TIDMAGL

RNS Number : 5234S

Angle PLC

25 June 2018

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS

RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN

WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM THE

UNITED STATES, AUSTRALIA, CANADA, JAPAN, THE REPUBLIC OF SOUTH

AFRICA, THE REPUBLIC OF IRELAND OR ANY OTHER JURISDICTION IN WHICH

SUCH RELEASE, PUBLICATION OR DISTRIBUTION WOULD BE UNLAWFUL

("RESTRICTED JURISDICTION"). THIS ANNOUNCEMENT IS NOT AN OFFER OF

SECURITIES FOR SALE IN THE UNITED STATES. THE SECURITIES DISCUSSED

HEREIN HAVE NOT BEEN AND WILL NOT BE REGISTERED UNDER THE US

SECURITIES ACT OF 1933, AS AMED (THE "US SECURITIES ACT") AND MAY

NOT BE OFFERED OR SOLD IN THE UNITED STATES ABSENT REGISTRATION OR

AN EXEMPTION FROM REGISTRATION UNDER THE US SECURITIES ACT. NO

PUBLIC OFFERING OF THE SECURITIES DISCUSSED HEREIN IS BEING MADE IN

THE UNITED STATES AND THE INFORMATION CONTAINED HEREIN DOES NOT

CONSTITUTE AN OFFERING OF SECURITIES FOR SALE IN THE UNITED STATES,

AUSTRALIA, CANADA, JAPAN OR THE REPUBLIC OF SOUTH AFRICA.

FURTHER, THIS ANNOUNCEMENT IS MADE FOR INFORMATION PURPOSES ONLY

AND DOES NOT CONSTITUTE AN OFFER TO SELL OR ISSUE OR SOLICITATION

TO BUY, SUBSCRIBE FOR OR OTHERWISE ACQUIRE SHARES IN ANGLE PLC IN

ANY JURISDICTION IN WHICH ANY SUCH OFFER OR SOLICITATION WOULD BE

UNLAWFUL.

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) No 596/2014 ("MAR"). Prior to

publication, certain information contained within this Announcement

was deemed to constitute inside information for the purposes of

Article 7 of MAR.

25 June 2018

ANGLE plc

("ANGLE" or the "Company")

Results of Fundraising

ANGLE plc (AIM:AGL OTCQX:ANPCY), a world-leading liquid biopsy

company, is pleased to announce that, further to the announcement

made earlier today, the Company has increased the size of the

Fundraising and successfully raised gross proceeds of GBP12.7

million with new and existing investors consisting of 8,400,000

EIS/VCT Placing Shares, 15,443,282 General Placing Shares and

1,556,718 Subscription Shares all at a price of 50 pence per New

Ordinary Share (the "Issue Price"). The Issue Price represents a

discount of approximately 8.76 per cent to the closing mid-market

price of an Ordinary Share of 54.8 pence on 22 June 2018.

A circular to Shareholders is expected to be posted shortly,

including details of the General Meeting and the Resolutions and

will be available on the Company's website, www.angleplc.com.

The General Meeting will be held at 10.00 a.m. on 18 July 2018

at the offices of the Company at 10 Nugent Road, The Surrey

Research Park, Guildford, Surrey GU2 7AF.

Related Party Transactions

Jupiter Asset Management Limited ("Jupiter") has agreed to

subscribe for 3,600,000 Placing Shares as part of the Placing.

Jupiter is a related party of the Company for the purposes of the

AIM Rules by virtue of their status as a substantial shareholder of

the Company. The Directors consider, having consulted with the

Company's nominated adviser, finnCap, that the terms of the Placing

with such related party are fair and reasonable insofar as the

Company's shareholders are concerned.

General Meeting and Admission

The Fundraising is conditional, inter alia, upon the passing of

the Resolutions at the General Meeting and upon the relevant

Admission becoming effective (placing of the EIS/VCT Placing Shares

is conditional upon, inter alia, receipt of Advanced Assurance from

HMRC in respect of VCT and EIS qualification and EIS/VCT Admission

and the subscription of the General Placing Shares and Subscription

Shares is conditional upon, inter alia, EIS/VCT Admission and

General Admission).

