TIDMANTO

RNS Number : 7213U

Antofagasta PLC

07 April 2021

NEWS RELEASE, 7 APRIL 2021

PUBLICATION OF 2020 ANNUAL REPORT AND 2021 NOTICE OF ANNUAL

GENERAL MEETING AND CLASS MEETINGS

Antofagasta plc (the "Company") has today posted its 2020 Annual

Report and Financial Statements and notice of the Annual General

Meeting and class meetings of the Company (the "2021 Notice of AGM

and Class Meetings") to shareholders.

The 2020 Annual Report and Financial Statements, which were

approved by the Board of Directors on 15 March 2021, constitute the

Company's statutory accounts for the purposes of section 434 of the

Companies Act 2006 and the Annual Financial Report for the purposes

of DTR 4.1.

The Annual General Meeting will be held at the Company's offices

at Cleveland House, 33 King Street, London SW1Y 6RJ on 12 May 2021

from 2 p.m. Separate meetings of the ordinary shareholders and

preference shareholders (the "Class Meetings") will follow directly

after the Annual General Meeting.

Due to the ongoing COVID-19 pandemic, the Board anticipate that

the meetings will go ahead as planned but that shareholders will

not be able to attend in person. A separate RNS announcement,

including details for remote engagement, will be published today in

relation to these arrangements.

In compliance with LR 9.6.1, the Company has submitted to the

Financial Conduct Authority each of the following documents:

-- 2020 Annual Report and Financial Statements

-- 2021 Notice of AGM and Class Meetings

-- Letter to Shareholders regarding Arrangements for the Annual

General Meeting and Class Meetings, which is supplementary to, and

must be read in conjunction with, the 2021 Notice of AGM and Class

Meetings.

-- Form of Proxy for Ordinary Shareholders for Annual General Meeting

-- Form of Proxy for Preference Shareholders for Annual General Meeting

-- Form of Proxy for Ordinary Shareholders for Class Meeting

-- Form of Proxy for Preference Shareholders for Class Meeting

-- Letter to Shareholders regarding Electronic Communications

These documents will shortly be available for inspection via the

National Storage Mechanism,

(https://data.fca.org.uk/#/nsm/nationalstoragemechanism).

In compliance with DTR 6.3.5, the following information is

extracted from the 2020 Annual Report and Financial Statements and

should be read in conjunction with the Company's Preliminary

Results Announcement issued on 16 March 2021. Together, these

constitute the material required by DTR 6.3.5 to be communicated to

the media in full unedited text through a Regulatory Information

Service. This material is not a substitute for reading the full

2020 Annual Report and Financial Statements and page numbers and

cross-references in the extracted information below refer to page

numbers and cross-references in the 2020 Annual Report and

Financial Statements. The full 2020 Annual Report and Financial

Statements and materials relating to the Annual General Meeting and

the Class Meetings are available on the Company's website at

(www.antofagasta.co.uk).

The information contained in this announcement and in the

Preliminary Results Announcement does not constitute the Group's

statutory accounts as defined in section 434 of the Companies Act

2006, but is derived from those accounts. The statutory accounts

for the year ended 31 December 2020 have been approved by the Board

and will be delivered to the Registrar of Companies following the

Company's Annual General Meeting. The auditors have reported on

those accounts and their report was unqualified, with no matters by

way of emphasis, and did not contain statements under section

498(2) of the Companies Act 2006 (regarding adequacy of accounting

records and returns) or under section 498(3) (regarding provision

of necessary information and explanations).

Statement of Directors' Responsibilities

The following information is extracted from page 155 of the 2020

Annual Report and Financial Statements.

"The directors consider that the annual report and accounts,

taken as a whole, is fair, balanced and understandable and provides

the information necessary for shareholders to assess the group's

and parent company's position and performance, business model and

strategy.

