TIDMAGL

RNS Number : 6487V

Angle PLC

25 July 2018

For Immediate Release 25 July 2018

ANGLE plc

("ANGLE" or "the Company")

Preliminary Results for the year ended 30 April 2018

STRENGTHENING A LEADING POSITION IN THE LIQUID BIOPSY MARKET

OVARIAN CANCER CLINICAL STUDIES SUCCESSFULLY COMPLETED AND

FDA CLINICAL STUDY IN PROGRESS

ANGLE plc (AIM: AGL OTCQX: ANPCY), a world leading liquid biopsy

company, today announces unaudited results for the year ended 30

April 2018.

Operational Highlights

-- FDA clinical study of 400 subjects set up and in progress

with four leading US cancer centres, targeted for completion this

year

-- Successful US and European ovarian cancer studies in 400

patients. Blood test delivered 95.1% accuracy in discriminating

between benign and malignant pelvic masses significantly

out-performing standard of care

-- Acquisition of the assets of Axela Inc. for GBP3.6 million.

The principal asset, the Ziplex(R) platform allows multiplex gene

expression analysis of cancer cells. This complements the

Parsortix(TM) system and, in time, will be offered to customers as

a full 'sample to answer' solution

-- Collaborative agreements signed with three leading, global

healthcare companies QIAGEN, Philips and Abbott

-- Research equipment installed base increased to 200 Parsortix systems (2017: 145)

-- Total of 10 peer-reviewed publications (30 April 2017: 4) and

21 publicly available posters (30 April 2017: 13)

Financial Highlights

-- Loss for the year GBP7.5 million (2017: loss GBP6.4 million) reflecting planned investment

-- Revenue and grant income GBP0.7 million (2017: GBP0.5 million)

-- GBP15.0 million fundraising during the year (GBP14.4 million net of expenses)

-- Cash balance at 30 April 2018 of GBP7.6 million (30 April 2017: GBP5.5 million)

-- Post year end fundraising of GBP12.7 million (GBP12.0 million net of expenses)

Garth Selvey, Non-Executive Chairman of ANGLE plc,

commented:

"With two successful ovarian cancer studies, the initiation of

our FDA clinical studies and three global healthcare companies

secured as partners, ANGLE has established world-wide recognition

and potential. The acquisition of downstream analysis technology

complements the Parsortix system and will, in time, allow us to

offer our customers a full 'sample to answer' solution.

We continue to invest heavily to pursue FDA clearance for the

Parsortix system as the first ever FDA cleared clinical device to

harvest intact circulating tumour cells for analysis from patient

blood. Commencement of clinical trials at four prestigious US

cancer centres marks a major step forward for the business."

Details of webcast

Please see

http://www.angleplc.com/investor-information/investor-centre/ for

details.

For further information ANGLE:

ANGLE plc +44 (0) 1483 343434

Andrew Newland, Chief Executive

Ian Griffiths, Finance Director

finnCap Ltd (NOMAD and Joint Broker)

Corporate Finance - Adrian Hargrave, Simon

Hicks, Max Bullen-Smith

Corporate Broking - Alice Lane, Nikita Jain +44 (0)20 7220 0500

WG Partners (Joint Broker)

Nigel Barnes, Nigel Birks, Andrew Craig, Chris

Lee +44 (0) 203 705 9330

FTI Consulting

Simon Conway, Mo Noonan, Stephanie Cuthbert +44 (0) 203 727 1000

Evan Smith, Anne Troy (US) +1 212 850 5612

For Frequently Used Terms, please see the Company's website on

http://www.angleplc.com/the-parsortix-system/glossary/

This announcement contains inside information.

These Preliminary Results may contain forward-looking

statements. These statements reflect the Board's current view, are

subject to a number of material risks and uncertainties and could

change in the future. Factors that could cause or contribute to

such changes include, but are not limited to, the general economic

climate and market conditions, as well as specific factors

including the success of the Group's research and development and

commercialisation strategies, the uncertainties related to

regulatory clearance and the acceptance of the Group's products by

customers.

CHAIRMAN'S STATEMENT

Introduction

ANGLE has strengthened its leading position in the liquid biopsy

market. Two successful ovarian cancer clinical studies were

followed by the successful design and commencement of clinical and

analytical studies in metastatic breast cancer specifically to

support a submission to the FDA in pursuit of FDA marketing

clearance.

ANGLE also acquired the assets of Axela Inc for GBP3.6 million.

The principal asset, the Ziplex platform, provides multiplex gene

expression analysis of cancer cells making it complementary to the

Parsortix system and ultimately allowing ANGLE to offer a full

'sample to answer' solution.

Overview of Financial Results

Revenue and grant income of GBP0.7 million (2017: GBP0.5

million) came mainly from research use of the Parsortix system.

Planned investment in studies to develop and validate the clinical

application and commercial use of the Parsortix system increased,

resulting in operating costs of GBP9.4 million (2017: GBP7.8

million). Thus, the loss for the year correspondingly increased as

expected to GBP7.5 million (2017: GBP6.4 million).

The cash balance was GBP7.6 million at 30 April 2018 (30 April

2017: GBP5.5 million) and an R&D tax credit of GBP1.1 million

was received shortly after the year end. The financial position was

strengthened during the year with a placing of shares with major

institutional investors, which raised GBP15.0 million gross

(GBP14.4 million net of expenses).

