TIDMANP

11 September 2019

Anpario plc("Anpario" or the "Group")

Interim Results

Anpario plc (AIM:ANP), the international producer and

distributor of natural animal feed additives for animal health,

nutrition and biosecurity is pleased to announce its interim

results for the six months to 30 June 2019.

Financial highlights

-- Sales of GBP14.3m (2018: GBP14.8m)

-- 2% increase in gross profit to GBP7.1m (2018: GBP7.0m)

-- 1% advance in profit before tax to GBP2.3m (2018: GBP2.2m)

-- 3% uplift in diluted earnings per share to 8.88p (2018: 8.66p)

-- 14% increase in interim dividend to 2.5p (2018: 2.2p) per share

-- Cash balances of GBP13.7m at 30 June 2019 (Dec 2018: GBP12.9m)

Operational highlights

-- Strong sales recovery in Latin America and the Middle East

-- GBP1m investment in automated bottling plant completed

-- Launch of Anpario Direct online channel to smaller farm customers

Peter Lawrence, Chairman, commented:

"The board is encouraged by the continued recovery in a number

of our markets which struggled during 2018. Latin America and the

Middle East delivered strong performances and the United States

continued its double-digit sales growth. As expected, China and

certain territories in South East Asia experienced weak trading,

where the impact of African Swine Fever put farmers under

significant strain. As our improved profitability demonstrates, the

geographic and species diversity of the Group is a major strength

when facing such external challenges and we have been able to

mitigate some of the impact by focusing on higher value-added

products and developing more direct routes to market, which have

helped to improve gross margins.

Expanding profitable sales and distribution channels around the

world remains our priority. Our strong balance sheet and cash

generation capability provide Anpario with a firm platform from

which to invest in new products and to develop the exciting Anpario

Direct opportunity. Our business development initiatives, backed by

the quality and ability of our employees worldwide, give me

confidence that we are in line for our full year management

expectations."

Chairman's statement

Group sales in the six months to 30 June 2019 were broadly the

same as in the equivalent period last year, after allowing for the

termination of our non-core business in the Philippines in early

2018. The impact of African Swine Fever in China and the

surrounding region and the US - China trade dispute created tougher

trading conditions than experienced during this period last year

and which affected our business in Asia. However, this was

significantly offset by the very strong recovery in our Latin

American and Middle East markets and continued progress in the US.

These positive trends highlight the benefit of our geographic

diversity and the underlying strength of the business.

Profit before tax rose 1% to GBP2.3m (2018: GBP2.2m). Basic

earnings were unchanged at 9.16 pence per share while diluted

earnings increased 3% to 8.88 pence per share (2018: 8.66 pence).

The Board is recommending an interim dividend of 2.5 pence per

share (2018: 2.2 pence) an increase of 14%. This dividend, payable

on 29 November to shareholders on the register at close of business

on 15 November, continues to reflect the Board's confidence in the

future of Anpario and its ability to generate cash.

Enquiries:

Anpario plcRichard Edwards, Chief Executive Officer +44 (0)7776

417129Karen Prior, Group Finance Director +44 (0)1909 537380

Peel Hunt LLP +44 (0)20 7418 8900Adrian Trimmings, George

Sellar

Operations

Latin America has delivered a very strong performance with sales

growth of 29% compared with the same period last year. The upturn

has been driven by a number of business development initiatives,

particularly in Brazil, which are now beginning to produce results.

Our Brazilian egg laying customers, using Orego-Stim®, have

experienced improved production with additional eggs per laying hen

and better egg size distribution. These benefits contribute to a

significant return on investment for our customers and we expect

further progress in the coming months. Mexico and Argentina also

recovered well after a poor 2018, with sales growth in the period

of 41% and 91% respectively. There has been renewed focus on our

aquaculture efforts in the region, where we recently registered a

number of products.

