TIDMBEM

RNS Number : 2829O

Beowulf Mining PLC

29 May 2020

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations ("MAR") (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

29 May 2020

Beowulf Mining plc

("Beowulf" or the "Company")

Unaudited Financial Results for the Period Ended 31 March

2020

Beowulf (AIM: BEM; Spotlight: BEO), the mineral exploration and

development company, announces its unaudited financial results for

the three months ended 31 March 2020.

Overview of Activities in the Quarter

-- The Company announced, on 3 February 2020, a management

update on its application for an Exploitation Concession (the

"Concession") for the Kallak Iron Ore Project ("Kallak") and the

Company's other business areas, Vardar Minerals ("Vardar") and

Fennoscandian Resources ("Fennoscandian").

-- On 4 February 2020, the Company announced that in response to

the CEO's letter sent to Minister Ibrahim Baylan in December 2019,

the Government stated it was not able to comment on when a

decision, in respect of the Concession for Kallak, is expected to

be taken, however, the Government had taken careful note of the

information provided by the Company.

-- The Company stated, on 13 February 2020, that contrary to

media reports, no legal action had been taken against the

Government, but that all options with regard to taking legal action

remain under active consideration.

-- On 17 February 2020, the Company announced that Vardar had

identified a copper-zinc exploration target at Mitrovica and that

the Company had invested a further GBP50,000 in Vardar, increasing

the Company's ownership from 41.5 per cent to 42.2 per cent.

-- On 25 March 2020, the Company invested a further GBP30,000 in

Vardar, alongside founders and existing shareholders in Vardar, to

fund a soil sampling programme across the Madjan Peak gold target,

part of the Mitrovica licence. The resulting investment maintained

the Company's ownership interest in Vardar at 42.2 per cent.

Post Period

-- On 18 May 2020, the Company provided an update on

Fennoscandian's activities in Finland. Fennoscandian continues to

develop a 'resource footprint' of natural flake graphite to provide

'security of supply' to Finland's emerging battery sector and to

benefit from Business Finland funding, as the Company seeks to move

downstream and develop its knowledge in processing and

manufacturing battery grade and value-added graphite products.

-- On 26 May 2020, the Company announced that a Parliamentary

Question regarding Kallak had been put to Mr Ibrahim Baylan,

Minister for Business, Industry and Innovation, which the Minister

is scheduled to answer on 3 June 2020. The question was posed by

Lars Hjälmered, a Moderate Party Member in the Swedish

Parliament.

-- On 27 May 2020, the Company announced that it had a awarded a

drilling contract for Kallak to Kati Oy. The work programme,

scheduled for Autumn 2020, will determine if a 3D seismic model can

be constructed, using the established seismic characteristics of

the Kallak deposit, and whether the 3D model can be used to

identify additional iron ore mineralisation for the Exploration

Target of 90-100 million tonnes ("Mt") at 22-30 per cent iron

("Fe") at Kallak.

Kurt Budge, Chief Executive Officer of Beowulf, commented:

"Over the quarter, we continued to see progress being made by

Vardar in Kosovo, with the addition of a copper-zinc exploration

target at Mitrovica and a soils sampling programme being carried

out over the prospective Madjan Peak gold target, the results of

which should be announced shortly.

"Post period, we updated the market on developments in Finland,

with positive early signs for a new graphite prospect, Karhunmäki,

and Fennoscandian playing an important role in studies into the

Lithium Ion Battery supply chain in Finland and improving the

traceability of battery raw material supply. In recent months,

Fennoscandian has completed spheroidization testwork and battery

tests on Aitolampi graphite, the results of which will be announced

in the coming weeks.

"Since my attendance at the Nordic Mining Day in Toronto in

early March, the Company has acted to face the ongoing threat posed

by COVID-19, as best we can, including 30 percent salary cuts for

the CEO and Board, and sought to maintain a 'business as usual'

attitude.

"This week, the Company updated the market on a Parliamentary

Question to Minister Baylan, which he is due to answer on 3 June

2020. Minister Baylan has responded to questions in the past

highlighting the complexity of the Kallak case.

"The Kallak case is not complex. During my time as CEO, no

authority has presented me with a long list of problems that needed

fixing. This is why the Board has consistently stated that the

Kallak application is comprehensive and satisfies the requirements

of the prescribed process for being granted an Exploitation

Concession in accordance with Swedish law.

