By Simon Clark

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (April 30, 2020).

LONDON -- Barclays PLC said the trading unit in its investment

bank generated record quarterly revenue, helping to stabilize the

U.K. lender as the coronavirus pandemic caused profit to fall and

provisions for bad loans to rise.

The strong trading performance buttresses Barclays Chief

Executive Jes Staley's universal banking strategy. He has been

under pressure from activist investor Edward Bramson, whose firm

Sherborne Investors has said it wants Barclays to shrink its

investment bank and become a more narrowly focused consumer

bank.

Mr. Staley said the results demonstrate the value of

diversification. "We want to make sure this bank is positioned to

allow for the recovery and to be a firewall as we face the economic

challenges brought on by the pandemic," he said.

Sherborne Investors didn't immediately respond to a request for

comment.

Shares in Barclays were trading about 7% higher by around noon

in London.

Revenue from the markets unit, which trades fixed-income

securities, equities and derivatives, soared 77% to GBP2.42 billion

($3 billion) in the first three months of the year compared with

the same period last year. Revenue at the U.K. unit that Sherborne

has called for the bank to focus on fell 4% to GBP1.7 billion in

the first quarter. Sherborne has said it holds the largest stake in

Barclays, with 5.8%.

Net profit at Barclays dropped 42% to GBP605 million as the

London-based bank set aside GBP2.1 billion in provisions for losses

from loans affected by the pandemic. Provisions for bad loans in

the first quarter of last year totaled GBP448 million.

"The charge was funded in part by a stellar performance in

markets," Jefferies analyst Joseph Dickerson wrote in a note to

investors, referring to the charge for bad-loan provisions.

Banks across the world are increasing provisions to account for

the impact of the virus on companies and the economy. The largest

U.S. banks have taken billions of dollars in new credit provisions.

HSBC Holdings PLC, Europe's biggest bank by assets, set aside $3

billion in the first quarter.

Standard Chartered PLC, a London-based bank that earns most of

its revenue in Asia and Africa, said Wednesday that it set aside

$965 million in the first quarter, more than 10 times as much as a

year earlier.

The virus is the latest challenge to banks in Europe, which have

been hobbled by low and negative interest rates that have made

lending particularly challenging.

Economic conditions are more difficult than the 2008 global

financial crisis "by some measure," Mr. Staley said. "Given the

uncertainty around the developing economic downturn and low

interest rate environment, 2020 is expected to be challenging."

To help customers, Barclays said it approved 238,000 mortgage

and loan payment holidays, and six million clients are paying no

personal overdraft or business banking charges. Those decisions

will affect earnings in the next quarter, Tushar Morzaria, the

bank's chief financial officer, told journalists.

"You'll see the full effect of that come through in the second

quarter, so there will be some sort of downward pressure,

particularly in our consumer businesses," Mr. Morzaria said.

By contrast, the prospects for the trading unit remain strong,

he said.

"Our trading revenues are running well ahead of where we were in

the second quarter of last year," Mr. Morzaria said.

Mr. Bramson's Sherborne has also strongly criticized Mr. Staley

for his professional relationship with the late financier and

convicted sex offender Jeffrey Epstein.

In March, Sherborne called on Barclays to withdraw its support

for its American CEO, who is up for re-election at the bank's

annual meeting. Sherborne said it would vote against him.

Then on April 16, Sherborne said that "with great reluctance" it

will now only withhold its vote on Mr. Staley's re-election because

of the challenges the bank faces due to the coronavirus

pandemic.

"We continue to believe that Mr. Staley has not demonstrated the

level of judgment befitting a director or senior executive of the

company," Sherborne said April 16.

The U.K.'s Financial Conduct Authority and Prudential Regulation

Authority are examining Mr. Staley's characterization to Barclays

of his relationship with Mr. Epstein and the bank's subsequent

description of the relationship to regulators, Barclays said in

February.

Mr. Staley said Wednesday that he didn't have an update on the

regulatory investigation. The investigation is ongoing, an FCA

spokesman said.

The Barclays chief said he is focused on steering Barclays

through the pandemic and making preparations to reopen the bank's

offices across the world. The return will be gradual and social

distancing between staff will remain a priority, he said.

The bank's headquarters are located in a skyscraper in London's

Canary Wharf financial district.

"How many people can work in this building if you limit the

number of people in the elevator to two at a time? It's that sort

of calculation which will determine how you roll this out," Mr.

Staley said. "I think the notion of putting 7,000 people in a

building may be a thing of the past."

Write to Simon Clark at simon.clark@wsj.com

(END) Dow Jones Newswires

April 30, 2020 02:47 ET (06:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

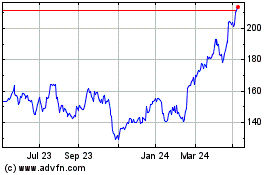

Barclays (LSE:BARC)

Historical Stock Chart

From Mar 2024 to Apr 2024

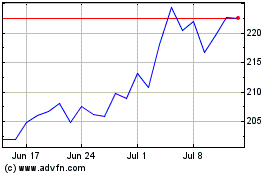

Barclays (LSE:BARC)

Historical Stock Chart

From Apr 2023 to Apr 2024