The USA achieved 14% sales growth compared with the same period

last year with Orego-Stim® contributing significantly to the

performance. Our mycotoxin binder growth was somewhat subdued due

to a weaker dairy sector but the recruitment of sales personnel in

California earlier this year is starting to deliver new business

and we are in discussions with a number of customers about our

Optomega dairy fertility product. Building on our success in Brazil

with Orego-Stim®, we have recently added to our US sales team by

expanding our poultry expertise, which is targeting the layer

industry. Results have also been replicated in a significant trial

programme commenced earlier in the year with North Carolina State

University, which is one of the world's leading institutions in

rearing and egg laying research. We continue to develop the poultry

broiler sector by supporting integrators with their antibiotic free

programmes.

In the UKand Europe sales declined 8%. This was largely due to

the closure of a customer, who we supplied with lower margin

vitamin and mineral premix formulations. Excluding this customer,

sales were flat with a small increase in gross profit compared to

the previous year. In general, the UK market was stable following a

stronger previous year where higher feed volumes and rising milk

prices benefited our toxin binder range. The UK sales team is

focused on driving smaller farm customers to use the Anpario Direct

online platform where they can experience transparent pricing, ease

of ordering and next day delivery for order requirements of less

than one tonne. A German subsidiary has been incorporated, as part

of our preparations for the potential impact of Brexit, and also to

enable Anpario to employ a sales team in the region as part of our

strategy to develop more direct routes to market.

The Middle East and Africa had its best six months on record

with sales growth of 23% compared with the previous year. The

region experienced strong performances in Iraq, Israel and the

United Arab Emirates driven by sales of Orego-Stim® and Mastercube,

our pellet binder. Turkey continued to disappoint as a result of

the economic situation there, but this is offset by strong sales to

Iraq; a region whose animal nutrition capability is now recovering

having been formerly dependent on supply from Turkey.

In China sales declined by 16% compared with the previous year

mainly as the result of African Swine Fever. In addition, a large

swine producer experienced financial difficulties and stopped using

our products. However, our China team has worked hard to refocus

the business by targeting the poultry industry, both broiler and

layers, where they have been successful in selling our acid based

eubiotic products.

In Asia African Swine Fever has spread to a number of countries,

particularly Vietnam, which has a land border with China. Anpario's

Asia region sales, excluding China, declined by 30% with a third of

this fall due to our decision to terminate non-core and low margin

product sales in the Philippines. In addition, a number of larger

customers either stopped or reduced their purchase volumes in South

Korea, Malaysia and the Philippines. Some of these decisions are

due to the cost pressures faced by integrators as a consequence of

cheap US meat exports, which have been diverted from the China

market because US production is currently uncompetitive, given the

tariff situation and the ongoing trade dispute. Territories that

delivered strong sales performances include Bangladesh, Taiwan and

Thailand. While Asia is expected to experience these headwinds for

the remainder of the year, we remain optimistic that we can build

on some of the work already underway when the region recovers.

Brexit

As highlighted in our full year results, released on 6 March

2019, Anpario's products and processes comply with European Union

regulations. However, it is difficult to anticipate exactly what

the regulatory environment will look like for our products in the

event of a no-deal Brexit. In preparation for this possibility, we

have incorporated a company in Germany. This business will be able

to invoice customers in the EU and we have plans in place with our

EU suppliers to try to minimise any Brexit related disruption.

These arrangements also include increasing certain raw material

stock levels in the UK.

Production

The GBP1 million investment in the automated bottling plant at

Manton Wood is now complete. The plant has been commissioned and

all previously toll-manufactured production brought in-house. This

investment will speed up the turnaround time for our customers and

enable us to support the Anpario Direct channel and some of their

target customer segments for whom liquid versions of our products

are more popular.

Our Anpario Direct channel was recently launched to the UK

market with both sales and user visits to the website increasing

week on week. The priority is to drive direct marketing activity

which will include online offers and promotional campaigns

coinciding with various agricultural shows throughout the UK. The

Anpario Direct proposition was designed to also complement our

field sales team channel and the UK sales team is actively

introducing the online platform to those farmers who typically

order smaller product quantities. The channel also targets other

species such as equine, pigeon and game birds.