"Last year, the Company went further, engaging lawyers to

prepare a Concluding Statement, submitted to the Government in

November 2019, which demonstrated that, under judicial review,

Beowulf's application has satisfied all requirements.

"Bergsstaten (the "Mining Inspectorate"), part of the Geological

Survey of Sweden ("SGU"), a Government Office, has granted

Exploration Permits for Kallak, the first in 2006, and seen the

Company drill almost 28,000 metres, 131 holes, to define a

significant iron ore resource.

"The SGU first discovered Kallak in the 1940s, designated it an

Area of National Interest ("ANI") in 2013 and produced its latest

study, headlined 'New light on iron ore at Kallak', this month.

Kallak has been on the SGU's radar for 80 years!

"Bergsstaten recommended to the Government in October 2015, that

the Concession for Kallak should be awarded, and last October

awarded an Exploration Permit for Parkijaure nr 6, which covers

approximately 1,000 hectares and lies immediately to the south of

the Kallak deposits. On the evidence, the authorities are happy for

companies to spend on exploration, in the case of Kallak over SEK

80 million to date, but it is another story when it is time to

consider granting an Exploitation Concession.

"In Toronto, Minister Baylan saved his biggest welcome for

investors. Beowulf has been invested in Sweden and working on

Kallak for 14 years. Minister Baylan said that I was welcome to do

business in Sweden. The fact of the matter is, Beowulf is unable to

do business, because we cannot get a decision from the Swedish

Government and take Kallak forward in partnership with the

community in Jokkmokk.

"In May 2019, the State Secretary said, to the Chairman and me,

in a face to face meeting, that the Government understood the

importance of Kallak to Jokkmokk. Now more than ever, with

COVID-19, it would be logical to assume that a project such as

Kallak, which has the potential to bring billions of SEK in

investment and hundreds of jobs to northern Sweden, should finally

gain approval.

"Beowulf has several thousand Swedish shareholders, who own

nearly 68 per cent of the Company. They, and the Company's

non-Swedish shareholders, have a right to know now what is

happening with the Kallak application and when a Government

decision will be forthcoming. At this time, the Government needs to

be transparent and remove the uncertainty as to when a decision

will be taken.

"We look forward to keeping the market updated on further

developments."

Financials

-- The consolidated loss remaining largely unchanged in quarter

ended at GBP217,342 (Q1 2019: GBP223,096). This decrease is partly

attributable to no share-based payment charge relating to employees

and Directors options for the quarter compared to GBP40,022

incurred in the previous quarter. This decrease is offset by the

consolidation of administration costs of GBP44,034 associated with

Vardar Minerals which became a subsidiary on 1 April 2019.

-- Consolidated basic and diluted loss per share for the quarter

ended 31 March 2020 was 0.03 pence (Q1 2019: loss of 0.04

pence).

-- GBP789,310 in cash held at the period end (Q1 2019: GBP1,229,606).

-- The cumulative translation losses held in equity decreased by

GBP120,819 in the quarter ended 31 March 2020 to GBP1,166,859 (31

December 2019: loss of GBP1,291,068). Much of the Company's

exploration costs are in Swedish Krona and Euro which has

strengthened against the pound since 31 December 2019.

-- At 30 April 2020 there were 402,150,037 Swedish Depository

Receipts representing 66.78 per cent of the issued share capital of

the Company. The remaining issued share capital of the Company is

held in the UK.

Operational

Vardar Minerals, Kosovo

-- On 17 February 2020, the Company announced that Vardar, has

identified an additional copper-zinc exploration target at

Mitrovica. Mineralised gossans have been identified through field

mapping and sampling to the north and east of drill tested

mineralisation at Wolf Mountain. The mineralised gossans identified

appear to be the surface expression of hydrothermal breccias and

stockworks.

Significant anomalies have been returned from rock grab sampling

and soil sampling grids over the area, with several rock samples

showing greater than 1 per cent copper and up to 3 per cent lead

and soil samples routinely over 500ppm copper and up to 1 per cent

lead and zinc.

-- At the same time, Beowulf announced that it had invested

GBP50,000 in Vardar, increasing the Company's ownership from 41.5

per cent to 42.2 per cent. Funds to be used for testing of an

automated terrain-following drone which will be used to collect

magnetic IP ("MIP") and magnetometric resistivity ("MMR") data over

priority areas at Viti and Mitrovica. Results from the drone

surveys will be combined with 3D Induced Polarisation surveys to

generate drill targets.

