TIDMBGEO

RNS Number : 2931G

Bank of Georgia Group PLC

16 March 2020

London, 16 March 2020

Bank of Georgia Group contingency planning - COVID-19

Bank of Georgia Group PLC (the "Group") announces that it has

introduced a number of resilience protocols and a comprehensive

business continuity plan aimed at protecting the health and safety

of all of our staff and customers. These have been introduced in

conjunction with the Government of Georgia and the National Bank of

Georgia, our banking regulator.

Bank of Georgia (the "Bank") has implemented its Business

Continuity Plan (the "BCP") aimed at the protection of both our

employees and our customers. All of the Bank's 93 main branches

will remain fully open, but two-week shifts have been introduced

for branch staff, to ensure ongoing availability of team members.

Express metro and 24/7 branches will remain fully open however,

with immediate effect, the Bank has initiated the temporary closure

of the customer service support areas of a number of express

branches, with only the self-service terminals and ATM areas

remaining open.

Banking services will, where possible, be conducted exclusively

via call centres, and we are also reducing the physical presence of

bankers in the Bank's service centres. Two-week shifts have also

been introduced in front offices in other service areas throughout

the business. In the Bank's back office environments, the majority

of staff are now being encouraged to work from home, with others

working, where appropriate, from split locations. These changes

have been implemented to reduce physical interaction and prevent

the spread of Coronavirus, whilst maintaining the full banking

capability required to support and assist our customers.

On 13 March 2020, the Government of Georgia announced a series

of support measures designed to mitigate the potential economic

impact of the global spread of the Coronavirus, COVID-19. These

measures are expected to create additional financial resources

within the economy of GEL 1 billion, and include:

-- At our suggestion, a three-month grace period on principal

and interest payments on all retail loans has been agreed with most

banks. Interest will continue to accrue. This will significantly

reduce the requirement for customers to physically visit Bank

branches.

-- Potential restructuring opportunities for corporate customers

and all legal entities operating in the tourism industry which has

already slowed significantly across the world. Specific sectors

will include the hotels, as well as restaurants, travel agencies,

and passenger transportation companies, amongst others. Interest

will continue to accrue.

-- These companies will also have their property and personal

income taxes deferred by the Government for an initial four-month

period. In addition, the Government will subsidise interest

payments for six months, for small and medium sized hotels with

less than 50 rooms.

-- The Government will double the volume of VAT refunds to

companies, from an expected GEL 600 million, to an anticipated GEL

1.2 billion this year.

-- The Government will increase its proposed capital expenditure by GEL 300 million this year.

These initiatives are aimed at alleviating challenges created by

the global COVID-19 crisis, which are expected to reduce the GDP

growth rate, particularly in relation to the tourism industry which

has already started to experience a high level of cancellations.

Bank of Georgia's lending exposure to the hotels and associated

tourism-related sectors, such as restaurants, is currently

approximately GEL 800 million, predominantly all of which is fully

secured.

When the Group announced its 2019 preliminary results on 13

February 2020, it reiterated its strategic targets based on at

least 20% return on average equity, and c.15% growth of its loan

book. In addition, the Board of Directors announced its intention

to recommend, at the 2020 Annual General Meeting, an annual

dividend for 2019 of GEL 2.67 per share payable in British Pounds

Sterling at the prevailing rate. Given the current level of

uncertainty with regard to the global impact of COVID-19, and the

potential length of time of that impact, the Board of Directors

will keep these issues under review in the light of developments

over the next few months. In the meantime, the Board of Directors

has decided not to recommend a dividend to shareholders at the 2020

Annual General Meeting, at this stage. When the full economic

impact of the COVID-19 pandemic is better understood, the Board

will consider the appropriate level. We will provide a further

update with the announcement of the Group's first quarter of 2020

results in May.

During the first few months of 2020, the Group's performance has

been consistent with, or slightly better than, its existing

guidance and strategic targets. Asset quality metrics have

continued to be very robust, and the Bank's capital adequacy

ratios, funding and liquidity positions have been strong, remaining

comfortably ahead of our minimum regulatory requirements.

Archil Gachechiladze , the Group CEO commented: "Georgia's

response to the evolving Coronavirus crisis has so far been

extremely successful, but these are unprecedentedly challenging

times and the country cannot be immune to the global economic

impact on many businesses, but particularly in the tourism and

tourism-related sectors. Our priority at Bank of Georgia is first

and foremost the health and well-being of our staff and customers,

and our BCP has been implemented to ensure that priority, together

with sustaining the long-term stability, strength and profitability

of the Group. We will monitor the impact of COVID-19 on an ongoing

basis, and adapt and manage our resources according to evolving

circumstances.

The Group is very well-positioned with strong capital, funding

and liquidity resources, and we aim to ensure that this remains the

case. We will also continue to work with the Government of Georgia

and the National Bank of Georgia to take the appropriate actions to

pro-actively manage this process."

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) No 596/2014.

Name of authorised official of issuer responsible for making

notification: Natia Kalandarishvili, Head of Investor Relations and

Funding

About Bank of Georgia Group PLC

Bank of Georgia Group PLC ("Bank of Georgia Group" or the

"Group" - LSE: BGEO LN) is a UK incorporated holding company, which

comprises: a) retail banking and payment services, b) corporate and

investment banking and wealth management operations and c) banking

operations in Belarus ("BNB"). JSC Bank of Georgia ("Bank of

Georgia", "BOG" or the "Bank"), the leading universal bank in

Georgia, is the core entity of the Group. The Group targets to

benefit from superior growth of the Georgian economy through both

its retail banking and corporate and investment banking services

and aims to deliver on its strategy, which is based on at least 20%

ROAE and c.15% growth of its loan book .

JSC Bank of Georgia has, as of

the date hereof, the following

credit ratings:

Fitch Ratings 'BB-/B'

Moody's 'Ba3/NP' (FC)

& 'Ba2/NP' (LC)

For further information, please visit www.bankofgeorgiagroup.com

or contact:

Archil Gachechiladze Michael Oliver Sulkhan Gvalia Natia Kalandarishvili

CEO Adviser to the CFO Head of Investor

CEO Relations

+995 322 444 444

+995 322 444 144 +44 203 178 4034 +995 322 444 108 (9282)

agachechiladze@bog.ge moliver@bgeo.com sgvalia@bog.ge ir@bog.ge

This news report is presented for general informational purposes

only and should not be construed as an offer to sell or the

solicitation of an offer to buy any securities

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCEAADKFFNEEFA

(END) Dow Jones Newswires

March 16, 2020 08:30 ET (12:30 GMT)

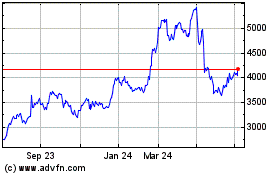

Bank Of Georgia (LSE:BGEO)

Historical Stock Chart

From Mar 2024 to Apr 2024

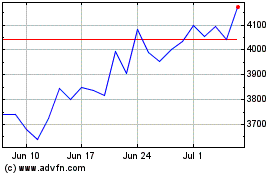

Bank Of Georgia (LSE:BGEO)

Historical Stock Chart

From Apr 2023 to Apr 2024