TIDMAFN

RNS Number : 5355R

ADVFN PLC

29 October 2019

29 October 2019

For immediate release

ADVFN PLC

("ADVFN" or the "Company")

Audited Results for the Year Ended 30 June 2019

ADVFN, the global stocks and shares website, announces its

audited results for the year ended 30 June 2019.

Chief Executive's Statement

The financial year 2018/19 was a year of development that has

seen us adapt to a changing marketplace and begin to strengthen our

business by pushing forward with our US facing business. Work in

2017 was responsible for addressing negative developments in

equities, replacing revenue from equity-focused clients with

revenues from the growing Blockchain industry. We now have a strong

and comprehensive on-line Crypto information and data offering and

we expect that to lead to a range of opportunities going forward

providing us with additional revenue and a chance to grow the

website with new opportunities.

Thanks to these developments we hope to avoid both the effects

of Brexit but also the European Contracts and Markets Authority

(ESMA) which has had a significant impact on some of our customers

who focus on Contract for Difference (CFD) and spread betting. We

have therefore accelerated our investment in the future to try to

capitalise on the potential of a rebound for these clients

alongside the next phase of the blockchain development which is

recently showing a strong comeback.

Our US offering is now our largest audience and this year we

have spent significant time and money to build on our presence

there. We believe that this investment should start to bear fruit

in 2019 and significantly in 2020. We are very happy with progress

there and the product developments that will also begin to

impact.

Whilst it is hard to predict the future in such an uncertain

political business landscape, 2018/19 has been a significant year

for us in positioning ADVFN to grow. Although, in this year, the

overall market has shrunk, to compensate there is less competition.

We would prefer to be operating in a burgeoning market, but it

certainly helps to be one of the few places where a private

investor or Cryptocurrency trader can get real-time high-quality

information. We are one of a small number of destinations where

financial services companies can get access to a high value

audience for their offerings.

ADVFN and Investorshub has a large audience whose high aggregate

net worth, is at the core of our business and we have been working

hard to broaden our offering to take advantage of it.

At the end of this year we feel we are well positioned to

prosper in an environment many look at with trepidation and we are

looking forward to developments next year which we feel will

deliver a strong performance.

Clement Chambers

CEO

29 October 2019

The annual report and accounts will shortly be sent to

shareholders and will be available on the Company's website,

http://www.advfn.com

Enquiries:

For further information please contact:

ADVFN PLC

Clem Chambers +44 (0) 207 070 0909

Beaumont Cornish Limited (Nominated

Adviser)

www.beaumontcornish.com

Roland Cornish/Michael Cornish +44 (0) 207 628 3396

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU) No. 596/2014. The person who arranged for the

release of this announcement on behalf of the Company was Clem

Chambers, Director.

STRATEGIC REPORT

Financial Overview

These consolidated and company accounts have been prepared under

International Financial Reporting Standards (IFRS) as adopted by

the European Union.

We are assailed by a constant demand for price increases,

particularly in the costs for data licenses and exchange fees and

we continue to monitor this and adapt by deleting poor value

sources and bringing in new data in response.

Business Review

The website is the centre of ADVFN's business and it can be seen

at www.advfn.com. Our customer's demands on our website means we

must provide sophisticated, technically challenging material which

is subject to constant 24-hour maintenance and engineering. This is

both a significant cost but also a wide defensive moat and barrier

to entry for our business. The cost of provision of our kind of

service has proved prohibitive to many competitors over the

years.

Blockchain and Cryptocurrencies have allowed us to add new

information and create a whole new area to the website dedicated to

the needs of the growing global cryptocurrency audience for timely

and accurate data. This has enhanced the whole ADVFN/Investorshub

proposition.

In the UK our audience remains interested in Brexit and the

impact it may or may not have, which creates much interest in the

financial markets in the UK, which is to our advantage. ADVFN's

data / information sites are a very important window into the

world's financial markets that private investors in any part of the

globe can use to help manage their investing and trading

activities. We see opportunities for growth in many countries

around the world and we support markets in many of them, however,

at this time we are focused on developing audiences in the US, UK

and Brazil.

