E.ON to Pursue Merger Squeeze-Out at Innogy

September 04 2019 - 1:19PM

Dow Jones News

By Pietro Lombardi

E.ON SE (EOAN.XE) said Wednesday that it intends to carry out a

merger squeeze-out as part of its planned takeover of Innogy SE

(IGY.XE) to fully integrate the company into the E.ON group.

Minority shareholders will receive "adequate cash compensation,"

it said.

The German utility said it wants to swiftly integrate Innogy as

soon as the European Commission approves the deal.

"This procedure, known as a merger squeeze-out, provided for in

company law applicable from a shareholding of 90 percent, allows us

to implement the integration plans, which have been developed

together with innogy during the last months, as swiftly as

possible," Chief Executive Johannes Teyssen said.

The takeover is part of a complex deal between E.ON and Innogy's

parent company RWE AG (RWE.XE), which would effectively split

Innogy's assets between the two companies.

RWE would retain control over Innogy's renewable-generation

centers, while E.ON would take over the retail and distribution

networks.

Write to Pietro Lombardi at pietro.lombardi@dowjones.com

(END) Dow Jones Newswires

September 04, 2019 13:04 ET (17:04 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

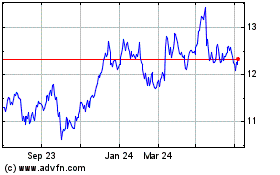

E. On (TG:EOAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

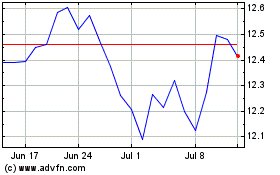

E. On (TG:EOAN)

Historical Stock Chart

From Apr 2023 to Apr 2024