By William Boston

BERLIN -- With empty dealerships across China and plunging

demand for cars, auto makers are accelerating the move to do more

business online and take their inventory pile directly to

home-bound customers.

Online sales of new cars are still such a small part of the

market that they barely register in official statistics. And

studies show that consumers, in China and elsewhere, still want to

walk into a dealership and kick the tires before plunking down a

pile of money for a new car.

But with a large number of Chinese consumers staying in their

homes because of the coronavirus epidemic, some manufacturers see

quarantined China, where visits to the dealership all but

disappeared in February, as a test bed for more aggressive online

sales.

Volkswagen AG has been training thousands of dealers to take

their pitch from the showroom to the chat room. In February,

Volkswagen tapped experts from Alibaba Group Holding Inc. and

Taobao to offer a three-day online training course for 50,000

salespeople, showing dealers how to use social media, create video

and live-stream events to reach customers outside the showroom.

The training covered about 90% of the staff at Volkswagen

dealerships and those of its joint-venture partners, said Michael

Mayer, head of sales and marketing for Volkswagen's passenger car

brands in China. Many of the auto maker's showrooms have been empty

or closed in recent weeks, Mr. Mayer said. Only a third of the

company's 2,100 dealerships across China are operating.

Volkswagen also is shifting some marketing resources away from

traditional sales channels. "It doesn't make sense to rent a

billboard now, so you shift resources online," Mr. Mayer said. "TV

advertising has also gone up; it's now more efficient because

people have more time to watch TV."

The coronavirus has pressured car makers to try new sales

approaches. In the first two weeks of February, new car sales fell

92%, according to the association of Chinese auto dealers.

For manufacturers, salvaging their China business during the

epidemic may depend on how well they have prepared their digital

showrooms.

In February, Geely Auto Group, a unit of Zhejiang Geely Holding

Group, launched an online ordering and home-delivery system,

providing a fully "contactless" auto purchasing and payment service

with the option of having cars delivered to customers at home.

Geely said that during the first week of operation, its online

sales orders jumped fivefold from the same period a year ago and

sales leads from Geely's website increased 75 times.

Audi AG, the luxury car maker owned by Volkswagen, said its

dealerships have remained open in China, but that "at the moment

their focus is on the online business."

A BMW spokeswoman said the Munich-based luxury-car maker is

providing dealers in China with an array of "digital toolboxes,"

including an online application that enables them to make video car

presentations and allows customers to view the car without leaving

home.

A Ford Motor Co. spokesman said the company is working with its

dealers in China to facilitate online sales when necessary,

allowing in some cases for financing to be dealt with via email.

When necessary, dealers are making home deliveries to customers who

can't come into the store.

Car companies have long tried to capitalize on the rise of

e-commerce, but that has often conflicted with their large

dealership networks. In some markets, like the U.S., franchise

agreements require them to only sell cars through dealers. U.S.

dealers have lobbied hard against Tesla Inc.'s direct-sales model,

blocking the electric car maker from several states.

Some car makers have tried online sales programs through their

dealership networks, like General Motors Co.'s Shop-Click-Drive,

but found that most car buyers still opt to shop in person for a

new vehicle. Online car sales are more prevalent in the used market

from startups like Carvana Co. and Shift Technologies Inc. and

China's Uxin Ltd.

European dealers also operate under a franchise system, but the

rules are more flexible than in the U.S. It is easier for companies

like Tesla, which only offers online sales, and third-party

multibrand online car dealers to do business online.

In China, there are large franchises but also independent

dealers, often part of larger chains, that sell many brands under

one roof.

In a 2019 study of Chinese consumers, the consulting group

McKinsey & Co. found that by the time consumers were ready to

buy a new car at a dealership, they had already obtained 90% of the

information they needed to make the purchase. Still, getting behind

the wheel in a car for a test drive remains the most important

factor for Chinese consumers when deciding whether to buy, the

study said, yet more than half of those surveyed would like dealers

to deliver the car to their homes for a test drive.

A survey of auto makers by KPMG LLP concluded that, world-wide,

30% to 50% of retail locations would disappear by 2025. "The

process is becoming much more digital," said Justin Benson, head of

KPMG's automotive research group in the U.K.

Regardless of the epidemic, Volkswagen is moving to completely

digitize its consumer sales, enabling anyone interested in

purchasing a car or a service, such as ride-hailing, to do so using

a Volkswagen app.

In Europe, Volkswagen spent two years negotiating with dealers

to agree on a model in 2018 by which they would be integrated in

the company's digital service channels and share 10% of online

revenues.

In China, where the company sells its namesake VW marque as well

as Audi, Skoda, Jetta, and Porsche, Volkswagen is partly building

on an online infrastructure. One Jetta dealer, for example,

conducted a virtual showroom tour online in December, with more

than 10,000 online viewers following the presentation.

Mr. Mayer said the company's past efforts are allowing VW to try

new tactics during the epidemic.

"This is what actually works now," he said. "You even have

people doing online test drives."

--Nora Naughton contributed to this article.

Write to William Boston at william.boston@wsj.com

(END) Dow Jones Newswires

March 01, 2020 05:44 ET (10:44 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

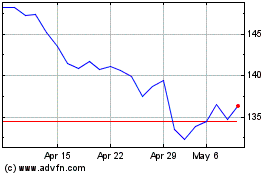

Volkswagen (TG:VOW)

Historical Stock Chart

From Mar 2024 to Apr 2024

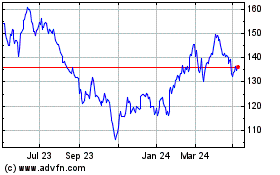

Volkswagen (TG:VOW)

Historical Stock Chart

From Apr 2023 to Apr 2024