TIDMAFN

RNS Number : 0268I

ADVFN PLC

16 March 2018

16 March 2018

For immediate release

ADVFN PLC

("ADVFN" or the "Company")

Unaudited Interim Results for the Six Months Ended 31 December

2017

ADVFN today announces its unaudited interim results for the six

months ended 31 December 2017 (the "Period").

Chief Executive's Statement

2017 was a year of consolidation at ADVFN. During the Period we

announced the first phase of our Plus 1 Coin cryptocurrency

project, which we had developed in conjunction with Online

Blockchain plc ("Online"). Following testing within the ADVFN

community, we offered our customers and members a Plus 1 coin

wallet, which had been built on software developed by Online. Plus

1 coin is designed as a social media cryptocurrency to enable

social media users to interact and "up vote" content of other

social media. As previously announced, Online and ADVFN are each

bearing their own costs in respect of the Plus 1 Coin

cryptocurrency cooperation project and while there are currently no

financial arrangements between the two companies in respect of this

project, we anticipate that Online will in due course charge ADVFN

a license fee for its software which supports the wallet, on terms

to be agreed.

We continue to broaden our information service on

cryptocurrencies and intend to make our Plus1 Coin product

available to our international community.

ADVFN's sales in the 6-month interim period have shown a top

line growth of GBP456,000, an increase of 12% on the comparable

period last year, from approximately GBP3.8m to GBP4.3m. Reported

operating profit for the 6-month interim period was GBP24,000

(2016: operating loss, GBP66,000).

Financial performance

Key financial performance for the Period has been summarised as

follows:

Six Months

ended Six Months ended

31 December 31 December

2017 2016

------------------------- ------------ -----------------

GBP'000 GBP'000

------------------------- ------------ -----------------

Turnover 4,282 3,826

------------------------- ------------ -----------------

Profit for the period 24 18

------------------------- ------------ -----------------

Operating profit/(loss) 24 (66)

------------------------- ------------ -----------------

Profit per share (see

note 3) 0.09 p 0.07 p

------------------------- ------------ -----------------

Clem Chambers

CEO

16 March 2018

A copy of this announcement is available on the Company's

website: www.ADVFN.com

Enquiries:

For further information please contact:

ADVFN PLC +44 (0) 207 070

Clem Chambers 0909

Beaumont Cornish Limited

(Nominated Adviser)

www.beaumontcornish.com

+44 (0) 207 628

Roland Cornish/Michael Cornish 3396

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU) No. 596/2014. The person who arranged for the

release of this announcement on behalf of the Company was Clem

Chambers, Director.

Consolidated income statement

6 months 6 months 12 months

to to to

31 Dec 31 Dec 30 June

2017 2016 2017

GBP'000 GBP'000 GBP'000

unaudited unaudited audited

Notes

Revenue 4,282 3,826 8,186

Cost of sales (90) (130) (201)

---------- ---------- ----------

Gross profit 4,192 3,696 7,985

Share option charge (3) - -

Amortisation of intangible

assets (105) (161) (302)

Other administrative expenses (4,060) (3,601) (7,636)

Total administrative expense (4,168) (3,762) (7,938)

Operating profit/(loss) 24 (66) 47

Finance income - 84 167

Finance expense - - -

Profit before tax 24 18 214

Taxation - - 30

---------- ---------- ----------

Profit for the period attributable

to shareholders of the

parent 24 18 244

========== ========== ==========

Earnings per share

Basic and diluted 3 0.09 0.07 0.95

p p p

Consolidated statement

of comprehensive income

6 months 6 months 12 months

to to to

31 Dec 31 Dec 30 June

2017 2016 2017

GBP'000 GBP'000 GBP'000

unaudited unaudited audited

Profit for the period 24 18 244

Other comprehensive income:

Items that will be reclassified

subsequently to profit

or loss:

Exchange differences on

translation of foreign

operations (70) 167 (281)

Deferred tax on translation

of foreign held assets - (29) 92

---------- ---------- ----------

Total other comprehensive

income (70) 138 (189)

Total comprehensive income

for the year attributable

to shareholders of the

parent (46) 156 55

========== ========== ==========

Consolidated balance sheet

31 Dec 31 Dec 30 June

2017 2016 2017

GBP'000 GBP'000 GBP'000

unaudited unaudited audited

Assets

Non-current assets

Property, plant and equipment 54 65 53

Goodwill 913 999 948

Intangible assets 1,235 1,438 1,156

Deferred tax 6 - 6

Trade and other receivables 92 126 92

2,300 2,628 2,255

Current assets

Trade and other receivables 844 1,091 948

Cash and cash equivalents 969 840 963

---------- ---------- --------

1,813 1,931 1,911

Total assets 4,113 4,559 4,166

========== ========== ========

Equity and liabilities

Equity

Issued capital 51 51 51

Share premium 145 145 145

Share based payments reserve 347 344 344

Foreign exchange reserve 208 605 278

Retained earnings 908 658 884

---------- ---------- --------

1,659 1,803 1,702

Non-current liabilities

Deferred tax - 122 -

- 122 -

Current liabilities

Trade and other payables 2,454 2,610 2,464

Current tax - 24 -

2,454 2,634 2,464

Total liabilities 2,454 2,756 2,464

---------- ---------- --------

Total equity and liabilities 4,113 4,559 4,166

========== ========== ========

Consolidated statement of changes in equity

Share Share Share Foreign Retained Total

capital premium based exchange earnings equity

payment

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 July 2016 51 119 344 467 640 1,621