Each of the directors, whose names and functions are listed in

the Corporate Governance Report, confirm that, to the best of their

knowledge:

-- the group financial statements, which have been prepared in

accordance with international accounting standards in conformity

with the requirements of the Companies Act 2006 and international

financial reporting standards adopted pursuant to Regulation (EC)

No 1606/2002 as it applies in the European Union, give a true and

fair view of the assets, liabilities, financial position and profit

of the group;

-- the parent company financial statements, which have been

prepared in accordance with United Kingdom Accounting Standards,

comprising FRS 101, give a true and fair view of the assets,

liabilities, financial position and profit of the parent company;

and

-- the Strategic Report includes a fair review of the

development and performance of the business and the position of the

group and parent company, together with a description of the

principal risks and uncertainties that it faces.

By order of the Board

Jean-Paul Luksic, Chairman

Ollie Oliveira, Senior Independent Director "

Principal Risks and Uncertainties

The following description of Principal Risks and Uncertainties

is extracted from pages 25 to 30 of the 2020 Annual Report and

Financial Statements.

"1. Talent management

Managing talent and maintaining a high-quality labour force in a

changing technological and cultural environment is a key priority

for us. Any failures in this respect could have a negative impact

on the performance of the existing operations and prospects for

future growth.

Preventive and mitigation measures

We develop the talents of our employees through training and

career development, invest in initiatives to widen the talent pool

and are committed to our diversity and inclusion policy. Through

these actions we aim to increase employee retention, as well as the

number of women, people with disabilities and employees with

international experience in the workplace.

Our Employee Performance Management System is designed to

attract and retain key employees by creating suitable reward and

remuneration structures and providing personal development

opportunities. We have a talent management system to identify and

develop internal candidates for key management positions, as well

as identifying suitable external candidates when appropriate.

Highlights

During 2020 our Group leadership framework was released, the

diversity and inclusion strategy was strongly promoted and a new

remote working standard was launched.

2. Labour relations

Our highly skilled workforce and experienced management team are

critical to maintaining our current operations, implementing

development projects and achieving long-term growth without major

disruption.

Preventive and mitigation measures

We maintain good relations with our employees and unions, which

are founded on trust, regular dialogue and good working conditions.

We are committed to safety, non-discrimination, diversity and

inclusion, and compliance with Chile's strict labour

regulations.

There are long-term labour agreements in place with all the

unions at our operations, helping to ensure labour stability.

We seek to identify and address labour issues that may arise

throughout the period covered by the labour agreements (usually

three years) and to anticipate any potential issues in good time.

Contractors are an important part of our workforce and under

Chilean law are subject to the same duties and responsibilities as

our own employees. We treat contractors as strategic associates and

build long-term, mutually beneficial relationships with them.

We maintain constructive relationships with our employees and

their unions through regular communication and consultation. Union

representatives are regularly involved in discussions about the

future of the workforce.

Highlights

Ten labour negotiations took place in 2020. In all cases, the

Company and labour representatives successfully reached

agreement.

3. Safety and health

Safety and health incidents could result in harm to our

employees, contractors and local communities. Ensuring their safety

and wellbeing is our ethical obligation and first priority and is

one of our core values. A poor safety record or serious accidents

could have a long-term impact on morale and on Antofagasta's

reputation and production.

Preventive and mitigation measures

We seek to continuously improve our safety and health risk

management procedures, with particular focus on the early

identification of risks and the prevention of fatalities.

The Corporate Safety and Health Department provides a common

strategy for our operations and co-ordinates all safety and health

matters. We have a Significant Incident Report system, which is an

important part of the overall approach to safety.

Our goals of zero serious accidents and fatalities and the

minimising of the number of accidents require all contractors to

comply with our Occupational Safety and Health Plan. This plan is

monitored through monthly audits and is supported by regular

training and awareness campaigns for employees, contractors,

employees' families and local communities, particularly with regard

to road safety. We require all staff in defined safety-critical

roles to satisfy at least the minimum qualifications, to have the

necessary experience for their role and to complete any required

training prior to commencing their work activities.

Critical controls and verification tools are regularly

strengthened through the verification programme and regular audits

of critical controls for potentially high-risk activities.

We continuously seek to incorporate technology and innovation to

reduce workers' exposure to safety and health risks.

Highlights

In 2020 there were no fatal accidents. The COVID-19 outbreak

threatened the health of all employees and contractors, and local

communities. We focused on implementing controls to prevent and

mitigate the impact of infection, prioritising the health of our

employees and contractors while minimising the impact on

operational continuity.