Operating Costs

Our main costs are relatively fixed, but licence and exchange

fees are continuing to rise which we monitor closely and have been

adapting our offering to compensate. We have removed some markets

and added others and have, up to now, seen no impact to our

business by rejecting exchanges that become too costly for their

profile. We have started to work closely with a select group of

markets to help them reach broader audiences and this is an

interesting opportunity for us.

Research and Development ("R&D")

Research and Development is what has allowed us to keep up with

a rapidly changing market. Technology is always changing,

competition appearing or disappearing, and we constantly strive to

be relevant by providing excellent services. It is this research

and development that is a key pillar for our future. The web and

mobile environments are also changing all the time and we have to

continue to move and evolve so that we can stay at the forefront of

what customers need.

Our R & D investment this year has been GBP360,000 (2018:

GBP353,000) and a substantial part of this investment has been to

develop the website and has been capitalised. This constant

investment ensures our web and mobile experience remains up to date

and fresh.

Environmental policy

The Group as a whole continues to look for ways to develop its

environmental policy. It remains our objective to improve our

performance in this area.

Future outlook for the business

The last two decades have taught us that we must keep abreast of

an ever-changing market. Blockchain and Crypto Currencies are very

much part of this and our future. They are new areas in which new

business opportunities could open up where we can take the business

forward. We are also developing other products that broaden our

offering to both our users and our advertising customers and with a

stable revenue platform we look towards meaningful growth.

Summary of key performance indicators

Our key indicators have not changed, as they are an important

part of the business.

The Directors monitor the Key Performance Indicators on an

ongoing basis. The chart below shows the level of performance

achieved in the financial year. The individual items are as

follows:

2019 2019 2018 2018

Actual Target Actual Target

-------- -------- -------- --------

Turnover GBP8.7M GBP8.8M GBP9.2M GBP8.5M

-------- --------

Average head count 46 44 46 40

-------- -------- --------

ADVFN registered users 4.7M 4.6M 4.5M 4.2M

-------- -------- -------- --------

Turnover - is of vital importance as it gives the sales

department a goal and measures the financial success of the Group's

services. The target for 2019 was set so as to show a steady

improvement over the target for 2018 where the actual for 2018 had

been unexpectedly high.

Head count - is a very significant part of the costs of the

company and is fixed as an overhead. It provides a good indicator

when taken against the revenue figure for the efficiency of the

business. Talented people are a vital part of the business.

Registered users - give us an accurate indication of our

audience pool and the potential available for marketing our

service.

Principal risks and uncertainties

In addition to the principal risks summarised above, the

following are also considered to be principal risks and

uncertainties.

Economic downturn

We constantly face rapid change and may face many new potential

issues, including the outcome and impact of the Brexit negotiations

and the leaving process itself. This, mixed with many emerging

global economic pressures such as the US/China trade war, makes for

an abundance of uncertainty. Uncertainty is a driver of our

audience's engagement, so our future is somewhat hedged by this

against negative outcomes beyond our control.

High proportion of fixed overheads coupled with variable

revenues

A large proportion of the Company's overheads are fixed. There

is the risk that any significant changes in revenue may lead to the

inability to cover such costs. We closely monitor fixed overheads

against budget on a monthly basis and cost saving exercises are

implemented on a constant review basis.

Product obsolescence

The systems and technology that we use are always in development

and constantly requiring changes and upgrading. All our technology

and products are subject to technological evolution and could

become obsolete.

We constantly innovate and adopt new developments to keep up

with this inevitable change.

The Board is committed to the Research and Development strategy

in place and are confident that the Company is able to react

effectively to the developments within the market.