Upon Admission the Enlarged Issued Share Capital is expected to

be 142,486,522 Ordinary Shares. On this basis, the New Ordinary

Shares will represent approximately 17.83 per cent. of the

Company's Enlarged Issued Share Capital.

Application will be made for the 25,400,000 New Ordinary Shares

to be admitted to trading on AIM. Subject to the Resolutions having

been passed and the Placing Agreement not having been terminated in

accordance with its terms, it is anticipated that:

-- admission of the 8,400,000 EIS/VCT Placing Shares will occur

at 8.00 a.m. on or around 19 July 2018; and

-- admission of the 15,443,282 General Placing Shares and

1,556,718 Subscription Shares will occur at 8.00 a.m. on or around

20 July 2018.

Capitalised terms not otherwise defined in this announcement

shall have the same meaning ascribed to such terms in the

announcement released earlier today unless the context requires

otherwise.

For further information on ANGLE:

ANGLE plc +44 (0) 1483 343434

Andrew Newland, Chief Executive

Ian Griffiths, Finance Director

finnCap Ltd (NOMAD and Joint Broker)

Corporate Finance - Adrian Hargrave,

Simon Hicks, Max Bullen-Smith

Corporate Broking - Alice Lane, +44 (0) 20 7220 0500

WG Partners (Joint Broker)

Nigel Barnes, Nigel Birks, Andrew Craig,

Chris Lee +44 (0) 203 705 9330

FTI Consulting

Simon Conway, Mo Noonan, Stephanie Cuthbert +44 (0) 203 727 1000

Evan Smith, Anne Troy (US) +1 212 850 5612

Important notice

Neither the contents of the Company's website nor the contents

of any website accessible from hyperlinks on the Company's website

(or any other website) is incorporated into, or forms part of, this

announcement.

This announcement does not constitute, or form part of, a

prospectus relating to the Company, nor does it constitute or

contain any invitation or offer to any person, or any public offer,

to subscribe for, purchase or otherwise acquire any shares in the

Company or advise persons to do so in any jurisdiction, nor shall

it, or any part of it form the basis of or be relied on in

connection with any contract or as an inducement to enter into any

contract or commitment with the Company.

The content of this announcement has not been approved by an

authorised person within the meaning of the Financial Services and

Markets Act 2000 ("FSMA"). This announcement has been issued by and

is the sole responsibility of the Company. The information in this

announcement is subject to change.

This announcement is not an offer of securities for sale into

the United States. The securities referred to herein have not been

and will not be registered under the U.S. Securities Act of 1933,

as amended (the "Securities Act"), and may not be offered or sold,

directly or indirectly, in or into the United States, except

pursuant to an applicable exemption from registration. No public

offering of securities is being made in the United States. This

announcement is not for release, publication or distribution,

directly or indirectly, in or into the United States, Australia,

Canada, the Republic of South Africa, Japan, the Republic of

Ireland or any jurisdiction where to do so might constitute a

violation of local securities laws or regulations (a "Prohibited

Jurisdiction"). This announcement and the information contained

herein are not for release, publication or distribution, directly

or indirectly, to persons in a Prohibited Jurisdiction unless

permitted pursuant to an exemption under the relevant local law or

regulation in any such jurisdiction.

finnCap is authorised and regulated by the Financial Conduct

Authority in the United Kingdom. finnCap is acting solely as

nominated adviser, joint broker and joint bookrunner exclusively

for the Company and no one else in connection with the contents of

this announcement and will not regard any other person (whether or

not a recipient of this announcement) as its client in relation to

the contents of this announcement nor will it be responsible to

anyone other than the Company for providing the protections

afforded to its clients or for providing advice in relation to the

contents of this announcement. Apart from the responsibilities and

liabilities, if any, which may be imposed on finnCap by FSMA or the

regulatory regime established thereunder, finnCap accepts no

responsibility whatsoever, and makes no representation or warranty,

express or implied, for the contents of this announcement including

its accuracy, completeness or verification or for any other

statement made or purported to be made by it, or on behalf of it,

the Company or any other person, in connection with the Company and

the contents of this announcement, whether as to the past or the

future. finnCap accordingly disclaims all and any liability

whatsoever, whether arising in tort, contract or otherwise (save as

referred to above), which it might otherwise have in respect of the

contents of this announcement or any such statement.

