TIDMAFN

RNS Number : 6091H

ADVFN PLC

25 March 2020

25 March 2020

For immediate release

ADVFN PLC

("ADVFN" or the "Group")

Unaudited Interim Results for the Six Months Ended 31 December

2019

ADVFN today announces its unaudited interim results for the six

months ended 31 December 2019 (the "Period").

Chief Executive's Statement

As previously reported, sales during the first half were

generally flat, although in the lead up to Brexit, advertising

sales volumes were below management's expectations while traffic

levels and subscription levels remained unaffected. The impact of

this lower than expected advertising demand in the first half can

be seen in the reported loss, which is further increased by higher

overheads which represented an effort to grow sales during the

Autumn of 2019.

The uncertainty created by this change to our revenue from

advertising led us to significantly adjust our cost base at the end

of the year and in January. As it turns out, with the uncertain and

adverse impact of the Covid-19 on markets and general business

activity, this pre-emptive action has proved to be fortunate.

Our reaction to the onset of Covid-19 has been to examine the

potential impact of the virus on our operations and our market. We

need to ensure that the welfare of our staff and the continued

provision of our service is our priority. We are currently a

company of home-based staff and we have looked at reasonable

worst-case scenarios and discussed potential mitigating strategies

to ensure the continuity of our service.

The Board believes it has reduced its cost base sufficiently to

ride out the current business environment and we are beginning to

see the return of advertising revenues. We are also experiencing a

growth in subscriptions levels which, if sustained, will over time

make up for suppressed advertising levels.

At the moment, our business seems to be performing well and with

February a profitable month, we are feeling confident that we are

able to weather the storm.

One of the results of the disruption to advertising revenues is

that the Group's cash levels decreased to GBP557,000 at the period

end, whereas we would have hoped to see them improve. The Directors

believe this has now stabilised and we look to benefit from the

reductions made to the cost base, reflected in an improvement in

performance in the second half, to restore our usual cash levels in

the near future.

While it is clear there are many challenges ahead, your Board is

committed to seeing the business through these, suddenly, extremely

unpredictable times.

Financial performance

Key financial performance for the period has been summarised as

follows:

Six Months ended Six Months ended

31 December 2019 31 December 2018

----------------------------- -----------------

GBP'000 GBP'000

----------------------------- -----------------

Revenue 3,748 4,265

----------------------------- -----------------

Loss for the period (399) (214)

----------------------------- -----------------

Operating loss (397) (210)

----------------------------- -----------------

Loss per share (see note 3) (1.56 p) (0.84 p)

----------------------------- -----------------

Clem Chambers

CEO

25 March 2020

A copy of this announcement is available on the Group's website:

www.ADVFN.com

Enquiries:

For further information please contact:

ADVFN PLC +44 (0) 207 070

Clem Chambers 0909

Beaumont Cornish Limited (Nominated Adviser)

www.beaumontcornish.com

+44 (0) 207 628

Roland Cornish/Michael Cornish 3396

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU) No. 596/2014. The person who arranged for the

release of this announcement on behalf of the Group was Clem

Chambers, Director.

Consolidated income statement

6 months 6 months 12 months

to to to

31 Dec 31 Dec 30 June

2019 2018 2019

GBP'000 GBP'000 GBP'000

unaudited unaudited audited

Notes

Revenue 3,748 4,265 8,714

Cost of sales (159) (227) (421)

---------- ---------- ----------

Gross profit 3,589 4,038 8,293

Share based payment - - (2)

Amortisation of intangible assets (156) (69) (220)

Other administrative expenses (3,830) (4,179) (8,546)

Total administrative expense (3,986) (4,248) (8,768)

Operating (loss)/profit (397) (210) (475)

Finance income and expense (5) (4) (7)

Profit from sale of equity investment

to a related party - - 47

Loss before tax (402) (214) (435)

Taxation 3 - 24

---------- ---------- ----------

Loss for the period attributable

to shareholders of the parent (399) (214) (411)

========== ========== ==========

Earnings per share

Basic and diluted 3 (1.56 p) (0.84 p) (1.60 p)

Consolidated statement of comprehensive

income

6 months 6 months 12 months

to to to

31 Dec 31 Dec 30 June

2019 2018 2019

GBP'000 GBP'000 GBP'000

unaudited unaudited audited

Loss for the period (399) (214) (411)

Other comprehensive income:

Items that will be reclassified

subsequently to profit or loss:

Exchange differences on translation

of foreign operations 16 33 37

Deferred tax on translation of - - -

foreign held assets

---------- ---------- ----------

Total other comprehensive income 16 33 37

Total comprehensive income for

the year attributable to shareholders

of the parent (383) (181) (374)