Post year end a further GBP12.7 million gross fundraising was

completed (GBP12.0 million net of expenses).

Strategy

ANGLE has made strong progress in its four pronged strategy for

achieving widespread adoption of its Parsortix system in the

emerging multi-billion dollar liquid biopsy market:

1) Completion of rigorous large scale clinical studies run by

leading cancer centres, demonstrating the effectiveness of

different applications of the system in cancer patient care

2) Securing regulatory approval of the system with the emphasis

on FDA clearance as the de facto global gold standard. ANGLE is

seeking to be the first company ever to gain FDA clearance for a

system which harvests circulating tumour cells (CTCs) from blood

for subsequent analysis

3) Establishing a body of published evidence from leading cancer

centres showing the effectiveness of the system through peer

reviewed publications, scientific data and clinical research

evidence, highlighting a wide range of potential applications

4) Establishing partnerships with large healthcare companies for

market deployment and development of multiple other clinical

applications incorporating the Parsortix system.

Progress towards FDA clearance

ANGLE is seeking to become the first ever company to receive FDA

Class II clearance for a product for harvesting intact circulating

tumour cells (CTCs) from patient blood for subsequent analysis. US

regulatory clearance by the FDA is considered the global standard

for approval of medical diagnostic systems and ANGLE believes that

such clearance would provide ANGLE's Parsortix system with a

further competitive differentiation, which would accelerate all

forms of commercial adoption of the system in both research and

clinical settings.

ANGLE has sustained a high level of resource commitment on its

efforts to progress towards FDA clearance over several years.

Preparation for the analytical and clinical studies required to

make a comprehensive submission to the FDA has necessitated an

enormous amount of work to develop, test and finalise the protocols

involved. Optimisation of the techniques used to analyse cells

harvested by the Parsortix system has required the development of

know-how which, now successfully completed, adds to the overall

capability and differentiation of the Parsortix system in the

market.

We are delighted that the FDA clinical study ANG-002 is in

progress with four of the leading US cancer centres enrolling

patients: University of Texas MD Anderson Cancer Center, University

of Rochester Wilmot Cancer Center, University of Southern

California Norris Comprehensive Cancer Center, and Robert H Lurie

Comprehensive Cancer Center Northwestern University.

We are also delighted that the global healthcare company Abbott

has joined the study enabling us to use its proprietary

PathVysion(TM) HER-2 DNA FISH Probe kits.

A key aim for the Company in the new financial year is to

complete the FDA clinical and analytical studies. Whilst the

enrolment of patients and analysis of results are conducted by

independent cancer centres and outside the control of the Company,

current expectations continue to be that both the FDA studies will

complete this year.

Large scale clinical studies

Ovarian cancer clinical application: triaging abnormal pelvic

mass

During the year, the Company's first clinical application for

the Parsortix system was advanced with two clinical studies

designed as a Pelvic Mass Triage (PMT) test to detect the presence

of ovarian cancer in women with an abnormal pelvic mass requiring

surgery.

Both studies reported positively during the year and the

detailed results of the US clinical study were reported at the

Society of Gynecologic Oncology (SGO) Annual Meeting on Women's

Cancer by the Principal Investigator, Dr Richard Moore, Director of

the Gynecologic Oncology Division, University of Rochester Medical

Center Wilmot Cancer Institute on 24 March 2018. The results

demonstrated a correct prediction of cancer with an accuracy (area

under the curve) of 95.1% for the predictive assay. ANGLE's PMT

test achieved higher sensitivity and specificity than any other

test available for the same application.

The excellent performance of ANGLE's Parsortix system in this

large scale clinical study for the detection of ovarian cancer

demonstrates the capability of ANGLE's CTC system to out-perform

current approaches for the detection of ovarian cancer. ANGLE is

now working to optimise this assay by the end of the year and then

complete a further clinical study in 2019/20 to progress

commercialisation. ANGLE estimates that the total addressable

market for its PMT test is worth US$1 billion per annum.

Ziplex downstream analysis technology

Whilst both the 200 patient European and US ovarian studies

outlined above utilised the Parsortix system to harvest cancer

cells from the blood of patients where present, the European study

used traditional PCR (polymerase chain reaction) techniques to

undertake molecular analysis of the harvested cells whereas the US

study used the novel multiplex gene and protein analysis platform,

Ziplex system provided by Axela.

On comparison of the studies, the Ziplex platform was shown to

offer key advantages over other technologies available on the

market including high sensitivity enabling successful use on only a

small number of cancer cells amongst a larger background population

of blood cells and the ability to multiplex a large number (up to

200) of gene expression analyses in a single reaction.

All the Axela assets, including worldwide intellectual property

in relation to the Ziplex platform, were acquired by ANGLE for

GBP3.6 million on 1 November 2017.

The acquisition represents a major strengthening of ANGLE's

position within the liquid biopsy market providing a key

competitive differentiation of owning both a CTC harvesting

technology and a downstream molecular analysis technology to

interrogate the harvested CTCs.