Innovation and development

Following an extensive programme of both in-vitro and in-vivo

trials on our Anpro® mycotoxin binder product, the dossier for

making mycotoxin deactivation claims was submitted during the

period to the EU for their approval. We anticipate receiving a

response early in 2020.

Anpario has an extensive programme of both scientific and

commercial trials covering various aspects of animal health and

performance. There is increasing pressure on the pig industry to

reduce antimicrobial usage whilst maximising animal health and

performance and some recent trials performed concluded that adding

Orego-Stim® to the feed on farm made significant improvements to

health and profitability.

Outlook

Sales in the current year are at a similar level to the

equivalent period last year, albeit with improved gross margins. We

expect African Swine Fever to continue to impact the market

although this should gradually ease albeit the timing remains

uncertain. Expanding profitable sales and distribution channels

around the world remains our priority. Our strong balance sheet and

cash generation capability provide Anpario with a firm platform

from which to invest in new products and to develop the exciting

Anpario Direct opportunity.

Our business development initiatives, backed by the quality and

ability of our employees worldwide, give me confidence that we are

in line for our full year management expectations.

Peter LawrenceChairman11 September 2019

Financial Review

restated restated

six months to six months to year ended

30/06/2019 30/06/2018 31/12/2018

GBP000 GBP000 GBP000

Revenue 14,285 14,773 28,277

Gross profit 7,102 6,994 13,542

Profit before tax 2,253 2,242 4,555

Adjusted EBITDA (note 3) 2,805 2,753 5,583

Adjusted earnings per 9.16p 9.16p 18.91p

share (note 4)

Cash generated/(absorbed) 718 (861) (615)

Cash and cash equivalents 13,653 12,647 12,912

Revenues for the first half of the year declined 3% to GBP14.3m

(2018: GBP14.8m). There was strong double digit sales growth across

the Middle-East, Latin America and US markets. However, overall

sales declined, largely due to the Asia region which was impacted

by a number of factors including African Swine Fever and the

previously announced planned withdrawal from non-core and low

margin product sales (GBP0.4m) in the Philippines which stopped

after H1 2018.

Gross profits were 2% higher than last year at GBP7.1m (2018:

GBP7.0m). This is a result of both increased sales to direct end

user segments in strategically important markets and the withdrawal

from the aforementioned, non-core, low margin sales. Gross margins

increased to 49.7% from 47.3%.

Administrative expenses, excluding foreign exchange, were

virtually unchanged at GBP4.9m (2018: GBP4.8m). Included in

administrative costs are immaterial net foreign exchange gains

while the prior year included gains of GBP0.2m.

Profit before tax rose by 1% to GBP2.3m (2018: GBP2.2m).

Adjusted EBITDA, also increased by 1% to GBP2.8m.

Basic and adjusted earnings per share were unchanged at 9.16

pence per share and diluted earnings per share increased by 3% to

8.88 pence per share (2018: 8.66 pence).

The balance sheet remains strong and debt free, with a

period-end cash balance of GBP13.7m (Dec 2018: GBP12.9m).

These financial statements reflect the adoption of IFRS 16 by

the Group, as outlined in the last annual report the impact of this

on the Income Statement is immaterial. IFRS 16 requires operating

leases to be capitalised on the statement of financial position, as

well as the present value of future lease obligations being shows

in liabilities. Prior period comparatives have been restated to

reflect the adoption and more detail about the impact can be found

in the notes to the financial statements.