========== ========== ==========

Consolidated balance sheet

31 Dec 31 Dec 30 June

2019 2018 2019

GBP'000 GBP'000 GBP'000

unaudited unaudited audited

Assets

Non-current assets

Property, plant and equipment 172 161 145

Goodwill 978 971 978

Intangible assets 1,467 1,417 1,447

Investments - 3 -

Deferred tax 1 1 -

Trade and other receivables 108 108 108

2,726 2,661 2,678

Current assets

Trade and other receivables 491 812 693

Cash and cash equivalents 557 871 887

---------- ---------- --------

1,048 1,683 1,580

Total assets 3,774 4,344 4,258

========== ========== ========

Equity and liabilities

Equity

Issued capital 51 51 51

Share premium 167 145 167

Share based payments reserve 367 365 367

Foreign exchange reserve 298 278 282

Retained earnings 436 1,063 835

---------- ---------- --------

1,319 1,902 1,702

Current liabilities

Trade and other payables 2,455 2,442 2,556

Current tax - - -

2,455 2,442 2,556

Total liabilities 2,455 2,442 2,556

---------- ---------- --------

Total equity and liabilities 3,774 4,344 4,258

========== ========== ========

Consolidated statement of changes in equity

Share Share Share Foreign Retained Total

capital premium based exchange earnings equity

payment

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 July 2018 - as originally

stated 51 145 365 245 1,277 2,083

Effect of the application

of IFRS 9* - - - - (31) (31)

--------- --------- --------- ---------- ---------- ----------

51 145 365 245 1,246 2,052

Loss for the period after

tax* - - - - (183) (183)

Other comprehensive income

Exchange differences on

translation of foreign operations - - - 33 - 33

Total comprehensive income - - - 33 (183) (150)

--------- --------- --------- ---------- ---------- ----------

At 31 December 2018 51 145 365 278 1,063 1,902

Equity settled share options - - 2 - - 2

Share issues 22 22

--------- --------- --------- ---------- ---------- ----------

Transactions with owners - 22 2 - - 24

Loss for the period after

tax - - - - (228) (228)

Other comprehensive income

Exchange differences on

translation of foreign operations - - - 4 - 4

--------- --------- --------- ---------- ---------- ----------

Total comprehensive income - - - 4 (228) (224)

--------- --------- --------- ---------- ---------- ----------

At 30 June 2019 51 167 367 282 835 1,702

Loss for the period after

tax - - - - (399) (399)

Other comprehensive income

Exchange differences on

translation of foreign operations - - - 16 - 16

--------- --------- --------- ---------- ---------- ----------

Total comprehensive income - - - 16 (399) (383)

--------- --------- --------- ---------- ---------- --------

At 31 December 2019 51 167 367 298 436 1,319

========= ========= ========= ========== ========== ==========

*The application of the Expected Loss method under IFRS 9 on 1

July 2018 has resulted in an adjustment of GBP31,000 at that date.

This, combined with GBP183,000 above, amounts to GBP214,000 which

is the total loss for the period after tax as previously reported

at 31 December 2018.

Consolidated cash flow statement

6 months 6 months 12 months

to to to

31 Dec 31 Dec 30 June

2019 2018 2019

GBP'000 GBP'000 GBP'000

unaudited unaudited audited

Cash flows from operating activities

(Loss)/profit for the year (399) (214) (411)

Taxation expense - - (24)

Net finance income in the income statement 5 4 7

Share based payment - - 2

Depreciation of property, plant and

equipment 52 36 81

Amortisation 156 69 220

Disposal of equity investment to a related

party - - (47)

Decrease in trade and other receivables 202 46 134

(Decrease)/increase in trade and other

payables (101) 129 243

Net cash generated by continuing operations (85) 70 205

Income tax paid - (22) 2

---------- ---------- ----------

Net cash generated by operating activities (85) 48 207

Cash flows from financing activities

Issue of share capital - 22

Interest paid (5) (4) (7)

---------- ---------- ----------

(5) (4) 15

Cash flows from investing activities

Payments for property, plant and equipment (79) (61) (90)

Purchase of intangibles (176) (179) (360)

Receipt from related party - - 50

Net cash used by investing activities (255) (240) (400)

Net decrease in cash and cash equivalents (345) (196) (178)

Exchange differences 15 6 4

---------- ---------- ----------

Net decrease in cash and cash equivalents (330) (190) (174)

Cash and cash equivalents at the start

of the period 887 1,061 1,061

---------- ---------- ----------

Cash and cash equivalents at the end

of the period 557 871 887

========== ========== ==========

1. Legal status and activities

ADVFN Plc is principally involved in the development and

provision of financial information primarily via the internet and

the development and exploitation of ancillary internet sites.

ADVFN Plc is a public limited liability company incorporated and

domiciled in England and Wales. The address of its registered

office is Suite 27, Essex Technology Centre, The Gables, Fyfield

Road, Ongar, Essex, CM5 0GA .

ADVFN Plc is quoted on the Alternative Investment Market ("AIM")

of the London Stock Exchange.

2. Basis of preparation

The unaudited consolidated interim financial information is for

the six-month period ended 31 December 2019. The financial

information does not include all the information required for full

annual financial statements and should be read in conjunction with

the consolidated financial statements of the Group for the year

ended 30 June 2019, which were prepared under IFRS as adopted by

the European Union (EU).