Prostate cancer: blood test alternative to prostate biopsy

During the year Barts Cancer Institute reported in the

peer-reviewed journal, Clinical Cancer Research, results of their

40 patient study, which showed that combining the analysis of

mesenchymal CTCs and megakaryocytes using Parsortix enabled the

identification of patients 10 times more likely to die of their

disease in the short term.

Coupled with Barts' earlier work, this suggests that the use of

the Parsortix system may enable not only the detection of prostate

cancer but also an assessment of its aggressiveness. The latter is

a key point as currently many men have invasive treatment for

prostate cancer which would have remained indolent. It would be a

big step forward in the treatment of prostate cancer if a forward

looking assessment could identify those men who need and those who

do not need invasive treatment.

At present, ANGLE is focusing resources primarily on breast

cancer and ovarian cancer, with prostate cancer receiving smaller

scale investment while plans are being developed. However, a number

of options are being explored to expedite further development in

the prostate cancer area through partnering.

Establishing a body of published evidence

Further strong progress was made this year in establishing a

body of published evidence.

The Company's strategy to secure research use adoption of the

Parsortix system by leading cancer research centres in order to get

third parties driving development of new applications for Parsortix

independent of ANGLE is working very well.

The installed base of Parsortix instruments is continuing to

grow, standing at over 200 at 30 April 2018, up from c. 145 at 30

April 2017. Over 49,000 blood separations have now taken place

using the Parsortix system, up from c. 30,000 at 30 April 2017.

This deployment of Parsortix in research use now means that the

system is widely presented and discussed at leading cancer

conferences around the world and, during the year, paying customers

have developed ground-breaking new research using the system. An

example of this was the breakthrough research presented at the

American Association for Cancer Research (AACR) Annual Meeting 2018

by the Robert H Lurie Comprehensive Cancer Center and the Feinberg

School of Medicine, Northwestern University, Chicago (Northwestern)

providing an optimised workflow for the recovery and culturing of

CTCs from a simple blood test to produce an effective ex-vivo

culture (cells growing outside the patient) of the individual

patient's cancer cells.

The development of CTC cultures is considered one of the hottest

topics in cancer currently and the Principal Researcher, Professor

Massimo Cristofanilli described it as "opening up a new frontier in

the management of breast cancer" as it offers the prospect of

testing cancer drugs outside the patient, avoiding unnecessary

toxic side effects, to determine which will be most effective,

thereby providing the patient with truly personalised cancer

care.

During the year, there were a further six peer-reviewed

publications and numerous posters and presentations at leading

conferences. Publications that have been released publicly are

available at https://angleplc.com/library/publications/. So far 17

separate cancer centres have published uniformly positive reports

on their use of the Parsortix system.

Leading independent cancer centres throughout Europe and North

America using ANGLE's Parsortix system are working on developments

in 21 different cancer types. Developments announced during the

year are summarised following the Chairman's Statement.

Progressing partnerships with large healthcare companies

Large scale deployment of the Parsortix system across numerous

cancer types and application areas requires ANGLE to partner with

large, global healthcare companies to take advantage of their

distribution and sales channels and economic resources.

Discussions are ongoing with companies in relevant fields:

medtech companies, pharma companies, contract research

organisations and reference laboratories (laboratories offering

clinical tests). We expect to see our partnership programme

accelerate as the FDA clearance process progresses.

During the year, three partnerships were signed.

A co-marketing agreement was signed with world-leading molecular

testing company QIAGEN. QIAGEN employs 4,600 people in over 35

countries and has more than 500,000 customers with annual revenues

exceeding US $1.3 billion. The first area of focus is to couple the

Parsortix system with QIAGEN's downstream technologies for use in

prostate and breast cancer research. Protocols are currently being

developed and optimised to allow sales into QIAGEN's established

customer base.

A collaborative research project was signed with Philips, a

global leader in health technology, to develop liquid biopsy

solutions as part of a four year European Union research grant

funded programme worth EUR6.3 million, of which GBP0.4 million will

flow to ANGLE. Philips has selected the Parsortix system as the

only system to be used for harvesting CTCs within the programme.

Breast and rectal cancers are being targeted.

An agreement was signed with global healthcare company Abbott in

which Abbott will supply ANGLE with its proprietary PathVysion

HER-2 DNA FISH Probe kits for ANGLE's ANG-002 FDA study for FISH

(fluorescence in situ hybridization) analysis of circulating tumor

cells (CTCs) in the form of a research grant. The objective of this

end-point is to demonstrate that harvested CTCs can be subjected to

FISH analysis to determine their HER-2 status. Assuming this is

successful, we hope to be able to work with Abbott to extend

PathVysion use into routine blood test analysis as an important

downstream application of the Parsortix system in breast cancer.

Abbott is the global market leader for FISH testing in solid tissue

biopsies, a market estimated to be worth $0.5 billion per annum in

2016 (source: Grand View Research). A positive result in this

clinical study would demonstrate the potential for Abbott to offer

a Parsortix-based product for HER-2 analysis from a routine blood

test.

Outlook

With two successful ovarian cancer studies, the initiation of

our FDA clinical studies and three global healthcare companies

secured as partners, ANGLE has established world-wide recognition

and potential. The acquisition of downstream analysis technology

complements the Parsortix system and will, in time, allow us to

offer our customers a full 'sample to answer' solution.

