The Luxury Car Industry's New-Old Bosses -- Heard on the Street

July 19 2019 - 9:19AM

Dow Jones News

By Stephen Wilmot

The German luxury car industry has stalled. Getting the engine

running again may require fresher thinking than the insiders

appointed to run both BMW and Daimler can supply.

Late Thursday, BMW said production chief Oliver Zipse, a

"decisive strategic and analytical leader," would next month take

ove r as head of the management board -- the equivalent of chief

executive under Germany's two-board system.

The current CEO and former production chief, Harald Krüger,

decided not to seek a second five-year term in office, perhaps

because his contract was at risk of not being renewed anyway after

a marked deterioration in the company's financial results and stock

price.

Mr. Zipse is still a largely unknown quantity, but he embodies

continuity. He has spent his entire career at BMW, including more

than four years on the management board. He is portrayed in the

local press as calm and consensus-seeking -- qualities previously

associated with Mr. Krüger.

The CEO-elect doesn't seem the man to make a U-turn, which is

what BMW arguably needs. Traumatized by the losses it made on its

pioneering i3 electric vehicle project, the company hasn't invested

in a dedicated EV platform, unlike its German rivals Daimler and

Volkswagen. Instead, BMW has made much of the flexibility afforded

by simply adding electric and hybrid options onto its existing

platform.

The result could be underwhelming products that get outcompeted

by more tailored designs. EVs built on a dedicated platform will be

roomier than conventional cars as the batteries can be packed flat

on the car's floor. Moreover, as Michael Muders, a portfolio

manager at Frankfurt-based Union Investment, points out: "If you're

a consumer and you pay up for an EV, you probably want people to

see you have an EV."

Daimler's problems are more operational than strategic. This

makes them even harder to square with the company's choice of an

internal candidate, Ola Källenius, to replace longtime CEO Dieter

Zetsche two months ago.

The new boss already has been forced to issue two major profit

warnings. One problem, almost four years after the Environmental

Protection Agency served its epochal notice of violation to

Volkswagen, has been the question of diesel fraud. Regulatory

investigations into and recalls of Mercedes-Benz diesel cars aren't

going away, however long Daimler appeals against them. The company

is due to set aside roughly EUR2.5 billion ($2.8 billion) in extra

provisions for diesel issues when it reports second-quarter results

next week.

Daimler is also provisioning a further EUR1 billion for an

industrywide air bag problem that first emerged in 2013. The

overall impression is that management has been sweeping problems

under the carpet. Mr. Källenius needs to tackle this even though he

has spent his entire career at the company and has been on the

management board since 2015.

He should also follow VW's lead with an initial public offering

of Daimler's underperforming heavy-truck division and get out of

the costly and unnecessary business of Formula One car racing. It

won't help if Mr. Zetsche returns to Daimler as supervisory-board

chairman in 2021 -- a proposed move that some investors, including

Mr. Muders, are now fighting.

Executive life is a much cozier affair in Germany than in the

U.S. The preference for continuity can be good for building

expertise and brands. It may prove a hindrance when the established

industry order is being disrupted, though, and problems can also

fester.

It speaks volumes that investors' preferred German car maker

these days tends to be the old laggard, VW. For the past 16 months

it has been run not by a VW-lifer but by Herbert Diess -- a former

BMW executive. In Germany, that counts as change.

Write to Stephen Wilmot at stephen.wilmot@wsj.com

(END) Dow Jones Newswires

July 19, 2019 09:04 ET (13:04 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

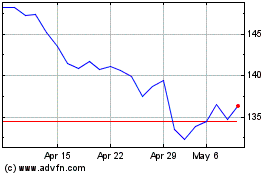

Volkswagen (TG:VOW)

Historical Stock Chart

From Mar 2024 to Apr 2024

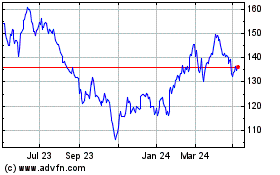

Volkswagen (TG:VOW)

Historical Stock Chart

From Apr 2023 to Apr 2024