The accounting policies adopted in this report are consistent

with those of the annual financial statements for the year to 30

June 2019 as described in those financial statements.

The financial statements are presented in Sterling (GBP) rounded

to the nearest thousand except where specified.

The unaudited interim financial information does not include all

the information required for full annual financial statements and

should be read in conjunction with the financial statements of the

Group for the year ended 30 June 2019.

The interim financial information has been prepared on the going

concern basis which assumes the Group will continue in existence

for the foreseeable future.

Our reaction to the onset of Covid-19 has been to examine the

potential impact of the virus on our operations and our market. We

need to ensure that the welfare of our staff and the continued

provision of our service is our priority. We are already a company

of home-based staff and we have looked at reasonable worst-case

scenarios and discussed potential mitigating strategies to ensure

the continuity of our service.

The Board believes it has reduced its cost base sufficiently to

ride out the current business environment and we are beginning to

see the return of advertising revenues. We are also experiencing a

growth in subscriptions levels which, if sustained, will over time

make up for suppressed advertising levels.

At the moment, our business seems to be performing well and with

February a profitable month we are feeling confident that we are

able to weather the storm.

One of the results of the disruption to advertising revenues is

that the Group's cash levels decreased to GBP557,000 at the period

end, whereas we would have hoped to see them improve. The Directors

believe this has now stabilised and we look to benefit from the

reductions made to the cost base, reflected in an improvement in

performance in the second half, to restore our usual cash levels in

the near future.

No material uncertainties that cast significant doubt about the

ability of the Group to continue as a going concern have been

identified by the directors. Accordingly, the directors believe it

is appropriate for the interim financial statement to be prepared

on the going concern basis.

The interim financial information has not been audited nor has

it been reviewed under ISRE 2410 of the Auditing Practices Board.

The financial information presented does not constitute statutory

accounts as defined by section 434 of the Companies Act 2006. The

Group's statutory accounts for the year to 30 June 2019 have been

filed with the Registrar of Companies. The auditors, Grant Thornton

UK LLP reported on these accounts and their report was unqualified

and did not contain a statement under section 498(2) or Section

498(3) of the Companies Act 2006.

New standards adopted in the period:

IFRS 16 Leases

The standard has replaced IAS 17 and introduces a single lessee

accounting model. Under the provisions of the new standard most

leases, including the majority of those previously classified as

operating leases, are brought onto the financial position statement

as a right-of-use asset and as an offsetting lease liability. Both

asset and liability are based on present values of the lease

payments due over the term of the lease with the asset being

depreciated in accordance with IAS 16 'Property, plant and

equipment' and the liability increased by the addition of interest

and reduced as lease payments are made.

3. Earnings per share

6 months 6 months 12 months

to to to

31 Dec 2019 31 Dec 2018 30 June

2019

GBP'000 GBP'000 GBP'000

Loss for the year attributable to equity

shareholders (399) (214) (411)

Earnings per share (pence)

Basic (1.56 p) (0.84 p) (1.60p)

Diluted (1.56 p) (0.84 p) (1.60p)

============ ============ ===========

Shares Shares Shares

Weighted average number of shares in

issue for the period 25,657,927 25,623,845 25,657,927

Dilutive effect of options - - -

------------ ------------ -----------

Weighted average shares for diluted

earnings per share 25,657,927 25,623,845 25,657,927

Where a loss is reported for the period the diluted loss per

share does not differ from the basic loss per share as the exercise

of share options would have the effect of reducing the loss per

share and is therefore not dilutive under the terms of IAS 33.

In addition, where a profit has been recorded but the average

share price for the period remains under the exercise price the

existence of options is not dilutive.

4. Events after the balance sheet date

Our assessment of the impact of the COVID-19 virus is set out in

Note 2. There are no other events of significance occurring after

the balance sheet date to report.

5. Dividends

The directors do not recommend the payment of a dividend.

6. Financial statements

Copies of these accounts are available from ADVFN Plc's

registered office at Suite 27, Essex Technology Centre, The Gables,

Fyfield Road, Ongar, Essex, CM5 0GA or from Companies House, Crown

Way, Maindy, Cardiff, CF14 3UZ.

www.companieshouse.gov.uk

and from the ADVFN plc website:

www.ADVFN.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR QELFLBXLBBBB

(END) Dow Jones Newswires

March 25, 2020 12:20 ET (16:20 GMT)

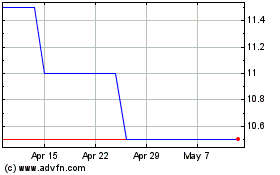

Advfn (LSE:AFN)

Historical Stock Chart

From Mar 2024 to Apr 2024

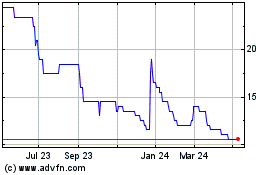

Advfn (LSE:AFN)

Historical Stock Chart

From Apr 2023 to Apr 2024