Athelney Trust PLC Net Asset Value(s) (2391M)

January 04 2019 - 5:26AM

UK Regulatory

TIDMATY

RNS Number : 2391M

Athelney Trust PLC

04 January 2019

Athelney Trust PLC

Legal Entity Identifier:

213800ON67TJC7F4DL05

The unaudited net asset value of Athelney Trust was 226p at 31

December 2018.

Fund Manager's comment for December 2018

The Athelney Trust unaudited NAV continued to decline during

December, the seventh month in a row, to 226p, a decline of 5.24%

which compares with a 3.61% decline in the FTSE Index, a 7.66%

decline in the AIM All Share index and a 4.41% decline in the Small

Cap Index. Most other major stock markets around the world declined

during the month. The Dow Jones Index declined in US$ by 8.66% and

there was a 7.71% decline in the MSCI World Index during the

month.

As mentioned in last month commentary, the portfolio continues

to be affected by world politics and macro-economic events rather

than specific business-related factors. Interest rates have been

rising gradually in the US for the last three years with the Fed

Funds rate increasing from essentially zero three years ago to

almost 2.5% today. While it is not clear how the trade tensions

between China and the US will be resolved, it seems inevitable that

some concessions will be made but, of course, what happens in

Washington now that the Democrats control the House of

Representatives makes the eventual outcome totally unpredictable.

However, experience has shown that during these trying times one

should ensure that the companies in the portfolio are of high

quality. Our focus should be on the level of predictability of a

business's medium-term future economic performance because the more

predictable the future cash flows, the more confident we can be

that our forecast investment outcome will be achieved.

To this end we have commenced a program of selling our holdings

in companies where there has been a change to the industry

structure, the business model, the senior management team or the

product/service offering, the occurrence of which will result in

our view in a deterioration in future profitability and hence

dividends. Our positions in Bonmarche Holdings, Communisis,

Standard Life and UK Commercial Property were sold. We added to our

position in Belvoir Lettings.

Fact Sheet

An accompanying fact sheet which includes the information above

as well as wider details on the portfolio can be found on the

Fund's website www.athelneytrust.co.uk under "Portfolio

Details".

Background Information

Dr. Emmanuel (Manny) Pohl

Manny is Chairman and Chief Investment Officer of E C Pohl &

Co ("ECP"), an investment management company and has been a major

shareholder in Athelney trust for many years.

E C Pohl & co is licensed by the Australian Financial

services (licence no.421704).

www.ecpohl.com

www.ecpam.com

Manny Pohl and the ECP group has over AU$1000m under its

management including four listed investment companies, three listed

in Australia and one in the UK:

-- Flagship Investments (ASX code:FSI)

AUD50m https://flagshipinvestments.com.au

-- Barrack St Investments (ASX code: BST)

AUD23m www.barrackst.com

-- Global Masters Fund Limited (ASX code: GFL)

AUD26m www.globalmastersfund.com.au

-- Athelney Trust plc (LSE code: ATY)

GBP5m www.athelneytrust.co.uk

Athelney Trust plc Investment Objective

The investment objective of the Trust is to provide shareholders

with prospects of long-term capital growth with the risks inherent

in small cap investment minimised through a spread of holdings in

quality small cap companies that operate in various industries and

sectors. The Fund Manager also considers that it is important to

maintain a progressive dividend record.

Athelney Trust plc Investment Policy

The investment objective of the Trust is to provide shareholders

with prospects of long-term capital growth with the risks inherent

in small cap investment minimised through a spread of holdings in

quality small cap companies that operate in various industries and

sectors. The Fund Manager also considers that it is important to

maintain a progressive dividend record.

The assets of the Trust are allocated predominantly to companies

with either a full listing on the London Stock Exchange or a

trading facility on AIM or ISDX. The assets of the Trust have been

allocated in two main ways: first, to the shares of those companies

which have grown steadily over the years in terms of profits and

dividends but, despite this progress, the market rating is

favourable when compared to future earnings and dividends; second,

to those companies whose shares are standing at a favourable level

compared with the value of land, buildings or cash in the balance

sheet.

Athelney Trust was founded in 1994. In 1996 it was on of the ten

pioneer members of the Alternative Investment Market ("AIM"). In

2008 the shares became fully listed on the main market of the

London Stock Exchange. Athelney Trust has a successful progressive

dividend growth record and the dividend has grown every year since

2004. According to the Association of Investment Companies (AIC)

Athelney Trust is one of only "22 investment companies that have

increased their dividend every year between 10 and 20 years - the

next generation of dividend heroes" (as at 20/03/2018). See

link

www.theaic.co.uk/aic/news/press-releases/next-generation-of-dividend-heroes

Website

www.athelneytrust.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

NAVBGGDBLDGBGCS

(END) Dow Jones Newswires

January 04, 2019 05:26 ET (10:26 GMT)

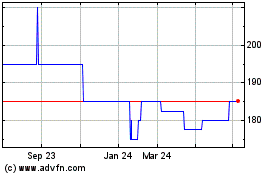

Athelney (LSE:ATY)

Historical Stock Chart

From Mar 2024 to Apr 2024

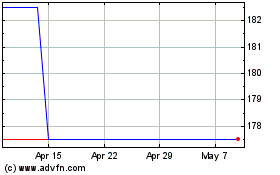

Athelney (LSE:ATY)

Historical Stock Chart

From Apr 2023 to Apr 2024