Siemens Shares Climb After 4Q Earnings Beat Views, Dividend Raise

November 17 2022 - 5:02AM

Dow Jones News

By Pierre Bertrand

Siemens AG shares climbed Thursday after the company raised its

dividend on fourth-quarter earnings that beat analysts'

expectations, driven by profit increases at all of its industrial

businesses.

At 0913 GMT shares traded 7% higher at EUR129.66.

The German industrial company's quarterly profit rose to 2.70

billion euros ($2.81 billion) from EUR1.17 billion for the

prior-year period on revenue that grew 18% on a reported basis to

EUR20.57 billion.

Net profit for the full fiscal year that ended in September came

in at EUR3.72 billion compared with EUR6.16 billion in fiscal

2021.

The Munich-based company said it had orders for the fourth

quarter valued at EUR21.82 billion, up from the EUR19.07 billion

for the prior-year period.

The result was above analysts' expectations who saw

fourth-quarter net profit at EUR2.55 billion, revenue at EUR19.3

billion, and orders at EUR19.89 billion, according to a

company-provided consensus.

There was helped by revenue growth at all of the company's

industrial businesses, led by double-digit growth at its digital

industries and smart infrastructure divisions, Siemens said, adding

that currency effects contributed 8 percentage points to

revenue.

Orders were boosted by strong demand for data centers and

digital building services at its smart infrastructure unit, while

digital industries benefited from larger software contracts,

Siemens said.

"Strong demand continues for our hardware and software

offerings, including higher than expected growth for our digital

business revenue," Siemens Chief Executive Roland Busch said.

The company added that it proposes to increase its dividend to

EUR4.25 from EUR4.0 a share.

For fiscal 2023, Siemens said it expects comparable revenue

growth excluding currency translation and portfolio effects in the

range of 6% to 9% and a book-to-bill ratio of above 1.

The company added that it expects fiscal 2023 earnings per share

from net income before purchase price allocation accounting in a

range of EUR8.70 to EUR9.20.

Siemens added that it is planning to create a new motor and

large-drive business which it will work on consolidating during

fiscal 2023 with the intent to separate it from Siemens.

The new company will be made up of Sykatec, the whole of

Siemens' large drives applications business, and will include low

voltage motors, geared motors and Weiss Technologies units which

will be carved out from Siemens' digital industries division.

Siemens said the new company isn't a sign that it is exiting its

core motion-control business, and that it is keeping all options

open over whether the new business will be sold, spun off or

listed.

Write to Pierre Bertrand at pierre.bertrand@wsj.com

(END) Dow Jones Newswires

November 17, 2022 04:47 ET (09:47 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

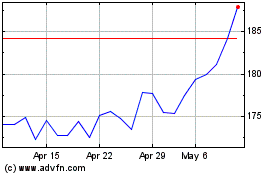

Siemens (TG:SIE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Siemens (TG:SIE)

Historical Stock Chart

From Apr 2023 to Apr 2024