Antofagasta PLC TCFD PROGRESS REPORT (8954L)

September 15 2021 - 8:09AM

UK Regulatory

TIDMANTO

RNS Number : 8954L

Antofagasta PLC

15 September 2021

NEWS RELEASE, 15 SEPTEMBER 2021

TCFD PROGRESS REPORT

Antofagasta ("the "Company") today releases a progress report on

its implementation of the recommendations of the Task Force on

Climate-Related Financial Disclosures (TCFD). The report provides

an overview of the Company's TCFD-related work to date and its

climate resilience response. The Company plans to achieve full

disclosure against the TCFD recommendations during Q1 2022.

Ivan Arriagada, Antofagasta CEO commented: "We recognise that

climate change is one of the greatest challenges facing society and

our company today. A successful transition to a low-carbon economy

requires a significant input of copper as a vital ingredient of

renewable power generation and electrification of transportation so

it is our responsibility as one of the world's largest copper

producers to ensure we understand and reduce exposure to climate

risks.

"Our long-term vision is to minimise our emissions, enhance

water security and have resilient operations".

"We are strengthening our climate resilience, adapting to

today's climate change impacts, whilst also mitigating against

emerging climate risks and seizing opportunities to decarbonise our

business. The TCFD recommendations provide a welcome framework for

us to share with our stakeholders our journey to combat climate

change and manage its impacts."

TCFD Progress Report Highlights:

Governance

-- The Board of Directors has ultimate responsibility and oversight for climate-related issues

-- Climate-related responsibilities are assigned to specific

management-level positions and employees and managers are held

accountable through annual performance agreements.

Strategy

-- Two scenarios are being used to reflect two extremes of climate change:

o An 'aggressive mitigation' scenario under which significant

policy and regulatory action and rapid technological change imply

that the rise in temperature remains well below 2degC (based on the

Sustainable Development Scenario of the International Energy Agency

(IEA))

o A 'high-warming' scenario under which there is limited action

taken to address rising emissions and average temperatures rise by

around 4degC by 2100, generating significant disruption of climate

and weather systems (based on the IPCC's RCP8.5 scenario)

-- Transition and physical climate-related issues are being

assessed under both scenarios to determine the potential risks and

opportunities and associated business impacts

-- The potential financial impact of the most material

climate-related risks and opportunities is being quantified so as

to inform the Company's response, in terms of strengthening its

business resilience.

Risk management

-- Climate change risk is managed within Antofagasta's risk

management framework, which considers the costs and benefits

associated with climate change

-- Building a lasting framework that enables the business to

adapt to, capture and manage the potential risks related to the

impact of the transition to a low-carbon economy and the physical

impacts of climate change

-- The Company will be seeking to analyse the financial impact

of climate risks, to help further tailor its current risk

management processes to allow the effective management of the

intricacies of climate risks.

Metrics and targets

-- The Company has committed to becoming carbon neutral by 2050,

in line with Chile's national target.

-- Having achieved its first emissions reduction target two

years early, the Company has now committed to a further 30%

reduction (730,000 tCO2e) of Scope 1 and 2 emissions by 2025

-- By the end of 2022 the Mining division will be using 100% renewable electricity

-- The completion of a desalination plant at Los Pelambres in

2022 will further increase the Company's use of seawater

-- In 2021, the Company will complete the analysis to assess

emissions across its entire value chain (Scope 1, 2 and 3)

The TCFD Progress Update Report is available on the Company's

website here .

Investors - London Media - London

Andrew Lindsay alindsay@antofagasta.co.uk Carole Cable antofagasta@brunswickgroup.com

Telephone +44 20 7808 0988 Telephone +44 20 7404 5959

Rosario Orchard rorchard@antofagasta.co.uk

Telephone +44 20 7808 0988

Media - Santiago

Pablo Orozco porozco@aminerals.cl

Carolina Pica cpica@aminerals.cl

Telephone +56 2 2798 7000

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCLELFFFKLBBBX

(END) Dow Jones Newswires

September 15, 2021 08:09 ET (12:09 GMT)

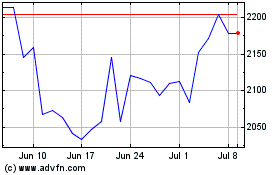

Antofagasta (LSE:ANTO)

Historical Stock Chart

From Mar 2024 to Apr 2024

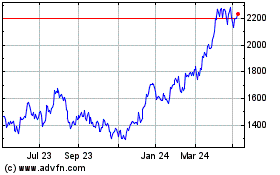

Antofagasta (LSE:ANTO)

Historical Stock Chart

From Apr 2023 to Apr 2024