-- On 25 March 2020, Beowulf invested a further GBP30,000 in

Vardar, alongside founders and existing shareholders in Vardar who

themselves invested GBP40,000, to fund an infill soil sampling

programme over approximately one square kilometre across the Madjan

Peak gold target at Mitrovica. The total proceeds from the

fundraising amounted to GBP70,000. The Company's ownership interest

remained at 42.2 per cent.

Madjan Peak has returned anomalous gold and silver assays along

the eastern margin of the license, corresponding with previously

mapped advanced argillic alteration, identified historic gold

workings/pits and anomalous rock chip samples (up to 7.2 grammes

per tonne gold). Gold values correlate well with arsenic, which

provides a useful (more sensitive) corresponding dataset to define

anomaly positions. Previous soil sampling was completed on a 200

metre x 50 metre grid. Spacing will be reduced to 50 metre x 50

metre in order to provide better definition for drill targets.

-- Vardar is also planning to fly an ultra-detailed drone

magnetic survey over its entire licence package, Mitrovica and

Viti. Vardar has acquired the drone, sensors and support equipment

and has developed flight automation software over the winter

period. This software is now in testing and when completed will

assist in flying accurate low-level survey lines across mountainous

terrain.

Finland

-- On 18 May 2020, the Company provided an update on the

activities of its 100 per cent owned subsidiary Fennoscandian.

Fennoscandian continues to develop a 'resource footprint' of

natural flake graphite to provide 'security of supply' to Finland's

emerging battery sector and to benefit from Business Finland

funding, as the Company seeks to move downstream and develop its

knowledge in processing and manufacturing battery grade and

value-added graphite products.

Since Fennoscandian was acquired in January 2016, Beowulf has

invested approximately Euros 1.56 million in graphite exploration,

resource development, metallurgical testwork and the assessment of

market applications for graphite from its Aitolampi project,

including Lithium Ion Battery ("LIB") applications.

-- Testwork on a composite sample for Karhunmäki, a new graphite

prospect, produced a concentrate grade of 96.4 per cent Total

Graphitic Carbon ("TGC"), with 51.3 per cent large/jumbo flakes

(+180 micron). An Exploration Permit application has been

submitted.

-- After upgrading the Mineral Resource Estimate ("MRE") for

Aitolampi in 2019, now with an Indicated and Inferred Mineral

Resource of 26.7 million tonnes at 4.8 per cent TGC for 1,275,000

tonnes of contained graphite, Fennoscandian will report, in the

coming weeks, on the results of spheroidization testwork and

battery tests on Aitolampi graphite.

-- Fennoscandian is supporting a study into the supply chain for

LIBs in Finland and collaborating with Åbo Akademi in Turku,

Finland.

-- Fennoscandian has joined, as a consortium member, the

Business Finland funded BATTrace project, which aims to improve

traceability along the battery raw materials value chain using

mineralogical/geochemical fingerprinting, to validate responsible

and sustainable sourcing of cobalt, nickel, lithium and

graphite.

Sweden

-- The Company announced, on 3 February 2020, that the Board

would be meeting in Stockholm to discuss the continuing and

unacceptable delays in getting a decision from the Swedish

Government for the Kallak Concession. The Board was already in

receipt of a paper detailing options, prepared by the Company's

lawyers, and actively considering ring-fencing funds for legal

action.

-- On 4 February 2020, the Company announced that in response to

the CEO's letter sent to Minister Ibrahim Baylan in December 2019,

the Government stated it was not able to comment on when a

decision, in respect of the Concession for Kallak, is expected to

be taken, however, the Government had taken careful note of the

information provided by the Company.

-- The Company provided, on 13 February 2020, a management

update on Kallak where the Company stated that contrary to media

reports, no legal action has yet been taken against the Government,

but that all options to take legal action remain under active

consideration.

-- The Board stated that it was satisfied that the Company's

application for the Concession for Kallak fully meets the

requirements of Swedish mining and environmental legislation.

-- On 26 May 2020, the Company announced that a Parliamentary

Question regarding Kallak had been put to Mr Ibrahim Baylan,

Minister for Business, Industry and Innovation, which the Minister

is scheduled to answer on 3 June 2020. The question was posed by

Lars Hjälmered, a Moderate Party Member in the Swedish

Parliament.

