TIDMABF

RNS Number : 9178Q

Associated British Foods PLC

25 February 2019

25 February 2019

Associated British Foods plc

Pre Close Period Trading Update

Associated British Foods plc issues the following update prior

to entering the close period for its interim results for the 24

weeks to 2 March 2019, which are scheduled to be announced on 24

April 2019.

Trading outlook

For the half year, other than the expected reduction in Sugar

revenue, sales growth will be delivered by all of our businesses.

We expect adjusted earnings per share to be broadly in line with

the same period last year, with lower net financial expenses

offsetting a small reduction in adjusted operating profit.

For the full year, our outlook for the group is unchanged with

adjusted operating profit and adjusted earnings per share for the

year expected to be in line with last year.

Cashflow and funding

We expect a cash outflow in the first half of the year,

consistent with the pattern seen in previous years, driven by the

seasonal increase in working capital in our European sugar

businesses following the substantial completion of processing

campaigns. Capital expenditure will be at the same level as last

year. Net cash is expected to be some GBP300m at the half year,

compared to GBP123m at the first half last year.

Grocery

Revenue and operating profit in the first half are expected to

be ahead of last year on an underlying basis, with a further

improvement in margin. Including a GBP12m one-time cost in respect

of supply chain consolidation at Twinings Ovaltine, adjusted

operating profit for the first half will be in line with last

year.

Twinings Ovaltine revenues are ahead of last year, with sales in

Australia and the UK benefiting from the continued success of the

Cold Infuse teas range launched last summer. Ovaltine achieved good

growth in the important market of Switzerland, although sales in

Thailand were lower than an exceptionally strong first half last

year. We have now successfully completed the transfer of tea

production from Jinqiao, China to our existing site in Swarzedz,

Poland.

Jordans and Ryvita achieved good sales growth in a number of

international markets, while sales of Ryvita Thins grew in the UK,

although profit declined due to increased raw material costs. We

will benefit from a full period of ownership of Acetum, which was

acquired in October 2017. Margins have improved with grape must

prices lower than the exceptionally high level last year following

a poor grape harvest in 2017.

Work continues to reduce the operating losses at Allied

Bakeries. Some bread sales volume will be lost next year as a

result of recent customer discussions on pricing. We remain focused

on reducing these losses and will take further measures to this end

as needed.

At ACH in the US, sales of Mazola corn oil increased through the

continued Heart Healthy advertising campaign while margins

strengthened due to lower oil commodity costs. Market share gains

were achieved in baking products in the US and Canada.

Sales increased at George Weston Foods in Australia and margins

improved significantly. Tip Top achieved higher packaged bread

volumes while the launch of Abbott's Bakery Thins has been well

received. Operating performance at the Don KRC meat business

improved with cost reduction initiatives and lower procurement

costs delivering a further increase in margin. The integration of

Yumi's, the recently acquired premium chilled dips and snacks

business, is progressing well. Sales grew strongly over the

Christmas period with gains in market share.

Sugar

AB Sugar revenue from continuing operations is expected to be

lower than last year in the first half, in line with previous

guidance, with lower EU contracted sugar prices impacting our UK

and Spanish businesses. As a result, in the first half AB Sugar

will record a marginal loss, but operating profit for the full year

remains in line with our expectations.

EU stock levels have been tightening during 2018/19 as a

consequence of the lower production in the current campaign. A

reduction in the European crop area for the 2019/20 season is

expected, and so stocks will remain low which should further

underpin the current upward trend in EU sugar prices.

The UK campaign is in its final stages and has continued to

progress well, benefiting from good harvesting conditions and

strong operating performance at all of our factories. Production

this year will be some 1.15 million tonnes compared to 1.37 million

tonnes last year when beet yields reached record levels. Sales for

this year are now largely contracted. Crop area for the 2019/20

season is expected to be between 5% and 10% lower than this

year.

In northern Spain, the campaigns at Miranda and Toro are now

complete and processing at La Beneza has commenced, with production

from beet at some 300,000 tonnes, lower than last year due to

adverse weather. The beet sugar shortfall will be compensated by

increased production from the refining of cane raws at Guadalete

which is expected to yield 170,000 tonnes. Reduced beet prices for

the 2019/20 campaign have been notified, and volumes will be

contracted with growers this spring. The benefit of these reduced

costs will be seen next financial year, and is expected to be

partially offset by a reduced crop area.

In China, our two factories at Zhangbei and Qianqi have

experienced difficult processing conditions due to very low levels

of sugar content in, and purity of, beet. Sugar production is

expected to be 10% lower than last year. Domestic sugar prices

continue to be low and, as previously advised, the business will

make a loss this financial year.

