TIDMANTO

RNS Number : 0814W

Antofagasta PLC

21 April 2021

NEWS RELEASE, 21 APRIL 2021

Q1 2021 PRODUCTION REPORT

PRODUCTION AND COSTS IN LINE WITH GUIDANCE

Antofagasta plc CEO, Iván Arriagada said: "Antofagasta's

production and cost performance in the first quarter was in line

with guidance with copper production at 183,000 tonnes and net cash

costs at $1.16/lb.

"Labour negotiations were successfully concluded at Los

Pelambres and no further negotiations are scheduled at our mining

operations until next year.

"In March, Chile entered a second wave of COVID-19 infections as

the number of cases in Chile accelerated, reaching record daily

cases since the outbreak of the pandemic. As a result, countrywide

lockdowns have been reinstated with the availability of critical

hospital infrastructure under significant pressure. In addition to

the health measures we introduced last year we have further reduced

our on-site workforce and these actions have allowed us to continue

to operate our mines and projects under these challenging

conditions. Additional testing has been introduced throughout the

Group while the full benefit of the country's successful

vaccination programme is expected to be realised later in the year.

We also remain committed to supporting our local communities and

suppliers, and contributing to the social and economic recovery of

Chile.

"The copper market continues to perform strongly, and we expect

this to continue as structural supply and demand dynamics support a

tight physical market. In the meantime, we maintain our focus on

cost control and disciplined capital allocation.

"Production, cost and capital expenditure guidance for the full

year is unchanged, assuming no additional nationwide restrictions

are imposed due the pandemic."

HIGHLIGHTS

PRODUCTION

-- Copper production in Q1 2021 was in line with guidance at

183,000 tonnes, 5.7% lower than in the same quarter in 2020 and

5.0% lower than in Q4 2020 mainly due to expected reduced grades at

Los Pelambres

-- Gold production was 59,100 ounces in Q1 2021, 9.2% lower than

in the same period in 2020 and 8.0% higher than in 4Q 2020, mainly

due to changes in grade at Centinela

-- Molybdenum production in the quarter was 3,000 tonnes, an

increase of 600 tonnes compared to the same period in 2020 due to

higher recoveries at Centinela, and 700 tonnes lower than in Q4

2020

CASH COSTS

-- Cash costs before by-product credits in Q1 2021 were

$1.68/lb, 17c/lb higher than the same period last year due to the

decrease in production, the stronger Chilean peso and the impact of

the payment of a one-off signing bonus following the completion of

labour negotiations at Los Pelambres

-- Net cash costs were $1.16/lb in Q1 2021, compared to $1.10/lb

in Q1 2020 and $1.14/lb in the previous quarter, reflecting the

increase in cash costs before by-product credits, partially offset

by the higher by-product credits

GUIDANCE 2021

-- Full year guidance assumes COVID-19 restrictions will remain

in place for all of 2021. However, because of the new wave of

COVID-19 cases and the nationwide lockdown imposed in late March,

major maintenance at Los Pelambres originally planned for Q2 and

which requires a large number of additional workers on-site is

under review so that some of the non-critical activities can be

rescheduled to later in 2021

-- With the drought in central Chile now in its 12(th) year, Los

Pelambres has implemented several operational changes during Q1

aimed at preserving water availability in anticipation of what

could be a delayed start to the winter rainfall. While rainfall in

2020 was slightly higher than 2019, which itself was one of the

worst years on record, the water balance in 2021 will reflect the

cumulative impact of another year of drought. Los Pelambres will

continue to regularly review projected water availability for the

year under different scenarios and a sustained focus on optimising

water usage will remain key, and in the second half 2022 we will

complete the desalination plant

-- In Q1, the growth projects at Los Pelambres, Centinela and

Zaldívar progressed according to their revised plans with the

COVID-19 health protocols fully integrated into their execution

plans. Given the more extensive lockdown imposed since late March a

further reduction in the number of on-site workers at Los Pelambres

has been implemented in April and, at this stage, this is not

expected to have an impact on the projects' schedules or costs

-- Despite the above, and the stronger than expected Chilean

peso, full year guidance is unchanged at 730-760,000 tonnes of

copper at a net cash cost of $1.25/lb and capital expenditure of

$1.6 billion

-- Production in the second half of the year is expected to be

slightly stronger than in the first half

-- Earlier this month Los Pelambres submitted the EIA for the

expansion of the desalination plant to 800 l/s, and for various

sustaining capital expenditure projects, including the replacement

of the concentrate pipeline and other infrastructure

GROUP PRODUCTION AND CASH COSTS Year to Date Q1 Q4

---------------------- ------ ------

2021 2020 % 2021 2020 %

------------------------------ ------ ------ ------ ------ ------ ------ -------

Copper production kt 183.0 194.0 (5.7) 183.0 192.6 (5.0)

Copper sales kt 182.8 195.3 (6.4) 182.8 202.2 (9.6)

Gold production koz 59.1 65.1 (9.2) 59.1 54.7 8.0

Molybdenum production kt 3.0 2.4 25.0 3.0 3.7 (18.9)

------------------------------ ------ ------ ------ ------ ------ ------ -------

Cash costs before by-product

credits (1) $/lb 1.68 1.51 11.3 1.68 1.63 3.1

Net cash costs (1) $/lb 1.16 1.10 5.5 1.16 1.14 1.8

------------------------------ ------ ------ ------ ------ ------ ------ -------

(1) Cash cost is a non-GAAP measure used by the mining industry

to express the cost of production in US dollars per pound of copper

produced.