Unaudited consolidated income statementfor the six months ended

30 June 2019

restated1 restated1

six months to six months to year ended

30/06/2019 30/06/2018 31/12/2018

Notes GBP000 GBP000 GBP000

Revenue 3 14,285 14,773 28,277

Cost of sales (7,183) (7,779) (14,735)

Gross profit 7,102 6,994 13,542

Administrative (4,891) (4,786) (9,069)

expenses

Operating profit 2,211 2,208 4,473

Finance income 42 34 82

Profit before 2,253 2,242 4,555

income tax

Income tax expense (371) (366) (552)

Profit for the period 1,882 1,876 4,003

Profit attributable

to:

Owners of the parent 1,882 1,875 4,003

Non-controlling - 1 -

interests

Profit for the period 1,882 1,876 4,003

Basic earnings 4 9.16p 9.16p 19.54p

per share

Diluted earnings 4 8.88p 8.66p 18.53p

per share

Unaudited consolidated statement of comprehensive incomefor the

six months ended 30 June 2019

restated1 restated1

six months to six months to year ended

30/06/2019 30/06/2018 31/12/2018

GBP000 GBP000 GBP000

Profit for the period 1,882 1,876 4,003

Items that may be subsequently

reclassified

to profit or loss:

Exchange difference on translating (43) 76 (3)

foreign operations

Cashflow hedge movements (75) (107) (184)

(net of deferred tax)

Total comprehensive income 1,764 1,845 3,816

for the period

Attributable to the owners 1,764 1,844 3,816

of the parent:

Non-controlling interests - 1 -

Total comprehensive income 1,764 1,845 3,816

for the period

1 Prior period comparatives have been restated following the

adoption of IFRS 16 as disclosed in note 8.

Unaudited consolidated balance sheetas at 30 June 2019

restated1 restated1

as at as at as at

30/06/2019 30/06/2018 31/12/2018

Notes GBP000 GBP000 GBP000

Intangible assets 5 11,474 10,954 11,373

Property, plant 6 4,207 3,319 3,710

and equipment

Right of use assets 7 280 131 196

Deferred tax assets 688 451 641

Non-current assets 16,649 14,855 15,920

Inventories 3,405 3,852 4,031

Trade and other receivables 5,767 6,821 5,328

Derivative financial 6 76 6

instruments

Cash and cash equivalents 13,653 12,647 12,912

Current assets 22,831 23,396 22,277

Total assets 39,480 38,251 38,197

Called up share capital 5,394 5,357 5,360

Share premium 10,849 10,397 10,423

Other reserves (5,824) (5,346) (5,449)

Retained earnings 24,696 22,119 22,814

Equity attributable to owners 35,115 32,527 33,148

of the parent company

Non-controlling interest - (1) -

Total equity 35,115 32,526 33,148

Lease liabilities 213 75 115

Deferred tax liabilities 1,288 1,045 1,182

Non-current liabilities 1,501 1,120 1,297

Trade and other payables 2,368 4,149 3,426

Lease liabilities 7 70 60 83

Derivative financial 113 - 11

instruments

Current income tax 313 396 232

liabilities

Current liabilities 2,864 4,605 3,752

Total liabilities 4,365 5,725 5,049

Total equity and 39,480 38,251 38,197

liabilities

1 Prior period comparatives have been restated following the

adoption of IFRS 16 as disclosed in note 8.

Unaudited consolidated statement of changes in equityfor the six

months ended 30 June 2019

Called up Share premium Otherreserves Retained Non-controlling Totalequity

share earnings interest

capital

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Balance 5,350 10,330 (5,406) 20,248 - 30,522

at 1

January

2018

IFRS - - - (5) - (5)

16

Adjustment

Balance at 5,350 10,330 (5,406) 20,243 - 30,517

1 January

2018

- restated1

Profit for - - - 1,876 (1) 1,875

the period

Currency - - 76 - - 76

translation

differences

Cash flow - - (107) - - (107)

hedge

reserve

Total - - (31) 1,876 (1) 1,844

comprehensive

income

for the

period

Issue of 7 67 - - - 74

share

capital

Share-based - - 91 - - 91

payment

adjustments

Transactions 7 67 91 - - 165

with owners

Balance 5,357 10,397 (5,346) 22,119 (1) 32,526

at 30

June 2018

Profit for - - - 2,127 1 2,128

the period

Currency - - (79) - - (79)

translation

differences

Cash flow - - (77) - - (77)