Equity settled share - - - - - -

options

Share issues - 26 - - - 26

--------- --------- --------- ---------- ---------- --------

Transactions with

owners - 26 - - - 26

Profit for the period

after tax - - - - 18 18

Other comprehensive

income

Exchange differences

on translation of

foreign operations - - - 167 - 167

Deferred tax on translation

of foreign held assets - - - (29) - (29)

--------- --------- --------- ---------- ---------- --------

Total comprehensive

income - - - 138 18 156

--------- --------- --------- ---------- ---------- --------

At 31 December 2016 51 145 344 605 658 1,803

Equity settled share - - - - - -

options

Share issues - - - - - -

--------- --------- --------- ---------- ---------- --------

Transactions with - - - - - -

owners

Profit for the period

after tax - - - - 226 226

Other comprehensive

income

Exchange differences

on translation of

foreign operations - - - (448) - (448)

Deferred tax on translation

of foreign held assets - - - 121 - 121

--------- --------- --------- ---------- ---------- --------

Total comprehensive

income - - - (327) 226 (101)

At 30 June 2017 51 145 344 278 884 1,702

Equity settled share

options - - 3 - - 3

Share issues - - - - - -

--------- --------- --------- ---------- ---------- --------

Transactions with

owners - - 3 - - 3

Profit for the period

after tax - - - - 24 24

Other comprehensive

income

Exchange differences

on translation of

foreign operations - - - (70) - (70)

Total comprehensive

income - - - (70) 24 (46)

--------- --------- --------- ---------- ---------- --------

At 31 December 2017 51 145 347 208 908 1,659

========= ========= ========= ========== ========== ========

Consolidated cash flow statement

6 months 6 months 12 months

to to to

31 Dec 31 Dec 30 June

2017 2016 2017

GBP'000 GBP'000 GBP'000

unaudited unaudited audited

Cash flows from operating activities

Profit for the year 24 18 244

Taxation - - (30)

Net finance income in the income

statement - (84) (167)

Share based payment 3 - -

Depreciation of property, plant

and equipment 18 32 52

Amortisation 105 161 286

Profit on disposal of Investor

Events - (56) (56)

Adjustment to fair value of

embedded derivative - 112 225

Increase in trade and other

receivables 104 (66) 82

Increase/(decrease) in trade

and other payables (10) 27 (119)

Net cash generated by continuing

operations 244 170 517

Income tax received - 36 14

---------- ---------- ----------

Net cash generated by operating

activities 244 206 531

Cash flows from financing activities

Issue of share capital - 26 26

Cash flows from investing activities

Interest received - 1 -

Payments for property, plant

and equipment (19) (29) (37)

Purchase of intangibles (184) (198) (379)

Sale of Investor Events - 40 40

Net cash used by investing

activities (203) (186) (376)

Net increase in cash and cash

equivalents 41 20 181

Exchange differences (35) (23) (61)

---------- ---------- ----------

Net increase/(decrease) in

cash and cash equivalents 6 (3) 120

Cash and cash equivalents at

the start of the period 963 843 843

---------- ---------- ----------

Cash and cash equivalents at

the end of the period 969 840 963

========== ========== ==========

1. Legal status and activities

ADVFN Plc ("the Company") is principally involved in the

development and provision of financial information primarily via

the internet and the development and exploitation of ancillary

internet sites.

The company is a public limited liability company incorporated

and domiciled in England and Wales. The address of its registered

office is Suite 27, Essex Technology Centre, The Gables, Fyfield

Road, Ongar, Essex, CM5 0GA.

The Company is quoted on the Alternative Investment Market

("AIM") of the London Stock Exchange.

2. Basis of preparation

The unaudited consolidated interim financial information is for

the six month period ended 31 December 2017. The financial

information does not include all the information required for full

annual financial statements and should be read in conjunction with

the consolidated financial statements of the Group for the year

ended 30 June 2017, which were prepared under IFRS as adopted by

the European Union (EU).

The accounting policies adopted in this report are consistent

with those of the annual financial statements for the year to 30

June 2017 as described in those financial statements.

The interim financial information has not been audited nor has

it been reviewed under ISRE 2410 of the Auditing Practices Board.

The financial information presented does not constitute statutory

accounts as defined by section 434 of the Companies Act 2006. The

Group's statutory accounts for the year to 30 June 2017 have been

filed with the Registrar of Companies. The auditors, Grant Thornton

UK LLP reported on these accounts and their report was unqualified

and did not contain a statement under section 498(2) or Section

498(3) of the Companies Act 2006.