Fluctuations in currency exchange rates

A major proportion of our turnover relates to overseas

operations. As a company, we are therefore exposed to foreign

currency fluctuations. The Company manages its foreign exchange

exposure on a net basis and, if required, uses forward foreign

exchange contracts and other derivatives/financial instruments to

reduce the exposure. Currently hedging is not employed and no

forward contracts are in place. If currency volatility was extreme

and hedging activity did not mitigate the exposure, then the

results and the financial condition of the Company might be

adversely impacted by foreign currency fluctuations.

Following the volatility post Brexit, management will continue

to monitor the impact of currency fluctuation. The exchange rate of

the US Dollar has been a recent focus.

People

I would like to thank the whole team at ADVFN who tirelessly

provide a global service for private investors 24 hours a day.

ON BEHALF OF THE BOARD

Clement Chambers

CEO

29 October 2019

Consolidated income statement

30 June 30 June

2019 2018

GBP'000 GBP'000

Revenue 8,714 9,201

Cost of sales (421) (392)

--------- --------

Gross profit 8,293 8,809

Share based payment (2) (21)

Amortisation of intangible assets (220) (202)

Other administrative expenses (8,546) (8,202)

--------- --------

Total administrative expenses (8,768) (8,425)

Operating (loss)/profit (475) 384

Finance income and expense (7) -

Income from related parties 5 - 58

Profit from sale of equity investment to

a related party 5 47 -

(Loss)/profit before tax (435) 442

Taxation 24 (49)

--------- --------

Total (loss)/profit for the period attributable

to shareholders of the parent (411) 393

Profit per share

Basic 4 (1.60 p) 1.53 p

Diluted 4 (1.60 p) 1.53 p

Consolidated statement of comprehensive

income

30 June 30 June

2019 2018

GBP'000 GBP'000

(Loss)/profit for the period (411) 393

Other comprehensive income:

Items that will be reclassified subsequently

to profit or loss:

Exchange differences on translation of

foreign operations 37 (33)

Total other comprehensive income 37 (33)

Total comprehensive income for the year

attributable to shareholders of the parent (374) 360

======== ========

Consolidated balance sheet

30 June 30 June

2019 2018

GBP'000 GBP'000

Assets

Non-current assets

Property, plant and equipment 145 136

Goodwill 978 941

Intangible assets 1,447 1,307

Investments - 3

Deferred tax - 4

Trade and other receivables 108 111

2,678 2,502

Current assets

Trade and other receivables 693 855

Cash and cash equivalents 887 1,061

-------- --------

1,580 1,916

Total assets 4,258 4,418

Equity and liabilities

Equity

Issued capital 51 51

Share premium 167 145

Share based payment reserve 367 365

Foreign exchange reserve 282 245

Retained earnings 835 1,277

-------- --------

1,702 2,083

Current liabilities

Trade and other payables 2,556 2,313

Current tax - 22

2,556 2,335

Total liabilities 2,556 2,335

-------- --------

Total equity and liabilities 4,258 4,418

======== ========

Consolidated statement of changes in equity

Share Share Share Foreign Retained Total

capital premium based exchange earnings equity

payment reserve

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 July 2017 51 145 344 278 884 1,702

Equity settled share options - - 21 - - 21

Total transactions with owners - - 21 - - 21

Profit for the period after

tax - - - - 393 393

Other comprehensive income

Exchange differences on translation

of foreign operations - - - (33) - (33)

Total other comprehensive

income - - - (33) - (33)

--------- --------- --------- ---------- ---------- --------

Total comprehensive income (33) 393 360

--------- --------- --------- ---------- ---------- --------

At 30 June 2018 - as originally

stated 51 145 365 245 1,277 2,083

Effect of the application

of IFRS 9 - - - - (31) (31)

--------- --------- --------- ---------- ---------- --------

51 145 365 245 1,246 2,052

Shares issued - 22 - - - 22

Equity settled share options - - 2 - - 2

--------- --------- --------- ---------- ---------- --------

Total transactions with owners - 22 2 - - 24

Loss for the year after tax - - - - (411) (411)

