TIDMBARC

RNS Number : 2687M

Barclays PLC

07 May 2020

7 May 2020

Barclays PLC

AGM Statements

Chairman's 2020 AGM statement

Good morning, everybody.

This is my first annual general meeting of Barclays, and it's

clearly going to be quite a strange one. I was looking forward to

updating you in person on the progress that we've been making in

the delivery of our strategy, but instead we find ourselves

addressing you remotely, and I am sorry about that. I'm sure you

all appreciate, however, the importance of us prioritising

everybody's safety and complying with the law, so that we do our

bit to slow the spread of this dreadful virus.

We would've preferred, obviously, to be meeting in Glasgow where

we are developing a new strategic campus, but we are going to do

our best to ensure that shareholders' questions can be answered and

that your views are properly represented.

I'd like to start, if I may, by paying a tribute to all of my

colleagues in Barclays around the world who have been working so

hard to keep the bank running and providing vital support to

customers and clients. We have today 80% attendance at our call

centres in the UK. We have over 650 branches open for business

every day and critical staff working here, as I am at the moment,

in our office at Canary Wharf and in other buildings around the

country and the world.

Those colleagues and our tens of thousands of people working

from home know how important it is to continue to provide essential

financial services and support, and all of us are extremely

grateful for the dedication that they are showing.

Before I say something about our results for 2019, I would just

like to comment on two other aspects of the crisis, how resilient

the bank has been and how we are responding to the requirements of

customers and clients around the world.

As for resilience, we have been catapulted into the largest-ever

test of dynamic working, something none of us were fully prepared

for, and I'm very pleased to report that the experiment is working

well so far. People at this bank are doing amazing things out of

their living rooms, their kitchens, a reminder of how ingenious and

inventive we can be. And I hope that we will be able to look back

when this period has past and learn some lessons but also take

pride in the way in which the organisation and the infrastructure

of the bank has stood up.

Secondly, I'd like to just share with you that our main external

priority has, of course, been to help the countries where we

operate get through the pandemic and get on to the task of economic

recovery as quickly as possible. Here in the UK we are

participating in many government schemes designed to support

businesses and people impacted by the virus. In addition, we have

deployed formidable programmes of our own, including offering

repayment holidays, waiving banking fees and extending as much

credit as we can responsibly manage.

We are also directly helping those vulnerable communities most

impacted by the virus through Barclays donating an unprecedented

GBP100 million to charities working to support people through the

crisis. The creation of this Barclays Community Impact Fund is a

source of great pride for colleagues, pleased to see the bank

trying to play its part in alleviating the social effects of

COVID-19 as well as some of the economic effects. I know too from

feedback that we have had from shareholders that you also are very

supportive of this initiative.

Our 2019 results feel like a world away, but I would like to

comment on them nonetheless, as they were a clear indication that

our strategy is working and that the group has transformed itself

considerably over the last few years.

Underlying returns and cost efficiency have improved, and the

capital position is now secure. Group return on tangible equity was

9%, in line with the 2019 target. We have strengthened the control

environment and dealt with our major legacy conduct issues. At the

same time, we are ensuring the operational resilience of the

organisation, including our ability to deal with cyber threats,

which have unfortunately become part of everyday life.

As you are aware, on the advice of the PRA we did take the

difficult decision to cancel the full-year dividend that was due at

the beginning of April in respect of 2019, and we know that this

had an immediate and unwelcome impact on the shareholders, which of

course we deeply regret. But as we have said, the bank has a strong

capital base, could well have afforded the payment, but we felt

that it was prudent to take the step that we did as part of

ensuring that Barclays comes through the crisis strong and

resilient.

The board and management remain committed to returning capital

to shareholders over time, and I want to place on record that it

remains a priority as soon as it is reasonable to do so.

One more word on our financial performance. You would have seen

that we reported results for the first quarter of this year last

week with the Corporate and Investment Bank's performance improving

strongly. As the UK and US retail markets came under pressure, this

demonstrated very clearly to us again the benefit of our

diversified strategy. We are today a strong British universal bank,

and our distinctive model makes us the leading European player in

the US, which in today's world has real benefit.

