LONDON MARKETS: British Pound Falls As Attention Turns To EU And Possible Brexit Extension

October 24 2019 - 11:50AM

Dow Jones News

By Steve Goldstein, MarketWatch

The British pound weakened as markets awaited the European

Union's decision on whether to grant an extension to the U.K. to

leaving the bloc.

The pound fell to $1.2833 from $1.2914 as the Times reported the

EU will grant a second extension on Friday. The issue is the length

of the extension, with the newspaper saying French President

Emmanuel Macron only wants a two-week extension

(https://www.thetimes.co.uk/edition/news/boris-johnson-poised-for-election-call-as-eu-wrangles-over-brexit-extension-qvr2q5x9b),

and not until Jan. 31 as many had thought.

Meanwhile, U.K. Prime Minister Boris Johnson could make a third

attempt to trigger a general election.

The FTSE 100 meanwhile gained 0.91% to 7236.81, buoyed in

particular by stronger-than-forecast earnings

(http://www.marketwatch.com/articles/astrazeneca-climbs-as-new-cancer-drug-sales-soar-51571924545)from

AstraZeneca (AZN.LN) (AZN.LN) , which rose 5.7%.

Breadth was overwhelmingly positive on the London Stock

Exchange, with advancers outnumbering decliners 1507 to 870.

The Royal Bank of Scotland (RBS.LN) (RBS.LN) struggled, falling

3.1% as the bank reported a swing to a third-quarter loss due to a

provision to cover payment protection insurance costs

(http://www.marketwatch.com/story/royal-bank-of-scotland-swings-to-loss-after-higher-ppi-costs-2019-10-24).

(END) Dow Jones Newswires

October 24, 2019 11:35 ET (15:35 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

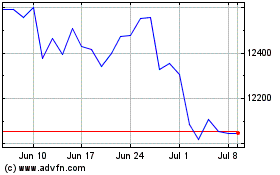

Astrazeneca (LSE:AZN)

Historical Stock Chart

From Mar 2024 to Apr 2024

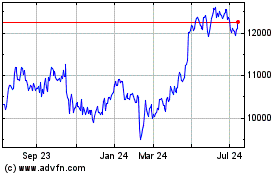

Astrazeneca (LSE:AZN)

Historical Stock Chart

From Apr 2023 to Apr 2024