We continue to invest heavily to pursue FDA clearance for the

Parsortix system as the first ever FDA cleared clinical device to

harvest intact circulating tumour cells for analysis from patient

blood. Commencement of clinical trials at four prestigious US

cancer centres marks a major step forward for the business.

Garth Selvey

Chairman

24 July 2018

Summary: Published research during the year using the Parsortix

system

Leading independent cancer centres throughout Europe and North

America using ANGLE's Parsortix system are working on developments

in 21 different cancer types. Key developments achieved during the

year, which were described in Company announcements at the time,

included:

-- June 2017: MD Anderson demonstrated ability to measure meEGFR

on CTCs in colorectal cancer, which is an indicator of whether a

patient will respond to EGFR inhibitor drugs.

-- June 2017: Barts Cancer Institute's discovery of the role of

megakaryocytes in prostate cancer. ANGLE subsequently acquired a

worldwide exclusive option over the resulting intellectual

property.

-- July 2017: Western University, Canada demonstrated use of

Parsortix in mouse models of human cancer.

-- September 2017: Heinrich Heine University Duesseldorf

published in the International Journal of Molecular Science work

showing the Parsortix system captures clinically relevant CTCs in

the waste of antibody-based CTC systems (i.e. cells missed by

competing systems).

-- October 2017: Heinrich Heine University Duesseldorf

demonstrated the ability to culture CTCs (grow the cells) harvested

from DLA blood product.

-- October 2017: University of Maryland demonstrated the use of

live CTCs harvested from patient blood to test the efficacy of

drugs outside the patient by observing the response of the

micro-tentacles on the living cancer cell surface.

-- October 2017: University Hospital Muenster published results

evaluating four CTC systems in clear cell renal carcinoma (kidney

cancer) showing that Parsortix out-performed all the other

systems.

-- October 2017: The Center for Women's Health Tuebingen,

Germany demonstrated a protocol for harvesting disseminated tumour

cells (DTCs) from cancer patient bone marrow samples.

-- November 2017: Medical University of Vienna published

peer-reviewed research in the journal Oncotarget showing molecular

characterisation of CTCs with positive results in 95% primary and

100% recurrent gynaecological cancers and 92% in metastatic breast

cancer.

-- December 2017: University of Southern California Norris

Comprehensive Cancer Center demonstrated comparable gene expression

of CTCs obtained from a simple blood test when compared to the

invasive tissue biopsy of the metastatic site. This will be an

important potential use of the Parsortix system post FDA

clearance.

-- January 2018: University of Hamburg, Medical University of

Graz and Stockholm University demonstrated measurement of the

expression of ARV7 (androgen receptor splice variant 7) in CTCs,

which is correlated with prostate cancer patient response to novel

hormone therapy (NHT) drugs such as Enzalutamide and

Abiraterone.

-- April 2018: Robert H Lurie Comprehensive Cancer Center and

the Feinberg School of Medicine, Northwestern University presented

an optimised work flow for culturing CTCs from blood of metastatic

breast cancer patients at AACR 2018. This is now an area of focus

for use of Parsortix post FDA clearance.

-- May 2018: ANGLE and QIAGEN jointly presented protocols for

the measurement of ARV7 in prostate cancer blood.

ANGLE PLC

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEARED 30 APRIL 2018

2018 2017

(Unaudited) (Audited)

Note GBP'000 GBP'000

Revenue 628 498

Cost of sales (169) (123)

------------ ----------

Gross profit 459 375

Other operating income 52 -

Operating costs (9,444) (7,810)

------------ ----------

Operating profit/(loss) (8,933) (7,435)

Net finance income/(costs) 8 25

------------ ----------

Profit/(loss) before tax (8,925) (7,410)

Tax (charge)/credit 5 1,387 1,018

------------ ----------

Profit/(loss) for the year (7,538) (6,392)

Other comprehensive income/(loss)

Items that may be subsequently reclassified to profit

or loss:

Exchange differences on translating

foreign operations (99) 139

------------ ----------

Other comprehensive income/(loss) (99) 139

Total comprehensive income/(loss)

for the year (7,637) (6,253)

============ ==========

Profit/(loss) for the year attributable

to:

Owners of the parent (7,556) (6,567)

Non-controlling interests 18 175

Profit/(loss) for the year (7,538) (6,392)

============ ==========

Total comprehensive income/(loss)

for the year attributable to:

Owners of the parent (7,702) (6,414)

Non-controlling interests 65 161

Total comprehensive income/(loss)

for the year (7,637) (6,253)

============ ==========

Earnings/(loss) per share attributable

to owners of the parent

Basic and Diluted (pence per share) 6 (10.09) (8.95)

All activity arose from continuing

operations.