We recognise that there is a lot more to do, and our target

remains to produce a group return on tangible equity consistently

above 10%. Of course, the global macroeconomic environment, fuelled

in large part by the challenges of COVID-19, make this target much

more difficult to achieve, but it remains our target and attainable

over time.

Let me just return, if I may, to where I started and add a few

more words about the relationship between the bank and society as a

whole.

Now, there's been a lot of talk over the past few years about

corporate purpose, and that's been true also internally at Barclays

where we have given an increasing amount of attention to our own

purpose and what it should mean in practice for how we operate and

the decisions we take, big and small.

We have done a lot of thinking recently about how we can make a

real and positive difference to society, and I think this has

informed the way in which the bank has responded to the current

crisis and to customers and clients. We may not get everything that

we do right, but our intention is to get everything that we do

right.

This in part builds on the extraordinary breadth and depth of

activity undertaken by colleagues to help communities in which we

live and work, and I think I have said before how impressed I have

been by the depth and feeling behind our citizenship

activities.

This also extends to our role in the preservation of our

external environment. Barclays can and should play a leading role

in tackling climate change. The size and scale of our business

means that we can really help accelerate the transition to a

low-carbon economy.

Resolution 29 before this meeting sets out a powerful ambition

for Barclays to be net-zero by 2050 and commits the group to a

strategy with targets for alignment of its entire financing

portfolio to the goals of the Paris agreement. I believe that this

represents a substantial and necessary step on the journey to

Barclays becoming one of the leading banks globally in addressing

climate change.

I'm extremely grateful to the shareholders and other

stakeholders who have engaged with us so patiently and thoughtfully

over recent months as we have developed this new strategy. Along

with the rest of the board, I strongly encourage you to vote in

favour of this resolution.

I would just like to conclude with a few words of thanks. Again,

to thank all of our staff at Barclays for their normal commitment

to the company but also the extraordinary commitment which they are

showing today. I would like to thank my boardroom colleagues for

welcoming me and for the work that we have done together. Finally,

I would like to thank Jes and the senior management team for the

leadership skills which they deploy on a daily basis today in even

more extraordinary circumstances than ever before.

All of these people are making a huge contribution to Barclays'

success and will continue to do so however challenging the times

ahead of us.

I say also to all of you, to our shareholders, thank you for

your patience with us, for the quality of dialogue that we have

had, and I wish you all well over the coming months.

Thank you very much for listening.

Chief Executive's 2020 AGM statement

Good morning everyone. First of all, let me say that I hope you

and your loved ones have been keeping safe and well in these very

challenging times. Second, let me apologise for the fact that, due

to the extraordinary circumstances we find ourselves in today, we

cannot meet in person this year at our annual general meeting. But,

as you know, and I'm sure you appreciate, it's important that we

all comply with the law, prioritise each other's safety and

wellbeing, and take the steps needed to slow the spread of the

Coronavirus.

Whilst the arrangements for today's meeting are consequently not

as optimal as we would wish, we nevertheless have worked hard to

ensure that your views will be appropriately represented and

recorded. That said, let me now offer you my CEO's report.

The last time we met, it was a long time ago in a very different

world. Obviously, an event like the Covid-19 pandemic changes

priorities and, inevitably, makes individuals and companies like

ours focus on what's really important right now.

For us, that means running the bank safely and profitably,

helping our customers and clients through the difficulties they

face, supporting the UK economy and the communities where we live

and work, and taking care of our colleagues around the world. We've

been able to do that because of the underlying strength of our

business and the resilience of our diversified model. And I've been

especially proud of the way my colleagues across Barclays have

risen to the challenges of this extraordinary time.

So I want to start today by taking a few minutes to set out how

we've been responding to the crisis. Our business touches half the

households in the UK. We know that some of our customers are facing

very real and very daunting financial challenges. And this is a

worrying time for the vast majority, regardless of their

circumstances. We've moved quickly to give them the reassurance and

support they need.

To give you just a couple of examples, so far Barclays has

granted repayment holidays on 100,000 mortgages and on over 69,000

loans. And we're providing an interest-free buffer on overdrafts

for 5.4 million customers. And, beyond that, we've reduced and

capped charges until at least July. We've waived late payment fees

and cash advance fees for eight million Barclaycard customers and

granted some 112,000 payment holidays.