Other comprehensive income

Exchange differences on translation

of foreign operations - - - 37 - 37

--------- --------- --------- ---------- ---------- --------

Total other comprehensive

income - - - 37 - 37

--------- --------- --------- ---------- ---------- --------

Total comprehensive income - - - 37 (411) (374)

--------- --------- --------- ---------- ---------- --------

At 30 June 2019 51 167 367 282 835 1,702

========= ========= ========= ========== ========== ========

Consolidated cash flow statement

12 months 12 months

to to

30 June 30 June

2019 2018

GBP'000 GBP'000

Cash flows from operating activities

Profit for the year (411) 393

Taxation (24) 49

Net finance income in the income statement 7 -

Depreciation of property, plant & equipment 81 68

Amortisation of intangible assets 220 202

Profit on disposal of equity investment

to a related party 5 (47) -

Profit on disposal of Equity Holdings

to a related party 5 - (53)

Share based payments - options/warrants 2 21

Decrease in trade and other receivables 134 74

Increase/(decrease) in trade and other

payables 243 (151)

Net cash generated by continuing operations 205 603

Income tax receivable/(payable) 2 (27)

---------- ----------

Net cash generated by operating activities 207 576

Cash flows from financing activities

Issue of share capital 22 -

Interest paid (7) -

Net cash generated by financing activities 15 -

Cash flows from investing activities

Payments for property, plant and equipment (90) (151)

Purchase of intangibles (360) (353)

Receipt from sale of equity investment

to a related party 50 50

Net cash used by investing activities (400) (454)

Net (decrease)/increase in cash and cash

equivalents (178) 122

Exchange differences 4 (24)

---------- ----------

Net (decrease)/increase in cash and cash

equivalents (174) 98

Cash and cash equivalents at the start

of the period 1,061 963

---------- ----------

Cash and cash equivalents at the end of

the period 887 1,061

========== ==========

1. Basis of preparation

The Group's financial statements have been prepared in

accordance with IFRS as adopted by the European Union ('EU') and

with those parts of the Companies Act 2006 that are relevant to the

Group in preparing its accounts in accordance with EU adopted IFRS.

While the financial information included in the announcement has

been prepared in accordance with EU adopted IFRS, this announcement

itself does not contain sufficient information to comply with EU

adopted IFRS.

The consolidated and company financial statements have been

prepared under the historical cost convention and are presented in

Sterling rounded to the nearest thousand except where indicated

otherwise.

Standards and amendments to existing standards adopted in these

accounts

Two additional standards have been adopted in these accounts,

the details of their application and the impact they have had on

the financial statement is as follow:

-- IFRS 15 - Revenue

The standard defines a new five step model to recognise revenue

from customers and replaces IAS 18 'Revenue', IAS 11 'Construction

contracts', IFRIC 13 'Customer loyalty programmes', IFRIC 15

'Agreements for the construction of real estate'. IFRIC 18

'Transfer of assets from customers' and SIC-3 'Revenue - Barter

transactions involving advertising services'.

The group has a number of income streams and the Directors have

examined the Group's revenue policy in detail as follows:

Subscriptions - both monthly and annual subscriptions are

offered and annual subscriptions are deferred on a time basis with

equal monthly transfers to the income statement.

Events - revenue from events is recognised at the time of the

event. There are no circumstances when the early payment of

entrance or stand fees entirely non-refundable.

Advertising - fees for advertising are recognised when the

service obligations are fulfilled. Where there are multiple

obligations amounts specific to that obligation are transferred to

the income statement.

The Directors have reviewed the standard and its effects in the

context of the Group's policy described above and the result is

that there will not be a significant impact on the Group's

revenue.

-- IFRS 9 Financial Instruments

The standard is a replacement for IAS 39 'Financial

Instruments'. The Group's financial assets consist of receivables

and the liabilities consist of payables. There are no material

borrowings.

Under the provisions of the standard the treatment of any

doubtful receivables will change to reflect an expected credit loss

rather than an incurred credit loss. The group will need to apply

an expected credit loss model when calculating impairment losses on

its trade and other receivables (both current and non-current).