3. Earnings per share

6 months 6 months 12 months

to to to

31 Dec 31 Dec 30 June

2017 2016 2017

GBP'000 GBP'000 GBP'000

Profit for the year attributable

to equity shareholders 24 18 244

Earnings per share (pence)

0.95

Basic 0.09 p 0.07 p p

0.95

Diluted 0.09 p 0.07 p p

Shares Shares Shares

Issued ordinary shares at

start of the period 25,623,845 25,523,845 25,523,845

Ordinary shares issued in

the period - 100,000 100,000

----------- ----------- -----------

Issued ordinary shares at

end of the period 25,623,845 25,623,845 25,623,845

=========== =========== ===========

Weighted average number of

shares in issue for the period 25,623,845 25,901,019 25,612,338

Dilutive effect of options - - -

----------- ----------- -----------

Weighted average shares for

diluted earnings per share 25,623,845 25,901,019 25,612,338

Where a loss is reported for the period the diluted loss per

share does not differ from the basic loss per share as the exercise

of share options would have the effect of reducing the loss per

share and is therefore not dilutive under the terms of IAS 33.

In addition, where a profit has been recorded but the average

share price for the period remains under the exercise price the

existence of options is not dilutive.

4. Events after the reporting date

On 9 March 2018 the directors announced that they have agreed

amended terms on the arrangements relating to the sale of Equity

Holdings Limited ('EHL'). As at 30 June 2017, the carrying value in

ADVFN's audited accounts of the outstanding consideration to be

received in respect of EHL, which had been fully provided for,

amounted to GBP nil.

Background

The sale by ADVFN of its entire interest in EHL was first agreed

and announced in July 2012. EHL is the holding company of Equity

Development Limited ("EDL") which produces research material for

distribution in the UK used by brokers, fund managers and

investors. As set out in in ADVFN's report and accounts for the

year ended 30 June 2017 ("Accounts"), payments due from the

shareholders of EHL and its subsidiary EDL as consideration for the

purchase of the companies had not been received. Amounts

outstanding as at 30 June 2017 comprised GBP200,000 in cash and the

repayment of an outstanding loan note of GBP1,000,000 ("Loan Note")

was due on 31 July 2017 (the "Consideration Debt"). Neither the

loan note nor the cash instalments had been received and therefore,

ADVFN Plc stated that it had the right to acquire 99.5% of the

shares of EHL. The Directors further stated in the Accounts that

they had decided not to enforce this right as the business of EHL

remained outside of the longer term strategy of the ADVFN Group and

that as a result, the Directors had commenced proceedings to alter

the arrangements so as to potentially give ADVFN a right to equity

in EHL should it grow in market value.

Amended EHL sale terms

The Board reports that on 8 March 2018 ADVFN agreed with EHL,

EDL and Bashco Limited amended terms on the arrangements relating

to the sale of EHL. ADVFN has agreed to waive, cancel and forgive

the payment of the Consideration Debt in consideration for the

issue to ADVFN of shares representing 30% in the share capital of

EHL and GBP 50,000 to be settled in cash (the "Transaction").

Related party matters

Brian Basham, a director of ADVFN, is also a director of EHL and

EDL and is interested in 100% of the issued share capital of Bashco

Limited, which is the ultimate parent company of EHL. The

Transaction is therefore classified as a related party transaction

for the purposes of the AIM Rules. The independent directors of

ADVFN (excluding Brian Basham) consider, having consulted with the

Company's nominated adviser, that the terms of the transaction are

fair and reasonable in so far as its shareholders are

concerned.

Further AIM disclosures

As at 30 June 2017, the last date to which EHL published

consolidated audited accounts, EHL's turnover and profit before tax

amounted to GBP657,602 and GBP49,316 respectively. EHL's total

assets as at 30 June 2017 amounted to GBP1,685,496 (of which GBP

1,000,000 represented an amount owed by a subsidiary undertaking in

respect of the Loan Note).

The cash to be received by ADVFN on completion will be used for

general working capital purposes. ADVFN intends to retain the EHL

Shares for the time being.

5. Dividends

The directors do not recommend the payment of a dividend.

6. Financial statements

Copies of this statement are being posted to shareholders

shortly and will be available from the company's registered office

at Suite 27, Essex Technology Centre, The Gables, Fyfield Road,

Ongar, Essex, CM5 0GA.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR ZQLFFVXFBBBB

(END) Dow Jones Newswires

March 16, 2018 10:02 ET (14:02 GMT)

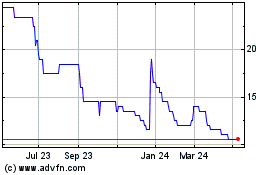

Advfn (LSE:AFN)

Historical Stock Chart

From Mar 2024 to Apr 2024

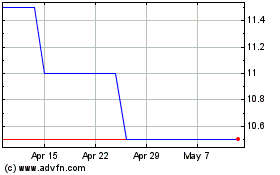

Advfn (LSE:AFN)

Historical Stock Chart

From Apr 2023 to Apr 2024