655 of our branches remain open across the UK, providing vital

banking services, while our teams are fielding some 260,000 calls a

week. That's 44 per cent higher than the typical volume. And I'm

really pleased that we've been able to proactively identify NHS and

key workers among our customer base and move them to the front of

call queues as their time is especially precious at this

moment.

Getting businesses through this period intact is crucial to give

the best chance of a rapid and sustainable economic recovery. And

it's also in our shareholders' interests. The UK government has put

huge resources into supporting that ambition, and it's the central

topic of almost every conversation I have with ministers. It is an

unprecedented effort by them, and by the Bank of England. And we're

committed to playing our full part to help get that support to the

businesses that need it.

We have now approved 5,270 CBILS loans(1) , with a total value

of just over one billion pounds and we expect those numbers to

increase rapidly in the coming weeks. So, in addition to the CBILS

programme, on Monday, we launched the Bounce Back programme with

Her Majesty's Treasury. On the first day, for 20,000 small

businesses across the United Kingdom, we approved loans that

totalled GBP670 million. Behind those numbers are stories of

businesses and jobs surviving this crisis.

Take the Titanic Brewery, up in Staffordshire. It's a local

favourite, selling three million pints in a normal year through its

chain of pubs and beyond. We helped them secure a GBP1 million

CBILS loan and put in place a 12-month payment holiday on an

existing loan they had with us. That has allowed the business to

keep producing and selling beers online, protecting jobs and

allowing them to pay their furloughed workers full wages.

Or take the Queensbury Hotel and Olive Tree restaurant in Bath,

which I've been to. This is a family-run, four-star hotel that's

had to shut its doors due to the Coronavirus. But with our help

they were able to get a GBP450,000 CBILS loan quickly. That loan

means that they can cover running costs, their staff are able to be

furloughed rather than laid off, and they'll be able to retain

their hard-earned Michelin star, which would have been forfeited if

they had been in closure.

Make no mistake, interventions like these are making the

difference between survival and failure for businesses and we're

pleased to be playing our part in keeping them going. We've also

been absolutely central, because of our strong investment banking

capabilities, to helping larger businesses to access the Bank of

England and Treasury's CCFF programme. So far, we have arranged

GBP7.2 billion of commercial paper for UK corporates over the past

few weeks, representing 45 per cent of this total market.

In addition to our backing for those government schemes, we've

also been able to provide significant help on our own to our

business clients. For example, we've waived everyday banking fees

and overdraft interest or charges until June for 650,000 of our

small business customers. And we've put in place 12-month capital

repayment holidays for most SMEs with loans of over GBP25,000.

We're continuing to extend credit to companies and there is GBP50

billion of lending limits available to our UK clients.

But we're not stopping there, we also continue to evolve our

approach and offering to clients big and small, to help them

through the crisis. Because it is crucial that we preserve as many

businesses and jobs as we can to aid the recovery when it

ultimately comes. As you know, Barclays has deep roots in the

communities where we live and work, and I'm proud of everything our

colleagues do, year-round, to support their local areas, never more

so than now.

That includes going above and beyond for our customers, to help

them any way we can. Whether that's our colleague, Glynis Wilson,

who's in a contact centre in Sunderland. She was helping a customer

in dire straits to access charitable support. Then we made a

goodwill payment to see that this customer got through a very tight

spot. Or our colleague, Heena Mistry in Hyde, ringing vulnerable

customers to see how they're doing and then getting an ambulance

for an elderly man who was obviously having difficulty breathing.

Or our colleague, Caroline Pearson, in Harrow and Edgware branch,

helping an 80-year old customer keep a special promise to her

grandson by guiding her through buying on his birthday a pair of

trainers online. These are just three stories of hundreds up and

down the country where our people are working beyond their

professional obligations to support vulnerable customers.

We are carrying on delivering our core citizenship programmes,

such as Life Skills and Connect with Work, with a particular focus

now on helping mitigate the impacts of Covid-19. But we're trying

to do even more. For example, where we can, we're now offering

colleagues four weeks' paid leave to volunteer to support health or

social care work and helping those that are vulnerable.

