Barclays Trading Arm Provides Lifeline Through Pandemic -- 2nd Update

February 18 2021 - 6:17AM

Dow Jones News

By Simon Clark

LONDON -- Barclays PLC posted a profit in 2020 as buoyant

securities trading made up for a lackluster performance in the

U.K., where the bank expects pent-up savings to give the economy a

boost as the coronavirus pandemic wanes.

Net profit at the London-based bank fell 38% from a year earlier

to GBP1.53 billion, equivalent to $2.12 billion. Profit at

Barclays's corporate and investment bank rose 29% to GBP2.55

billion.

Barclays shares traded 2% lower on the results. The bank said it

intends to pay a dividend for 2020 and buy back up to GBP700

million of shares. The proposed dividend of one pence a share was

less than some investors were expecting.

The results support the strategy of Barclays Chief Executive Jes

Staley, who has fended off demands from activist investor Edward

Bramson to scale back the investment bank. Mr. Bramson's Sherborne

Investors says it owns 5.8% of Barclays. European lenders with

large securities-trading units, such as Deutsche Bank AG and BNP

Paribas SA, have fared better in the pandemic.

Barclays is the U.K.'s second-largest lender by assets after

HSBC Holdings PLC, operating a large domestic retail and commercial

bank as well as a trans-Atlantic investment bank that competes with

the likes of Goldman Sachs Group Inc. and Morgan Stanley.

The investment and consumer banks "act differently during an

economic cycle," Mr. Staley said on a media call Thursday. "That

enabled Barclays to be profitable every quarter during the

year."

Revenue from Barclays's markets unit, which trades fixed-income

securities, equities and derivatives, rose 45% to GBP7.61 billion.

Its cards-and-payments unit lost GBP388 million in 2020 on

impairments and lower economic activity. Barclays shares have risen

2% this year after dropping 18% in 2020.

British banks have been hit hard by the economic impact of

Covid-19. The U.K. recorded the largest economic contraction among

the world's advanced economies last year. Prospects are improving

with the rollout of a nationwide vaccination program but

uncertainty persists, in part because of added challenges because

of the country's exit from the European Union.

Consumers reduced credit-card debt and boosted savings because

of fear caused by the pandemic, Mr. Staley said.

"Deposits went through the roof," he said. "Once people start to

regain confidence they're going to spend it and that, I think, is

what we believe will happen and will generate quite a strong

economic recovery sometime in the second half of this year."

Nevertheless, the toll of the pandemic on borrowers led Barclays

to set aside GBP492 million in the last three months of the year to

cover bad loans, bringing the total for the year to GBP4.84

billion, more than double the amount for 2019.

Despite the drop in profit for the year, the bank paid 6% more

in bonuses in 2020 than the year earlier, a total of GBP1.58

billion. Mr. Staley said the bonuses were appropriate compensation

for the company's bankers and traders. "The profitability was led

by our wholesale business and we need to be responsive to that," he

said.

Banks across Wall Street are having to walk a fine line on

bonuses, weighing very strong performance during a year of

widespread economic turmoil.

As CEO of the U.K.'s biggest investment bank, Mr. Staley said he

wasn't concerned that Britain's departure from the EU would damage

London's finance industry. So far this year, Amsterdam has

overtaken London in terms of the average value of shares traded a

day.

"I wouldn't overreact to the stock trading coming out of

Amsterdam," Mr. Staley said. "The main pool of capital that is

managed out of London today is pretty much unchanged from where it

was six months ago or a year ago. I don't think you have an exodus

that should make people stand up and say 'Oh my God, does London

have a problem?'"

Mr. Staley is under scrutiny for his professional relationship

with a deceased former client from his time working at JPMorgan

Chase & Co., convicted sex offender Jeffrey Epstein. U.K.

financial regulators said last year that they were investigating

the relationship. Mr. Staley declined to comment on the

investigation Thursday. The U.K.'s Financial Conduct Authority

declined to comment.

In October, Mr. Staley, 64, said he intended to remain at

Barclays for "another couple of years."

Write to Simon Clark at simon.clark@wsj.com

(END) Dow Jones Newswires

February 18, 2021 06:02 ET (11:02 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

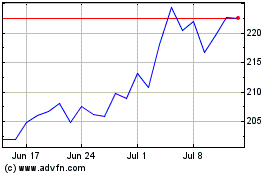

Barclays (LSE:BARC)

Historical Stock Chart

From Mar 2024 to Apr 2024

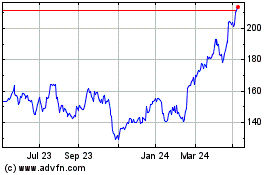

Barclays (LSE:BARC)

Historical Stock Chart

From Apr 2023 to Apr 2024