hedge

reserve

Total - - (156) 2,127 1 1,972

comprehensive

income

for the

period

Issue of 3 26 - - - 29

share

capital

Deferred - - (23) - - (23)

tax

regarding

share-based

payments

Share-based - - 76 - - 76

payment

adjustments

Final - - - (965) - (965)

dividend

relating

to 2017

Interim - - - (467) - (467)

dividend

relating

to 2018

Transactions 3 26 53 (1,432) - (1,350)

with owners

Balance 5,360 10,423 (5,449) 22,814 - 33,148

at 31

December

2018

Profit for - - - 1,882 - 1,882

the period

Currency - - (43) - - (43)

translation

differences

Cash flow - - (75) - - (75)

hedge

reserve

Total - - (118) 1,882 - 1,764

comprehensive

income

for the

period

Issue of 34 426 - - - 460

share

capital

Joint-share - - (320) - - (320)

ownership

plan

Share-based - - 63 - - 63

payment

adjustments

Transactions 34 426 (257) - - 203

with owners

Balance 5,394 10,849 (5,824) 24,696 - 35,115

at 30

June 2019

1 Prior period comparatives have been restated following the

adoption of IFRS 16 as disclosed in note 8.

Unaudited consolidated statement of cash flowsfor the six months

ended 30 June 2019

restated1 restated1

six months to six months to year ended

30/06/2019 30/06/2018 31/12/2018

GBP000 GBP000 GBP000

Cash generated from operating 1,885 (172) 3,362

activities

Income tax paid (229) (257) (673)

Net cash generated from 1,656 (429) 2,689

operating activities

Investment in subsidiary - - (132)

Purchases of property, (657) (130) (695)

plant and equipment

Payments to acquire (394) (354) (1,106)

intangible assets

Interest received 47 35 87

Net cash used in investing (1,004) (449) (1,846)

activities

Joint share ownership plan (320) - -

Proceeds from issuance of shares 460 74 103

Cash payments in relation (69) (56) (124)

to lease liabilities

Operating lease interest paid (5) (1) (5)

Dividend paid to Company's - - (1,432)

shareholders

Net cash used in financing 66 17 (1,458)

activities

Net increase in cash 718 (861) (615)

and cash equivalents

Effect of exchange rate changes 23 (51) (32)

Cash and cash equivalents at 12,912 13,559 13,559

the beginning of the period

Cash and cash equivalents 13,653 12,647 12,912

at the end of the period

restated1 restated1

six months to six months to year ended

30/06/2019 30/06/2018 31/12/2018

GBP000 GBP000 GBP000

Cash generated from operating

activities

Profit before income tax 2,253 2,242 4,555

Net finance income (42) (34) (82)

Depreciation, amortisation 523 433 992

and impairment

(Profit)/Loss on disposal - - 13

of property,

plant and equipment

Share-based payments 63 91 167

Fair value adjustment (75) 37 32

to derivatives

Changes in working capital:

Inventories 657 (783) (900)

Trade and other receivables (426) (1,130) 401

Trade and other payables (1,068) (1,028) (1,816)

Net cash generated from 1,885 (172) 3,362

operating activities

1 Prior period comparatives have been restated following the

adoption of IFRS 16 as disclosed in note 8.

Notes to the financial statementsfor the six months ended 30

June 2019

1. General information

Anpario plc ("the Company") and its subsidiaries (together "the

Group") manufacture and supply high performance natural feed

additives for the agricultural market with products to improve the

health and output of animals.

The Company is traded on the London Stock Exchange AIM market

and is incorporated and domiciled in the UK. The address of the

registered office is Manton Wood Enterprise Park, Worksop,

Nottinghamshire, S80 2RS.

2. Basis of preparation

The consolidated financial statements comprise the accounts of

the Company and its subsidiaries drawn up to 30 June 2019.

The Group has presented its financial statements in accordance

with International Financial Reporting Standards ("IFRS's"), as

endorsed by the European Union, IFRS IC interpretations and the

Companies Act 2006 applicable to companies reporting under IFRS.

