By Mike Colias

Volkswagen AG has agreed to invest around $2.6 billion in Ford

Motor Co.'s autonomous-vehicle partner, Argo AI, in a deal that

values the startup at $7 billion, as the two global

auto-manufacturing giants expand an alliance struck earlier this

year.

Together the two auto makers help create a deep-pocketed new

player in the race to commercial self-driving-car services, while

at the same time expanding commitments to develop fully electric

cars. As part of the alliance, Ford said it would use a Volkswagen

tool kit to help develop and make at least one electric vehicle for

European customers starting in 2023.

"The collaboration brings some of the smartest people in the

field of autonomous driving together," said VW Chief Executive

Herbert Diess at a news conference Friday.

Jim Hackett, the Ford chief executive, said that in turn, Argo

will be able to leverage having two global auto makers as clients

which should prove crucial for hiring and retaining the best

talent.

Both companies emphasized that while they will jointly invest in

Argo and share tools, they will make distinct products for their

own respective customers.

"We remain competitors, we've been purposeful in designing

this," Mr. Hackett added.

Ford has been the majority shareholder of Pittsburgh-based Argo

since early 2017, when it agreed to invest $1 billion. VW's

investment will leave the two auto makers jointly owning a majority

stake in Argo, the companies said.

Argo will work with VW and Ford to develop autonomous-driving

technology and eventually supply each of the respective auto makers

with driverless systems once they roll out in a few years.

The $2.6 billion investment in Argo includes $1 billion in

capital funding as well as the value of VW's 200-person

autonomous-driving division in Munich, which the companies placed

at $1.6 billion. That group, called Autonomous Intelligent Driving,

is run by VW's Audi luxury-car unit and will form the foundation of

Argo's presence in Europe, the companies said.

Major auto makers have been consolidating efforts as they race

to develop driverless and electric cars and build business models

around them.

General Motors Co.'s San Francisco-based Cruise subsidiary is

developing an autonomous-driving system with Honda Motor Co., which

has agreed to invest $2.75 billion in Cruise. The startup has

attracted more than $6 billion in outside investment and was valued

at $19 billion after its latest financing round in May, GM has

said.

For Ford, bringing VW into its efforts with Argo will give the

No. 2 U.S. auto maker a foothold to develop autonomous vehicles for

the European market, said Jim Farley, Ford's president of new

businesses, technology and strategy. He said the market for

driverless-vehicle services in Europe will develop differently from

the U.S., with distinct regulations and business models.

"This is going to cost billions to develop this technology," Mr.

Farley said in an interview. "Having two incredibly strong [auto

makers] with complementary geographic footprints allows us to not

only to be smart about the deployment of capital but to attract

resources and talent."

For VW, the expanded alliance comes as the German company

aggressively ramps up its investments in electric vehicles. Last

fall the Wolfsburg-based auto maker said it would earmark roughly

$50 billion over the coming five years for electric cars,

autonomous vehicles and digital services.

On Friday, Mr. Diess said that through offering use of VW's

modular electric tool kit to Ford, the partnership hopes to

increase adoption of electric vehicles world-wide.

VW is grappling with a host of challenges. Earlier this year, VW

said it would cut 7,000 jobs in effort to trim costs as it focuses

on the electric-vehicle market. VW and some of its executives are

also facing new legal challenges from the U.S. Securities and

Exchange Commission as well as German authorities for the

continuing diesel-emissions scandal.

Ford and VW began talks last year that led to the January deal

to work together on vans and trucks for markets around the world.

The idea to work together on electric and self-driving technology

grew from those earlier talks. Both sides have said they aren't

interested in any cross-ownership deals with each other.

The race to develop self-driving cars has spawned numerous

partnerships between car companies, auto suppliers and tech

companies -- all with the goal of solving what GM Chief Executive

Mary Barra has called "one of the biggest technical challenges of

our time."

German luxury-car rivals Daimler AG and BMW AG are working

together to develop driverless cars and smartphone-based mobility

services. Alphabet Inc. 's Waymo unit, considered by many analysts

to be furthest along in technical development, is working with

several big auto makers, including Fiat Chrysler Automobiles NV,

France's Renault SA and its alliance partner, Japan's Nissan Motor

Co.

The partnerships are especially crucial for the German auto

industry, which is a pillar of the domestic economy and which has

been dogged by a steady stream of profit warnings and management

shake-ups in recent months.

Also on Friday, Daimler issued its second profit warning in

three weeks -- its fourth within a year -- citing its own ongoing

challenges from Dieselgate.

"If we still want to play a leading role going forward," said

Hubert Barth, chief executive of Ernst & Young Germany, "we

have to join forces because the competitors aren't sitting within

the country anymore."

Consulting firm AlixPartners LLP forecasts that about $45

billion will be spent on developing autonomous vehicles globally by

2025.

"This is a time, talent and capital-intensive business," Argo

Chief Executive said Bryan Salesky said in an interview. "I think

you're going to continue to see consolidation as those realizations

set in."

Ford and Argo have been testing driverless cars, with safety

drivers at the wheel, in five U.S. cities, including Miami and

Washington, D.C. The companies plan to offer an autonomous-vehicle

service sometime in late 2021, Mr. Farley said. He declined to say

whether that would involve robot taxis, commercial delivery or

other services.

Pittsburgh-based Argo has grown from about a dozen employees

since Ford's early 2017 cash infusion to about 500 people. Formed

out of the robotics program at Carnegie Mellon University, the

company will benefit from a second customer in VW and from having

its artificial-intelligence system learn from Europe's different

driving conditions, Mr. Salesky said.

Write to Mike Colias at Mike.Colias@wsj.com

(END) Dow Jones Newswires

July 12, 2019 10:31 ET (14:31 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

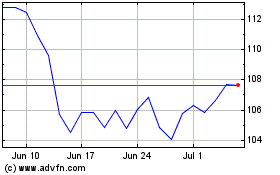

Volkswagen (TG:VOW3)

Historical Stock Chart

From Mar 2024 to Apr 2024

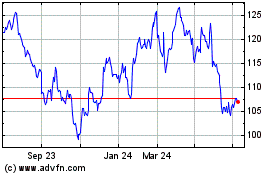

Volkswagen (TG:VOW3)

Historical Stock Chart

From Apr 2023 to Apr 2024