Summary translation of Mr Hjälmered's question:

"The Kallak iron ore project has had to wait for a decision on

permits for over six years. The matter has been ready to make a

decision on the Minister's table for three years without him and

the Government making any decision. Another project received [by

the Government and] waiting unreasonably long for a decision is

Laver [Boliden AB].

In the [mining] industry, the question is now asked why the

Government is not coming to terms with it. Despite repeated

questions about when a decision may be made, and great irritation

from the industry, [the Government] has not yet returned to the

issue.

This management [of the issue by the Government] is under all

criticism, and the Government must recognize the importance of it

to Swedish mining industry. The industry is responsible for large

export revenues and employment [of] many people in Sweden. When the

Government cannot give any message, investments are not completed,

jobs are [not created] and [wider] benefits are not realized. In

addition, long processing times and uncertain processes mean Sweden

becomes less relevant to foreign investment.

In view of the above, I would like to ask Minister of Business

Ibrahim Baylan: When does the Minister and the Government intend to

make a decision on any mining activity in Kallak and Laver?"

-- On 27 May 2020, the Company announced that it had a awarded a

drilling contract for Kallak to Kati Oy. The work programme,

scheduled for Autumn 2020, will determine if a 3D seismic model can

be constructed, using the established seismic characteristics of

the Kallak deposit, and whether the 3D model can be used to

identify additional iron ore mineralisation for the Exploration

Target of 90-100 Mt at 22-30 per cent iron Fe at Kallak.

The work is being undertaken as part of the European Union

("EU") funded PACIFIC Project ("PACIFIC"). The aim of PACIFIC is to

develop a new low-cost and environmentally friendly tool for

exploring for sub-surface mineral deposits. The programme will test

a multi-array method in parallel with drilling at Kallak South,

with noise from drilling providing a passive seismic source.

The magnetic signature of mineralisation at Kallak, extends

southwards from Kallak North to Kallak South, and then beyond to

Parkijaure. Interpretation of geophysical data suggests the

potential for additional iron ore mineralisation, which could add

to the Kallak North and Kallak South resource.

If successful, the set-up could then be applied to the

Parkijaure nr 6 Exploration Licence, awarded by the Mining

Inspectorate in October 2019, which covers approximately 1,000

hectares and lies immediately to the south of the Kallak

deposits.

Enquiries:

Beowulf Mining plc

Kurt Budge, Chief Executive Tel: +44 (0) 20 3771

Officer 6993

SP Angel

(Nominated Adviser & Broker)

Ewan Leggat / Soltan Tagiev Tel: +44 (0) 20 3470

0470

Blytheweigh

Tim Blythe / Megan Ray Tel: +44 (0) 20 7138

3204

Cautionary Statement

Statements and assumptions made in this document with respect to

the Company's current plans, estimates, strategies and beliefs, and

other statements that are not historical facts, are forward-looking

statements about the future performance of Beowulf. Forward-looking

statements include, but are not limited to, those using words such

as "may", "might", "seeks", "expects", "anticipates", "estimates",

"believes", "projects", "plans", strategy", "forecast" and similar

expressions. These statements reflect management's expectations and

assumptions in light of currently available information. They are

subject to a number of risks and uncertainties, including, but not

limited to , (i) changes in the economic, regulatory and political

environments in the countries where Beowulf operates; (ii) changes

relating to the geological information available in respect of the

various projects undertaken; (iii) Beowulf's continued ability to

secure enough financing to carry on its operations as a going

concern; (iv) the success of its potential joint ventures and

alliances, if any; (v) metal prices, particularly as regards iron

ore. In the light of the many risks and uncertainties surrounding

any mineral project at an early stage of its development, the

actual results could differ materially from those presented and

forecast in this document. Beowulf assumes no unconditional

obligation to immediately update any such statements and/or

forecasts.