WG Partners is authorised and regulated by the Financial Conduct

Authority in the United Kingdom. WG Partners is acting solely as

joint broker and joint bookrunner exclusively for the Company and

no one else in connection with the contents of this announcement

and will not regard any other person (whether or not a recipient of

this announcement) as its client in relation to the contents of

this announcement nor will it be responsible to anyone other than

the Company for providing the protections afforded to its clients

or for providing advice in relation to the contents of this

announcement. Apart from the responsibilities and liabilities, if

any, which may be imposed on WG Partners by FSMA or the regulatory

regime established thereunder, WG Partners accepts no

responsibility whatsoever, and makes no representation or warranty,

express or implied, for the contents of this announcement including

its accuracy, completeness or verification or for any other

statement made or purported to be made by it, or on behalf of it,

the Company or any other person, in connection with the Company and

the contents of this announcement, whether as to the past or the

future. WG Partners accordingly disclaims all and any liability

whatsoever, whether arising in tort, contract or otherwise

(save

as referred to above), which it might otherwise have in respect

of the contents of this announcement or any such statement.

In connection with the Placing, finnCap, WG Partners and their

respective affiliates, acting as investors for their own accounts,

may subscribe for or purchase ordinary shares in the Company

("Ordinary Shares") and in that capacity may retain, purchase,

sell, offer to sell or otherwise deal for their own accounts in

such Ordinary Shares and other securities of the Company or related

investments in connection with the Placing or otherwise.

Accordingly, references to the Ordinary Shares being offered,

subscribed, acquired, placed or otherwise dealt in should be read

as including any offer to, or subscription, acquisition, placing or

dealing by finnCap, WG Partners and any of their respective

affiliates acting as investors for their own accounts. In addition,

finnCap, WG Partners or their respective affiliates may enter into

financing arrangements and swaps in connection with which it or its

affiliates may from time to time acquire, hold or dispose of

Ordinary Shares. Neither finnCap nor WG Partners has any intention

to disclose the extent of any such investment or transactions

otherwise than in accordance with any legal or regulatory

obligations to do so.

Forward-looking Statements

This announcement includes "forward-looking statements" which

include all statements other than statements of historical facts,

including, without limitation, those regarding the Company's

business strategy, plans and objectives of management for future

operations, or any statements proceeded by, followed by or that

include the words "targets", "believes", "expects", "aims",

"intends", "will", "may", "anticipates", "would", "could" or

similar expressions or negatives thereof. Such forward-looking

statements involve known and unknown risks, uncertainties and other

important factors beyond the Company's control that could cause the

actual results, performance or achievements of the Company to be

materially different from future results, performance or

achievements expressed or implied by such forward-looking

statements. Such forward-looking statements are based on numerous

assumptions regarding the Company's present and future business

strategies and the environment in which the Company will operate in

the future. No undue reliance should be placed upon forward-looking

statements. These forward looking statements speak only as at the

date of this announcement. The Company expressly disclaims any

obligation or undertaking to disseminate any updates or revisions

to any forward-looking statements contained herein to reflect any

change in the Company's expectations with regard thereto or any

change in events, conditions or circumstances on which any such

statements are based, unless required to do so by applicable law or

the AIM Rules for Companies.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IOESEEFWIFASEFM

(END) Dow Jones Newswires

June 25, 2018 13:20 ET (17:20 GMT)

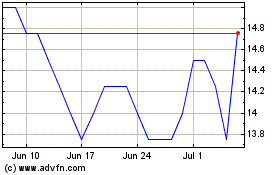

Angle (LSE:AGL)

Historical Stock Chart

From Mar 2024 to Apr 2024

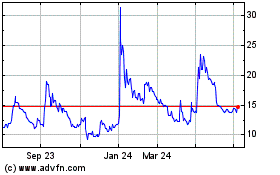

Angle (LSE:AGL)

Historical Stock Chart

From Apr 2023 to Apr 2024