Full details on the basis of the accounting policies used are set

out in the Group's financial statements for the year ended 31

December 2018, which are available on the Company's website at

www.anpario.com.

This condensed consolidated interim financial information does

not comprise statutory accounts within the meaning of section 434

of the Companies Act 2006. Statutory accounts for the year ended 31

December 2018 were approved by the Board of Directors on 6 March

2019 and delivered to the Registrar of Companies. The report of the

auditors on those accounts was unqualified, did not contain an

emphasis of matter paragraph and did not contain any statement

under section 498 (2) or (3) of the Companies Act 2006.

The consolidated interim financial information for the period

ended 30 June 2019 is neither audited nor reviewed.

3. Segment information

Management has determined the operating segments based on the

reports reviewed by the Board that are used to make strategic

decisions. The Board considers the business from a geographic

perspective.

Americas Asia Europe MEA Head Office Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

for the six months

ended 30 June 2019

Total segmental 3,339 4,958 5,556 2,577 - 16,430

revenue

Inter-segment - - (2,145) - - (2,145)

revenue

Revenue from 3,339 4,958 3,411 2,577 - 14,285

external

customers

Adjusted EBITDA 784 1,556 1,442 848 (1,825) 2,805

Depreciation and (2) (9) - - (512) (523)

amortisation

Net finance income - - - 1 41 42

Share-based - - - - (71) (71)

payments

Profit before 782 1,547 1,442 849 (2,367) 2,253

income tax

Income tax - - - - (371) (371)

Profit for 782 1,547 1,442 849 (2,738) 1,882

the period

Total assets 39,480 39,480

Total liabilities (4,365) (4,365)

Americas Asia Europe MEA Head Office Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

for the six months

ended 30 June 2018

Total segmental 2,678 6,401 6,366 2,068 - 17,513

revenue

Inter-segment - - (2,740) - - (2,740)

revenue

Revenue from 2,678 6,401 3,626 2,068 - 14,773

external

customers

Adjusted EBITDA 568 2,118 1,410 645 (1,988) 2,753

Depreciation and (4) (6) - - (423) (433)

amortisation

Net finance income - - - 1 33 34

Share-based - - - - (112) (112)

payments

Profit before 564 2,112 1,410 646 (2,490) 2,242

income tax

Income tax - - - - (366) (366)

Profit for 564 2,112 1,410 646 (2,856) 1,876

the period

Total assets 38,251 38,251

Total liabilities (5,725) (5,725)

Americas Asia Europe MEA Head Office Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

for the year

ended

31 Dec 2018

Total 5,703 11,563 12,341 3,614 - 33,221

segmental

revenue

Inter-segment - - (4,944) - - (4,944)

revenue

Revenue from 5,703 11,563 7,397 3,614 - 28,277

external

customers

Adjusted 1,444 3,776 2,971 1,097 (3,705) 5,583

EBITDA

Depreciation (7) (12) - - (973) (992)

and

amortisation

Net finance - 1 - 2 79 82

income

Share-based - - - - (118) (118)

payments

Profit before 1,437 3,765 2,971 1,099 (4,717) 4,555

income tax

Income tax 103 (72) - - (583) (552)

Profit for 1,540 3,693 2,971 1,099 (5,300) 4,003

the year

Total assets 38,197 38,197

Total (5,049) (5,049)

liabilities

4. Earnings per share

restated1 restated1

six months to six months to year ended

30/06/2019 30/06/2018 31/12/2018

Weighted average number of 20,538 20,472 20,482

shares in Issue (000's)

Adjusted for effects of 664 1,183 1,121

dilutive potential

Ordinary shares (000's)

Weighted average number for diluted 21,202 21,655 21,603

earnings per share (000's)

Profit attributable to owners 1,882 1,875 4,003

of the Parent (GBP000's)

Basic earnings per share 9.16p 9.16p 19.54p

Diluted earnings per share 8.88p 8.66p 18.53p

restated1 restated1

six months to six months to year ended

30/06/2019 30/06/2018 31/12/2018

GBP000 GBP000 GBP000

Adjusted profit attributable

to owners of the Parent

Profit attributable to 1,882 1,875 4,003

owners of the Parent

Prior year tax adjustments - - (129)