ANGLE PLC

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 30 APRIL 2018

Note 2018 2017

(Unaudited) (Audited)

GBP'000 GBP'000

Non-current assets

Intangible assets 7 5,588 1,918

Property, plant and equipment 1,475 824

------------ -----------

Total non-current assets 7,063 2,742

------------ -----------

Current assets

Inventories 599 665

Trade and other receivables 828 714

Taxation 2,147 1,261

Cash and cash equivalents 7,645 5,536

------------ -----------

Total current assets 11,219 8,176

------------ -----------

Total assets 18,282 10,918

------------ -----------

Current liabilities

Trade and other payables (2,398) (2,112)

------------ -----------

Total current liabilities (2,398) (2,112)

------------ -----------

Total liabilities (2,398) (2,112)

------------ -----------

Net assets 15,884 8,806

============ ===========

Equity

Share capital 9 11,709 7,482

Share premium 43,449 33,285

Share-based payments reserve 1,072 822

Other reserve 2,553 2,553

Translation reserve (14) 132

Retained earnings (42,129) (34,647)

ESOT shares (102) (102)

------------ -----------

Equity attributable to owners of the parent 16,538 9,525

------------ -----------

Non-controlling interests (654) (719)

Total equity 15,884 8,806

------------ -----------

ANGLE PLC

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE YEARED 30 APRIL 2018

2018 2017

(Unaudited) (Audited)

GBP'000 GBP'000

Operating activities

Profit/(loss) before tax from continuing

operations (8,925) (7,410)

Adjustments for:

Depreciation of property, plant and equipment 446 267

(Profit)/loss on disposal of property,

plant and equipment 1 5

Amortisation and impairment of intangible

assets 344 245

Share-based payments 324 254

Exchange differences (33) (50)

Net finance (income)/costs (8) (25)

------------ ----------

Operating cash flows before movements in

working capital (7,851) (6,714)

(Increase)/decrease in inventories (83) (575)

(Increase)/decrease in trade and other

receivables (106) (290)

Increase/(decrease) in trade and other

payables 727 131

------------ ----------

Operating cash flows (7,313) (7,448)

Research and development tax credits received 501 65

Net cash from/(used in) operating activities (6,812) (7,383)

Investing activities

Purchase of property, plant and equipment (1,031) (70)

Purchase of intangible assets (830) (374)

Acquisition of assets and business (Note

8) (3,613) -

Interest received 8 26

------------ ----------

Net cash from/(used in) investing activities (5,466) (418)

Financing activities

Net proceeds from issue of share capital 14,391 9,570

------------ ----------

Net cash from/(used in) financing activities 14,391 9,570

Net increase/(decrease) in cash and cash

equivalents from continuing operations 2,113 1,769

Discontinued operations

Net cash from/(used in) operating activities - (5)

Net increase/(decrease) in cash and cash

equivalents from discontinued operations - (5)

Net increase/(decrease) in cash and cash

equivalents 2,113 1,764

Cash and cash equivalents at start of year 5,536 3,764

Effect of exchange rate fluctuations (4) 8

------------ ----------

Cash and cash equivalents at end of year 7,645 5,536

============ ==========

ANGLE PLC

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE YEARED 30 APRIL 2018

------------ Equity attributable

to owners of the parent -----------------

Share-based

Share Share payments Other Translation

capital premium reserve reserve reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 May 2016 (Audited) 5,898 25,299 629 2,553 (21)

For the year to 30 April 2017

-------------------------------------------------- ----------- ------------ ------------ ----------- ------------

Consolidated profit/(loss)

Other comprehensive income/(loss):

Exchange differences on translating foreign

operations 153

-------------------------------------------------- ----------- ------------ ------------ ----------- ------------

Total comprehensive income/(loss) 153

Issue of shares (net of costs) 1,584 7,986

Share-based payments 254

Released on exercise (1)

Released on forfeiture (60)

___ ___

___ ______ ___ _______ ___ ______ ______ ______

At 30 April 2017 (Audited) 7,482 33,285 822 2,553 132

For the year to 30 April 2018

-------------------------------------------------- ----------- ------------ ------------ ----------- ------------

Consolidated profit/(loss)

Other comprehensive income/(loss):

Exchange differences on translating foreign

operations (146)

-------------------------------------------------- ----------- ------------ ------------ ----------- ------------

Total comprehensive income/(loss) (146)

Issue of shares (net of costs) 4,227 10,164

Share-based payments 324

Released on forfeiture (74)

___ ___

___ ______ ___ _______ ___ ______ ______ ______

At 30 April 2018 (Unaudited) 11,709 43,449 1,072 2,553 (14)

========== ========== ========== ========== =========

---------- Equity attributable to owners of the parent -----

Total Non-

Retained ESOT Shareholders' controlling Total

earnings shares equity interests equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 May 2016

(Audited) (28,141) (102) 6,115 (880) 5,235

For the year to 30

April 2017

----------------------- --------------------- ------------------ ---------------------- ------------ ------------

Consolidated

profit/(loss) (6,567) (6,567) 175 (6,392)

Other comprehensive

income/(loss):

Exchange

differences on

translating

foreign

operations 153 (14) 139

----------------------- --------------------- ------------------ ---------------------- ------------ ------------

Total comprehensive

income/(loss) (6,567) (6,414) 161 (6,253)

Issue of shares (net

of costs) 9,570 9,570

Share-based payments 254 254

Released on exercise 1 - -

Released on

forfeiture 60 - -

___ ________ ___ ______ ___ _______ __ _______ ___ _______

At 30 April 2017

(Audited) (34,647) (102) 9,525 (719) 8,806

For the year to 30

April 2018

----------------------- --------------------- ------------------ ---------------------- ------------ ------------

Consolidated

profit/(loss) (7,556) (7,556) 18 (7,538)

Other comprehensive

income/(loss):

Exchange

differences on

translating

foreign

operations (146) 47 (99)