This will result in increased impairment provisions and greater

judgement due to the need to factor in forward looking information

when estimating the appropriate amount of provisions. In applying

IFRS 9 the group must consider the probability of a default

occurring over the contractual life of its trade receivables and

contracts asset balances on initial recognition of those

assets.

The directors have reviewed the effects of adopting this

standard and the current year provision on an expected credit loss

basis is GBP70,000.

Standards, amendments and interpretations to existing standards

that are not yet effective and have not been early adopted by the

Company in the 30 June 2019 financial statements

-- IFRS 16 Leases

The standard is effective for periods commencing on or after 1

January 2019 and will therefore be adopted no later than the period

commencing 1 July 2019. The standard replaces IAS 17 and introduces

a single lessee accounting model. Under the provisions of the new

standard most leases, including the majority of those previously

classified as operating leases, will be brought onto the financial

position statement as a right-of-use asset and as an offsetting

lease liability. Both asset and liability are based on present

values of the lease payments due over the term of the lease with

the asset being depreciated in accordance with IAS 16 'Property,

plant and equipment' and the liability increased by the addition of

interest and reduced as lease payments are made.

The directors continue to monitor the likely impact of the new

standard on the Group. If the standard were to be adopted during

the current financial period and applied to the operating leases

currently in the Group, the value of leases recognised as 'right of

use' assets on the balance sheet at 30 June 2019 would be in the

range GBP230,000 to GBP270,000. The impact on profit or loss will

be minimal as the operating lease charge will be replaced by an

interest expense on the lease liability and a depreciation charge

in administrative expense which together will approximate the

operating lease charge. There is a tendency for this method to

front load the expense but this is minimal in ADVFN's case.

Effects of changes in accounting policies

During the year the Group has adopted IFRS 9 "Financial

Instruments" and IFRS 15 "Revenue from contracts with

customers".

The adoption of IFRS 15 has not led to the need to restate prior

period figures. However the Company and Group has financial assets

at amortised cost that are subject to IFRS 9's new expected credit

loss model and was required to revise its impairment methodology

under IFRS 9 for this class of asset. As permitted by the

transitional provisions of IFRS 9, the Company elected not to

restate comparative figures. Any adjustments to the carrying

amounts of the financial assets were recognised in the opening

retaining earnings of the current period. The identified impairment

loss for the Company and the Group was immaterial. Applying the

expected credit risk model resulted in the recognition of a loss

allowance of GBP12,000 and GBP31,000 in the Company and Group

respectively in the year ended 30 June 2018.

All other accounting policies remain unchanged since the year

ended 30 June 2019.

2. Segmental analysis

The directors identify operating segments based upon the

information which is regularly reviewed by the chief operating

decision maker. The Group considers that the chief operating

decision makers are the executive members of the Board of

Directors. The Group has identified two reportable operating

segments, being that of the provision of financial information and

that of other services. The provision of financial information is

made via the Group's various website platforms.

The parent entities operations are entirely of the provision of

financial information.

Three minor operating segments, for which IFRS 8's quantitative

thresholds have not been met, are currently combined below under

'other'. The main sources of revenue for these operating segments

is the provision of financial broking services, financial

conference events and other internet services not related to

financial information. Segment information can be analysed as

follows for the reporting period under review:

2019 Provision Other Total

of financial

information

GBP'000 GBP'000 GBP'000

Revenue from external customers 8,490 224 8,714

Depreciation and amortisation (360) 60 (300)

Other operating expenses (8,321) (568) (8,889)

-------------- -------- --------

Segment operating (loss)/profit (191) (284) (475)

Interest income - - -

Interest expense (7) - (7)

============== ======== ========

Segment assets 3,740 518 4,258

Segment liabilities (2,559) 3 (2,556)

Purchases of non-current assets 340 110 450

============== ======== ========

2018 Provision Other Total

of financial

information

GBP'000 GBP'000 GBP'000

Revenue from external customers 8,900 301 9,201

Depreciation and amortisation (388) 122 (266)

