Bank of Georgia Group PLC General provision relating to COVID-19 (8854I)

April 06 2020 - 5:30AM

UK Regulatory

TIDMBGEO

RNS Number : 8854I

Bank of Georgia Group PLC

06 April 2020

London, 6 April 2020

General provision relating to COVID-19

Bank of Georgia Group PLC (the "Group") announces that, further

to our announcement on 3 April 2020, relating to the National Bank

of Georgia's (the "NBG") updated supervisory plan for Georgian

banking sector, we have now agreed with the NBG that JSC Bank of

Georgia (the "Bank") will create a general provision of GEL 400

million under the Bank's local accounting basis, which is used for

calculation of the Bank's capital ratios. This represents

approximately 3.3% of the Bank's lending book, and the general

provision is expected to be taken in the first quarter of 2020. Our

understanding is that the specific quantum of the provision

reflects the NBG's current expectation of estimated credit losses

on the Bank's lending book for the whole economic cycle, given

current economic expectations.

The Group publishes its financial accounts on an International

Financial Reporting Standards (IFRS) basis and, at this stage, it

is too early to estimate our likely provisioning requirements on

this basis. We will provide a detailed update with our first

quarter of 2020 results in May.

As we announced last week, the Bank's capital adequacy ratios,

funding and liquidity positions have been strong, and remaining

comfortably above of minimum regulatory requirements. At 29

February 2020, the CET1, Tier 1 and total capital adequacy ratios

were 12.2%, 14.2% and 18.6%, respectively, and following recently

announced measures, the Bank expects the CET1, Tier 1 and Total

Capital adequacy ratio requirements at 6.9%, 8.7% and 13.3%,

respectively, as of 31 March 2020. The NBG has also stated its

willingness, if necessary, to fully or partially release the

remaining requirements of Pillar 2 capital buffers, and, again if

necessary, to introduce initiatives to reduce liquidity

requirements.

The NBG considers the Bank's capital ratios to be sufficiently

in excess of the expected minimum capital requirements at 31 March

2020, to be able to absorb this upfront general provision whilst

maintaining a sufficiently comfortable buffer over the required

minimum capital ratios. This is supported by the Group's recent

track record of strong profitability, and capacity to generate high

levels of internal capital.

Name of authorised official of issuer responsible for making

notification: Natia Kalandarishvili, Head of Investor Relations and

Funding

About Bank of Georgia Group PLC

Bank of Georgia Group PLC ("Bank of Georgia Group" or the

"Group" - LSE: BGEO LN) is a UK incorporated holding company, which

comprises: a) retail banking and payment services, b) corporate and

investment banking and wealth management operations and c) banking

operations in Belarus ("BNB"). JSC Bank of Georgia ("Bank of

Georgia", "BOG" or the "Bank"), the leading universal bank in

Georgia, is the core entity of the Group. The Group targets to

benefit from superior growth of the Georgian economy through both

its retail banking and corporate and investment banking services

and aims to deliver on its strategy, which is based on at least 20%

ROAE and c.15% growth of its loan book .

JSC Bank of Georgia has, as of

the date hereof, the following

credit ratings:

Fitch Ratings 'BB-/B'

Moody's 'Ba3/NP' (FC)

& 'Ba2/NP' (LC)

For further information, please visit www.bankofgeorgiagroup.com

or contact:

Archil Gachechiladze Michael Oliver Sulkhan Gvalia Natia Kalandarishvili

CEO Adviser to the CFO Head of Investor

CEO Relations

+995 322 444 444

+995 322 444 144 +44 203 178 4034 +995 322 444 108 (9282)

agachechiladze@bog.ge moliver@bgeo.com sgvalia@bog.ge ir@bog.ge

This news report is presented for general informational purposes

only and should not be construed as an offer to sell or the

solicitation of an offer to buy any securities

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

UPDMZGGDLVRGGZG

(END) Dow Jones Newswires

April 06, 2020 05:30 ET (09:30 GMT)

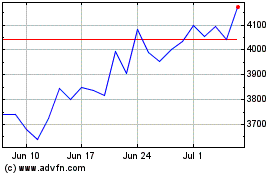

Bank Of Georgia (LSE:BGEO)

Historical Stock Chart

From Mar 2024 to Apr 2024

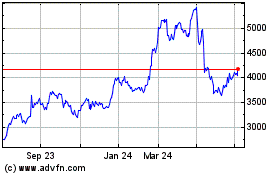

Bank Of Georgia (LSE:BGEO)

Historical Stock Chart

From Apr 2023 to Apr 2024