4. Environmental management

An operating incident that damages the environment could affect

both our relationship with local stakeholders and our reputation,

reducing the social value we generate.

We operate in challenging environments, including the largely

agricultural Choapa Valley and the Atacama Desert, where water

scarcity is a key issue.

Preventive and mitigation measures

We have a comprehensive approach to incident prevention.

Relevant risks are assessed, monitored and controlled in order to

achieve our goal of zero incidents with significant environmental

impact. We work to raise awareness among employees and contractors,

providing training to promote operating excellence. The potential

environmental impact of a project is a key consideration when

assessing its viability, and we encourage the integration of

innovative technology in the project design to mitigate such

impacts.

We prioritise the efficient use of natural renewable resources

by using sea water, favouring the use of renewable power sources,

achieving higher rates of reuse and recovery of water through

thickened tailings technology and reducing greenhouse gas

emissions.

We recognise that environmental sustainability is key to our

ability to generate social value and perform regular risk

assessments in order to identify potential impacts and develop

preventive and mitigating strategies.

Each site maintains updated environmental emergency preparedness

and detailed closure plans with appropriate financial provisions to

ensure physical and chemical stability once operations have

ceased.

Highlights

We had no significant environmental incidents during 2020.

We monitored and reinforced our critical controls in line with

our low appetite for environmental risk.

5. Climate change

The effects of climate change have had an increasing impact on

our operations. The drought in the central area of Chile is

affecting water availability, while higher than expected rainfall

in the northern part of the country is impacting the infrastructure

in the region and the increasing severity of sea swells are leading

to delays in the delivery of key supply materials.

We are committed to contributing to the reduction of the global

problem of growing greenhouse gas emissions and water scarcity by

reducing our own emissions. We can do this by increasing the amount

of power and water we obtain from renewable and sustainable

sources.

Preventive and mitigation measures

We recognise that climate change is a threat to human life and

the planet as we know it today.

We measure and report our greenhouse gas emissions and have

committed to reduction targets based on realistic plans.

As regards water scarcity, we are reducing our dependence on

continental water through improved water use efficiency and the

increased use of sea water as a total proportion of our water

consumption. On completion of each phase of the Los Pelambres

desalination plant construction, the proportion of continental

water used will decrease and significantly lower the potential

impact of water scarcity on the Group.

We seek constantly to identify risks associated with climate

change and to implement actions to mitigate and adapt to their

potential impact. For each risk evaluated as "High" or "Extreme" we

define specific action plans and strategies.

As part of our regular communication with local stakeholders we

discuss the material risks and our controls, action plans and

related strategies.

Highlights

In 2020, a Climate Change Strategy was approved by the Board. It

has five pillars: the development of climate change resilience, the

management of GHG emissions, supply security and efficient use of

strategic resources, the management of environmental and

biodiversity, and the integration of stakeholders. While being

committed to reducing GHG emissions we also support local

communities in preparing for the effects of increasing

emissions.

6. Community relations

Failure to identify and manage local concerns and expectations

could negatively impact the Company. Relations with local

communities and stakeholders affect our reputation and our ability

to generate social value and grow.

Preventive and mitigation measures

We have a dedicated team that establishes and maintains

relations with local communities. These relationships are based on

trust and mutual benefit throughout the mining lifecycle, from

exploration to final remediation on closure. We seek to identify

early any potentially negative operating impacts and minimise these

through responsible behaviour. This means acting transparently and

ethically, prioritising the safety and health of our employees and

contractors, avoiding environmental incidents, promoting dialogue,

complying with our commitments to stakeholders and establishing

mechanisms to prevent or address a crisis. These steps are

undertaken in the early stages of each project and continue

throughout the life of each operation.

We contribute to the development of communities in the areas in

which we operate, starting with an assessment of the existing

situation and their specific needs, while looking to develop

long-term, sustainable relations and evaluating the impact of our

contributions. We are also focused on developing the potential of

members of local communities through education, training and

employment.

We work to communicate clearly and transparently with local

communities, in line with our Community Relations Plan. This

includes a grievance management process, local perception surveys,

and local media and community engagement.

