TIDMANCR

RNS Number : 3406G

Animalcare Group PLC

23 July 2019

23 July 2019

Animalcare Group plc

(the "Group" or the "Company")

Trading Update & Notice of Results

23 July 2019. Animalcare Group plc (AIM: ANCR), the

international animal health business, today provides the following

unaudited trading update for the six months ended 30 June 2019 (the

"Period") ahead of publishing its interim results on 24 September

2019.

Trading overview

Current trading is in line with market expectations and we are

delivering against all our five key objectives, with cash

conversion improving significantly as a result.

For the period to 30 June 2019, revenue from our continuing

Pharmaceuticals segment was in line with prior year (c.0.9%

increase on a constant currency basis) at GBP36.1m (2018:

GBP36.1m).

The small revenue improvement on a constant currency basis was

noteworthy, given the previously reported supply challenges from a

third-party manufacturer. These expected one-off challenges within

Companion Animals impacted sales by GBP1.1m during the period. We

are on track to resolve the supply issues during the current

financial year which is anticipated to be reflected in sales during

the second half. Underlying revenue growth during the period has

been driven primarily by the launch of seven new products and

annualised growth of products launched in 2018.

We have maintained our focus on operating costs and cash

generation. The Board expects underlying EBITDA for the period to

be in line with 2018, before a c.GBP0.5m benefit following the

adoption of IFRS 16, which has no impact on profit before tax for

the Group.

At the end of 2018, we committed to reducing our net debt and

improving cash conversion. In line with these aims, we have

significantly improved our cash generation vs the first half of

2018 and remain on track to improve on the 80% achieved for the

full year 2018. Net debt was around GBP21.0m as at 30 June 2019 (31

December 2018: GBP23.6m; 30 June 2018: GBP26.0m), the reduction

since the 2018 year end largely driven by lower working capital

including an inventory reduction of c.GBP1.5m.

Operational update

The Group continues to execute upon its five strategic

priorities to deliver short and long term sustainable, profitable

growth. During the first half of 2019 we have accelerated the pace

of integration to drive simplification and improve efficiency,

delivered against these priorities, as follows:

1) Build a strong financial basis through revenue growth, cash

conversion, EPS growth and EBITDA margin growth

As outlined above we are trading in line with expectations and

cash conversion has been strong. We have streamlined supply across

Southern Europe, delivering inventory reduction ahead of plan.

Investment in SAP ERP will commence in H2 to drive further

efficiencies during 2020.

We completed the R&D and Technical & Regulatory

centralisation during Q2 2019, which will drive efficiencies and

integrate management. We have therefore completed our planned

headcount reduction of nine employees in the UK and Spain, for

which around GBP1.4m one-off costs were incurred in the period.

2) Grow the business through a focussed portfolio of existing

products and build a robust future pipeline in five key therapy

areas in the companion animal and equine markets

Phase 1 of the project to create a focussed range of higher

margin and growth brands that support our primary portfolio areas

is nearing completion. 25% of brands that are insubstantial in

terms of revenue and insignificant in terms of EBITDA contribution

are expected to be delisted or divested by the end of the year with

a further c20% reduction during 2020.

3) Build on existing customer relationships with vets and other

stakeholders to deliver trusted products and services

We continue to strengthen our relationships with key

stakeholders including our international partners and will be

launching our first products with our partner in China in Q3.

4) Business development focus with partners to in license and acquire innovative products

The product development pipeline has progressed in line with

expectations during the first half, with approval granted for three

new products. All three will be launched as planned during H2 and

we expect two further approvals by the end of 2019.

5) Organisation for success, building leadership strength and

attract, retain and develop talent for the future

We implemented an LTIP for Senior Leaders and rolled out

performance-based bonus plans. We have strengthened our Country

Manager team with the recruitment of Sara Maddens in Belgium.

Animalcare's Chief Executive Officer, Jenny Winter, commented:

"We have a clear strategy to become a leading international

veterinary pharmaceutical business and we have made good progress

towards this goal during the first half of 2019. We have

strengthened the Group's finances with greater cash conversion and

made significant strides in streamlining our product portfolio

which is critical to enhancing our profitability. Greater focus on

integration has also begun to impact with further simplification

leading to efficiency improvements. I am pleased that the growth

platform that we have been focused on building is coming to

fruition and I look forward to updating the market further on our

progress."

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) No 596/2014.

For further information, please contact:

Animalcare Group plc Tel: 01904 487 687

Jenny Winter, Chief Executive

Officer

Chris Brewster, Chief Financial

Officer

Panmure Gordon (Nominated Adviser Tel: 020 7886 2500

& Broker)

Corporate Finance

Freddy Crossley / Emma Earl

Corporate Broking

James Stearns

animalcare@consilium-comms.com

Consilium Strategic Communications

Amber Fennell/Angela Gray/Olivia

Manser

About Animalcare (www.animalcaregroup.com)

Animalcare Group plc is a UK AIM listed veterinary sales and

marketing organisation resulting from the merger of Animalcare and

Ecuphar NV in July 2017. Animalcare operates in seven countries and

exports to approximately 32 countries in Europe and a further 16

worldwide. The company is focused on bringing new and innovative

products to market through its own development pipeline,

partnerships and via acquisition.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTLLFVTDFIFFIA

(END) Dow Jones Newswires

July 23, 2019 02:00 ET (06:00 GMT)

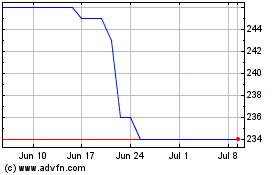

Animalcare (LSE:ANCR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Animalcare (LSE:ANCR)

Historical Stock Chart

From Apr 2023 to Apr 2024