----------------------- --------------------- ------------------ ---------------------- ------------ ------------

Total comprehensive

income/(loss) (7,556) (7,702) 65 (7,637)

Issue of shares (net

of costs) 14,391 14,391

Share-based payments 324 324

Released on

forfeiture 74 - -

___ ________ ___ ______ ___ _______ ___ ______ ___ _______

At 30 April 2018

(Unaudited) (42,129) (102) 16,538 (654) 15,884

=========== ========== ========== ========== ==========

ANGLE PLC

NOTES TO THE PRELIMINARY ANNOUNCEMENT

FOR THE YEARED 30 APRIL 2018

1 Preliminary announcement

The preliminary announcement set out above does not constitute

ANGLE plc's statutory Financial Statements for the years ended 30

April 2018 or 2017 within the meaning of section 434 of the

Companies Act 2006.

The financial information for the year ended 30 April 2018 is

unaudited and an auditor's report has not yet been issued.

Statutory audited financial statements for the year will be

finalised on the basis of the financial information presented by

the directors in this preliminary announcement.

The financial information for the year ended 30 April 2017 is

derived from the audited financial statements for that year, which

have been delivered to the registrar of companies, and the

auditor's report on the consolidated Financial Statements for the

year ended 30 April 2017 is unqualified and does not contain

statements under s498(2) or (3) of the Companies Act 2006.

The format of the financial information has been amended to

incorporate "Other operating income" (being grant income), the

acquisition completed in the year, and a re-ordering of the

Consolidated Statement of Financial Position. The accounting

policies used for the year ended 30 April 2018 are unchanged from

those used for the statutory Financial Statements for the year

ended 30 April 2017, except as referred to in Note 2. The 2018

statutory accounts will be delivered to the Registrar of Companies

following the Company's Annual General Meeting.

2 Compliance with accounting standards

While the financial information included in this preliminary

announcement has been computed in accordance with the measurement

principles of IFRS, this announcement does not itself contain

sufficient information to comply with IFRS.

Accounting standards adopted in the year

No new accounting standards that have become effective and

adopted in the year have had a significant effect on the Group's

Financial Statements.

Accounting standards issued but not yet effective

At the date of authorisation of the Financial Statements, there

were a number of other Standards and Interpretations (International

Financial Reporting Interpretation Committee - IFRIC) which were in

issue but not yet effective, and therefore have not been applied in

these Financial Statements. Other than for IFRS 15, the Directors

have not yet assessed the impact of the adoption of these standards

and interpretations for future periods.

IFRS 15 Revenue from Contracts with Customers (effective for

accounting periods commencing on or after 1 January 2018) will be

adopted by ANGLE in the next financial year. During the year, ANGLE

have reviewed all income streams against the requirements of IFRS

15. The review concluded that there were no material contracts

which would require different treatment under IFRS 15 versus

current standards. Consequently, the introduction of IFRS 15 is not

expected to materially impact the financial statements in future

periods other than additional disclosure requirements.

Accounting policies have been added and/or updated to address

acquisition accounting in relation to business combinations,

acquired intangible assets and goodwill. A number of other

accounting policies have been slightly amended and updated for

readability.

3 Going concern

The Group's business activities, together with the factors

likely to affect its future development, performance and financial

position are set out in the Chairman's Statement.

The Directors have prepared and reviewed the financial

projections for the 12 month period from the date of signing of

these Financial Statements. Based on the level of existing cash,

agreed funding, the projected income and expenditure (the timing of

some of which is at the Group's discretion) and other potential

sources of funding, the Directors have a reasonable expectation

that the Company and Group have adequate resources to continue in

business for the foreseeable future. Accordingly the going concern

basis has been used in preparing the Financial Statements.

4 Critical accounting estimates and judgements

The preparation of the Financial Statements requires the use of

estimates, assumptions and judgements that affect the reported

amounts of assets and liabilities at the date of the Financial

Statements and the reported amounts of revenues and expenses during

the reporting period. Although these estimates, assumptions and

judgements are based on the Directors' best knowledge of the

amounts, events or actions, and are believed to be reasonable,

actual results ultimately may differ from those estimates.

The estimates, assumptions and judgements that have a

significant risk of causing a material adjustment to the carrying

amounts of assets and liabilities are described below.

Valuation and amortisation of internally-generated intangible

assets (Note 7)

IAS 38 Intangible Assets contains specific criteria that if met

mean development expenditure must be capitalised as an internally

generated intangible asset. Judgements are required in both

assessing whether the criteria are met (for example,

differentiating between enhancements and maintenance) and then in

applying the rules (for example, determining an estimated useful

life). Intangible assets are amortised over their useful lives.

Useful lives are assessed by reference to observable data (for

example, remaining patent life) and taking into consideration

specific product characteristics (for example, product life cycle)

and market characteristics (for example, estimates of the period

that the assets will generate revenue). Each of these factors is

periodically reviewed for appropriateness. Changes to estimates in

useful lives may result in significant variations in the

amortisation charge.

Business combinations - identification, valuation and

amortisation of acquisition-related assets (Notes 7 and 8)

In accounting for business combinations, the Group is required

to determine the fair value of the identifiable assets acquired and

allocate the purchase price accordingly. In determining the fair

value of the intangible assets acquired, judgement is required in

determining and valuing the identifiable intangible assets through

the use of appropriate valuation techniques and discount rates.