And we've launched a 100 million Community Aid Package, made up

of GBP50 million in grants for charity partners in the UK and our

international markets, and GBP50 million to match colleague

donations. That equates to up to GBP150 million from Barclays and

our colleagues, deployed to help the communities and people

hardest-hit by the crisis from providing food to vulnerable

families to purchasing protective equipment for NHS staff.

We understand that our fortunes are intertwined with those of

the communities and economies we serve. And at time like these,

more than ever, our obligation is to support them. And we're going

to continue to do that and prioritise that effort through this

crisis.

Finally today I want to briefly set out some overall thoughts on

our performance, both in 2019 and in the first quarter, which we

reported on the 29(th) April. Barclays finished 2019 in a very good

position. The group return on tangible equity, our ROTE, was nine

per cent, meeting our target for the year and almost double what it

was a couple of years' ago.

We also met the cost guidance we had set out, coming in at the

lower end of the range, at GBP13.6 billion. Our liquidity ratio, at

160 per cent, was among the highest we've ever had. And the bank's

CET1 capital ratio, the key measure of our financial strength and

stability, stood at 13.8 per cent at year-end, the highest in our

company's history.

We were pleased with that performance in and of itself, but more

importantly, Barclays was in a really robust state going into what

has become an extraordinary period of social and economic stress.

The impact of Covid-19 came late in what was, until that point, a

pretty good quarter. That said, the performance of the business

since then, has demonstrated clearly the resilience of our

universal banking model - rooted in diversification by business

line and geography and currency.

As we've said in the past, there's a kind of cyclicality between

the consumer business and the wholesale business. So in this

economic crisis, while you would expect returns were down in

Barclays UK and in Consumer Cards and Payments, where their ROTE's

went single-digits or below, the Corporate and Investment Bank

performed strongly in the first quarter, producing a double-digit

return on tangible equity of 12.1 per cent.

And this was particularly done as we supported our clients

during a period of extreme volatility in our capital markets

business, which roughly doubled its revenue in the first quarter.

Sustained cost discipline and positive jaws in our CIB delivered a

group cost income ratio of 52 per cent. That's better than our

target of less than 60 per cent over time, and our lowest quarterly

group cost interim ratio since 2011.

Overall, the group return on tangible equity for the quarter was

5.1 per cent. Given the uncertainty around the developing economic

downturn and the low interest rate environment, 2020 is expected to

be challenging for our business. That said, we continue to believe

that a sustainable group ROTE above 10 per cent is the right target

for Barclays and is attainable over time.

Importantly, we've taken a 2.1 billion credit impairment charge

in the quarter, of which 1.4 billion is a result of applying a very

challenging forecast to our credit models. We think this is very

prudent. Even after this, Barclays generated GBP913 million of

profit before tax, three and a half pence of earnings per share,

and attributable profit of GBP605 million in the quarter.

Your group remains well capitalised, with a CET1 ratio of 13.1

per cent. And we will manage our capital position through this

crisis in a way which enables us to support customers and clients

whilst maintaining an appropriate headroom for regulatory

requirements. As you know, in response to a request by the

Prudential Regulation Authority, we cancelled the 2019 full-year

dividend payment.

The board will make a decision about future dividends and

capital returns policy at the end of 2020, when the full impact of

Covid-19 on our bank is clear. But let me say, for the avoidance of

doubt, there remains a management priority to generate and

distribute attractive returns for shareholders and we want to do so

again as soon as we can.

So to conclude, and in summary, my colleagues and I are today

primarily focused on what matters right now, which is supporting

our customers and clients, our communities, and the wider economy,

to navigate the pandemic. The strength of our business and the

resilience of our model means we can run this bank safely and

profitably and provide that support until this crisis passes.

And I believe that your bank will emerge on the other side in a

strong position to support the recovery and leave a reputation as

having stood with the citizens of Great Britain in this time of

crisis.

Thank you.

(1) As at Monday 4 May 2020

- ENDS -

For further information, please contact:

Investor Relations Media Relations

Chris Manners Tom Hoskin

+44 (0)20 7773 2136 +44 (0)20 7116 4755

About Barclays

Barclays is a British universal bank. We are diversified by

business, by different types of customer and client, and geography.