Highlights

During the COVID-19 pandemic the Company has worked with the

local and regional government to support local communities,

including establishing a community support fund providing financial

support and PPE and testing equipment.

7. Political, legal and regulatory

Political instability may affect our operations, projects and

exploration activities in the countries in which we operate. Issues

regarding the granting of permits, or amendments to permits already

granted, and changes to the legal environment or regulations, could

also adversely affect our operations and development projects.

Preventive and mitigation measures

Political, legal and regulatory developments affecting our

operations and projects are constantly monitored. We comply fully

with the existing laws, regulations, licences, permits and rights

in each of the countries in which we operate.

We assess political risk as part of our evaluation of potential

projects, including the nature of any foreign investment

agreements.

We monitor proposed changes in government policies and

regulations, particularly in Chile, and belong to several

associations that engage with governments on these matters. This

helps to improve our internal processes and means we are prepared

to meet any new regulatory requirements.

As we have no operations in or material exposure to the UK,

Brexit is not expected to have any appreciable impact on the

Company.

Highlights

Monitoring of possible regulatory changes due to planned

constitutional reform in Chile. We will evaluate the impact of

these changes on our activities and will seek to mitigate any

negative impacts.

8. Corruption

Our operations or projects around the world could be affected by

risks related to corruption or bribery, including operating

disruptions or delays resulting from a refusal to make

"facilitation payments". Such risks depend on the economic or

political stability of the country in which we are operating.

Preventive and mitigation measures

We have a zero-tolerance regime for any activity that would

result in contravening anti-bribery and corruption legislation. A

robust governance regime, including an Ethics Committee, open

channels of communication, training and multiple layers of

controls, are maintained at all our operations, projects and

exploration activities, and in our third-party relationships.

Our Compliance Model seeks to prevent any activity which may

involve us directly or indirectly in any irregular situation, to

detect any potential risk in good time and to act accordingly.

There are control procedures in place that help to prevent

corruption, covering such issues as conflicts of interest,

suitability of suppliers, the receiving and giving of gifts and

hospitality, and facilitation payments.

All our employees receive training on our Compliance Model,

which is subject to external certification.

Highlights

During 2020 new offences were included in the Chilean

anti-bribery and employment protection laws relating to health

measures during emergencies. Accordingly, our crime prevention

model was updated, and related risks re-evaluated. The main risk

identified is a severe transgression of the law, which has been

evaluated as being very unlikely, yet with potentially severe

consequences.

9. Operations

Our operations are subject to a number of circumstances not

wholly within our control. These include damage to or breakdown of

equipment or infrastructure, unexpected geological variations or

technical issues, any of which could adversely affect production

and/or costs.

Preventive and mitigation measures

Key risks relating to each operation are identified as part of

the regular risk review process undertaken by the individual

operations. This process also identifies appropriate mitigation

measures for such risks. Monthly reports to the Board provide

variance analysis of operating and financial performance, allowing

potential issues to be identified in good time and any necessary

monitoring or control activities to be implemented to prevent

unplanned downtime.

Our focus is on maximising the availability of equipment and

infrastructure and ensuring the effective use of our assets, in

line with their nameplate design and technical limits. We keep the

variation of processes within defined tolerance limits.

We have Business Continuity Plans and Disaster Recovery Plans

for all key processes within our operations to mitigate the

consequences of a crisis or natural disaster. We also have property

damage and business interruption insurance to provide protection

from some, although not all, of the costs that may arise from such

events.

Highlights

In 2020 all operational risks were continually and consistently

monitored at all our operations. Common operating models,

preventive maintenance and cost control supported our strong

operating performance during the year, despite the health

restrictions imposed by the government.

10. Tailings storage

Ensuring the stability of our tailings storage facilities (TSFs)

during their entire lifecycle is central to our operations. A

failure or collapse of any of our TSFs could result in fatalities,

damage to the environment, regulatory violations, reputational

damage and the disruption of the quality of life of neighbouring

communities as well as at our operations.

Preventive and mitigation measures

We manage our TSFs in a manner that allows the effectiveness of

their design, operation and closure to be monitored at the highest

level of the Company.