BEOWULF MINING PLC

CONDENSED CONSOLIDATED INCOME STATEMENT

FOR THE THREE MONTHS TO 31 MARCH 2020

(Unaudited) (Unaudited) (Unaudited)

3 months 3 months 12 months

ended 31 ended 31 ended 31

March March December

2019

2020 2019

GBP

Notes GBP GBP

Continuing operations

Administrative expenses (217,651) (183,650) (904,666)

Impairment of exploration

costs - - (10,720)

Share based payment

expense - (40,022) (119,720)

Share of loss of associates - (2,246) -

Gain on step acquisition - - 563,431

------------ ------------ ------------

Operating (Loss) (217,651) (225,918) (471,675)

Finance costs (88) - (410)

Finance income 397 2,822 6,298

Grant Income - - 37,080

------------ ------------ ------------

(Loss) before and after

taxation (217,342) (223,096) (428,707)

============ ============ ============

Loss attributable to:

Owners of the parent (191,543) (223,055) (249,192)

Non-controlling interests (25,799) (41) (179,515)

(217,342) (223,096) (428,707)

============ ============ ============

Loss per share attributable

to the owners of the

parent:

Basic and diluted (pence) 3 (0.03) (0.04) (0.04)

BEOWULF MINING PLC

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE LOSS

FOR THE THREE MONTHS TO 31 MARCH 2020

(Unaudited) (Unaudited) (Unaudited)

3 months 3 months 12 months

ended 31 ended 31

March March

2020 2019 ended 31

December

2019

GBP GBP GBP

(Loss) for the period

/ year (217,342) (223,096) (428,707)

Other comprehensive income

Items that may be reclassified

subsequently to profit

or loss:

Exchange gain/ (losses)

arising on translation

of foreign operations 124,676 (529,814) (794,299)

------------ ------------ ------------

Total comprehensive (loss) (92,666) (752,910) (1,223,006)

============ ============ ============

Total comprehensive (loss)

attributable to:

Owners of the parent (70,725) (752,748) (1,037,811)

Non-controlling interests (21,941) (162) (185,195)

(92,666) (752,910) (1,223,006)

============ ============ ============

BEOWULF MINING PLC

CONDENSED COMPANY STATEMENT OF COMPREHENSIVE INCOME

FOR THE THREE MONTHS TO 31 MARCH 2020

(Unaudited) (Unaudited) (Unaudited)

3 months 3 months 12 months

ended 31 ended 31 ended 31

March March December

2019

2020 2019

GBP

Notes GBP GBP

Continuing operations

Administrative expenses (157,336) (163,032) (651,433)

Share based payment

expense - (40,022) (119,720)

Operating Loss (157,336) (203,054) (771,153)

Finance income 396 2,822 6,298

Grant Income - - 1,425

------------ ------------ ------------

Loss before and after

taxation and total comprehensive

loss (156,940) (200,232) (763,430)

============ ============ ============

Loss per share attributable

to the owners of the

parent:

Basic and diluted (pence) 3 (0.03) (0.04) (0.03)

BEOWULF MINING PLC

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 31 MARCH 2020

(Unaudited) (Unaudited) (Unaudited)

As at As at As at

31 31 31

March March December 2019

2020 2019 GBP

GBP GBP

ASSETS Notes

Non-current assets

Intangible assets 5 10,427,186 7,856,750 10,213,722

Property, plant and

equipment 126,637 28,129 86,998

Investments - 227,874 -

Loans and other financial

assets 5,234 5,284 5,212

Right of use asset 6,018 - 7,324

------------- ------------- ---------------

10,565,075 8,118,037 10,313,256

------------- ------------- ---------------

Current assets

Trade and other receivables 201,572 56,995 167,261

Cash and cash equivalents 789,310 1,229,606 1,124,062

------------- ------------- ---------------

990,882 1,286,601 1,291,323

------------- ------------- ---------------

TOTAL ASSETS 11,555,957 9,404,638 11,604,579

============= ============= ===============

EQUITY

Shareholders' equity

Share capital 4 6,022,446 5,663,072 6,022,446

Share premium 20,824,009 19,266,271 20,824,009

Merger Reserve 137,700 137,700 137,700

Capital contribution

reserve 46,451 46,451 46,451

Share based payment

reserve 732,185 652,487 732,185

Translation reserve (1,170,250) (1,049,950) (1,291,068)

Accumulated losses (15,770,476) (15,534,988) (15,578,933)