Investors - London Media - London

Andrew Lindsay alindsay@antofagasta.co.uk Carole Cable antofagasta@brunswickgroup.com

Telephone +44 20 7808 0988 Telephone

+44 20 7404 5959

Rosario Orchard rorchard@antofagasta.co.uk

Telephone +44 20 7808 0988

Media - Santiago

Pablo Orozco porozco@aminerals.cl

Carolina Pica cpica@aminerals.cl

Telephone +56 2 2798 7000

Register on our website to receive our email alerts

https://www.antofagasta.co.uk/investors/news/email-alerts/

MINING OPERATIONS

Los Pelambres

Los Pelambres produced 84,900 tonnes of copper in Q1 2021, 9.0%

lower than in the same quarter last year and 6.2% lower than the

previous quarter, mainly driven by lower grades.

Molybdenum production in Q1 2021 increased to 2,600 tonnes from

2,400 in Q1 2020, due to higher molybdenum grades.

Gold production for the quarter was 14,300 ounces, 3.4% lower

than the same period last year.

Cash costs before by-product credits at $1.46/lb in Q1 2021 were

18.7% higher than in the same quarter in 2020 due to the decrease

in production, the stronger Chilean peso, and the payment of a

one-off signing bonus following the successful completion of labour

negotiations which increased costs by approximately 2c/lb for the

full year. Compared to the previous quarter, costs increased by

7.4%, again on the decrease in production and the impact of a

one-off signing bonus.

Net cash costs in Q1 2021 increased by 2c/lb compared to Q1 2020

to $0.84/lb reflecting higher cash costs before by-product credits

partially offset by by-product credits increasing from 41c/lb to

62c/lb on higher molybdenum production and higher realised prices.

Compared to the previous quarter net cash costs increased by

5.0%.

The Los Pelambres Expansion project was 47.9% complete

(engineering, procurement and construction) as at the end of the

quarter.

LOS PELAMBRES Year to Date Q1 Q4

----------------------- ------ ------

2021 2020 % 2021 2020 %

------------------------------ ------ ------ ------ ------- ------ ------ -------

Daily ore throughput kt 164.5 163.9 0.4 164.5 167.8 (2.0)

Copper grade % 0.67 0.72 (6.9) 0.67 0.67 0.0

Copper recovery % 89.1 90.0 (1.0) 89.1 90.3 (1.3)

Copper production kt 84.9 93.3 (9.0) 84.9 90.5 (6.2)

Copper sales kt 80.7 98.2 (17.8) 80.7 97.1 (16.9)

------------------------------ ------ ------ ------ ------- ------ ------ -------

Molybdenum grade % 0.021 0.017 23.5 0.021 0.023 (8.7)

Molybdenum recovery % 85.3 84.4 1.1 85.3 85.1 0.2

Molybdenum production kt 2.6 2.4 8.3 2.6 3.0 (13.3)

Molybdenum sales kt 2.6 2.1 23.8 2.6 3.3 (21.2)

Gold grade g/t 0.048 0.045 7.2 0.048 0.049 (1.1)

Gold recovery % 68.1 75.7 (10.0) 68.1 74.5 (8.6)

Gold production koz 14.3 14.8 (3.4) 14.3 16.6 (13.9)

Gold sales koz 12.9 13.3 (3.0) 12.9 16.7 (22.8)

------------------------------ ------ ------ ------ ------- ------ ------ -------

Cash costs before by-product

credits (1) $/lb 1.46 1.23 18.7 1.46 1.36 7.4

Net cash costs (1) $/lb 0.84 0.82 2.4 0.84 0.80 5.0

------------------------------ ------ ------ ------ ------- ------ ------ -------

(1) Includes tolling charges of $0.14/lb in Q1 2021, $0.15/lb in

Q4 2020, and $0.20/lb Q1 2020

Centinela

Total copper production in Q1 2021 at Centinela was 66,800

tonnes, 0.5% higher than in the same quarter in 2020. Compared to

the previous quarter, copper production decreased by 4.6% on lower

throughput at both Centinela Concentrates and Centinela

Cathodes.

