Barclays 2Q Pretax Profit Rose Above Views, Pre-Pandemic Levels -- Update

July 28 2021 - 3:15AM

Dow Jones News

By Sabela Ojea

Barclays PLC on Wednesday reported a significant rise in pretax

profit for the second quarter, surpassing market views and

pre-pandemic levels, and said that it aims to launch another share

buyback program after resuming dividends.

The FTSE 100 bank posted a pretax profit of 2.58 billion pounds

($3.58 billion), up from GBP359 million a year earlier. Pretax

profit for the second quarter of 2019 stood at GBP1.53 billion.

Pretax profit had been expected to reach GBP1.70 billion,

according to Barclays' compiled consensus.

Barclays benefited from credit impairment releases of GBP797

million after booking charges of GBP55 million in the previous

quarter.

The U.K. lender's total income rose to GBP5.42 billion, compared

with GBP5.34 billion a year earlier. This compares with GBP5.54

billion for the second quarter of 2019. It had been expected to

generate total income of GBP5.31 billion for the latest

quarter.

The board has declared a dividend of 2.0 pence a share, higher

than the expected 1.8 pence a share, following the Bank of

England's decision to remove restrictions on limited dividend

payouts

The bank also said that it intends to initiate a further share

buyback of up to GBP500 million after having completed the latest

GBP700 million buyback in April.

The bank ended the second quarter with a common equity Tier 1

ratio --a key measure of balance-sheet strength-- of 15.1%. The

planned buyback would have an effect of 17 basis points on the CET1

ratio.

Write to Sabela Ojea at sabela.ojea@wsj.com; @sabelaojeaguix

(END) Dow Jones Newswires

July 28, 2021 03:01 ET (07:01 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

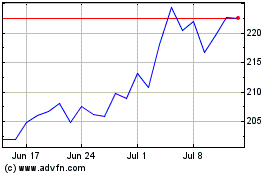

Barclays (LSE:BARC)

Historical Stock Chart

From Mar 2024 to Apr 2024

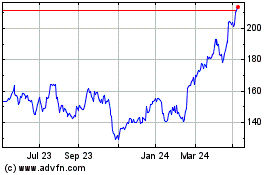

Barclays (LSE:BARC)

Historical Stock Chart

From Apr 2023 to Apr 2024