------------- ------------- ---------------

Total Equity 10,822,065 9,181,043 10,892,790

------------- ------------- ---------------

Non-controlling interests 365,469 (160,749) 326,555

------------- ------------- ---------------

TOTAL EQUITY 11,187,534 9,020,294 11,219,345

------------- ------------- ---------------

LIABILITIES

Current liabilities

Trade and other payables 229,412 192,139 242,885

Grant income 132,833 192,205 134,877

Lease Liability 6,178 - 7,472

------------- ------------- ---------------

TOTAL LIABILITIES 368,423 384,344 385,234

------------- ------------- ---------------

TOTAL EQUITY AND LIABILITIES 11,555,957 9,404,638 11,604,579

============= ============= ===============

BEOWULF MINING PLC

CONDENSED COMPANY STATEMENT OF FINANCIAL POSITION

AS AT 31 MARCH 2020

(Unaudited) (Unaudited) (Unaudited)

As at As at As at

31 March 31 March 31 December

2020 2019 2019

GBP GBP GBP

ASSETS

Non-current assets

Investments 1,777,988 732,988 1,697,988

Loans and other financial

assets 9,078,455 8,396,593 8,989,451

10,856,443 9,129,581 10,687,439

------------- ------------- -------------

Current assets

Trade and other receivables 32,278 24,046 23,260

Cash and cash equivalents 679,445 1,155,768 978,514

------------- -------------

711,723 1,179,814 1,001,774

------------- ------------- -------------

TOTAL ASSETS 11,568,166 10,309,395 11,689,213

============= ============= =============

EQUITY

Shareholders' equity

Share capital 6,022,446 5,663,072 6,022,446

Share premium 20,824,009 19,266,271 20,824,009

Merger Reserve 137,700 137,700 137,700

Capital contribution

reserve 46,451 46,451 46,451

Share option reserve 732,185 652,487 732,185

Accumulated losses (16,455,799) (15,735,661) (16,298,859)

------------- ------------- -------------

TOTAL EQUITY 11,306,992 10,030,320 11,463,932

------------- ------------- -------------

LIABILITIES

Current liabilities

Trade and other payables 128,341 279,075 90,404

Grant income 132,833 - 134,877

------------- -------------

TOTAL LIABILITIES 261,174 279,075 225,281

------------- ------------- -------------

TOTAL EQUITY AND LIABILITIES 11,568,166 10,309,395 11,689,213

============= ============= =============

BEOWULF MINING PLC

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE THREE MONTHS TO 31 MARCH 2020

Share Share Merger Capital Share-based Translation Accumulated Total Non- Total

capital premium reserve contribution payment reserve losses controlling equity

reserve reserve interest

GBP GBP GBP GBP GBP GBP GBP GBP GBP GBP

At 1 January

2019 5,663,072 19,266,271 137,700 46,451 612,465 (520,257) (15,311,933) 9,893,769 (160,587) 9,733,182

Loss for the

period - - - - - - (223,055) (223,055) (41) (223,096)

Foreign

exchange

translation - - - - - (529,693) - (529,693) (121) (529,814)

---------- ----------- -------- ------------- ------------ ------------ ------------- ----------- ------------ -----------

Total

comprehensive

loss - - - - - (529,693) (223,055) (752,748) (162) (752,910)

Transactions

with

owners

Equity-settled

share-based

payment

transactions - - - - 40,022 - - 40,022 - 40,022

---------- ----------- -------- ------------- ------------ ------------ ------------- ----------- ------------ -----------

At 31 March

2019

(Unaudited) 5,663,072 19,266,271 137,700 46,451 652,487 (1,049,950) (15,534,988) 9,181,043 (160,749) 9,020,294

---------- ----------- -------- ------------- ------------ ------------ ------------- ----------- ------------ -----------

Loss for the

period - - - - - - (43,945) (43,945) (161,666) (205,611)

Foreign

exchange

translation - - - - - (241,118) - (241,118) (23,367) (264,485)

---------- ----------- -------- ------------- ------------ ------------ ------------- ----------- ------------ -----------

Total

comprehensive

loss - - - - - (241,118) (43,945) (285,063) (185,033) (470,096)

Transactions

with

owners

Issue of share

capital 359,374 1,651,043 - - - - - - - 2,010,417

Issue costs - (93,305) - - - - - - - (93,305)

Equity-settled

share-based

payment

transactions - - - - 79,698 - - 79,698 - 79,698

Acquisition of

subsidiary - - - - - - - - 672,337 672,337

---------- ----------- -------- ------------- ------------ ------------ ------------- ----------- ------------ -----------