Assumptions on future cash flows, length of life of the assets,

reproduction and replacement cost are, where possible, based on

information available to management at the time of acquisition.

Future cash flows include significant subjective assumptions in

relation to market demand, success in obtaining regulatory

clearance, pricing, levels of reimbursement and gross margins and

getting in national guidelines. The Group considers that for each

of these variables there is a range of reasonably possible

alternative values, which results in a range of fair value

estimates, and determining values requires considerable judgement

and there remain inherent uncertainties in forecasting. Changes to

key assumptions may result in significant variations to fair values

of the identifiable assets. The amount of goodwill initially

recognised is dependent on the allocation of the fair value of the

identifiable assets acquired.

Impairment (Note 7)

The Group is required to review, at least annually, whether

there are indications (events or changes in circumstances) that

intangible assets have suffered impairment and that the carrying

amount may exceed the recoverable amount. If there are indications

of impairment then an impairment review is undertaken. The

recoverable amount is the higher of the asset's fair value less

costs to sell and its value-in-use. The value-in-use method

requires the estimation of future cash flows and the selection of a

suitable discount rate in order to calculate the present value of

these cash flows. When reviewing intangible assets for impairment

the Group has had to make various assumptions and estimates of

individual components and their potential value and potential

impairment impact. The Group considers that for each of these

variables there is a range of reasonably possible alternative

values, which results in a range of fair value estimates. None of

these estimates of fair value is considered more appropriate or

relevant than any other and therefore determining a fair value

requires considerable judgement.

Share-based payments

In calculating the fair value of equity-settled share-based

payments the Group uses an options pricing model. The Directors are

required to exercise their judgement in choosing an appropriate

options pricing model and determining input parameters that may

have a material effect on the fair value calculated. These input

parameters include, among others, expected volatility, expected

life of the options taking into account exercise restrictions and

behavioural considerations of employees, the number of options

expected to vest and liquidity discounts.

Research and development tax credit (Note 5)

The Directors make their best estimate of qualifying R&D

expenditure to calculate the R&D tax credit. The interpretation

of qualifying expenditure requires judgement.

5 Tax

The Group undertakes research and development activities. In the

UK these activities qualify for tax relief and result in research

and development tax credits.

6 Earnings/(loss) per share

The basic and diluted earnings/(loss) per share is calculated by

dividing the after tax loss for the year attributable to the owners

of the parent of GBP7.6 million (2017: GBP6.6 million).

In accordance with IAS 33 Earnings per share 1) the "basic"

weighted average number of ordinary shares calculation excludes

shares held by the Employee Share Ownership Trust (ESOT) as these

are treated as treasury shares and 2) the "diluted" weighted

average number of ordinary shares calculation considers potentially

dilutive ordinary shares from instruments that could be converted.

Share options are potentially dilutive where the exercise price is

less than the average market price during the period. Due to the

losses in 2018 and 2017, share options are non-dilutive for those

years as adding them would have the effect of reducing the loss per

share and therefore the diluted loss per share is equal to the

basic loss per share.

The basic and diluted earnings/(loss) per share are based on

95,500,762 weighted average ordinary 10p shares (2017:

73,350,486).

7 Intangible assets

Total

GBP'000

Cost

At 1 May 2016 1,787

Additions 672

Disposals (5)

Exchange movements 194

At 30 April 2017 2,648

Additions 651

Acquisition of assets (Note

8) 3,421

Disposals (1)

Exchange movements (105)

At 30 April 2018 6,614

=========

Amortisation and impairment

At 1 May 2016 441

Charge for the year 156

Disposals (5)

Impairment 89

Exchange movements 49

At 30 April 2017 730

Charge for the year 341

Disposals (1)

Impairment 3

Exchange movements (47)

At 30 April 2018 1,026

=========

Net book value

At 30 April 2018 5,588

=========

At 30 April 2017 1,918

=========

Intangible assets arising as a result of the business

combination are described in Note 8 and comprise the fair value of

the identifiable intangible assets and the goodwill arising at the

date of acquisition. Identifiable intangible assets are amortised

over their estimated useful economic life. Goodwill is deemed to

have an indefinite useful life and is not amortised.

Internally-generated intangible assets comprises intellectual

property (patents) and product development costs capitalised in

accordance with IAS 38 Intangible Assets. Capitalised product

development costs are directly attributable costs comprising cost

of materials, specialist contractor costs, labour and overheads.

Product development costs are amortised over their estimated useful

lives commencing when the related new product is in commercial

production. Development costs not meeting the IAS 38 criteria for

capitalisation continue to be expensed through the Statement of

Comprehensive Income as incurred.

The carrying value of intangible assets is reviewed for

indications of impairment whenever events or changes in

circumstances indicate that the carrying value may exceed the

recoverable amount. The recoverable amount is the higher of the

asset's fair value less costs to sell and its "value-in-use". The

key assumptions to assess value-in-use are the estimated useful

economic life, future revenues, cash flows and the discount rate to

determine the net present value of these cash flows. Where

value-in-use exceeds the carrying value then no impairment is made.

Where value-in-use is less than the carrying value then an

impairment charge is made.

