AstraZeneca Upgrades Outlook Despite Slide in Profit

October 24 2019 - 2:57AM

Dow Jones News

By Carlo Martuscelli

AstraZeneca PLC (AZN.LN) said Thursday that third-quarter net

profit fell, while sales increased as it raised its guidance.

Profit in the period was $299 million, down from $431 million in

the prior year. Revenue climbed 16% to $6.13 billion. Core earnings

per share, a closely-watched company measure that strips out

exceptional items, rose 40% to 99 cents, edging ahead of the 97

cents expected by analysts.

The drug maker said that its reported net profit was hit by

increased legal provisions, while comparables were made more

difficult by a positive $436 million legal settlement the year

before.

Product sales in China, a market that has been a key focus for

Chief Executive Pascal Soriot, grew by 40% at constant exchange

rates.

Meanwhile, revenue from the pharmaceutical company's oncology

portfolio, which has been key to returning the business to sales

growth after years of declines, increased by 48% excluding currency

effects. The drug that generated the most revenue in the category

was Tagrisso, with total sales of $891 million in the quarter.

Astra upgraded its full-year outlook for the year. The company

said it now expects to product sales to grow by a low to mid-teens

percentage at constant exchange rates. Previously it guided for low

double-digit percentage growth.

Write to at carlo.martuscelli@dowjones.com; @carlomartu

(END) Dow Jones Newswires

October 24, 2019 02:42 ET (06:42 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

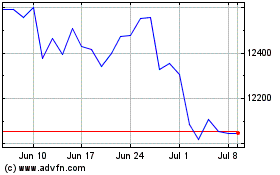

Astrazeneca (LSE:AZN)

Historical Stock Chart

From Mar 2024 to Apr 2024

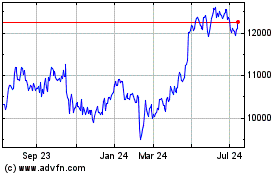

Astrazeneca (LSE:AZN)

Historical Stock Chart

From Apr 2023 to Apr 2024