Catastrophic failures of TSFs are unacceptable and their

potential for failure is evaluated and addressed throughout the

life of each facility. Our TSFs are constantly monitored and all

relevant information is provided to the authorities, regulating

bodies and the communities that could be affected.

We manage our TSFs using data, modelling, and construction and

operating methods validated by highly qualified independent

international experts, whose recommendations we implement in order

to strengthen the control environment. Risk management includes

timely risk identification, and control definition and

verification. Controls are based on the consequences of the

potential failure of the tailings facilities.

Highlights

The Global Industry Standard on Tailings Management was adopted

in 2020. In accordance with this new standard, we began to

implement a more detailed risk identification and assessment

methodology focused on failure modes, in order to avoid

catastrophic failures.

11. Strategic resources

Disruption or restrictions to the supply of any of our key

strategic inputs, such as electricity, water, fuel, sulphuric acid

or mining equipment, could negatively impact production.

In the longer term, restrictions to the availability of key

strategic resources such as water and electricity could also affect

our growth opportunities.

Preventive and mitigation measures

In order to maintain our security of supply, contingency plans

are in place to address any short-term disruptions to strategic

resources. We negotiate early with suppliers of key inputs to

ensure continuity. Certain key supplies are purchased from several

sources to mitigate potential disruption arising from exposure to a

single supplier.

To achieve cost competitiveness, we endeavour to buy the highest

possible proportion of our key inputs, such as fuel and tyres, on

as variable a price basis as possible and to link costs to

underlying commodity indices where this option exists.

We are committed to incorporating sustainable technological and

innovative solutions, such as using sea water and renewable power

when economically viable, to mitigate exposure to potentially

scarce resources.

We maintain a rigorous, risk-based supplier management framework

to ensure that we engage solely with reputable product and service

providers and keep in place necessary controls to ensure the

traceability of all supplies (including avoiding any conduct

related to modern slavery).

Highlights

During the health emergency the supply of critical inputs has

been maintained through constant monitoring and the application of

contingency plans.

12. Cyber security

Breaches in, or failures of, our information security management

could adversely impact our business activities. Malicious

interventions (hacking) of our information or operations' networks

could affect our reputation and/or operational continuity.

Preventive and mitigation measures

Our information security management model is designed with

defensive structural controls to prevent cyber risks and mitigate

their effects. It employs a set of rules and procedures, including

a Disaster Recovery Plan, to restore critical IT functions in the

event of an attack.

Our systems are regularly audited to identify any potential

weaknesses or threats to the operations, and specific systems are

in place to protect our assets and data.

Highlights

In 2020 preventive controls and constant communication with

users were reinforced to prevent cyber attacks.

13. Liquidity

Restrictions in financing sources for future growth could

prevent us from taking advantage of growth or other opportunities

available in the market.

Preventive and mitigation measures

Security, liquidity and return represent the order of priorities

for our investment strategy. We maintain a strong and flexible

balance sheet, consistently returning capital to shareholders while

leaving sufficient funds to progress our short-, medium- and

long-term growth plans and maintain the financial flexibility to

take advantage of opportunities as they may arise.

We have a risk-averse investment strategy, managing our

liquidity by maintaining adequate cash reserves and financing

facilities through the periodic review of forecast and actual cash

flows. We choose to hold surplus cash in demand or term deposits or

highly liquid investments.

Highlights

During 2020 the Company launched its inaugural corporate bond,

raising $500 million.

14. Commodity prices and exchange rates

Our results are heavily dependent on commodity prices -

principally copper and, to a lesser extent, gold and molybdenum.

The prices of these commodities are strongly influenced by a

variety of external factors, including world economic growth,

inventory balances, industry demand and supply, possible

substitution, etc.

Our sales are mainly denominated in US dollars, although some of

our operating costs are in Chilean pesos. As a result, the

strengthening of the Chilean peso may negatively affect our

financial results.

Preventive and mitigation measures

We consider exposure to commodity price fluctuations to be an

integral part of our business and our usual policy is to sell our

products at prevailing market prices. We monitor the commodity

markets closely to determine the effect of price fluctuations on

earnings, capital expenditure and cash flows. Very occasionally,

when we feel it is appropriate, we use derivative instruments to

manage our exposure to commodity price fluctuations.

