T-Mobile, Sprint Spar Over Dish -- WSJ

July 12 2019 - 3:02AM

Dow Jones News

Parties are haggling over satellite-network ownership

restrictions and other conditions

By Drew FitzGerald and Brent Kendall

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (July 12, 2019).

Negotiations to complete the merger of T-Mobile US Inc. and

Sprint Corp. are dragging on as the parties haggle over ownership

restrictions and other conditions for Dish Network Corp. once it

gets assets from the wireless companies, according to people

familiar with the matter.

Discussions are continuing, and all sides remain optimistic they

can find common ground on the ownership question and other issues

to complete the more than $26 billion merger, the people said.

T-Mobile and Sprint are planning to extend their merger

agreement past its July 29 deadline, one of the people said. It

would be the second such extension to close a deal that was

announced more than a year ago and has run into resistance from

federal and state antitrust officials.

The Justice Department has overseen several weeks of

negotiations designed to ensure the merger of the third- and

fourth-biggest cellphone carriers by subscribers won't lessen

competition. Dish, a satellite-TV provider with an ample stockpile

of spectrum licenses, has emerged as the favorite to acquire

divested assets from the merging companies to develop a new

wireless network.

One issue frustrating negotiators in recent days is potential

limits on who could own or later buy a part of the new Dish

wireless network, which has pushed back on potential ownership caps

and change-in-control restrictions, the people said. The company's

chairman, Charlie Ergen, owns more than 51% of Dish shares and has

a special class of stock that gives him control over 91% of the

vote.

T-Mobile and parent Deutsche Telekom AG are seeking to impose

ownership limits to prevent the satellite-TV company from turning

around and selling parts of the wireless business won through the

divestiture process to a cable or technology company, the people

familiar with the matter said. The parties have also discussed

restrictions on how much traffic Dish can send over the new

T-Mobile's network, one of the people said. CNBC previously

reported on both issues.

Dish and the cellphone carriers have mostly agreed in principle

to a broad deal that would transfer spectrum licenses, prepaid

phone customers and other assets to the satellite company. Dish

would also get a multiyear agreement to use the wireless companies'

network while it builds dedicated infrastructure, some of the

people said.

The Justice Department has made its blessing contingent upon the

companies shedding enough assets to form a fourth competitor strong

enough to vie with giants Verizon Communications Inc., AT&T and

the new T-Mobile. Each of those three would have roughly 100

million subscribers or more after the merger.

The deal would help protect more than $21 billion of wireless

spectrum licenses Mr. Ergen has amassed in recent years by putting

them to work on a customer base. The Federal Communications

Commission could rescind some of the licenses if they aren't put to

use soon.

The arrangement also could save T-Mobile and Sprint's all-stock

merger, which the companies unveiled in April 2018 after several

years of failed attempts to combine. FCC Chairman Ajit Pai in May

said his commission would support the deal, but the Justice

Department's antitrust division hasn't blessed it yet, and the

outcome will likely depend on whether the companies can resolve the

remaining issues to the department's satisfaction.

Several state attorneys general sued last month to block the

merger, arguing that the proposed tie-up would leave cellphone

customers with less competition for their business. T-Mobile plans

to contest the lawsuit in a trial set to start Oct. 7.

--Sarah Krouse contributed to this article.

Write to Drew FitzGerald at andrew.fitzgerald@wsj.com and Brent

Kendall at brent.kendall@wsj.com

(END) Dow Jones Newswires

July 12, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

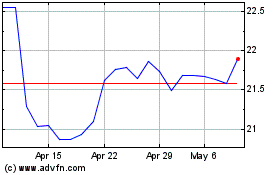

Deutsche Telekom (TG:DTE)

Historical Stock Chart

From Mar 2024 to Apr 2024

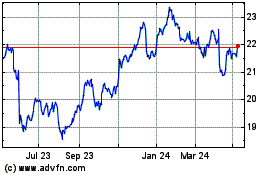

Deutsche Telekom (TG:DTE)

Historical Stock Chart

From Apr 2023 to Apr 2024