Other operating expenses (7,984) (567) (8,551)

-------------- -------- --------

Segment operating (loss)/profit 528 (144) 384

Interest income - - -

Interest expense - - -

============== ======== ========

Segment assets 3,831 587 4,418

Segment liabilities (2,196) (139) (2,335)

Purchases of non-current assets 444 60 504

============== ======== ========

The Group's revenues, which wholly relate to the sale of

services, from external customers and its non-current assets, are

divided into the following geographical areas:

Revenue Non-current Revenue Non-current

assets assets

2019 2019 2018 2018

UK (domicile) 2,925 1,679 3,466 1,547

USA 5,532 999 5,259 955

Other 257 - 476 -

8,714 2,678 9,201 2,502

======== ============ ======== ============

Revenues are allocated to the country in which the customer

resides. During both 2019 and 2018 no single customer accounted for

more than 10% of the Group's total revenues.

3. Profit per share

12 months 12 months

to to

30 June 30 June

2018 2017

GBP'000 GBP'000

(Loss)/profit for the year attributable to equity

shareholders (411) 393

Total loss per share - basic and diluted

Basic (1.60 p) 1.53 p

Diluted (1.60 p) 1.53 p

Shares Shares

Weighted average number of shares in issue for

the year 25,657,927 25,623,845

Dilutive effect of options - 100,000

----------- -----------

Weighted average shares for diluted earnings

per share 25,657,927 25,723,845

=========== ===========

Where a loss has been recorded for the year the diluted loss per

share does not differ from the basic loss per share. Where a profit

has been recorded but the average share price for the year remains

under the exercise price the existence of options is not

dilutive.

4. Disposal of Equity Holdings Ltd and Equity Developments Ltd

GROUP AND COMPANY

Following the failure of Bashco Limited to make any payments to

the Company for the acquisition of Equity Holdings Ltd and its

subsidiary Equity Developments Ltd during the year to 30 June 2018,

it was agreed between the parties that a payment be made by Bashco

Ltd to ADVFN Plc amounting to a cash payment of GBP50,000 plus the

issue to ADVFN Plc of shares amounting to a 30% stake in the

disposed companies. These payments were received and the parties

consider the transaction complete. The shareholding was therefore

recognised at fair value through profit or loss within investments

on the balance sheet at GBP3,000. On 15 June 2019 the investment

was sold back to Brian Basham, the owner of Equity Holdings Limited

and Equity Development Limited (a related party resulting from a

joint directorship) for GBP50,000 thus creating a profit the

Company of GBP47,000.

5. Events after the balance sheet date

There are no events of significance to report occurring after

the balance sheet date.

6. Publication of non-statutory accounts

The financial information set out in this preliminary

announcement does not constitute statutory accounts as defined in

section 435 of the Companies Act 2006.

The consolidated balance sheet at 30 June 2019 and the

consolidated income statement, consolidated statement of

comprehensive income, consolidated statement of changes in equity,

consolidated cash flow statement and associated notes for the year

then ended have been extracted from the Company's 2018 statutory

financial statements upon which the auditors' opinion is

unqualified and does not include any statement under Section 498(2)

or (3) of the Companies Act 2006.

The annual report and accounts will shortly be sent to

shareholders and will be available on the Company's website,

http://www.advfn.com.

ENDS

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR CKCDBOBDDQKB

(END) Dow Jones Newswires

October 29, 2019 13:26 ET (17:26 GMT)

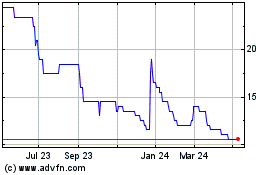

Advfn (LSE:AFN)

Historical Stock Chart

From Mar 2024 to Apr 2024

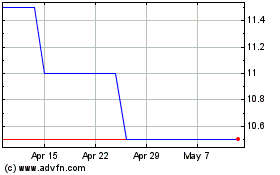

Advfn (LSE:AFN)

Historical Stock Chart

From Apr 2023 to Apr 2024