We run our business plans through various commodity price

scenarios and develop contingency plans as required.

As copper exports account for some 50% of Chile's exports, there

is a correlation between the copper price and the US dollar/Chilean

peso exchange rate. This natural hedge partly mitigates our foreign

exchange exposure. However, we monitor the foreign exchange markets

and the macroeconomic variables that affect them and occasionally

we implement a focused currency-hedging programme to reduce

short-term exposure to fluctuations in the US dollar against the

Chilean peso.

Highlights

Some limited copper hedge positions were put in place when

prices fell and the Chilean peso weakened significantly following

the outbreak of COVID-19. However, both had strengthened materially

by the end of the year.

15. Growth of mineral resource base and opportunities

We need to identify new mineral resources to ensure continued

future growth, and we do this through exploration and

acquisition.

We may fail to identify attractive acquisition opportunities or

select inappropriate targets. The long-term commodity price

forecast, and other assumptions used when assessing potential

projects and other investment opportunities, have a significant

influence on the forecast return of investments. If incorrectly

estimated, these could result in poor decision-making.

As regards exploration, there is a risk that we may not identify

sufficient viable mineral resources.

Preventive and mitigation measures

Our exploration and investment strategy prioritises exploration

and investment in the Americas. We focus on growth opportunities in

stable and secure countries in order to reduce our risk

exposure.

We conduct rigorous assessment processes to evaluate and

determine the risks associated with all potential business

acquisitions and strategic exploration alliances, including

conducting stress-test scenarios for sensitivity analysis. Each

assessment includes a country risk analysis (including corruption)

and analysis of our ability to operate in a new jurisdiction.

At the very least, all joint ventures must operate in line with,

or to the equivalent level of, our policies and technical

standards.

Our Business Development Committee reviews potential growth

opportunities and transactions, approving or recommending them

within authority levels set by the Board.

Highlights

During 2020 we reduced the volume of activity during the

COVID-19 pandemic, giving priority to compliance with protocols to

ensure the health of workers.

Our exploration activities continued to be focused mostly on the

Americas and our risk exposure level remained at the same level as

in 2019.

16. Project execution

Failure to effectively manage our development projects could

result in delays to the start of production and cost overruns.

Preventive and mitigation measures

We have a project management system to ensure that best

practices are applied at each phase of a project's development. The

project management system provides a common language and standards

to support the decision-making process by balancing risk with the

benefit of growth. In addition, all geometallurgical models are

reviewed by independent experts.

During the project development lifecycle, quality checks for

each of the standards applied are carried out by a panel of experts

from within the Company. This panel reviews each completed

feasibility study to assess the technical and commercial viability

of the project. It also assesses how the project can be developed

safely and considers any relevant risks or opportunities that could

potentially impact the schedule, cost or future performance of the

project.

Detailed progress reports on ongoing projects are regularly

reviewed and include assessments of progress against key project

milestones and performance against budget.

Project robustness is stress-tested against a range of copper

price scenarios. Joint project/operation teams are established

early in the development project in order to ensure the smooth

transition of the project into operating mode once construction is

completed.

Highlights

The Los Pelambres Expansion project was largely suspended for

some five months following the outbreak of COVID-19. The project

risks are being proactively managed and frequently evaluated by the

project team according to a specific project risk management

procedure.

17. Innovation and digitisation

Our ability to deliver on our strategy and performance targets

may be undermined by missed opportunities or delays in adopting new

technologies or innovations.

Preventive and mitigation measures

We seek value-capturing innovations that realise cost savings

and/or improve the efficiency, reliability and safety of our

processes while supporting our corporate strategic pillars. We

evaluate the potential of all ideas using our stage-gate approval

process and Innovation Board.

We maintain partnerships with academic institutions and

companies specialising in technology and engineering - including

peers where there is no competitive barrier to doing so - in order

to maximise the potential for improvements in our processes and

systems. A dedicated team monitors, identifies and analyses

external innovation trends with potential application to our

business, including in non-operational areas such as product sales

and purchasing. The team also maintains and manages a portfolio of

ongoing innovation projects.

We have a recognition and incentives programme to encourage all

staff to suggest innovations to our day-to-day operating systems.