At 31 December

2019

(Unaudited) 6,022,446 20,824,009 137,700 46,451 732,185 (1,291,068) (15,578,933) 10,892,790 326,555 11,219,345

---------- ----------- -------- ------------- ------------ ------------ ------------- ----------- ------------ -----------

Loss for the

period - - - - - - (191,543) (191,543) (25,799) (217,342)

Foreign

exchange

translation - - - - - 120,818 - 120,818 3,858 124,676

---------- ----------- -------- ------------- ------------ ------------ ------------- ----------- ------------ -----------

Total

comprehensive

loss - 120,818 (191,543) (70,724) (21,941) (92,666)

Transactions

with

owners

Investments by

Minority

interest - - - - - - - - 60,855 60,855

At 31 March

2020

(Unaudited) 6,022,446 20,824,009 137,700 46,451 732,185 (1,170,250) (15,770,476) 10,822,065 365,469 11,187,534

---------- ----------- -------- ------------- ------------ ------------ ------------- ----------- ------------ -----------

BEOWULF MINING PLC

CONDENSED COMPANY STATEMENT OF CHANGES IN EQUITY

FOR THE THREE MONTHS TO 31 MARCH 2020

Share capital Share Merger Capital Share-based Accumulated Total

premium reserve contribution payment losses

reserve reserve

GBP GBP GBP GBP GBP GBP GBP

At 1 January 2019 5,663,072 19,266,271 137,700 46,451 612,465 (15,535,429) 10,190,530

Loss for the period - - - - - (200,232) (200,232)

Total comprehensive

loss - - - - - (200,232) (200,232)

Transactions with

owners

Equity-settled

share-based

payment

transactions - - - - 40,022 - 40,022

-------------- ----------- --------- -------------- ------------ ------------- -----------

At 31 March 2019

(Unaudited) 5,663,072 19,266,271 137,700 46,451 652,487 (15,735,661) 10,030,320

-------------- ----------- --------- -------------- ------------ ------------- -----------

Loss for the period - - (563,198) (563,198)

Total comprehensive

loss - - (563,198) (563,198)

Transactions with

owners

Issue of share

capital 359,374 1,651,043 - - - - 2,010,417

Issue costs - (93,305) - - - - (93,305)

Equity-settled

share-based

payment

transactions - - - - 79,698 - 79,698

At 31 December 2019

(Unaudited)

(Unaudited) 6,022,446 20,824,009 137,700 46,451 732,185 (16,298,859) 11,463,932

-------------- ----------- --------- -------------- ------------ ------------- -----------

Loss for the period - - - - - (156,940) (156,940)

Total comprehensive

loss - - - - - (156,940) (156,940)

At 31 March 2020

(Unaudited) 6,022,446 20,824,009 137,700 46,451 732,185 (16,455,799) 11,306,992

-------------- ----------- --------- -------------- ------------ ------------- -----------

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED INTERIM FOR THE

THREE MONTHS TO 31 MARCH 2020

1 . Nature of Operations

Beowulf Mining plc (the "Company") is domiciled in England and

Wales. The Company's registered office is 201 Temple Chambers, 3-7

Temple Avenue, London, EC4Y 0DT. This consolidated financial

information comprises that of the Company and its subsidiaries

(collectively the 'Group' and individually 'Group companies'). The

Group is engaged in the acquisition, exploration and evaluation of

natural resources assets and has not yet generated revenues.

2. Basis of preparation

The condensed consolidated financial information has been

prepared on the basis of the recognition and measurement

requirements of International Financial Reporting Standards (IFRS)

as adopted by the European Union (EU) and implemented in the UK.

The accounting policies, methods of computation and presentation

used in the preparation of the interim financial information are

the same as those used in the Group's unaudited financial

statements for the year ended 31 December 2019 except as noted

below.

The financial information in this statement does not constitute

full statutory accounts within the meaning of Section 434 of the UK

Companies Act 2006. The financial information for the quarter ended

31 March 2019 and twelve months ended 31 December 2019 is unaudited

and has not been reviewed by the auditors. The financial

information for the three month period ended 31 March 2020 is

unaudited and has not been reviewed by the auditors. The audit of

the financial information for the year ended 31 December 2019 has

not yet been completed and therefore the financial information is

considered unaudited until the approval of the audited financial

statements. The auditor's report on the statutory financial

statements for the year ended 31 December 2018 was unqualified and

did not contain any statement under sections 498 (2) or (3) of the

Companies Act 2006. The audit report did contain a material

uncertainty with respect of going concern, however following

additional audit procedures and noting it as key audit matter, it

was concluded the going concern basis was appropriate.