Our businesses include consumer banking and payments operations

around the world, as well as a top-tier, full service, global

corporate and investment bank, all of which are supported by our

service company which provides technology, operations and

functional services across the Group. For further information about

Barclays, please visit our website home.barclays

Forward-looking statements

This document contains certain forward-looking statements within

the meaning of Section 21E of the US Securities Exchange Act of

1934, as amended, and Section 27A of the US Securities Act of 1933,

as amended, with respect to the Group. Barclays cautions readers

that no forward-looking statement is a guarantee of future

performance and that actual results or other financial condition or

performance measures could differ materially from those contained

in the forward-looking statements. These forward-looking statements

can be identified by the fact that they do not relate only to

historical or current facts. Forward-looking statements sometimes

use words such as 'may', 'will', 'seek', 'continue', 'aim',

'anticipate', 'target', 'projected', 'expect', 'estimate',

'intend', 'plan', 'goal', 'believe', 'achieve' or other words of

similar meaning. Forward-looking statements can be made in writing

but also may be made verbally by members of the management of the

Group (including, without limitation, during management

presentations to financial analysts) in connection with this

document. Examples of forward-looking statements include, among

others, statements or guidance regarding or relating to the Group's

future financial position, income growth, assets, impairment

charges, provisions, business strategy, capital, leverage and other

regulatory ratios, payment of dividends (including dividend payout

ratios and expected payment strategies), projected levels of growth

in the banking and financial markets, projected costs or savings,

any commitments and targets, estimates of capital expenditures,

plans and objectives for future operations, projected employee

numbers, IFRS impacts and other statements that are not historical

fact. By their nature, forward-looking statements involve risk and

uncertainty because they relate to future events and circumstances.

The forward-looking statements speak only as at the date on which

they are made and such statements may be affected by changes in

legislation, the development of standards and interpretations under

IFRS, including evolving practices with regard to the

interpretation and application of accounting and regulatory

standards, the outcome of current and future legal proceedings and

regulatory investigations, future levels of conduct provisions, the

policies and actions of governmental and regulatory authorities,

geopolitical risks and the impact of competition. In addition,

factors including (but not limited to) the following may have an

effect: capital, leverage and other regulatory rules applicable to

past, current and future periods; UK, US, Eurozone and global

macroeconomic and business conditions; the effects of any

volatility in credit markets; market related risks such as changes

in interest rates and foreign exchange rates; effects of changes in

valuation of credit market exposures; changes in valuation of

issued securities; volatility in capital markets; changes in credit

ratings of any entity within the Group or any securities issued by

such entities; direct and indirect impacts of the coronavirus

(COVID-19) pandemic; instability as a result of the exit by the UK

from the European Union and the disruption that may subsequently

result in the UK and globally; and the success of future

acquisitions, disposals and other strategic transactions. A number

of these influences and factors are beyond the Group's control. As

a result, the Group's actual financial position, future results,

dividend payments, capital, leverage or other regulatory ratios or

other financial and non-financial metrics or performance measures

may differ materially from the statements or guidance set forth in

the Group's forward-looking statements. Additional risks and

factors which may impact the Group's future financial condition and

performance are identified in our filings with the SEC (including,

without limitation, our Annual Report on Form 20-F for the fiscal

year ended 31 December 2019 and our Q1 2020 Results Announcement

for the three months ended 31 March 2020 filed on Form 6-K), which

are available on the SEC's website at www.sec.gov .

Subject to our obligations under the applicable laws and

regulations of any relevant jurisdiction, (including, without

limitation, the UK and the US), in relation to disclosure and

ongoing information, we undertake no obligation to update publicly

or revise any forward-looking statements, whether as a result of

new information, future events or otherwise.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

AGMVDLBBBELEBBV

(END) Dow Jones Newswires

May 07, 2020 06:01 ET (10:01 GMT)

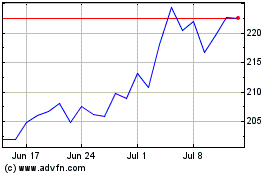

Barclays (LSE:BARC)

Historical Stock Chart

From Mar 2024 to Apr 2024

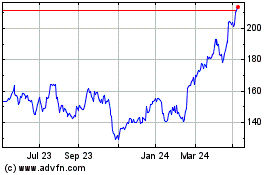

Barclays (LSE:BARC)

Historical Stock Chart

From Apr 2023 to Apr 2024