Illovo continued to perform well, with higher production and

strong domestic sugar prices. Following wet conditions in the early

part of the season, successful extended campaigns have been

completed in all countries. Sugar production is now expected to

increase again to 1.76 million tonnes compared to 1.7 million

tonnes last year, with cane yields further improved and production

at the Nakambala mill in Zambia exceeding 400,000 tonnes.

Agriculture

Revenue in the first half will be ahead of last year with growth

of UK compound feed sales through increased volumes and pricing due

to higher commodity costs.

The closure of the Vivergo bioethanol plant last autumn reduced

the availability of co-products, of which Trident Feeds was the

sole marketer, with a consequent reduction in operating profit for

AB Agri.

AB Vista maintained its position as a leader in phytase in the

global feed enzyme market, although margins were held back by

increased competition, particularly in the Americas.

Ingredients

Revenues in the first half are expected to be ahead of last

year, with progress in operating profit.

At AB Mauri, trading performance in bakery ingredients in EMEA

benefited from the integration of Holgran and Fleming Howden which

were acquired last year. Price increases were achieved in a number

of countries including the important markets of North America and

Argentina. Following a sustained period of high price inflation, we

have adopted hyperinflationary accounting under IAS 29 for

Argentina from the beginning of this financial year.

ABF Ingredients continued to increase revenue in the first half

driven by sales of protein crisps, with further share gains in the

expanding US market.

Retail

Sales at Primark are expected to be 4% ahead of last year in the

first half, at both constant currency and actual exchange rates,

driven by increased retail selling space partially offset by a 2%

decline in like-for-like sales. With a much higher margin, profit

is expected to be well ahead of the same period last year. Early

trading of the new spring/summer range has been encouraging.

The UK continued to perform well and we substantially increased

our share of the total clothing, footwear and accessories market,

with sales 2% ahead of last year. Cumulative like-for-like sales

have improved since the January trading update. The effect of low

footfall in November was offset by good trading in all other

months, and like-for-like sales are expected to be level with last

year in the first half.

Sales in the Eurozone are expected to be 5% ahead of last year,

with particularly strong sales growth in Spain, France, Italy and

Belgium. Like-for-like sales in the Eurozone are expected to show a

decline of 3%. In Germany we have strengthened management and plan

focused marketing to address trading which continues to be

difficult. Preparations are underway to reduce selling space at a

small number of German stores in order to optimise their cost

base.

Our business in the US continues to perform strongly, driven by

excellent trading at our recently opened Brooklyn store combined

with like-for-like sales growth. This, coupled with the benefit to

store profitability arising from the reduction in selling space at

Freehold and Danbury last year, has much reduced the US operating

loss.

As expected, the effect of a weaker US dollar on purchases

contracted for the first half benefited input costs. With better

buying, tight stock management and reduced markdowns, operating

margin for the first half is consequently expected to be well ahead

of last year.

Foreign exchange contracts are now in place for the majority of

the remaining purchases for the year and the strengthening of the

US dollar will result in a lower operating margin in the second

half. Our expectation for full year operating profit is

unchanged.

Retail selling space increased by 0.3 million sq ft since the

financial year end and, at 2 March 2019, 364 stores will be trading

from 15.1 million sq ft compared to 14.3 million sq ft a year ago.

Four new stores were opened in the period: Seville and Almeria in

Spain, Toulouse in France and a city centre store in Berlin,

Germany. In the UK we relocated to larger premises in Harrow and

the Merry Hill store was extended.

We still expect to open 0.9 million sq ft of new selling space

in this financial year. In the next quarter a net 0.4 million sq ft

of additional selling space is planned, with new stores in

Hastings, Bluewater, Belfast and Milton Keynes in the UK, Bordeaux

in France, Brussels in Belgium, Wuppertal in Germany and Utrecht in

the Netherlands. Our smaller store in Oviedo, Spain will close and

selling space will be reduced in the US store at the King of

Prussia mall in Pennsylvania. In April we will relocate to new

premises in Birmingham which, at 160,000 sq ft, will become our

largest store.

Our first store in Slovenia will open in the summer in Ljubljana

and, following the signing of the lease for our first store in

Poland, we have now signed the lease for our first store in the

Czech Republic, which is in the city centre of Prague.

For further enquiries please contact:

Associated British Foods

John Bason, Finance Director Tel: 020 7399 6500

Citigate Dewe Rogerson

Chris Barrie, Jos Bieneman Tel: 020 7638 9571

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTTTMATMBATBTL

(END) Dow Jones Newswires

February 25, 2019 02:00 ET (07:00 GMT)

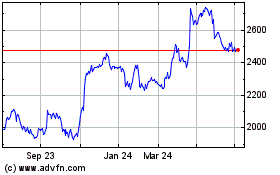

Associated British Foods (LSE:ABF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Associated British Foods (LSE:ABF)

Historical Stock Chart

From Apr 2023 to Apr 2024