Copper in concentrates production was 45,300 tonnes in Q1 2021,

3.9% higher than in Q1 2020 as the concentrate plant operated at

above design capacity for the second consecutive quarter, which was

partially offset by lower grades and recoveries. Compared to the

previous quarter, copper in concentrate decreased by 2.8% on

slightly lower throughput.

Production of copper in cathodes fell 6.1% compared to Q1 2020.

This was primarily due to expected lower grades and recoveries,

despite higher throughput.

Gold production was 44,900 ounces in Q1 2021, 10.7% lower than

in the same period last year due to lower gold grades and

recoveries, partially offset by higher throughput, and 18.2% higher

than in Q4 2020 as grades and recoveries increased.

Cash costs before by-product credits in Q1 2021 were $1.78/lb,

the same as in Q1 2020. Compared to the previous quarter costs

decreased by 1.1% primarily on the impact of a one-off signing

bonus in Q4 2020 partially offset by lower production.

Net cash costs in Q1 2021 were $1.12/lb, some 5c/lb lower than

in the same quarter last year due to by-product credits increasing

from 61c/lb to 66c/lb on higher molybdenum production and realised

prices. Compared to the previous quarter net cash costs decreased

by 5.1%, or 6c/lb reflecting the lower cash costs before by-product

credits and higher by-product credits.

CENTINELA Year to Date Q1 Q4

----------------------- ------ ------

2021 2020 % 2021 2020 %

------------------------------ ------ ------ ------ ------- ------ ------ -------

CONCENTRATES

Daily ore throughput kt 106.4 91.1 16.8 106.4 108.0 (1.5)

Copper grade % 0.60 0.64 (6.3) 0.60 0.59 1.7

Copper recovery % 84.2 89.3 (5.7) 84.2 82.9 1.6

Copper production kt 45.3 43.6 3.9 45.3 46.6 (2.8)

Copper sales kt 45.1 43.0 4.9 45.1 45.1 0.0

------------------------------ ------ ------ ------ ------- ------ ------ -------

Molybdenum grade % 0.010 0.007 42.9 0.010 0.015 (33.3)

Molybdenum recovery % 39.5 11.1 255.9 39.5 44.6 (11.4)

Molybdenum production kt 0.4 0.1 300.0 0.4 0.7 (42.9)

Molybdenum sales kt 0.4 0.1 300.0 0.4 0.9 (55.6)

Gold grade g/t 0.22 0.27 (18.5) 0.22 0.18 22.2

Gold recovery % 71.9 75.7 (5.0) 71.9 68.9 4.4

Gold production koz 44.9 50.3 (10.7) 44.9 38.0 18.2

Gold sales koz 42.6 50.4 (15.5) 42.6 34.9 22.1

------ ------ ------- ------ ------ -------

Daily ore throughput kt 56.9 53.6 6.2 56.9 58.0 (1.9)

Copper grade % 0.59 0.64 (7.8) 0.59 0.64 (7.8)

Copper recovery % 66.4 69.7 (4.7) 66.4 65.1 2.0

Copper production - heap

leach kt 20.4 21.5 (5.1) 20.4 22.3 (8.5)

Copper production - total

(1) kt 21.5 22.9 (6.1) 21.5 23.4 (8.1)

Copper sales kt 21.8 22.2 (1.8) 21.8 26.1 (16.5)

------------------------------ ------ ------ ------ ------- ------ ------ -------

Total copper production kt 66.8 66.5 0.5 66.8 70.0 (4.6)

Cash costs before by-product

credits (2) $/lb 1.78 1.78 0.0 1.78 1.80 (1.1)

Net cash costs (2) $/lb 1.12 1.17 (4.3) 1.12 1.18 (5.1)

------------------------------ ------ ------ ------ ------- ------ ------ -------

(1) Includes production from ROM material

(2) Includes tolling charges of $0.19/lb in Q1 2021, $0.14/lb in

Q4 2020, and $0.13/lb Q1 2020

Antucoya

Antucoya produced 20,200 tonnes of copper in Q1 2021, equal to

the same quarter last year as a 9.7% increase in throughput was

offset by lower grades and consequentially lower recoveries.

Production decreased by 6.5% compared to Q4 2020 on lower grades

and recoveries.

During the quarter, the cash costs were $1.96/lb, a 4.8%

increase compared to the previous quarter. This was mainly due to

lower grades.

