IRB Brasil Former CFO Charged With Fraud in U.S. for Spreading False Information -- Update

April 18 2022 - 3:00PM

Dow Jones News

By Jeffrey T. Lewis

SÃO PAULO--The U.S. Securities and Exchange Commission has

charged a former chief financial officer of IRB Brasil with

spreading false information that Berkshire Hathaway Inc. was an

investor in the Brazilian reinsurance company to fraudulently prop

up IRB's share price.

The SEC charged Fernando Passos with allegedly carrying out the

scheme starting in February 2020 because of his concern about a

significant decline in IRB's share price, according to the SEC.

Mr. Passos, 39, allegedly falsified documents and information

and shared them with members of the press, some of IRB's directors

and with IRB investors, resulting in news outlets in Brazil and the

U.S. reporting incorrectly that Berkshire Hathaway was a

shareholder, the SEC said

IRB declined to comment, except to say that Mr. Passos left the

company in 2020 and IRB no longer has any contact with him.

IRB shares were up 0.7% at 3.06 reais, the equivalent of 66

cents, in late-afternoon trading.

Write to Jeffrey T. Lewis at jeffrey.lewis@wsj.com

(END) Dow Jones Newswires

April 18, 2022 14:45 ET (18:45 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

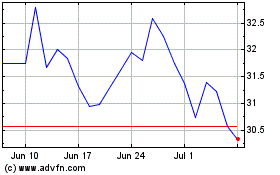

IRB BRASIL ON (BOV:IRBR3)

Historical Stock Chart

From Mar 2024 to Apr 2024

IRB BRASIL ON (BOV:IRBR3)

Historical Stock Chart

From Apr 2023 to Apr 2024