inherent

risks.

Given the increase in NAV of the overall portfolio since

inception, plus sufficient cash reserves, improving liquidity

provided by our listed investments and the increasing investor

interest in the activities of our portfolio companies, the Board is

confident that it is both well-funded and well-positioned to

perform strongly in the second half of 2022 and beyond.

Derek Lew

Chairman

29 June 2022

Statement of Comprehensive Income

for the six months ended 31 March 2022

Unaudited Audited

Year ended

Six months ended 31 March 30 September

2022 2021 2021

GBP GBP GBP

Revenue - - -

Fair valuation movements in financial instruments designated at fair

value through profit

or loss: (937, 941) (19,684) 2,772,447

(937, 941) (19,684) 2,772,447

Foreign exchange movements 37,904 (318,991) (325,554)

Administrative expenses (100,642) (159,379) (324,785)

-------------- ----------- -------------

Operating (loss)/profit (1,000,679) (498,054) 2,122,108

Finance income 3,873 3,511 7,207

(Loss)/profit before and after taxation and total comprehensive

income for

the period (996,806) (494,543) 2,129,315

-------------- ----------- -------------

Loss per ordinary share:

Basic (loss)/earnings per share (0.02p) (0.01p) 0.05p

Diluted (loss)/earnings per share (0.02p) (0.01p) 0.05p

-------------- ----------- -------------

The loss for the period was derived from continuing operations

and is attributable to equity shareholders.

Statement of Financial Position

as at 31 March 2022

Unaudited Audited

Year ended

Six months ended 31 March 30 September

-------------------------------------- -------------

2022 2021 2021

GBP GBP GBP

Non-current assets

Investments 11,463,552 8,740,719 12,367,204

Convertible loan note 158,323 143,725 150,846

11,621,875 8,884,444 12,518,050

------------------------- ----------- -------------

Current assets

Trade and other receivables 28,243 18,813 135,501

Cash and cash equivalents 113,416 59,491 296,106

141,659 78,304 431,607

------------------------- ----------- -------------

Total assets 11,763,534 8,962,748 12,949,657

------------------------- ----------- -------------

Current liabilities

Trade and other payables 44,825 35,729 234,142

Total current liabilities 44,825 35,729 234,142

------------------------- ----------- -------------

Net assets 11,718,709 8,927,019 12,715,515

------------------------- ----------- -------------

Shareholders' equity

Share capital 4,892,774 4,228,251 4,892,774

Share premium account 9,575,072 9,074,957 9,575,072

Other reserves - 96,290 -

Retained earnings (2,749,137) (4,472,479) (1,752,331)

11,718,709 8,927,019 12,715,515

------------------------- ----------- -------------

Statement of changes in equity

as at 31 March 2022

Share capital Share premium Other reserves Retained earnings Total

-------------- ---------------- ------------------ ------------------ ----------

GBP GBP GBP GBP GBP

Six months ended

31 March 2021

At 1 October 2020 4,892,774 9,575,072 - (1,752,331) 12,715,515

Loss for the period and

total comprehensive

income - - - (996,806) (996,806)

At 31 March 2022 4,892,774 9,575,072 - (2,749,137) 11,718,709

-------------- ---------------- ------------------ ------------------ ----------

Six months ended

31 March 2020

At 1 October 2020 4,133,251 9,074,957 143,210 (4,024,856) 9,326,562

Loss for the period and

total comprehensive

income - - - (494,543) (494,543)

