Primark Owner Relies on Cost Cutting, Government Help to Manage Coronavirus Fallout, CFO Says

March 27 2020 - 4:57PM

Dow Jones News

By Nina Trentmann

Associated British Foods PLC is cutting costs and relying on

government assistance to protect its balance sheet while its

Primark fashion stores are closed during the coronavirus

pandemic.

Primark, which accounts for about half of ABF's earnings before

interest and taxes, doesn't have an online store and depends on

foot traffic to generate sales.

"If all of your stores are closed, your sales are zero," ABF

finance director John Bason said in an interview Thursday. "The

focus is very much on cash flow and on cash going out."

London-based ABF said Monday it closed all 376 Primark outlets

in 12 countries and forecast a net sales loss of about GBP650

million ($811 million) a month. It is unclear how long the store

closures will last, but Mr. Bason expects ABF to recover about 50%

of operating costs through subsidies, negotiations with landlords

and other measures.

Wages for about 78,000 employees make up the bulk of Primark's

operating costs of about GBP220 million a month, and government

assistance programs launched in response to the crisis will cover

about 75% of salary costs in Europe, Mr. Bason said.

Under these programs, governments in the U.K., France, Italy,

Spain, Germany and other European countries pay companies around

75% to 80% of salary costs for employees who are not working

because of the coronavirus, assuming that employees retain their

jobs, according to recent announcements by various governments.

"This can lead to significant cost savings during the period of

store closures," analysts at Berenberg Bank said in a note to

clients.

The financial relief from these job retention programs will come

with a certain delay; many governments haven't specified when they

would start making payments, said AllianceBernstein LP analyst

Aneesha Sherman. "At the moment, retailers still have to front wage

costs," she said, estimating that ABF's Primark operations in the

U.K. could expect to get funds from the government by the end of

April.

ABF said this week it has cash resources of about GBP800 million

and a revolving credit facility of GBP1.1 billion, bringing its

total available liquidity to about GBP1.9 billion. Mr. Bason

declined to comment on whether the company would seek additional

loans or other types of funding in the coming weeks.

"They can survive the quarter without additional funds," Ms.

Sherman said.

The company is negotiating with its landlords to reduce rent

obligations, Mr. Bason said. Those efforts could result in a

permanently lower cost base for Primark, said Ms. Sherman, adding

that competitors Next PLC and H&M owner Hennes & Mauritz AB

are pursuing similar efforts.

A decision by the U.K. government to exempt retail, leisure and

hospitality businesses from paying business rates -- a form of

property tax -- also helps the company, Berenberg analysts

said.

ABF stopped placing new orders with its suppliers, but pledged

to pay for goods already en route to Europe. "We said, 'Don't

produce anything more for us,' " Mr. Bason said. Primark has about

1,000 suppliers globally, including 600 in China, he said.

Clothing retailers such as Zara-owner Inditex SA and Boohoo

Group PLC have taken similar measures.

"It is the right decision, because otherwise you have large

amounts of inventory that would bind a lot of working capital," Ms.

Sherman said.

ABF benefits from having other businesses, including food and

sugar production. The grocery unit, which makes products such as

Twinings tea and Patak's sauces, has seen stronger demand in recent

weeks, Mr. Bason said.

"What we have seen is a big shift to home cooking," he said,

noting that it's too early to tell whether the grocery business

could help offset losses at Primark.

Write to Nina Trentmann at Nina.Trentmann@wsj.com

(END) Dow Jones Newswires

March 27, 2020 16:42 ET (20:42 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

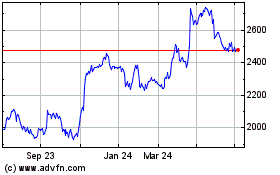

Associated British Foods (LSE:ABF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Associated British Foods (LSE:ABF)

Historical Stock Chart

From Apr 2023 to Apr 2024