Continental Cuts 2019 Outlook on Global Car Production Slump

July 23 2019 - 2:17AM

Dow Jones News

By Max Bernhard

German automotive supplier Continental AG (CON.XE) cut its

earnings and sales guidance for the year, citing a decline in

global car production, as well as lower demand and possible

warranty claims.

Continental had previously forecast global auto production to

remain stable, but it now anticipates a decline of about 5%, the

company said late Monday.

It said it now expects an adjusted operating profit margin of

about between 7% and 7.5% in 2019, compared with previous

expectations of between 8% and 9%. Continental now forecasts sales

of about between 44 billion and 45 billion euros ($49.34 billion

and $50.47 billion) compared with EUR45 million to EUR47 million

before.

Continental's guidance cut is the latest in a slew of profit

warnings from car makers and parts suppliers. Premium car maker

Daimler AG (DAI.XE) cut its earnings outlook twice since last

month, while Chinese manufacturer Geely warned on profit at the

beginning of July. Auto makers have been struggling with slowing

demand in the world's largest markets, such as China and Europe. At

the same time, they have to stem large investments for the

development of new technology and adapt to stricter emissions

rules.

Continental Chief Financial Officer Wolfgang Schaefer said the

company is less optimistic about the second half of the year than

before. "The reason for this is the continuing downward trend in

vehicle production in Europe, in North America and particularly in

China. Unresolved trade conflicts are also contributing to economic

uncertainty," he said.

Continental said the profit warning was also due to

"unanticipated changes in customer demand" which could hit sales of

some of the products in its core automotive division. Earnings may

also take a hit from potential provisions for warranty claims over

the second half of the year. "The causes of these potential

expenses from warranty claims and the corresponding amounts are not

clarified at this time," it said.

Nevertheless, Continental said its results in the second quarter

were solid. Sales in the quarter fell slightly to EUR11.2 billion

from EUR11.4 billion a year earlier, according to preliminary data,

it said. The adjusted operating profit margin shrunk to 7.8% from

10.2%, however. The company is scheduled to report second-quarter

results on August 7.

Write to Max Bernhard at max.bernhard@dowjones.com;

@mxbernhard

(END) Dow Jones Newswires

July 23, 2019 02:02 ET (06:02 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

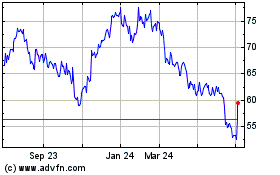

Continental (TG:CON)

Historical Stock Chart

From Mar 2024 to Apr 2024

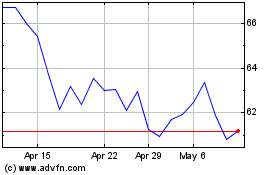

Continental (TG:CON)

Historical Stock Chart

From Apr 2023 to Apr 2024