ANTUCOYA Year to Date Q1 Q4

--------------------- ----- -----

2021 2020 % 2021 2020 %

---------------------- ------ ----- ----- ------- ----- ----- -------

Daily ore throughput Kt 80.6 73.5 9.7 80.6 79.5 1.4

Copper grade % 0.35 0.41 (14.6) 0.35 0.39 (10.3)

Copper recovery % 69.1 75.9 (9.0) 69.1 75.3 (8.2)

Copper production Kt 20.2 20.2 0.0 20.2 21.6 (6.5)

Copper sales Kt 22.9 18.3 25.1 22.9 22.8 0.4

---------------------- ------ ----- ----- ------- ----- ----- -------

Cash costs $/lb 1.96 1.78 10.1 1.96 1.87 4.8

---------------------- ------ ----- ----- ------- ----- ----- -------

Zaldívar

Copper production at Zaldívar was 11,100 tonnes in Q1 2021, a

20.7% decrease compared with the same period last year on lower

grades and recoveries. Production increased by 4.7% compared to Q4

2020 as throughput returned to levels achieved earlier in 2020.

Cash costs at $2.30/lb in Q1 2021 rose by 2.2% compared to the

previous quarter primarily due to lower grades. Compared to Q1 2020

costs increased by 64c/lb on lower grades and lower recoveries.

ZALDÍVAR Year to Date Q1 Q4

--------------------- ----- -----

2021 2020 % 2021 2020 %

--------------------------- ------ ----- ----- ------- ----- ----- -------

Daily ore throughput kt 42.2 42.2 0.0 42.2 34.8 21.3

Copper grade % 0.88 0.99 (11.1) 0.88 0.99 (11.1)

Copper recovery (1) % 48.8 61.3 (20.4) 48.8 50.1 (2.6)

Copper production - heap

leach (2) kt 9.0 11.0 (18.2) 9.0 8.0 12.5

Copper production - total

(2,3) kt 11.1 14.0 (20.7) 11.1 10.6 4.7

Copper sales (2) kt 12.4 13.5 (8.1) 12.4 11.1 11.7

Cash costs $/lb 2.30 1.66 38.6 2.30 2.25 2.2

----- ----- ----- -----

(1) Restated from average over full leach cycle to 12-month

rolling recoveries

(2) Group's 50% share

(3) Includes production from secondary leaching

Transport Division

Total transport volumes in Q1 2021 were 1.5 million tonnes, 6.2%

lower than in the same quarter last year and 7.2% lower than in Q4

2020 mainly due to the impact of sea swells affecting port access

and customers' lower copper production and sulphuric acid

consumption.

TRANSPORT Year to Date Q1 Q4

----------------------- ------ ------

2021 2020 % 2021 2020 %

--------------------------- ---- ------ ------ ------- ------ ------ -------

Rail kt 1,216 1,221 (0.4) 1,216 1,255 (3.1)

Road kt 309 405 (23.7) 309 390 (20.7)

Total tonnage transported kt 1,526 1,626 (6.2) 1,526 1,645 (7.2)

------ ------ ------ ------

Commodity prices and exchange rates

Year to Date Q1 Q4

----------------------- ------ ------

2021 2020 % 2021 2020 %

------ ------ ------- ------ ------

Copper

Market price $/lb 3.85 2.56 50.4 3.85 3.25 18.5

Realised price $/lb 4.26 2.02 110.9 4.26 3.67 16.1

---------------- ------ ------ ------ ------- ------ ------ -------

Gold

Market price $/oz 1,800 1,584 13.6 1,800 1,875 (4.0)

Realised price $/oz 1,708 1,605 6.4 1,708 1,901 (10.2)

---------------- ------ ------ ------ ------- ------ ------ -------

Molybdenum

Market price $/lb 11.3 9.7 16.5 11.3 9.0 25.6

Realised price $/lb 13.3 9.8 35.7 13.3 9.8 35.7

---------------- ------ ------ ------ ------- ------ ------ -------

Exchange rates

per

Chilean peso $ 724 804 (10.0) 724 762 (5.0)

---------------- ------ ------ ------ ------- ------ ------ -------

Spot commodity prices for copper, gold and molybdenum as at 31

March 2021 were $4.01/lb, $1,688/oz and $11.1/lb respectively,

compared with $3.51/lb, $1,891/oz and $10.0/lb as at 31 December

2020 and $2.18/lb, $1,607/oz and $8.4/lb as at 31 March 2020.

The provisional pricing adjustments for copper, gold and

molybdenum for the quarter were positive $169.0 million, negative

$7.1 million and positive $12.8 million respectively.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DRLURSVRAOUSUAR

(END) Dow Jones Newswires

April 21, 2021 02:00 ET (06:00 GMT)

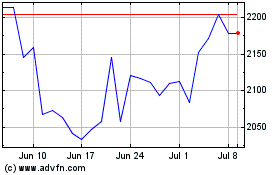

Antofagasta (LSE:ANTO)

Historical Stock Chart

From Mar 2024 to Apr 2024

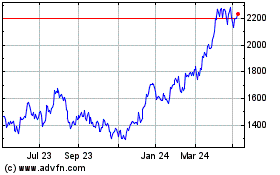

Antofagasta (LSE:ANTO)

Historical Stock Chart

From Apr 2023 to Apr 2024