Barclays' 4Q Pretax Profit Well Ahead of Market Views -- Earnings Review

February 18 2021 - 9:28AM

Dow Jones News

By Sabela Ojea

Barclays PLC reported earnings for the fourth quarter of 2020 on

Thursday, reinstated its dividend and said it would buyback up to

700 million pounds ($970.4 million) worth of its shares. Here's

what you need to know:

PRETAX PROFIT: Barclays posted a pretax profit of GBP646 million

for the fourth quarter compared with GBP1.10 billion for the

year-earlier period. It was expected to post a pretax profit of

GBP285 million, taken from a compilation of forecasts provided by

Barclays.

TOTAL INCOME: The U.K. lender's total income for the fourth

quarter decreased to GBP4.94 billion from GBP5.30 billion for the

fourth quarter of 2019. It was anticipated to decline to GBP4.81

billion.

NET PROFIT: The bank reported net profit of GBP220 million

compared with GBP681 million for the same period a year earlier.

The bank was expected to post a swing to a loss of GBP17 million,

according to its compilation of forecasts.

WHAT WE WATCHED:

--DIVIDEND: The board has resumed dividends with a payout of 1.0

pence a share, to reflect the strength of the business. In total,

the bank said it is paying out 5 pence a share to investors, which

includes the planned share buyback, expected to start in the first

quarter of this year.

--COMMON EQUITY TIER 1 RATIO: The bank ended the period with a

common equity Tier 1 ratio--a key measure of balance-sheet

strength--of 15.1% compared with a forecast of 14.7% and 13.8% in

the year-earlier period. It attributed the better performance to

regulatory measures and the cancellation of its 2019 dividend, but

said this was partially offset by the 2020 dividend payment.

--CREDIT IMPAIRMENTS AND OTHER PROVISIONS: Credit impairment

charges stood at GBP492 million in the quarter compared with

expectations of GBP689 million, and GBP608 million in the third

quarter. For the year as a whole, the credit impairment charge rose

to GBP4.84 billion, from GBP1.91 billion, which the company blamed

on the deterioration in the economic outlook due to the coronavirus

pandemic. It said that the board expects the credit impairment for

2021 to be materially below 2020's figure.

Write to Sabela Ojea at sabela.ojea@wsj.com; @sabelaojeaguix

(END) Dow Jones Newswires

February 18, 2021 09:13 ET (14:13 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

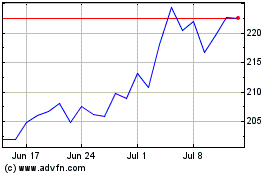

Barclays (LSE:BARC)

Historical Stock Chart

From Mar 2024 to Apr 2024

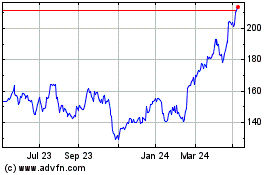

Barclays (LSE:BARC)

Historical Stock Chart

From Apr 2023 to Apr 2024