China Keeps Germany's Car Makers in the Fast Lane -- Heard on the Street

May 20 2020 - 5:20AM

Dow Jones News

By Stephen Wilmot

Germany's car manufacturers are once again being bailed out by

China.

Having skidded to a halt in February, Chinese vehicle sales are

rebounding -- particularly at the luxury end of the market. Premium

brands clocked year-over-year growth of 13.6% in April, according

to insurance sales tracked by brokerage Bernstein, bringing the

decline for the first four coronavirus-stricken months of 2020 to

just 14.2%. Bernstein's feedback from dealers suggests demand

remains strong this month.

Volkswagen, which owns the Porsche and Audi brands,

Mercedes-maker Daimler and BMW dominate the field in China just as

they do elsewhere -- only more so. Jürgen Pieper, an analyst at

private German bank Metzler, estimates their combined share of the

country's luxury-car market is more than 90%, versus roughly 85%

globally.

It seems counterintuitive that a sales recovery should be led by

products that are more status symbols than everyday necessities.

China's wider car market has been shrinking since mid-2018, though,

even as premium sales have kept growing. In previous years, the

segment's resilience seemed linked to consumers' funding sources:

Mass-market brands were more dependent on shadow finance and

subsidies, on which Beijing was trying to clamp down.

This year, the uncomfortable truth may be that, in China as in

the U.S., the tech-enabled affluent class that might buy a BMW or

Mercedes is less economically affected by the health crisis than

the blue-collar workers that make them. Social distancing has also

given those with means an extra reason to buy a vehicle. China has

excellent public transport, but people are nervous about using it,

subway use last week was down about 40% year over year.

The luxury-car boom in China is in little danger of running out

of road. Car ownership in the country is still far below levels in

the West. Premium brands account for just 15.3% of total sales

nationwide, according to Goldman Sachs -- up from 9.6% in 2016, but

far below the level of the top coastal cities (25% to 29%), let

alone luxury hot spot Hong Kong (52%).

The rise of China may be the single biggest reason why Germany's

auto stocks -- cost-heavy Daimler aside -- have massively

outperformed U.S. peers and the wider European stock market over

the past two decades. China kept them in business in the 2009

crisis and will help them through the current one. The country

usually contributes roughly 35% and 50% of their profits, estimates

Michael Muders, a portfolio manager at Frankfurt-based Union

Investment.

This long-term growth story comes with challenges. An increasing

share of the vehicles that the companies sell in China are made by

local joint ventures of which they only own half. BMW signed a

landmark deal in 2018 to increase its stake in its key joint

venture to 75%, but it still hasn't completed it. Meanwhile, the

car industry in Germany itself has suffered from years of

production cuts. The combination of growth in Chinese factories

they can never really control with a slow decline at home will only

get more awkward politically.

Still, their enduring appeal to China's confident elite puts

Germany's manufacturers in a league of their own for investors

within the otherwise risk-laden global auto sector. This year the

difference will be more obvious than ever.

Write to Stephen Wilmot at stephen.wilmot@wsj.com

(END) Dow Jones Newswires

May 20, 2020 05:05 ET (09:05 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

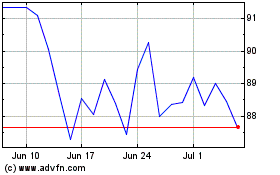

Bayerische Motoren Werke (TG:BMW)

Historical Stock Chart

From Mar 2024 to Apr 2024

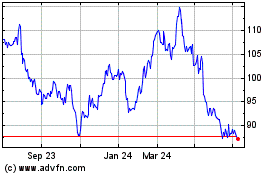

Bayerische Motoren Werke (TG:BMW)

Historical Stock Chart

From Apr 2023 to Apr 2024