Shares issued in period 95,000 - - - 95,000

Exercise of warrants - - (29,716) 29,716 -

Lapse of warrants - - (17,204) 17,204 -

At 31 March 2021 4,228,251 9,074,957 96,290 (4,472,479) 8,927,019

-------------- ---------------- ------------------ ------------------ ----------

Year ended

30 September 2021

At 1 October 2020 4,133,251 9,074,957 143,210 (4,024,856) 9,326,562

Profit for the year and

total comprehensive

income - - - 2,129,315 2,129,315

Shares issued in year 759,523 500,115 - - 1,259,638

Exercise of warrants - - (54,704) 54,704 -

Lapse of warrants - - (88,506) 88,506

At 30 September 2021 4,892,774 9,575,072 - (1,752,331) 12,715,515

-------------- ---------------- ------------------ ------------------ ----------

Statement of cash flows

for the six months ended 31 March 2022

Unaudited Audited

Six months ended Year ended

31 March 30 September

--------------------- -------------

2022 2021 2021

GBP GBP GBP

Operating activities

(Loss)/profit for the period (996,806) (494,543) 2,129,315

Adjustments for:

Finance income (3,873) (3,511) (7,207)

Fair value losses/(gains) 937,941 19,684 (2,772,447)

Foreign exchange (37,904) 315,486 318,394

Working capital adjustments

Decrease/(Increase) in trade and

other receivables 107,258 (16,145) (132,833)

(Decrease)/Increase in trade and

other payables (189,317) 7,842 206,256

---------- --------- -------------

Net cash used in operating activities (182,701) (171,187) (258,522)

---------- --------- -------------

Investing activities

Increase in investments - - (844,360)

Interest received 11 3,511 7,183

---------- --------- -------------

Net cash generated from/(used in)

investing activities 11 3,511 (837,177)

---------- --------- -------------

Financing activities

Proceeds from issue of equity shares - 95,000 1,259,638

Net cash generated by financing activities - 95,000 1,259,638

---------- --------- -------------

Net (decrease)/ increase in

cash and cash equivalents (182,690) (72,676) 163,939

Cash and cash equivalents at

beginning of the period 296,106 132,167 132,167

---------- --------- -------------

Cash and cash equivalents at

end of the period 113,416 59,491 296,106

---------- --------- -------------

Notes to the Interim Financial Statements

for the six months ended 31 March 2022

1. Basis of preparation

The principal accounting policies used for preparing the

half-yearly accounts are those the Company expects to apply in its

nancial statements for the year ending 30 September 2021 and are

unchanged from those disclosed in the Company's Report and

Financial Statements for the year ending 30 September 2021.

The nancial information for the six months ended 31 March 2022

and for the six months ended 31 March 2021 have neither been

audited nor reviewed by the Company's auditors.

2. Critical accounting estimates and judgements

The Company makes certain estimates and assumptions regarding

the future. Estimates and judgements are continually evaluated

based on historical experience and other factors, including

expectations of future events that are believed to be reasonable

under the circumstances. In the future, actual experience may di er

from these estimates and assumptions. The estimates and assumptions

that have a signi cant risk of causing a material adjustment to the

carrying amounts of assets and liabilities within the next

financial year are discussed below:

Fair value of financial instruments:

The Company holds investments that have been designated at fair

value through pro t or loss on initial recognition. The Company

determines the fair value of these nancial instruments that are not

quoted, using valuation techniques, contained in the IPEVC

guidelines. These techniques are signi cantly a ected by certain

key assumptions. Other valuation methodologies such as discounted

cash ow analysis assess estimates of future cash ows and it is

important to recognise that in that regard, the derived fair value

estimates cannot always be substantiated by comparison with

independent markets and, in many cases, may not be capable of being

realised immediately.

In certain circumstances, where fair value cannot be readily

established, the Company is required to make judgements over

carrying value impairment, and evaluate the size of any impairment

required.

3. Loss per ordinary share

The calculation of a basic loss per share is based on the loss

for the period attributable to equity holders of the Company and on

the weighted average number of shares in issue during the

period.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SEAEFUEESEIM

(END) Dow Jones Newswires

June 30, 2022 02:00 ET (06:00 GMT)

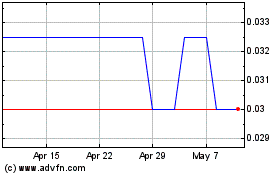

Blue Star Capital (LSE:BLU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Blue Star Capital (LSE:BLU)

Historical Stock Chart

From Apr 2023 to Apr 2024