We also dedicate resources to evaluating and implementing

innovations which have the potential to positively impact our

business and growth options.

Highlights

In 2020 we launched three automation projects: a remote

operations centre in the city of Antofagasta, autonomous drilling

at Los Pelambres and the use of autonomous trucks in a new pit at

Centinela.

18. External risks

We must develop the ability to manage external threats that are

complex to predict and can significantly impact the Group's

strategic objectives and its operational continuity.

Preventive and mitigation measures

We promote the flexibility of our business and our labour force.

We have defined a new structure for working both from home and at

the workplace and have implemented many other measures as part of a

project on new ways of working.

We incorporate lessons learned into our business, maintaining

good practice and including potential improvements learnt from

responses and actions taken during periods of crisis.

We annually challenge the risk strategies associated with each

key risk category, including the diversification of suppliers,

routes, levels of autonomy, etc.

We recognise the volatility of the markets and proactively seek

new business models and work to expand our client base.

We regularly review our Business Continuity Plan.

We conduct scenario analysis to challenge the principles on

which we base our financial planning, identifying potential risks

and cost/benefits of feasible action plans.

Highlights

This new key risk category was included in our risk analysis for

the first time in 2020. The risks in this category cut across the

other key risk categories and high-impact risks were identified,

particularly COVID-19. Control actions were implemented to

guarantee the safety and health of our employees and provide

support to local communities in order to maintain their wellbeing

and the operations' continuity."

Related party transactions

The following description of related party transactions is

extracted from Note 34 on page 210 of the 2020 Annual Report and

Financial Statements. A condensed version of this note was

published in the Preliminary Results Announcement as Note 26.

"Transactions between the Company and its subsidiaries, which

are related parties, have been eliminated on consolidation and are

not disclosed in this note. Transactions between the Group and its

associates and joint ventures are disclosed below.

The transactions which Group companies entered into with related

parties who are not members of the Group are set out below. There

are no guarantees given or received and no provisions for doubtful

debts related to the amount of outstanding balances.

A) Quiñenco SA

Quiñenco SA ("Quiñenco") is a Chilean financial and industrial

conglomerate, the shares of which are traded on the Santiago Stock

Exchange, and in which members of the Luksic family are interested.

Two Directors of the Company, Jean-Paul Luksic and Andrónico

Luksic, are also directors of Quiñenco.

The following transactions took place between the Group and the

Quiñenco group of companies, all of which were on normal commercial

terms at market rates:

-- the Group made purchases of fuel from ENEX SA, a subsidiary

of Quiñenco, of $212.6 million (2019 - $159.3 million). The balance

due to ENEX SA at the end of the year was nil (2019 - nil);

-- the Group earned interest income of $1.7 million (2019 - $4.0

million) during the year on deposits with Banco de Chile SA, a

subsidiary of Quiñenco. Deposit balances at the end of the year

were $nil (2019 - $67.9 million);

-- the Group earned interest income of $0.3 million (2019 - $0.2

million) during the year on investments with BanChile

Administradora General de Fondos SA, a subsidiary of Quiñenco.

Investment balances at the end of the year were nil (2019 - $6.0

million).

-- the Group purchased shipping services from Hapag Lloyd, an

associate of Quiñenco, of $7.0 million (2019 - $1.0 million). The

balance due to Hapag Lloyd at the end of the year was nil (2019 -

nil).

B) Compañía de Inversiones Adriático SA

In 2020, the Group leased office space on normal commercial

terms from Compañía de Inversiones Adriático SA, a company in which

members of the Luksic family are interested, at a cost of $0.7

million (2019 -$0.6 million).

C) Antomin 2 Limited and Antomin Investors Limited

The Group holds a 51% interest in Antomin 2 Limited ("Antomin

2") and Antomin Investors Limited ("Antomin Investors"), which own

a number of copper exploration properties. The Group originally

acquired its 51% interest in these properties for a nominal

consideration from Mineralinvest Establishment, which continues to

hold the remaining 49% of Antomin 2 and Antomin Investors.

Mineralinvest is owned by the E. Abaroa Foundation, in which

members of the Luksic family are interested. During the year ended

31 December 2020 the Group incurred $0.1 million (year ended 31

December 2019 - $0.1 million) of exploration expense at these

properties.