The financial statements are presented in GB Pounds Sterling.

They are prepared on the historical cost basis or the fair value

basis where the fair valuing of relevant assets and liabilities has

been applied.

3. Share Capital

(Unaudited) (Unaudited) (Unaudited)

31 March 31 March

2020 2019 31 Dec 2019

GBP GBP GBP

Allotted, issued and fully paid

Ordinary shares of 1p each

6,022,446 5,663,072 6,022,446

----------- ----------- --------------

The number of shares in issue was as follows:

Number

of shares

Balance at 1 January 2019 566,307,254

Issued during the period -

------------

Balance at 31 March 2019 566,307,254

Issued during the period 35,937,418

------------

Balance at 31 December 2019 602,244,672

Issued during the period -

------------

Balance at 31 March 2020 602,244,672

------------

4 . Intangible Assets: Group

Exploration costs As at 31 As at 31

March December

2020 2019

(Unaudited) (Unaudited)

GBP GBP

Cost

At 1 January 10,213,722 8,285,547

Additions for the year 64,201 748,354

Additions arising from the

step-up in interest in Vardar 20,854 1,962,455

Foreign exchange movements 128,409 (771,914)

Impairment - (10,720)

10,427,186 10,213,722

============ ============

The net book value of exploration costs is comprised of

expenditure on the following projects:

As at As at

31 31

March December

2020 2019

(Unaudited) (Unaudited)

GBP GBP

Project Country

Kallak Sweden 6,719,487 6,675,124

Åtvidaberg Sweden 349,986 345,978

Ågåsjiegge Sweden 16,739 15,568

Pitkäjärvi Finland 1,165,449 1,058,078

Joutsijärvi Finland 20,933 19,095

Rääpysjärvi Finland 41,934 39,905

Karhunmäki Finland 33,568 24,078

Merivaara Finland 22,817 17,846

Polvela Finland 33,201 31,316

Tammijärvi Finland 25,822 24,278

Mitrovica Kosovo 1,407,933 1,382,845

Viti Kosovo 589,318 579,612

10,427,186 10,213,722

============ ============

Total Group exploration costs of GBP10,427,186 are currently

carried at cost in the financial statements. No impairment has been

recognised during the year, (2019: Sala GBP10,720).

Accounting estimates and judgements are continually evaluated

and are based on a number of factors, including expectations of

future events that are believed to be reasonable under the

circumstances. Management are required to consider whether there

are events or changes in circumstances that indicate that the

carrying value of this asset may not be recoverable.

The most significant risk currently facing the Group is that it

does not receive an Exploitation Concession for Kallak. The Company

originally applied for the Exploitation Concession in April 2013

and throughout 2017, and since the year-end, management have

actively sought to progress the application, engaging with the

various government bodies and other stakeholders. These activities

are summarised above.

Kallak is included in the condensed financial statements as at

31 March 2020 as an intangible exploration licence with a carrying

value of GBP6,719,487. Management have considered the status of the

application for the Exploitation Concession and in their judgement,

they believe it is appropriate to be optimistic about the chances

of being awarded the Exploitation Concession and thus have not

impaired the project.

5. Availability of interim report

A copy of these results will be made available for inspection at

the Company's registered office during normal business hours on any

weekday. The Company's registered office is at 207 Temple Chambers,

3-7 Temple Avenue, London, EC4Y 0DT. A copy can also be downloaded

from the Company's website at www.beowulfmining.com. Beowulf Mining

plc is registered in England and Wales with registered number

02330496.

** Ends **

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

QRFQVLFLBELXBBB

(END) Dow Jones Newswires

May 29, 2020 02:00 ET (06:00 GMT)

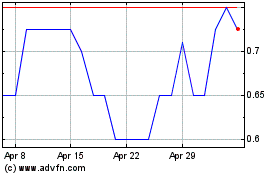

Beowulf Mining (LSE:BEM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Beowulf Mining (LSE:BEM)

Historical Stock Chart

From Apr 2023 to Apr 2024