Amortisation and impairment charges are charged to operating

costs in the Consolidated Statement of Comprehensive Income.

8 Acquisition

On 1 November 2017, the Group acquired the assets and business

of Axela Inc, a private corporation based in Toronto, Canada, with

a novel multiplex gene and protein analysis platform. The assets

and business were acquired as the Axela technology had been used

over a two year period in ANGLE's US ovarian cancer studies and had

shown key advantages over other established downstream analysis

technologies on the market. The acquisition also represented a

major strengthening of ANGLE's position within the liquid biopsy

market providing a key competitive differentiation of owning both a

CTC harvesting technology and a downstream molecular analysis

technology thereby enabling a "sample-to-answer" solution, and also

allowing ANGLE to capture more of the value chain. The Chairman's

Statement provides more details.

The deal was structured as an asset purchase whereby specific

assets were purchased, liabilities were excluded and key people

transferred such that the business could continue. The transaction

is treated as a business combination within the scope of IFRS 3

Business Combinations.

The amounts recognised in respect of the identifiable assets

acquired on 1 November 2017 are as set out in the table below:

Fair value

GBP'000

Intangible assets 3,421

Property, plant and equipment 89

Inventories 86

Other tangible assets 17

-----------

Total consideration 3,613

===========

The total consideration was paid entirely in cash in full and

final settlement in the amount of CAD$6.2 million (GBP3.6

million).

The acquired intangible assets comprise separately identifiable

assets and goodwill.

The acquired identifiable intangible assets primarily relate to

technology assets, comprising patents, developed and in-process

products, documented trade secrets such as technical know-how and

manufacturing and operating procedures, methods and processes.

The goodwill arising represents the highly knowledgeable,

skilled and specialised workforce, cost savings and operating

synergies expected to result from having a larger R&D base in

North America, the ability to access new markets and the advantages

of the combination of Parsortix and Ziplex technologies enabling

"sample-to-answer".

The fair value of acquired property, plant and equipment

primarily relates to the residual values of the assets

acquired.

The fair value of acquired inventories represents inventories

valued at the sales price less provision to take account of the

condition of the inventory and any costs needed to bring the

product up to current regulations and standards.

Acquisition-related expenses of GBP0.1 million (2017: GBP0.3

million) are included in operating costs in the Consolidated

Statement of Comprehensive Income, which includes internal costs as

well as expenditure on market research, IP advice, legal and

accounting services.

Included in the Consolidated Statement of Comprehensive Income

in the period 1 November 2017 to 30 April 2018 for the newly

acquired business was revenue of GBP0.1 million and a loss before

tax of GBP0.6 million.

9 Share capital

The Company has one class of ordinary shares which carry no

right to fixed income and at 30 April 2018 had 117,086,522 ordinary

shares of GBP0.10 each allotted, called up and fully paid (2017:

74,815,774).

The Company issued 1) 7,481,570 new ordinary shares with a

nominal value of GBP0.10 at an issue price of GBP0.375 per share in

a subscription for shares realising gross proceeds of GBP2.8

million and 2) 34,789,178 new ordinary shares with a nominal value

of GBP0.10 at an issue price of GBP0.35 per share in a placing and

subscription for shares realising gross proceeds of GBP12.2

million. Total gross proceeds of the fundraise were GBP15.0

million. The shares were admitted to trading on AIM in October and

November 2017 respectively.

Post the reporting date the Company completed a Fundraise. The

General Meeting of 18 July 2018 approved the transaction. HMRC

Advance Assurance has now been received and the transaction is in

the process of closing. The proposed Placing and Subscription will

result in the issue of 25,400,000 new ordinary shares with a

nominal value of GBP0.10 at an issue price of GBP0.50 per share in

a placing and subscription for shares realising gross proceeds of

GBP12.7 million. Shares are expected to be admitted to trading on

AIM in late July and/or early August.

10 Shareholder communications

Copies of this announcement are posted on the Company's website

www.ANGLEplc.com.

The Annual General Meeting of the Company will be held at 2:00pm

on Tuesday 30 October 2018 at ANGLE plc, 10 Nugent Road, the Surrey

Research Park, Guildford, GU2 7AF. Notice of the meeting will be

enclosed with the audited Statutory Financial Statements.

The audited Statutory Financial Statements for the year ended 30

April 2018 are expected to be distributed to shareholders by 5

October 2018 and will subsequently be available on the Company's

website or from the registered office, 10 Nugent Road, Surrey

Research Park, Guildford, GU2 7AF.

This preliminary announcement was approved by the Board on 24

July 2018.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR FMGZNNDGGRZM

(END) Dow Jones Newswires

July 25, 2018 02:00 ET (06:00 GMT)

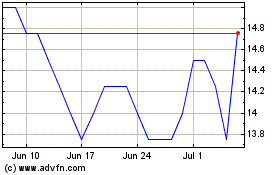

Angle (LSE:AGL)

Historical Stock Chart

From Mar 2024 to Apr 2024

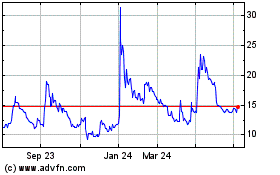

Angle (LSE:AGL)

Historical Stock Chart

From Apr 2023 to Apr 2024