Barclays CEO Under Investigation Over Links to Jeffrey Epstein -- 2nd Update

February 13 2020 - 6:34AM

Dow Jones News

By Simon Clark

LONDON -- Barclays PLC said U.K. regulators are investigating

the relationship between Chief Executive Jes Staley and Jeffrey

Epstein, the disgraced financier who died in jail last year.

The U.K.'s Financial Conduct Authority is examining how Mr.

Staley characterized his relationship with Mr. Epstein to Barclays

and how the U.K. lender described it to the regulator, the bank

said Thursday.

The probe marks the latest brush with authorities for Mr.

Staley, an American. In 2018, he was hit with penalties equal to

about a quarter of his 2016 pay over his efforts to unmask a

whistleblower, which U.K. regulators called a "serious error of

judgment." U.S. authorities also fined him over the episode.

"Mr. Staley retains the full confidence of the board, and is

being unanimously recommended for re-election at the annual general

meeting," the London-based bank said.

Mr. Staley worked at JPMorgan Chase & Co. for more than 30

years before becoming Barclays's CEO in December 2015. He told

journalists Thursday that his contact with Mr. Epstein went back to

2000, when he led JPMorgan's private bank and the financier was a

client. He said his contact with Mr. Epstein began to "taper off"

after he left JPMorgan in 2013 and the last time he had contact

with him was in the "middle to fall" of 2015.

"I thought I knew him well and I didn't," Mr. Staley said. "For

sure, with hindsight, with what we all know now, I deeply regret

having had any relationship with Jeffrey Epstein."

Mr. Epstein was found dead in August last year at a New York

detention center, where he was awaiting trial on federal

sex-trafficking charges, in what the New York medical examiner

ruled as a suicide.

Barclays said Thursday that Mr. Epstein's death prompted renewed

interest in Mr. Staley's relationship with him, and that the CEO

gave an explanation to executives, including Chairman Nigel

Higgins. Mr. Staley confirmed to the board that he had no contact

with Mr. Epstein after taking up his role as Barclays's CEO, the

bank said.

The FCA tests executives to ascertain whether they are "fit and

proper" to lead. Considerations include honesty, openness with

self-disclosures, integrity and reputation, as well as competence

and financial soundness, according to the FCA's website.

The announcement of the investigation overshadowed Barclays's

annual results, which were also released Thursday.

The bank's net profit rose 54% to GBP2.46 billion ($3.19

billion) in 2019 from 2018 and revenue was flat at GBP19.72

billion, but Mr. Staley gave a cautious outlook for the year ahead.

Barclays said it hit its return-on-tangible-equity target of 9.0%

in 2019, excluding GBP1.58 billion of litigation and misconduct

costs, but improving on that will be difficult.

"We continue to believe that it is appropriate to target a

return greater than 10%, and we are managing our business to

achieve that," Mr. Staley said. "However, given the low interest

rate environment, it has become more challenging to achieve that

target in 2020."

Shares in Barclays dropped 2.4% in early trading Thursday, and

was among the weakest performers in the Stoxx Europe 600 Banks

index, which also fell.

Executives at banks across Europe have blamed ultralow interest

rates for making the business of lending more challenging. Activist

investor Sherborne Investors has been waging a campaign to have

Barclays scale back in investment banking. Mr. Staley has defended

Barclays's mix of businesses, saying it makes the bank resilient to

market conditions to have a large U.K. retail and business bank, a

New York- and London-based corporate and investment bank and a U.S.

credit-card business. Mr. Staley said Thursday that the model is

working.

Write to Simon Clark at simon.clark@wsj.com

(END) Dow Jones Newswires

February 13, 2020 06:19 ET (11:19 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

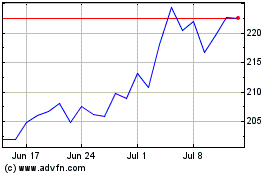

Barclays (LSE:BARC)

Historical Stock Chart

From Mar 2024 to Apr 2024

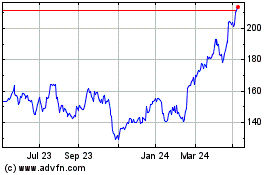

Barclays (LSE:BARC)

Historical Stock Chart

From Apr 2023 to Apr 2024