By Sara Germano

BERLIN -- Germany is looking for new ways to power its economy

as the traditional growth engines of manufacturing and exports

falter. But the country's outdated internet is acting as a

bottleneck.

The sorry state of the online network has become a national joke

and an economic liability. Germany ranks 33rd in the world in

average monthly fixed broadband connection speeds, and 47th for

mobile, according to Speedtest Global Index.

The slow speeds are hampering the digitization of swaths of

industry and the delivery of products and services to consumers,

causing pain for German companies such as media conglomerate

Bertelsmann SE, whose portfolio includes online video producer RTL

Group, music group BMG and a controlling stake in publisher Penguin

Random House.

"Our business is about content and reach, and monetizing the

reach," said Chief Executive Thomas Rabe. "And if the reach is

reduced by the lack of technical infrastructure, that is, of

course, a problem."

Germany largely missed the upgrade to fiber broadband that

neighboring countries deployed a decade ago, which is making a

swift rollout of next-generation 5G mobile internet especially

urgent, according to business leaders, economists and

politicians.

Chancellor Angela Merkel said last month that the government is

committed to improving digital infrastructure over the next decade.

"It will be a long time, but we have devoted ourselves to this

question," she said.

In the meantime, the consequences are felt everywhere from the

German countryside, where many companies in the highly

decentralized economy have their headquarters, to Berlin's startup

scene.

"Almost every one of us has had bad experiences with the

internet connection...too unstable, too slow, not available

everywhere," said Thilo Grösch, a spokesman for an insurance

startup who has worked at various firms in the capital for seven

years.

Mr. Grösch said he often had to work from home at a previous job

because the office internet wouldn't function.

In the new Netflix series "How to Sell Drugs Online (Fast),"

based on the true story of a German teen who set up an online

pill-dealing empire, the protagonist curses his glitchy mobile

connection in the pilot episode.

Germany's internet woes are rooted in a range of factors,

according to network operators, regulators, business executives,

and industry analysts.

Among them are the country's large geographic area; an evenly

spread population; decades of subdued private-sector investment;

and strict fiscal rules that discourage government investment in

infrastructure.

But one technical factor stands out: the reliance on copper

rather than glass fiber to link end users to the fixed-line

network.

"The whole problem in Germany is the lack of fiber-to-the-home

strategy by Deutsche Telekom and other carriers," said Guy Peddy, a

telecommunications analyst for Macquarie Research.

Telecom giants in France and Portugal were already rolling out

all-fiber networks early in the decade, in keeping with a 2010

European Union report that recommended that national carriers

invest in fiber.

But Deutsche Telekom, Germany's dominant operator, took a less

costly route in 2012, upgrading its existing copper network through

a technology called vectoring. The idea was to improve speed on

copper cables to up to 100 megabits per second by cutting down on

interference, a relatively inexpensive way to get faster internet

to consumers.

At the time, Deutsche Telekom acknowledged that it would

eventually have to build a fiber-based network. But Henrik Schmitz,

a spokesman for the company, said it needed to rely on vectoring in

order to meet a government target of 80% of households having

access to download speeds of at least 50 megabits per second by the

end of 2018, a target that Telekom says it will hit a year

late.

Fiber would have enabled faster speeds but would have been

available to just 10-to-20% of households, Mr. Schmitz said.

Many commercial customers say the vectoring approach has left

them frustrated. Holger Ehrhardt, a graphic designer and IT

consultant for a print media company in the state of Lower Saxony,

said the firm decided to invest in its own server because fiber

isn't available and Deutsche Telekom has only been able to connect

them with 25-megabit internet.

"It must have something to do with the 'antique' lines," he

said.

In 2017, the German Federal Network Agency said vectoring wasn't

enough, and that further glass fiber cable investments were needed

to hit government targets. That same year, the German ministry for

transportation called for gigabit internet -- download speeds ten

to twenty times faster than those generated through vectoring -- to

be broadly available by 2025.

Deutsche Telekom responded by pledging to add up to 60,000

kilometers (37,200 miles) of fiber cable per year and to connect

90% of Germany's surface area with 5G by 2025, offering high-speed

data traffic to those places that fiber couldn't reach in time.

Critics say Germany still isn't moving fast enough.

"It's too slow," Hubert Barth, the chief executive of Ernst

& Young Germany, said of the gigabit internet initiative. "If

you're really world class in production, having a ranking of, say,

[33rd] in working internet does not fit together with that

image."

Write to Sara Germano at sara.germano@wsj.com

(END) Dow Jones Newswires

August 05, 2019 07:12 ET (11:12 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

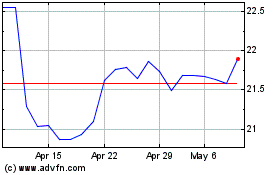

Deutsche Telekom (TG:DTE)

Historical Stock Chart

From Mar 2024 to Apr 2024

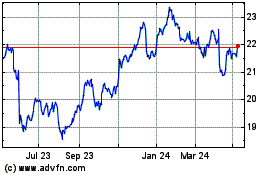

Deutsche Telekom (TG:DTE)

Historical Stock Chart

From Apr 2023 to Apr 2024