Adjusted profit attributable 1,882 1,875 3,874

to owners of the Parent

Adjusted earnings per share 9.16p 9.16p 18.91p

Diluted adjusted earnings per share 8.88p 8.66p 17.93p

5. Intangible assets

Goodwill Brands Customer relationships Patents, trademarks and registrations Development costs Software and Licences Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Cost

As at 1 January 2019 5,960 3,432 786 1,636 2,499 688 15,001

Additions - 11 - 124 254 5 394

As at 30 June 2019 5,960 3,443 786 1,760 2,753 693 15,395

Accumulated amortisation/impairment

As at 1 January 2019 - 394 522 635 1,823 254 3,628

Charge for the period - 71 38 127 - 57 293

As at 30 June 2019 - 464 561 761 1,823 312 3,921

Net book value

As at 30 June 2019 5,960 2,979 225 999 930 381 11,474

As at 1 January 2019 5,960 3,038 264 1,001 676 434 11,373

6. Property, plant and equipment

Land Plant Fixtures, Assets Total

and and machinery fittings in the

buildings and equipment course

of

construction

GBP000 GBP000 GBP000 GBP000 GBP000

Cost

As 2,181 2,137 488 554 5,360

at

1 January

2019

Additions - 525 132 - 657

Transfer - 554 - (554) -

of

assets

in

construction

As at 30 2,181 3,216 620 - 6,017

June

2019

Accumulated

depreciation

As 340 973 337 - 1,650

at

1 January

2019

Charge 15 110 35 - 160

for

the

period

As at 30 355 1,083 372 - 1,810

June

2019

Net book

value

As at 30 1,826 2,133 248 - 4,207

June

2019

As 1,841 1,164 151 554 3,710

at

1 January

2019

7. Right-of-use assets

Landand buildings Plantand machinery Fixtures, Total

fittingsand

equipment

GBP000 GBP000 GBP000 GBP000

Cost

As at 1 Jan 404 106 28 538

2019

Additions 149 - - 149

Disposals (209) (64) - (273)

Modification - 5 - 5

to

lease terms

As at 30 June 344 47 28 419

2019

Accumulated

depreciation

As at 1 Jan 236 90 16 342

2019

Depreciation 60 6 4 70

Disposals (209) (64) - (273)

As at 30 June 87 32 20 139

2019

NBV

As at 1 Jan 168 16 12 196

2019

As at 30 June 257 15 8 280

2019

as at as at

30/06/2019 31/12/2018

GBP000 GBP000

Non-current 213 115

Current 70 83

Total lease liabilities 283 198

8. Effect of the adoption of IFRS 16

IFRS 16 Leases has been adopted by the Group. The standard has

been applied from 1 January 2019, the comparatives for prior

periods have been restated accordingly. IFRS16 requires operating

leases to be capitalised on the statement of financial position.

Anpario has applied the full retrospective approach and as such at

the end of 2018 fixed assets increased by GBP0.2m being the present

value of future lease obligations with a corresponding increase in

liabilities of GBP0.2m. The impact on the profit before tax in the

Consolidated Income Statement is not material and the cash flow

impact is nil. The tables below detail the full impact of the

restatement.

Restated consolidated income statement

As reported IFRS Restated As reported IFRS Restated

16 Adjustments 16 Adjustments

six months to six months to six months to year ended year ended year ended

30/06/2018 30/06/2018 30/06/2018 31/12/2018 31/12/2018 31/12/2018

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Revenue 14,773 - 14,773 28,277 - 28,277

Gross 6,994 - 6,994 13,541 1 13,542

profit

Administrative (4,788) 2 (4,786) (9,076) 7 (9,069)

expenses

Operating 2,206 2 2,208 4,465 8 4,473

profit

Net 35 (1) 34 87 (5) 82

finance

income

Profit 2,241 1 2,242 4,552 3 4,555

before

income

tax

Profit 1,875 1 1,876 4,000 3 4,003

for

the

period

Profit

attributable

to:

Owners 1,874 1 1,875 4,000 3 4,003

of the

parent

Profit 1,875 1 1,876 4,000 3 4,003

for

the

period

Restated adjusted EBITDA

As IFRS Restated As reported IFRS Restated

reported 16 16

Adjustments Adjustments

six months six months six months year ended year year ended

to to to ended

30/06/2018 30/06/2018 30/06/2018 31/12/2018 31/12/2018 31/12/2018

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Adjusted 2,696 57 2,753 5,454 129 5,583

EBITDA

Depreciation (378) (55) (433) (871) (121) (992)

and

amortisation

Net 35 (1) 34 87 (5) 82

finance

income

Profit 2,241 1 2,242 4,552 3 4,555

before

income

tax

Profit 1,875 1 1,876 4,000 3 4,003

for

the

period

Restated consolidated balance sheet

as IFRS restated as reported IFRS restated

reported 16 16

adjustments adjustments

six months six months six months year ended year year ended

to to to ended

30/06/2018 30/06/2018 30/06/2018 31/12/2018 31/12/2018 31/12/2018

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Right - 131 131 - 196 196

of

use

assets

Total 38,120 131 38,251 38,001 196 38,197

assets

Retained 22,123 (4) 22,119 22,816 (2) 22,814

earnings

Total 32,530 (4) 32,526 33,150 (2) 33,148

equity

Lease - 75 75 - 115 115

liabilities

Non-current 1,045 75 1,120 1,182 115 1,297

liabilities

Lease - 60 60 - 83 83

liabilities

Current 4,545 60 4,605 3,669 83 3,752

liabilities

Total 5,590 135 5,725 4,851 198 5,049

liabilities

Total 38,120 131 38,251 38,001 196 38,197

equity

and

liabilities

Restated consolidated statement of cash flows

as reported IFRS 16 restated as reported IFRS 16 restated

six months to adjustments six months to year ended adjustments year ended

30/06/2018 var 30/06/2018 31/12/2018 var 31/12/2018

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Cash (229) 57 (172) 3,233 129 3,362

generated

from

operating

activities

Net (486) 57 (429) 2,560 129 2,689

cash

generated

from

operating

activities

Net cash (449) - (449) (1,846) - (1,846)

used

in

investing

activities

Cash - (56) (56) - (124) (124)

payments

in

relation

to

lease

liabilities

Operating - (1) (1) - (5) (5)

lease

interest

paid

Net cash 74 (57) 17 (1,329) (129) (1,458)

used

in

financing

activities

Net (861) - (861) (615) - (615)

increase

in cash

and

cash

equivalents

Cash and 12,647 - 12,647 12,912 - 12,912

cash

equivalents

at the

end of

the

period

Cash

generated

from

operating

activities

Profit 2,241 1 2,242 4,552 3 4,555

before

income

tax

Net (35) 1 (34) (87) 5 (82)

finance

income

Depreciation, 378 55 433 871 121 992

amortisation

and

impairment

Net (229) 57 (172) 3,233 129 3,362

cash

generated

from

operating

activities

View source version on businesswire.com:

https://www.businesswire.com/news/home/20190910006180/en/

This information is provided by Business Wire

(END) Dow Jones Newswires

September 11, 2019 02:00 ET (06:00 GMT)

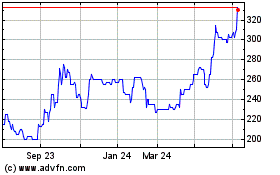

Anpario (LSE:ANP)

Historical Stock Chart

From Mar 2024 to Apr 2024

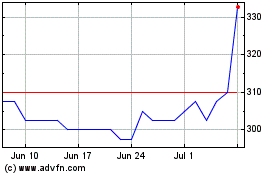

Anpario (LSE:ANP)

Historical Stock Chart

From Apr 2023 to Apr 2024