TIDMAHT

Ashtead Group PLC

AGM Statement

17th September 2021

ASHTEAD GROUP PLC

(the "Company")

AGM Statement & Results

AGM Statement & Results

At the Annual General Meeting of the Company "Ashtead Group plc" held on 16th

September 2021 at 2:30pm, all resolutions put to shareholders were duly passed

on a poll with the required majorities. The full text of each resolution is

contained in the Notice of Annual General Meeting. Resolutions 1 to 16 were

passed as ordinary resolutions. Resolutions 17 - 21 were passed as special

resolutions.

ORDINARY Votes for % Votes Votes % Votes Total no. Total % of Votes

RESOLUTIONS (including for * against against of votes voting withheld

discretionary * validly capital

votes) cast voted

(including

withheld)

**

1. That the 336,487,579 99.98 58,770 0.02 338,546,349 75.25 2,037,076

accounts for the

year ended

30 April 2021,

the directors'

report and the

auditors' report

be adopted.

2. That the 214,865,136 63.97 121,031,689 36.03 335,896,825 75.10 2,686,595

directors'

remuneration

report for the

year ended

30 April 2021 be

approved.

3. That the 184,430,438 60.72 119,284,600 39.28 303,715,038 67.91 34,868,385

directors'

remuneration

policy set out

in the annual

report of the

Company for the

year ended 30

April 2021 be

approved.

4. That the final 338,551,782 99.99 28,181 0.01 338,579,963 75.70 3,461

dividend

recommended by

the directors of

35p

per ordinary

share for the

year ended 30

April 2021 be

declared payable

on 21 September

2021 to holders

of ordinary

shares

registered at

the close of

business on 20

August 2021.

5. That Paul Walker 328,266,803 97.09 9,823,099 2.91 338,089,902 75.59 493,523

be re-elected as

a director.

6. That Brendan 335,073,154 98.97 3,483,164 1.03 338,556,318 75.70 27,107

Horgan be

re-elected as a

director.

7. That Michael 337,899,182 99.81 656,536 0.19 338,555,718 75.70 27,707

Pratt be

re-elected as a

director.

8. That Angus 329,480,982 97.32 9,075,006 2.68 338,555,988 75.70 27,437

Cockburn

re-elected as a

director.

9. That Lucinda 296,991,992 97.41 7,884,918 2.59 304,876,910 68.17% 33,706,515

Riches be

re-elected as a

director.

10. That Tanya 330,128,591 97.51 8,424,397 2.49 338,552,988 75.69% 30,437

Fratto be

re-elected as a

director.

11. That Lindsley 331,811,670 97.91 7,083,670 2.09 338,895,340 75.77 30,437

Ruth be

re-elected as a

director.

12. That Jill 333,512,655 98.41 5,382,685 1.59 338,895,340 75.77 30,437

Easterbrook

re-elected as a

director.

13. That Deloitte 331,318,649 97.76 7,588,785 2.24 338,907,434 75.77 18,352

LLP be

re-appointed as

auditor of the

Company.

14. That the 336,076,809 99.16 2,839,462 0.84 338,916,271 75.78 9,515

directors be

authorised to

fix the

remuneration of

the

auditor of the

Company.

15. Approval of 251,802,181 74.44 86,440,905 25.56 338,243,086 75.63 682,699

Long-Term

Incentive Plan

16. That the 321,584,625 94.89 17,331,859 5.11 338,916,484 75.78 9,301

directors are

authorised to

allot the shares

under section

551 (1) (a) and

(b) of the

Companies Act

2006.

Votes for % Votes Votes % Votes Total no. Total % of Votes

SPECIAL (including for * against against of votes voting withheld

RESOLUTIONS discretionary * validly capital

votes) cast voted

(including

withheld)

**

17. That the 336,839,971 99.70 1,023,733 0.30 337,863,704 75.54 1,062,083

directors be

empowered to

disapply the

provisions of

section 561 (1)

to (6) of the

Companies Act

2006.

18. That the 330,229,671 97.74 7,638,118 2.26 337,867,789 75.54 1,057,998

directors be

empowered to

issue shares on

a non

pre-emptive

basis.

19. That the 330,078,164 97.78 7,500,959 2.22 337,579,123 75.48 1,346,664

directors be

authorised to

make market

purchases of the

Company's shares

under section

701 of the

Companies Act.

20. That a general 324,108,847 95.63 14,799,626 4.37 338,908,473 75.77 17,314

meeting other

than an annual

general meeting

may be called on

not less than 14

clear days'

notice.

21. Amendments to 338,734,201 100.00 6,037 0.00 338,740,238 75.74 185,549

articles of

association

* A vote withheld is not a vote in law and is not counted in the calculation of

the proportion of votes "for" and "against" a resolution.

** Percentage of issued share capital (excluding 4,093,307 treasury shares)

The Ashtead Board is pleased to note that all resolutions were passed with the

requisite majority of votes and welcomes the overwhelming support of the

Company's shareholders for the majority of the resolutions proposed.

During 2020/21, we consulted extensively with our largest shareholders, proxy

advisors and shareholder representative organisations on the proposed

Directors' Remuneration Report (Resolution 2), the proposed Directors'

Remuneration Policy (Resolution 3) and the new Long-Term Incentive Plan

(Resolution 15). The Board notes that a majority of shareholders voted in

support of the three resolutions. Accordingly, the new Remuneration Policy will

take effect for three years from fiscal year 2022 and will be implemented by

the Remuneration Committee.

The Board acknowledges that some shareholders did not vote in favour of these

three resolutions. In making its Executive Director pay decisions and devising

the new Directors' Remuneration Policy, the Board was acutely aware of the

sensitivities around executive remuneration in the prevailing environment and

balanced these concerns with the need to retain and incentivise a strong

management team to deliver on our ambitious growth strategy. Importantly, the

new policy is aligned with the wider workforce, who have the opportunity to

share, in a meaningful and aligned manner, in the value created for

shareholders over the next few years. Consequently, the Board firmly believes

that the changes approved by shareholders are in the best interests of all of

the Group's stakeholders.

We value an open and transparent dialogue with our shareholders and we will

continue to engage with them to ensure all views are understood and respected

and taken into consideration in applying the new Directors' Remuneration Policy

going forwards. In accordance with the UK Corporate Governance Code we will

publish an update on this engagement within six months of the AGM.

Contact:

Will Shaw - Investment Manager, 020 7726 9700

Maitland - James McFarlane - 0207 379 5151

END

(END) Dow Jones Newswires

September 17, 2021 05:21 ET (09:21 GMT)

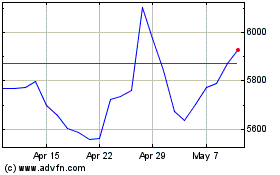

Ashtead (LSE:AHT)

Historical Stock Chart

From Mar 2024 to Apr 2024

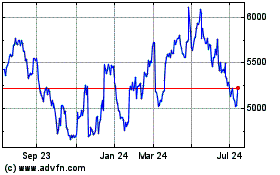

Ashtead (LSE:AHT)

Historical Stock Chart

From Apr 2023 to Apr 2024