D) Tethyan Copper Company Limited

As explained in Note 18 the Group has a 50% interest in Tethyan

Copper Company Limited ("Tethyan"), which is a joint venture with

Barrick Gold Corporation over Tethyan's mineral interests in

Pakistan. During 2020 the Group contributed $7.2 million (2019 -

$1.8 million) to Tethyan.

E) Compañia Minera Zaldívar SpA

The Group has a 50% interest in Zaldívar (see Note 18), which is

a joint venture with Barrick Gold Corporation. Antofagasta is the

operator of Zaldívar. The balance due from Zaldívar to Group

companies at the end of the year was $0.5million (2019 - $6.0

million). During 2020 the Group has received dividends of $65.0

million from Minera Zaldívar (2019 - 50.0 million).

F) Inversiones Hornitos SA

As explained in Note 18, the Group has a 40% interest in

Inversiones Hornitos SA, which is accounted for as an associate.

The Group paid $128.2 million (year ended 31 December 2019 - $187.7

million) to Inversiones Hornitos in relation to the energy supply

contract at Centinela. During 2020 the Group has not received

dividends from Inversiones Hornitos SA (2019 - $8.0 million).

G) Directors and other key management personnel

Information relating to Directors' remuneration and interests is

given in the Remuneration Report on page 139. Information relating

to the remuneration of key management personnel including the

Directors is given in Note 9."

Investors - London Media - London

Andrew Lindsay alindsay@antofagasta.co.uk Carole Cable antofagasta@brunswickgroup.com

Telephone +44 20 7808 0988 Telephone +44 20 7404 5959

Rosario Orchard rorchard@antofagasta.co.uk

Telephone +44 20 7808 0988

Media - Santiago

Pablo Orozco porozco@aminerals.cl

Carolina Pica cpica@aminerals.cl

Telephone +56 2 2798 7000

Cautionary statement about forward - looking statements

This announcement contains certain forward-looking statements.

All statements other than historical facts are forward-looking

statements. Examples of forward-looking statements include those

regarding the Group's strategy, plans, objectives or future

operating or financial performance; reserve and resource estimates;

commodity demand and trends in commodity prices; growth

opportunities; and any assumptions underlying or relating to any of

the foregoing. Words such as "intend", "aim", "project",

"anticipate", "estimate", "plan", "believe", "expect", "may",

"should", "will", "continue" and similar expressions identify

forward-looking statements.

Forward-looking statements involve known and unknown risks,

uncertainties, assumptions and other factors that are beyond the

Group's control. Given these risks, uncertainties and assumptions,

actual results could differ materially from any future results

expressed or implied by these forward-looking statements, which

apply only as at the date of this report. Important factors that

could cause actual results to differ from those in the

forward-looking statements include: global economic conditions;

demand, supply and prices for copper and other long-term commodity

price assumptions (as they materially affect the timing and

feasibility of future projects and developments); trends in the

copper mining industry and conditions of the international copper

markets; the effect of currency exchange rates on commodity prices

and operating costs; the availability and costs associated with

mining inputs and labour; operating or technical difficulties in

connection with mining or development activities; employee

relations; litigation; and actions and activities of governmental

authorities, including changes in laws, regulations or taxation.

Except as required by applicable law, rule or regulation, the Group

does not undertake any obligation to publicly update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise.

Past performance cannot be relied on as a guide to future

performance.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NOAUBASRARUSRAR

(END) Dow Jones Newswires

April 07, 2021 10:46 ET (14:46 GMT)

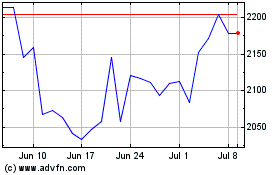

Antofagasta (LSE:ANTO)

Historical Stock Chart

From Mar 2024 to Apr 2024

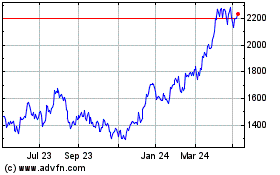

Antofagasta (LSE:ANTO)

Historical Stock Chart

From Apr 2023 to Apr 2024