VW Warns of Worsening Downturn -- WSJ

October 31 2019 - 3:02AM

Dow Jones News

By William Boston

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (October 31, 2019).

BERLIN -- Volkswagen AG warned Wednesday that the downturn in

the global car market was worsening, but maintained its outlook for

profit and revenue as the world's biggest auto maker by sales

continued to sell more higher-priced sport-utility vehicles.

Volkswagen's warning comes amid a spate of profit revisions and

downbeat assessments of the industry by major players such as

General Motors Co., Ford Motor Co. and Renault SA, citing trade

conflicts, Brexit and economic uncertainty in China, the U.S. and

Europe. Auto sales world-wide are expected to decline 4% this year,

after a 0.5% decline in 2018.

Meanwhile, pressure is mounting on manufacturers to achieve

scale, cut costs and generate more cash to finance investment in

electric vehicles and new self-driving technology. Underscoring

this, Fiat Chrysler Automobiles NV and PSA Group, maker of Peugeot

and Citroën cars, have agreed on merging to create a trans-Atlantic

heavyweight better able to absorb the rising costs of industry

transformation, according to people familiar with the

situation.

Volkswagen, whose automotive brands range from passenger cars

and luxury sports cars to vans and long-haul tractor-trailer

trucks, is reaping the rewards of an overhaul of its business that

began in the wake of its 2015 diesel-emissions cheating

scandal.

"The best days of the party are over, but I wouldn't want to

drown in worries about recession," Volkswagen finance chief Frank

Witter said of his industry's prospects.

Despite delivering fewer new vehicles, Volkswagen posted a 42%

rise in third-quarter profit to EUR3.8 billion ($4.2 billion),

while revenue rose 11% to EUR61.4 billion. It attributed the

improvement to cost cuts and an increase in the share of

higher-price SUVs in its product mix.

Overall, its new-car sales were down 1.7% for the first nine

months of the year because of a fall-off in Europe and China.

Mr. Witter said the company's finances were improving, pointing

to EUR8.6 billion in cash flow in the first nine months, up from

EUR3.5 billion the year before, as the ratio of capital expenditure

to revenue remained steady at around 5%.

Volkswagen shares rose 0.6% in Frankfurt, giving up earlier

gains in the session.

As industry consolidation accelerates, global scale could decide

the winners and losers in the race to dominate the sector. Big

players such as Volkswagen, Toyota Motor Corp. and GM have long

been seen as favorites, with the size and financial firepower to

shoulder the costs of change. A merger of Peugeot and Fiat Chrysler

would add to the mix in creating a $50 billion giant with solid

footing in the U.S. and Europe and the potential to grow in

China.

Smaller players, such as the German luxury brands Daimler AG and

BMW AG, are struggling to maintain profits. Daimler reported higher

overall earnings last week, but its flagship Mercedes-Benz luxury

car division is struggling, with a 1% decline in sales to 1.74

million vehicles in the first nine months of this year and a sharp

drop in its return on sales.

Renault, which is grappling with upheaval in its alliance with

Japan's second-largest auto maker, Nissan Motor Co., reported last

week that third-quarter revenue fell 1.6% to EUR11.3 billion and

that vehicle unit sales dropped more than 4%. The French car maker

also recently booted its chief executive.

GM and Ford face challenges as well. The former lowered its

profit outlook this week, saying the 40-day United Auto Workers

strike nearly wiped out its free cash flow for the year and cost it

nearly $3 billion in lost earnings.

Ford, in the midst of a global reorganization, slashed its

profit outlook for 2019 amid tougher competition in the U.S.

Write to William Boston at william.boston@wsj.com

(END) Dow Jones Newswires

October 31, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

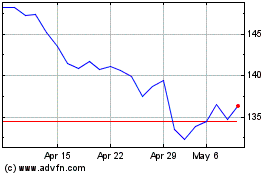

Volkswagen (TG:VOW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Volkswagen (TG:VOW)

Historical Stock Chart

From Apr 2023 to Apr 2024